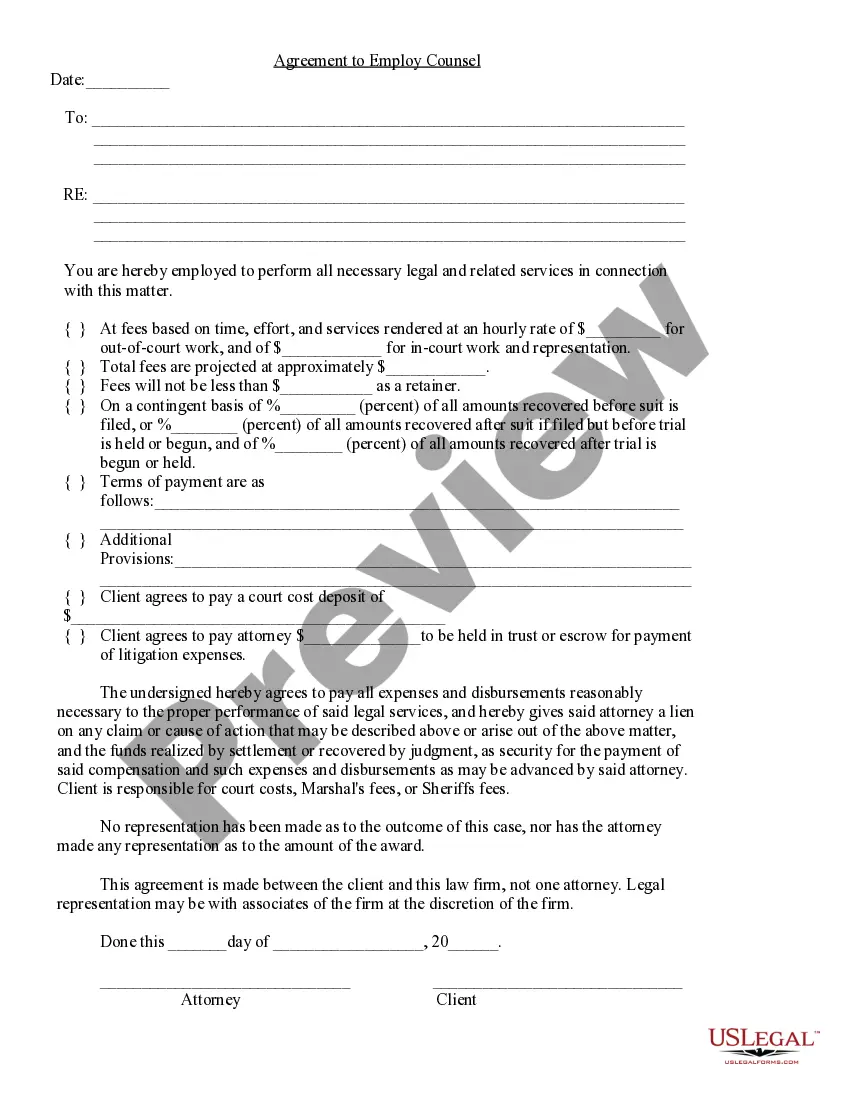

Vermont Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Self-Employed Independent Contractor Payment Schedule?

If you want to be thorough, acquire, or print official document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Use the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to find the Vermont Self-Employed Independent Contractor Payment Schedule in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Click the My documents section and choose a form to print or download again.

Complete and acquire, and print the Vermont Self-Employed Independent Contractor Payment Schedule with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- When you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Vermont Self-Employed Independent Contractor Payment Schedule.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, consult the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Utilize the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms within the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to execute the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Vermont Self-Employed Independent Contractor Payment Schedule.

Form popularity

FAQ

Taxpayers should use Schedule C (Form 1040) to report self-employed income. This form allows independent contractors to detail their income and expenses related to their business activities. For those following the Vermont Self-Employed Independent Contractor Payment Schedule, accurate reporting on Schedule C is crucial to ensure compliance with tax obligations. Additionally, using trusted platforms like US Legal Forms can simplify the process of completing and filing your Schedule C, ensuring that you capture all necessary details effectively.

To report income from self-employment, you generally need to utilize Schedule C (Form 1040) for reporting earnings. This form captures profits or losses from your business activities. Coupling it with the Vermont Self-Employed Independent Contractor Payment Schedule enhances your reporting accuracy, ultimately making tax time much easier.

To accept payments as an independent contractor, you can set up a business bank account or use online payment platforms. This allows you to keep personal and business finances separate. Utilizing the Vermont Self-Employed Independent Contractor Payment Schedule will ensure you track your payments effectively and manage your earnings efficiently.

Contractors can accept payments through various methods, including bank transfers, checks, or payment apps. Each method has its own advantages, depending on the client's preferences and the nature of the work. Familiarizing yourself with the Vermont Self-Employed Independent Contractor Payment Schedule can help you choose the best payment options for your services.

For self-employment, individuals typically use Schedule C to report income and expenses. This form helps you detail your earnings and business-related costs. As a self-employed individual in Vermont, understanding the Vermont Self-Employed Independent Contractor Payment Schedule is crucial for accurate financial planning and tax compliance.

Payment terms for independent contractors can range widely, from upfront payments to net 30 or net 60 days after invoicing. These terms should be clearly outlined in the contract to align expectations with clients. A well-structured Vermont Self-Employed Independent Contractor Payment Schedule provides clarity on payment timelines and methods. For those seeking guidance, UsLegalForms offers resources to create effective payment agreements.

Typical payment terms for contractors often vary, but many contractors receive payments within 30 days after submission of an invoice. Some clients may negotiate different terms based on specifics of the project or their budget cycles. Establishing a clear Vermont Self-Employed Independent Contractor Payment Schedule is crucial in setting mutual expectations. This approach fosters a positive working relationship and ensures timely compensation.

The payment terms for a 1099 typically depend on the agreement between the client and the independent contractor. Generally, payments can be made upon completion of milestones, monthly, or per project. It's important to establish a Vermont Self-Employed Independent Contractor Payment Schedule to ensure both parties agree on when payments will be made, thus avoiding confusion. Using platforms like UsLegalForms can help you standardize these terms effectively.