Vermont Electrologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers an extensive variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the most recent versions of documents such as the Vermont Electrologist Agreement - Self-Employed Independent Contractor in just a few minutes.

If you currently possess a monthly subscription, Log In and download the Vermont Electrologist Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Select the format and download the document to your device.

Make modifications. Fill out, edit, print, and sign the saved Vermont Electrologist Agreement - Self-Employed Independent Contractor. Each template you add to your account has no expiration date and belongs to you permanently. Therefore, if you want to download or print another copy, just navigate to the My documents section and click on the form you need. Access the Vermont Electrologist Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If this is your first time using US Legal Forms, here are straightforward steps to get you started.

- Ensure you have selected the correct form for your city/region.

- Click the Review button to check the details of the form.

- Review the form description to confirm that you have picked the right document.

- If the form does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, pick the pricing plan you prefer and provide your information to register for an account.

- Process the payment. Utilize your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

Yes, having a contract as an independent contractor is highly beneficial, even if it's not mandated by law. A Vermont Electrologist Agreement - Self-Employed Independent Contractor can protect your interests and clearly outline the terms of your arrangement with clients. A well-defined contract reduces the risk of disputes and sets a professional tone for your work, ensuring everyone adheres to agreed-upon terms.

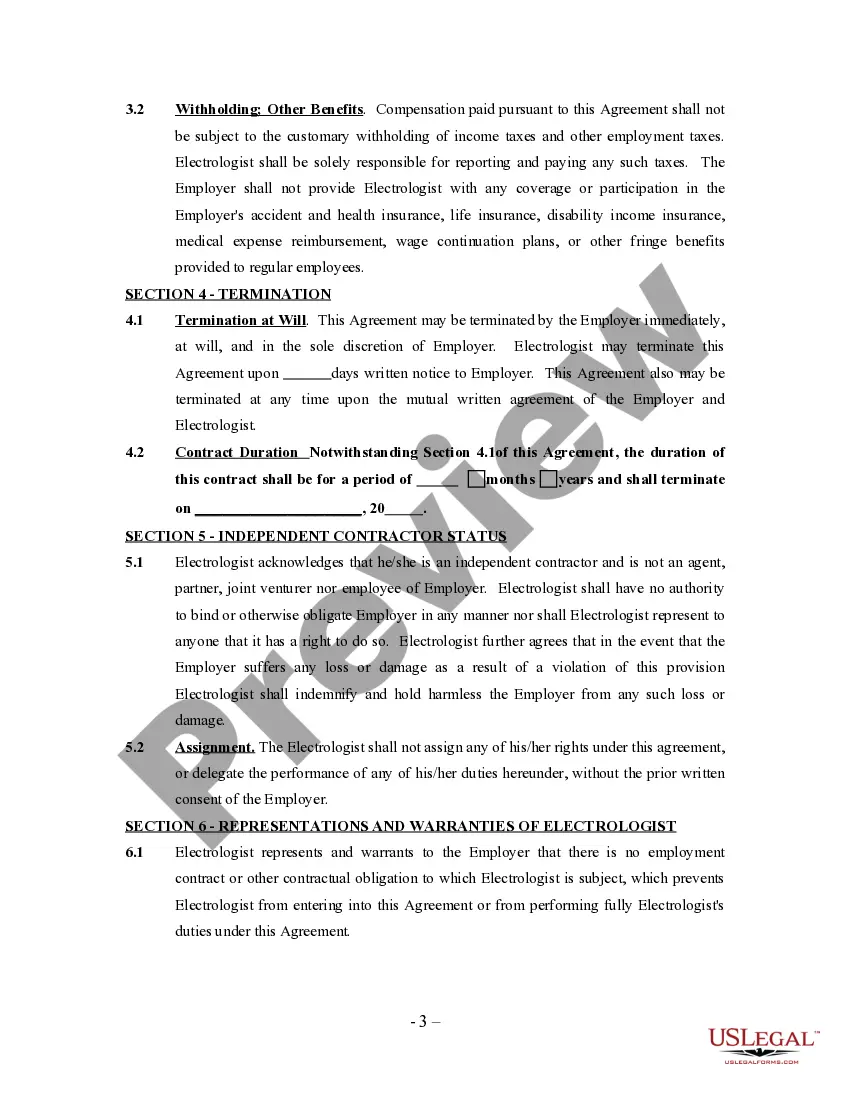

The new federal rule aims to clarify the classification of workers as independent contractors versus employees. This regulation impacts how businesses in various sectors, including electrology, define their workforce. Understanding this rule is crucial for self-employed professionals, and a Vermont Electrologist Agreement - Self-Employed Independent Contractor can assist you in aligning your practices with federal guidelines.

