Vermont Memo - Using Self-Employed Independent Contractors

Description

How to fill out Memo - Using Self-Employed Independent Contractors?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or create.

Through the website, you can locate thousands of forms for business and personal use, organized by type, state, or keywords.

You will find the latest forms such as the Vermont Memo - Using Self-Employed Independent Contractors in just seconds.

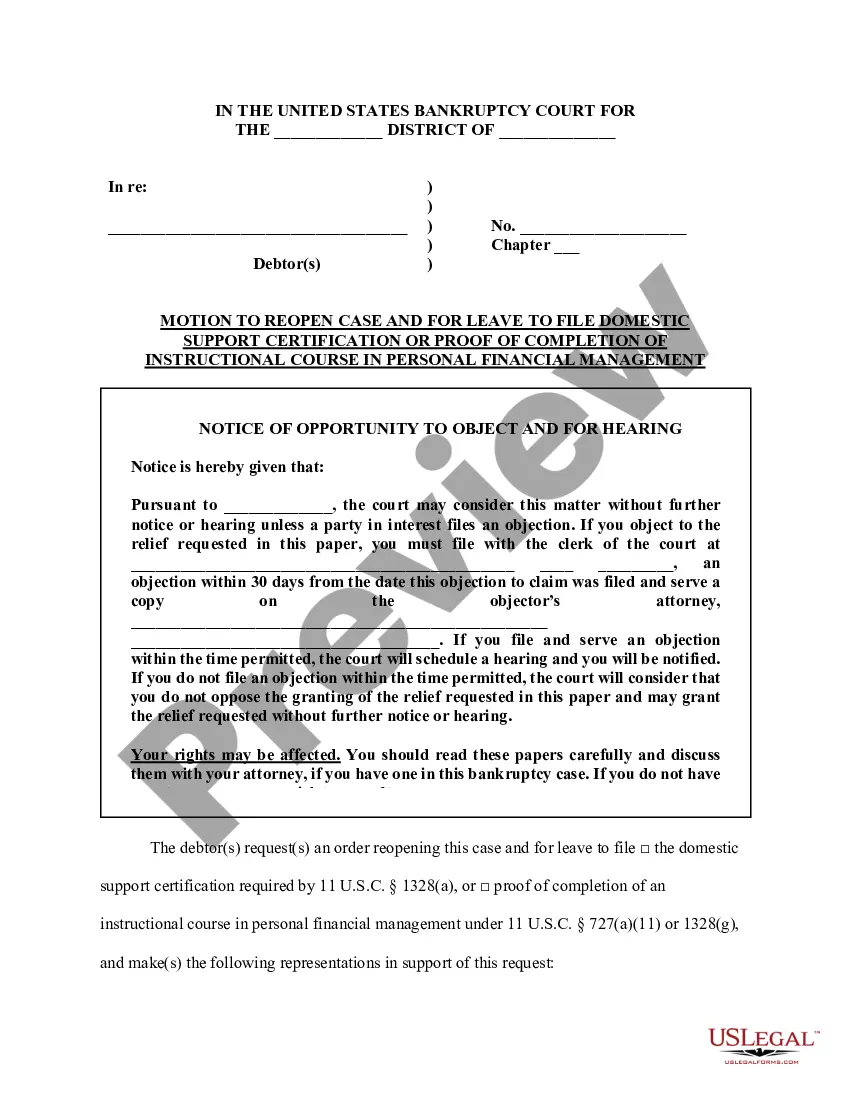

Select the Review option to review the form`s information. Check the form outline to confirm that you have chosen the right form.

If the form doesn’t meet your needs, use the Search area at the top of the screen to find one that does.

- If you already have a subscription, Log In and download the Vermont Memo - Using Self-Employed Independent Contractors from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You have access to all previously saved forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are some simple steps to get you started.

- Ensure you have selected the appropriate form for your city/state.

Form popularity

FAQ

The self-employment tax in Vermont refers to the taxes you owe for Social Security and Medicare, which generally sum up to about 15.3% of your net earnings. This tax is applicable at both the federal and state levels. It is crucial to account for this when calculating your total liabilities as a self-employed individual. For more details, refer to the Vermont Memo - Using Self-Employed Independent Contractors.

