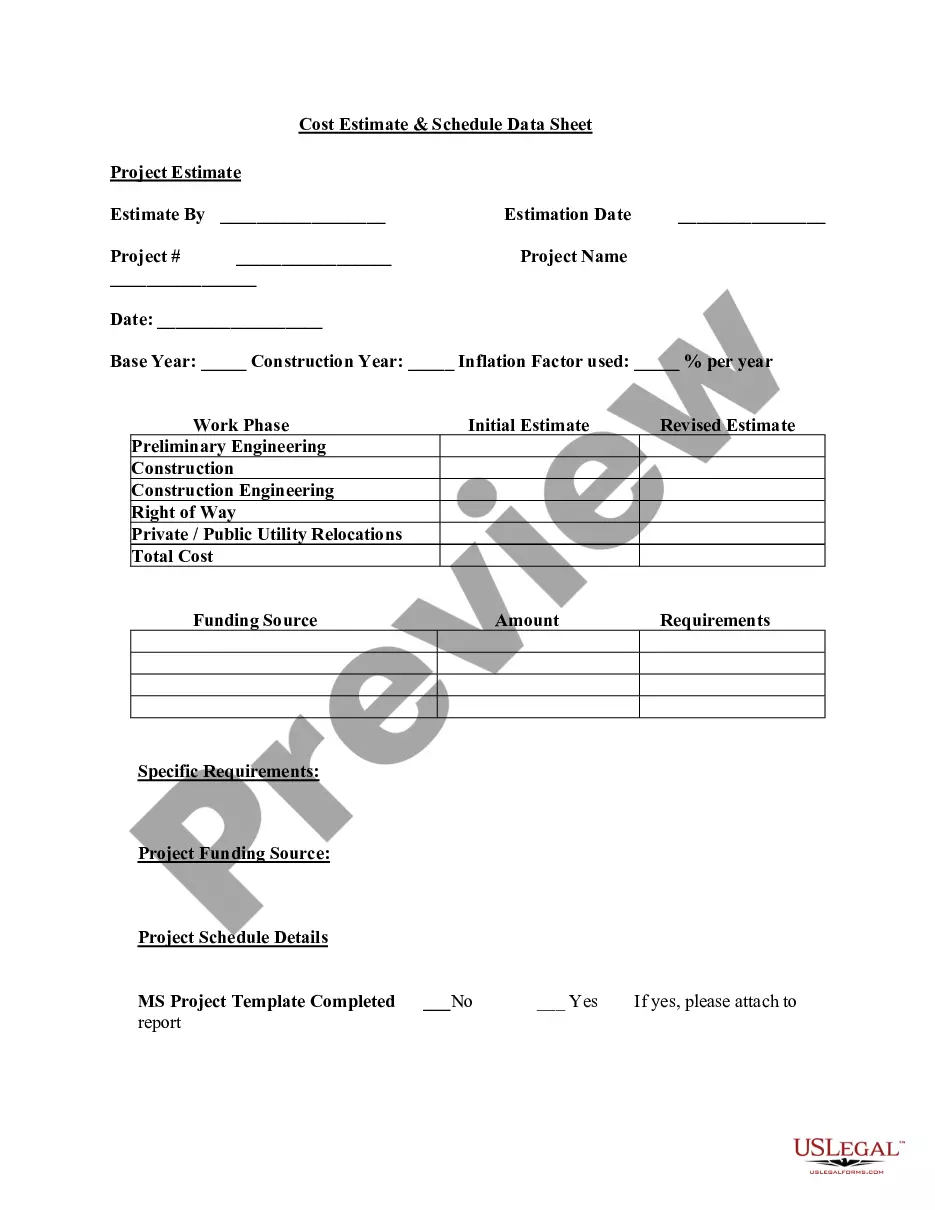

This due diligence form is used to summarize data for each LLC associated with the company in business transactions.

Vermont Limited Liability Company Data Summary

Description

How to fill out Limited Liability Company Data Summary?