While not legally required, having a contract is strongly recommended when you are self-employed. A contract, like a Vermont Electrologist Agreement - Self-Employed Independent Contractor, helps establish clear expectations and responsibilities between you and your clients. It can prevent disputes and provide security in your business arrangements. Securing a written agreement is a smart step towards success.

Independent contractors must fulfill specific legal requirements, including maintaining proper licensing and paying self-employment taxes. In Vermont, you should also ensure compliance with state regulations related to your specific field, especially for specialties like electrology. Drafting a Vermont Electrologist Agreement - Self-Employed Independent Contractor can help you navigate these requirements effectively.

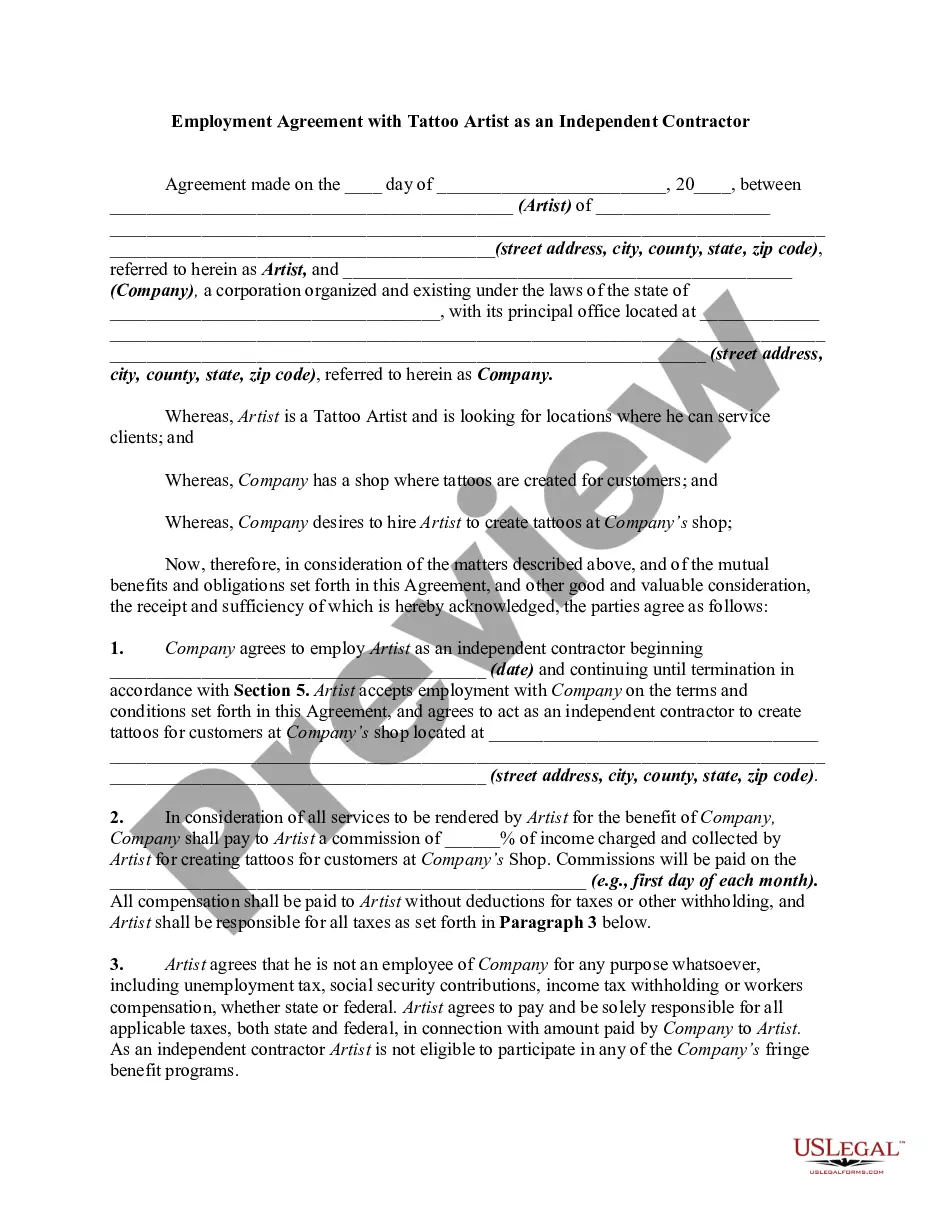

An independent contractor esthetician operates their own business rather than working directly for a salon or spa. This allows for greater flexibility and control over services, schedules, and clients. A Vermont Electrologist Agreement - Self-Employed Independent Contractor is often essential to outline the terms of your independent practice, ensuring both you and your clients understand the working relationship.

