Vermont Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

If you need to obtain, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search function to find the documents you require.

An array of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After finding the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to create an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Vermont Lab Worker Employment Contract - Self-Employed. Every legal document template you acquire is yours for an extended period. You have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again. Be proactive and download and print the Vermont Lab Worker Employment Contract - Self-Employed using US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Vermont Lab Worker Employment Contract - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Vermont Lab Worker Employment Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Make sure you have selected the form for the correct city/state.

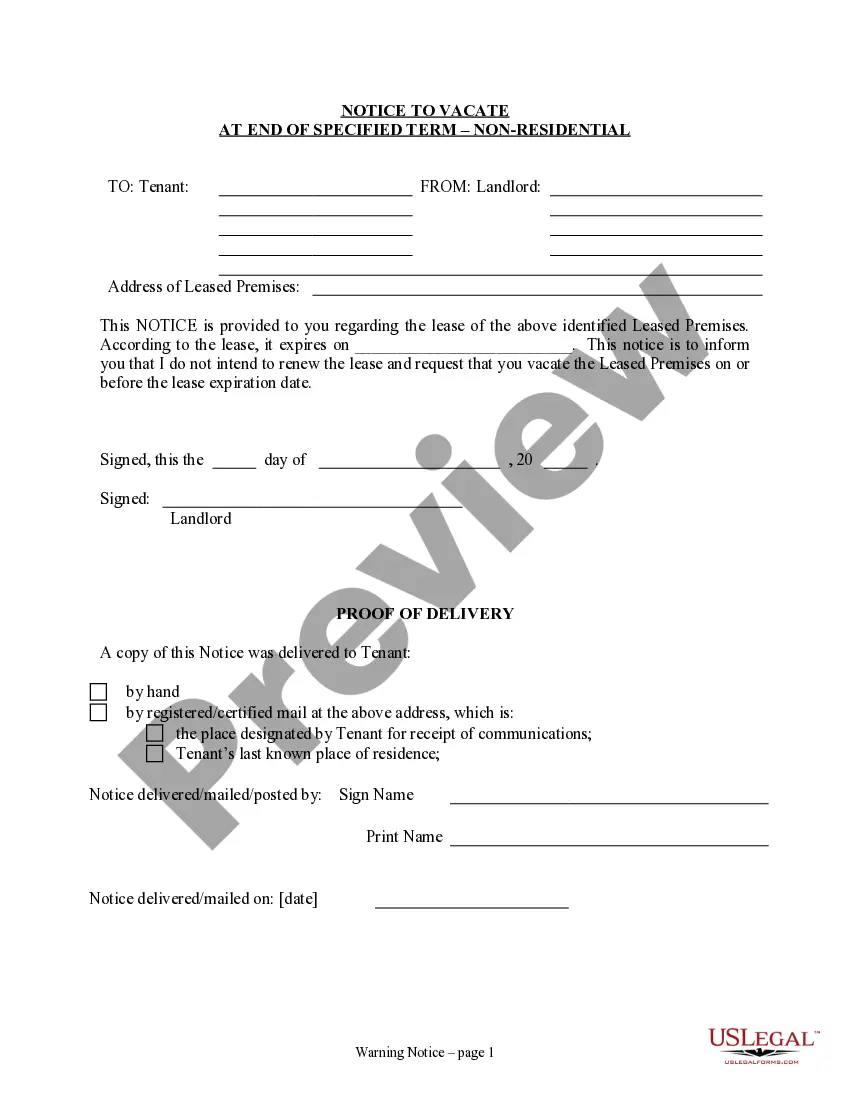

- Step 2. Utilize the Preview option to review the content of the form. Be sure to check the details.

- Step 3. If you are not satisfied with the form, take advantage of the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Contract work and self-employment often overlap, but they are not identical. While both involve working independently, a Vermont Lab Worker Employment Contract - Self-Employed provides a clear legal framework outlining specific work terms. Understanding this distinction can help you better navigate your opportunities and obligations as you pursue your career.

Filing taxes as a 1099 employee requires a slightly different approach compared to traditional employees. You will report your income from a Vermont Lab Worker Employment Contract - Self-Employed on a Schedule C form, detailing your business income and expenses. It's advisable to keep accurate records throughout the year to ensure smooth tax filing and to consult a tax professional if needed for guidance.

Yes, a 1099 employee is considered self-employed because they receive income directly without tax withholding from an employer. This classification applies to many who work under a Vermont Lab Worker Employment Contract - Self-Employed. It's important to note that while these individuals operate independently, they still must adhere to tax regulations tied to their income.

Contract work does not fit neatly into traditional definitions of employment. In the context of a Vermont Lab Worker Employment Contract - Self-Employed, this type of work typically does not entail the same benefits as full-time employment. However, it can still provide valuable experience and income opportunities for skilled workers, depending on their contractual agreements.

While a contract often outlines the terms for self-employment, it is not synonymous with being self-employed. A Vermont Lab Worker Employment Contract - Self-Employed specifies the working relationship and terms between the worker and the client. Understanding this distinction is key, as contracts lay out responsibilities but each worker's employment status differs based on their specific arrangement.

Not necessarily; a contract employee typically works under the direction of an employer, which may not fit the self-employed definition. In contrast, a self-employed individual operates their own business and manages their own contracts, such as a Vermont Lab Worker Employment Contract - Self-Employed. Understanding the distinctions between these terms helps in accurately labeling your work arrangements.

Absolutely, having a contract is essential for self-employed individuals. A Vermont Lab Worker Employment Contract - Self-Employed clarifies your business arrangements, protects your interests, and defines service expectations. By formalizing your agreements, you enhance your professionalism and build trust with clients. Utilize platforms like uslegalforms to create tailored contracts easily.

In Vermont, certain self-employed individuals may be exempt from carrying workers' compensation insurance. Generally, individuals who do not have employees and work independently may not need coverage. However, it's vital to review your specific circumstances regarding your Vermont Lab Worker Employment Contract - Self-Employed. Understanding your obligations ensures compliance and protection.

Recent regulations may impact self-employed individuals in various ways, such as tax implications and benefits eligibility. It's essential to stay informed about changes that might affect your Vermont Lab Worker Employment Contract - Self-Employed. Regularly review new legislation or guidelines from the Vermont Department of Labor. Consulting a legal expert can help you navigate these changes effectively.

Yes, having a contract is common for self-employed individuals. A Vermont Lab Worker Employment Contract - Self-Employed serves as a formal agreement that outlines your rights and responsibilities. It helps protect both you and your clients by providing clarity on terms of service, payment, and deadlines. This type of contract fosters a professional relationship and ensures accountability.