In Vermont, the self-employment tax includes both Social Security and Medicare taxes, totaling approximately 15.3%. This rate applies to your net earnings from self-employment. Remember that you must also file federal self-employment taxes, which can impact your overall tax burden. Understand the implications through the Vermont Memo - Using Self-Employed Independent Contractors for better financial planning.

Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

Hire and pay employeesGet an Employer Identification Number (EIN)Find out whether you need state or local tax IDs.Decide if you want an independent contractor or an employee.Ensure new employees return a completed W-4 form.Schedule pay periods to coordinate tax withholding for IRS.More items...

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Steps to Hiring your First Employee in VermontStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

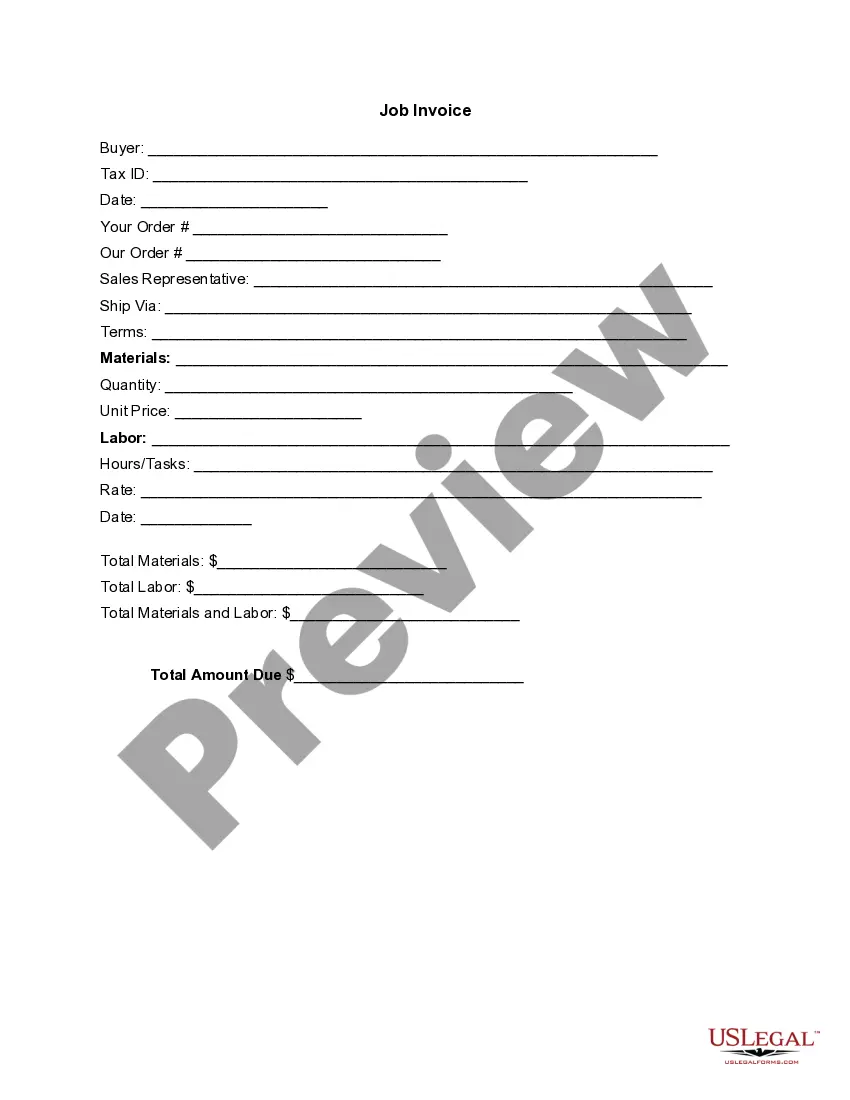

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?

Pandemic Unemployment Assistance (PUA): This will allow for unemployment insurance benefits to individuals not eligible for regular Unemployment Insurance, such as the self-employed.