Yes, you can be classified as a 1099 worker without a formal contract, though having one is highly advisable. As a self-employed independent contractor, you might miss out on essential protections without a Vermont Electrologist Agreement. A well-drafted agreement clarifies expectations and roles, granting you more security. Ensuring you have a written agreement can help avoid misunderstandings.

If you find yourself without a contract, you still have rights as a self-employed independent contractor. In Vermont, your rights may be governed by implied agreements or state labor laws. It's essential to document your working relationship with the business for clarity. Exploring a Vermont Electrologist Agreement - Self-Employed Independent Contractor can help you formalize your rights.

To fill out a declaration of independent contractor status form, start by identifying your business and work activities clearly. Include any supporting documents that show your independent status, such as contracts or invoices. This is crucial for a Vermont Electrologist Agreement - Self-Employed Independent Contractor, as it confirms your role and protects your interests.

Filling out an independent contractor form requires you to present your business information and describe the services you offer. You should also include your tax ID and payment preferences. Utilizing resources like the Vermont Electrologist Agreement - Self-Employed Independent Contractor can streamline this task and ensure you're compliant with regulations.

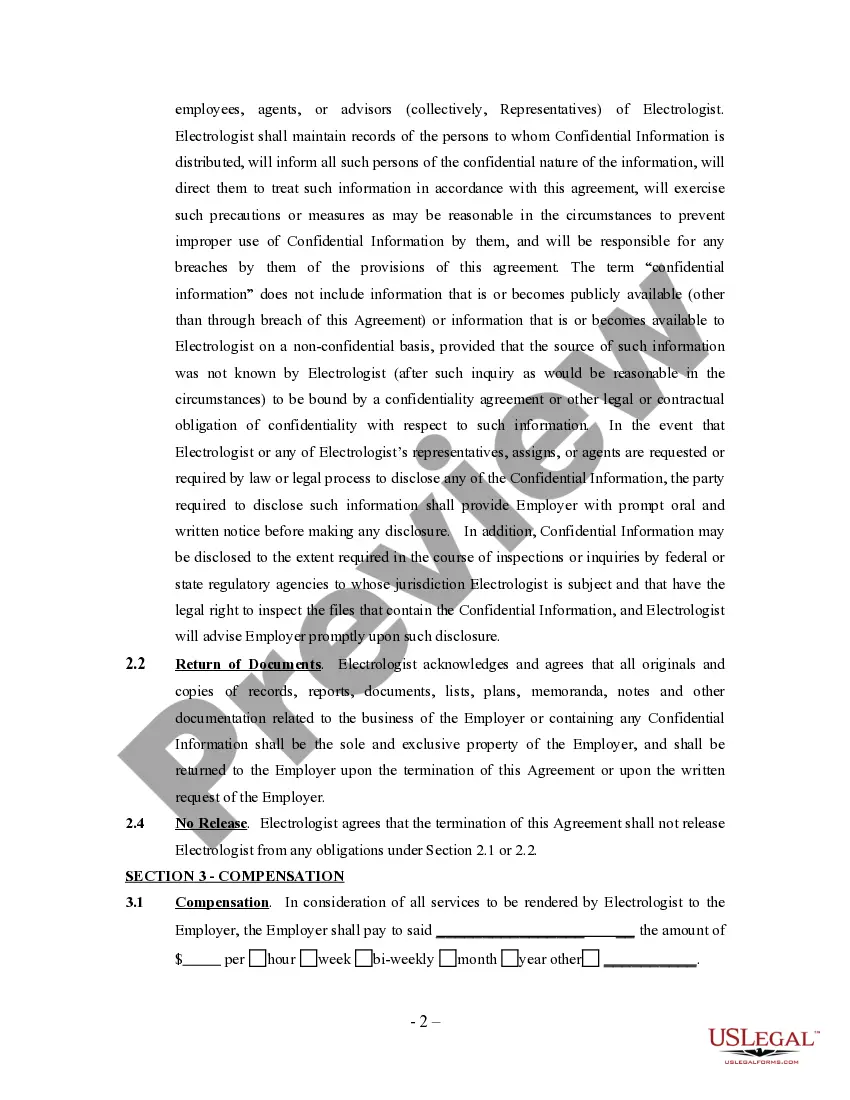

Writing an independent contractor agreement involves detailing the scope of work, timelines, payment terms, and confidentiality clauses. Clearly define the roles and responsibilities for both parties to ensure mutual understanding. Incorporating a Vermont Electrologist Agreement - Self-Employed Independent Contractor template can simplify the process and enhance clarity.