Vermont Engineering Agreement - Self-Employed Independent Contractor

Description

How to fill out Engineering Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Vermont Engineering Agreement - Self-Employed Independent Contractor in just moments.

If you already have a monthly subscription, Log In and download the Vermont Engineering Agreement - Self-Employed Independent Contractor from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Select the format and download the form to your device.

Make edits. Fill out, modify, and print and sign the downloaded Vermont Engineering Agreement - Self-Employed Independent Contractor. Each template you add to your account does not have an expiration date and is yours permanently. So, if you want to download or print another copy, just go to the My documents section and click on the form you need. Access the Vermont Engineering Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

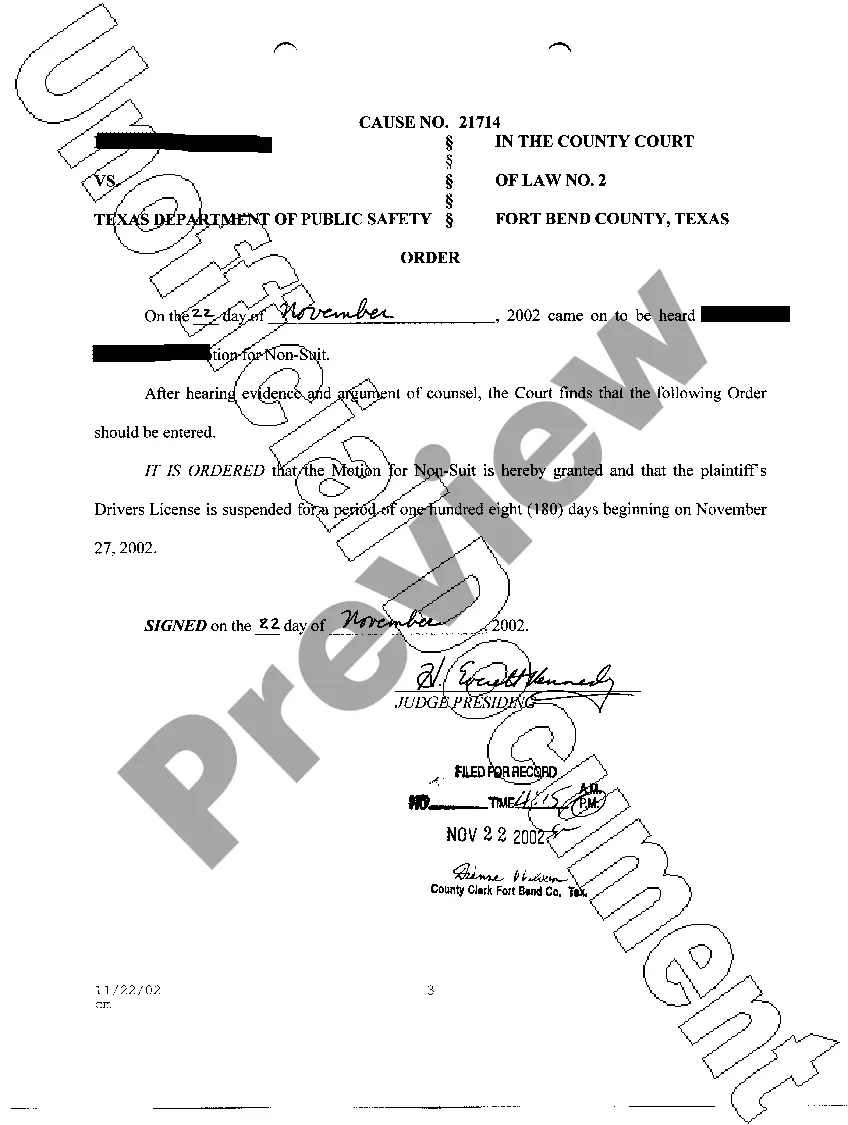

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s content.

- Examine the form description to confirm you have selected the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button. Then, select the payment plan you want and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

The recent federal rules regarding independent contractors aim to clarify classifications and rights. These new regulations affect how relationships are defined and enforced, which is crucial for anyone working under a Vermont Engineering Agreement - Self-Employed Independent Contractor. You should stay informed about these changes to ensure compliance and understand your rights as an independent contractor.

Being self-employed means you work for yourself rather than a traditional employer, often entering into agreements like the Vermont Engineering Agreement - Self-Employed Independent Contractor. Key indicators include earning income directly from clients, having multiple clients, and being responsible for your taxes and business expenses. This status allows for greater flexibility and independence in your work.

Yes, indeed! An independent contractor is considered self-employed because they operate their own business, serving clients directly under a Vermont Engineering Agreement - Self-Employed Independent Contractor. This classification affects your tax responsibilities and the ability to control your work. Understanding this distinction can help you navigate your career more effectively.

While both terms describe similar work status, using 'independent contractor' can clarify your specific role in a Vermont Engineering Agreement - Self-Employed Independent Contractor. This term emphasizes your contractual relationships with clients and the project-based nature of your work. Ultimately, the best term depends on your audience and context.

Yes, having a contract is essential as an independent contractor. A Vermont Engineering Agreement - Self-Employed Independent Contractor provides clarity on the terms of your relationship with clients. It protects your rights and specifies deliverables, payment terms, and confidentiality expectations. Leveraging resources from USLegalForms can help you draft a comprehensive agreement that suits your business needs.

In most cases, a Vermont Engineering Agreement - Self-Employed Independent Contractor does not require notarization. However, some situations may call for notarization, especially for certain types of contracts or funding. Always check state laws and consider legal advice to ensure your agreement meets all necessary requirements. By using USLegalForms, you can find relevant information and templates that align with your needs.

Creating an independent contractor agreement involves several key steps. First, define the scope of work clearly so that both parties understand their responsibilities. Next, include terms regarding payment, deadlines, and project completion. Utilizing platforms like USLegalForms can simplify this process by providing customizable templates tailored for a Vermont Engineering Agreement - Self-Employed Independent Contractor.

Writing an independent contractor agreement involves outlining the complete relationship between the contractor and the hiring party. Start by defining the contractors’ responsibilities, payment structure, and length of service. It is crucial to reference terms related to the Vermont Engineering Agreement - Self-Employed Independent Contractor in order to cover key aspects. If you need assistance, templates available on uslegalforms can help you create a comprehensive agreement.

To fill out an independent contractor agreement, start with your basic contractor information at the top of the document. Clearly define the work scope, payment details, and duration of the engagement in the appropriate sections. Ensure you incorporate details specific to the Vermont Engineering Agreement - Self-Employed Independent Contractor to protect both parties. Templates from uslegalforms can provide a structured format to guide your completion.

Filling out an independent contractor form requires understanding the basic information needed. First, gather personal details, such as the contractor's name and contact information. Next, include essential terms of the Vermont Engineering Agreement - Self-Employed Independent Contractor, like the scope of work, payment terms, and deadlines. Using a template from uslegalforms can simplify this process and ensure completeness.