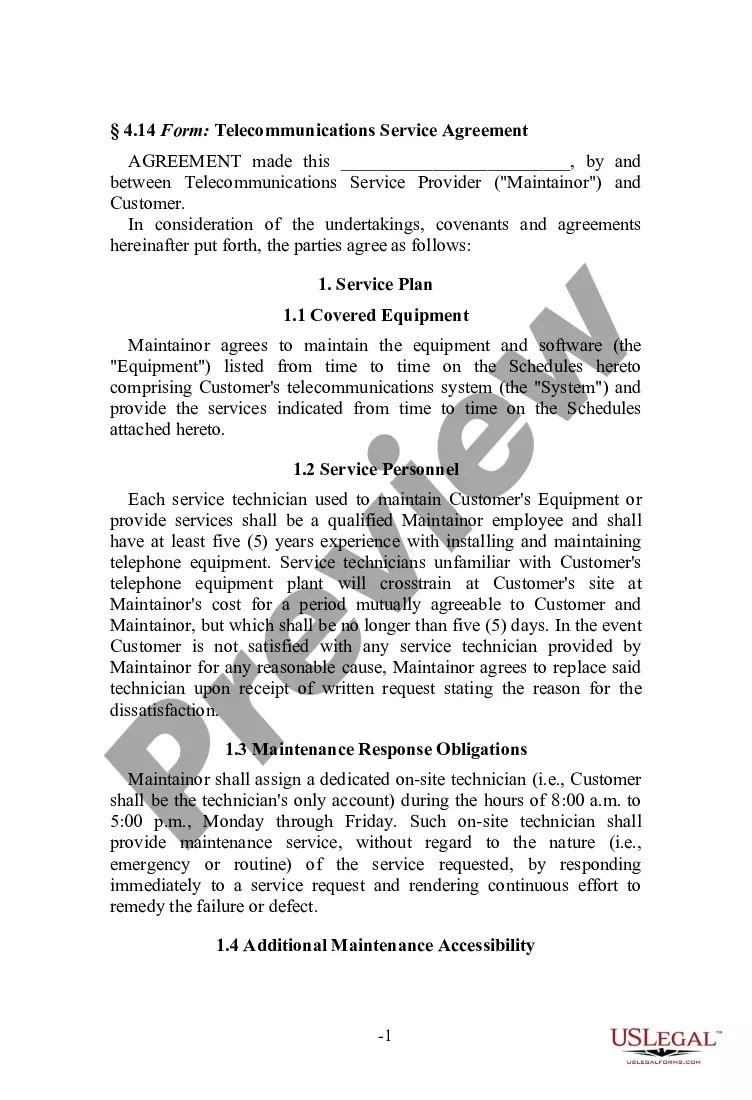

Finding the correct legal document template can be a challenge. Of course, there are numerous templates available online, but how do you locate the legal form you need? Utilize the US Legal Forms website. This service provides thousands of templates, including the Vermont Limited Liability Company Data Summary, suitable for both business and personal needs. All templates are reviewed by experts and meet federal and state requirements.

If you are already a registered user, Log In to your account and click the Download button to obtain the Vermont Limited Liability Company Data Summary. Use your account to access the legal forms you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple instructions to follow: First, ensure you have selected the correct form for your region/state. You can browse the form using the Preview button and review the form description to confirm it meets your needs. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are sure the form is correct, click the Get now button to acquire the form. Select the payment plan you prefer and input the necessary information. Create your account and process the payment using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill, modify, print, and sign the obtained Vermont Limited Liability Company Data Summary.

- US Legal Forms boasts the largest collection of legal templates where you can find a variety of document forms.

- Utilize the service to download professionally crafted paperwork that comply with state regulations.

Form popularity

FAQ

Yes, most states, including Vermont, require LLCs to file an annual report to remain in good standing. This report typically confirms key information about your business, helping maintain transparency and compliance. Keeping your Vermont Limited Liability Company Data Summary on hand will assist you in compiling necessary details for this important task.

Common mistakes when filing an LLC annual report include incorrect or missing information, such as the address or registered agent details. Additionally, failing to file on time or overlooking renewal deadlines can create legal hurdles. To avoid these issues, use the Vermont Limited Liability Company Data Summary as a checklist and consider employing tools like USLegalForms for a smooth filing experience.

While your focus may be on Vermont, it’s useful to know that the annual report in Mississippi typically requires company identification, a list of directors, and a summary of business activities. Ensure your information is current to avoid complications. While each state has unique requirements, platforms like USLegalForms can provide the necessary guidance tailored to your state’s requirements.

Failing to file an annual report for your LLC can result in various consequences, including fines and the potential loss of your company’s good standing. In Vermont, non-compliance might lead to administrative dissolution, meaning you may lose the ability to operate legally. To avoid this situation, keep track of your filing deadlines and maintain your Vermont Limited Liability Company Data Summary updated.

Filing an annual report for your LLC involves completing the form and submitting it to the relevant state authority. It's essential to check the specific instructions provided for Vermont LLCs to ensure compliance. Many choose to file online for convenience. Platforms such as USLegalForms can guide you through the steps and provide the necessary forms.

To complete a limited liability company annual report, gather all necessary business information, including your Vermont Limited Liability Company Data Summary. Begin by filling in your company name, address, and other details required by the state. Ensure accuracy to avoid issues with your filing. You can utilize online platforms like USLegalForms to simplify this process.

If you forget to file an annual report for your LLC in Vermont, your business may incur late fees and other penalties. Additionally, your company could face dissolution, resulting in significant disruptions. To avoid this situation, consider using USLegalForms to receive reminders and assistance with your Vermont Limited Liability Company Data Summary and annual report filings.

To look up an LLC in Vermont, you can utilize the Vermont Secretary of State’s online business database. Simply enter the LLC's name or registration number to access its Vermont Limited Liability Company Data Summary and other relevant details. This tool is convenient for ensuring you have the right information at your fingertips.

Filing an annual report in Vermont involves completing the appropriate forms that include essential information about your LLC. You can file by mail or online through the Vermont Secretary of State’s website. Make sure to include your Vermont Limited Liability Company Data Summary to ensure all information is accurate and up to date.

If your LLC does not file an annual report in Vermont, it may face penalties, which include late fees. Furthermore, failing to file can lead to the dissolution of your LLC by the state. It is essential to keep your Vermont Limited Liability Company Data Summary updated to maintain good standing and avoid any legal complications.