Vermont Information for Alternative Method of Counting Creditable Coverage

Description

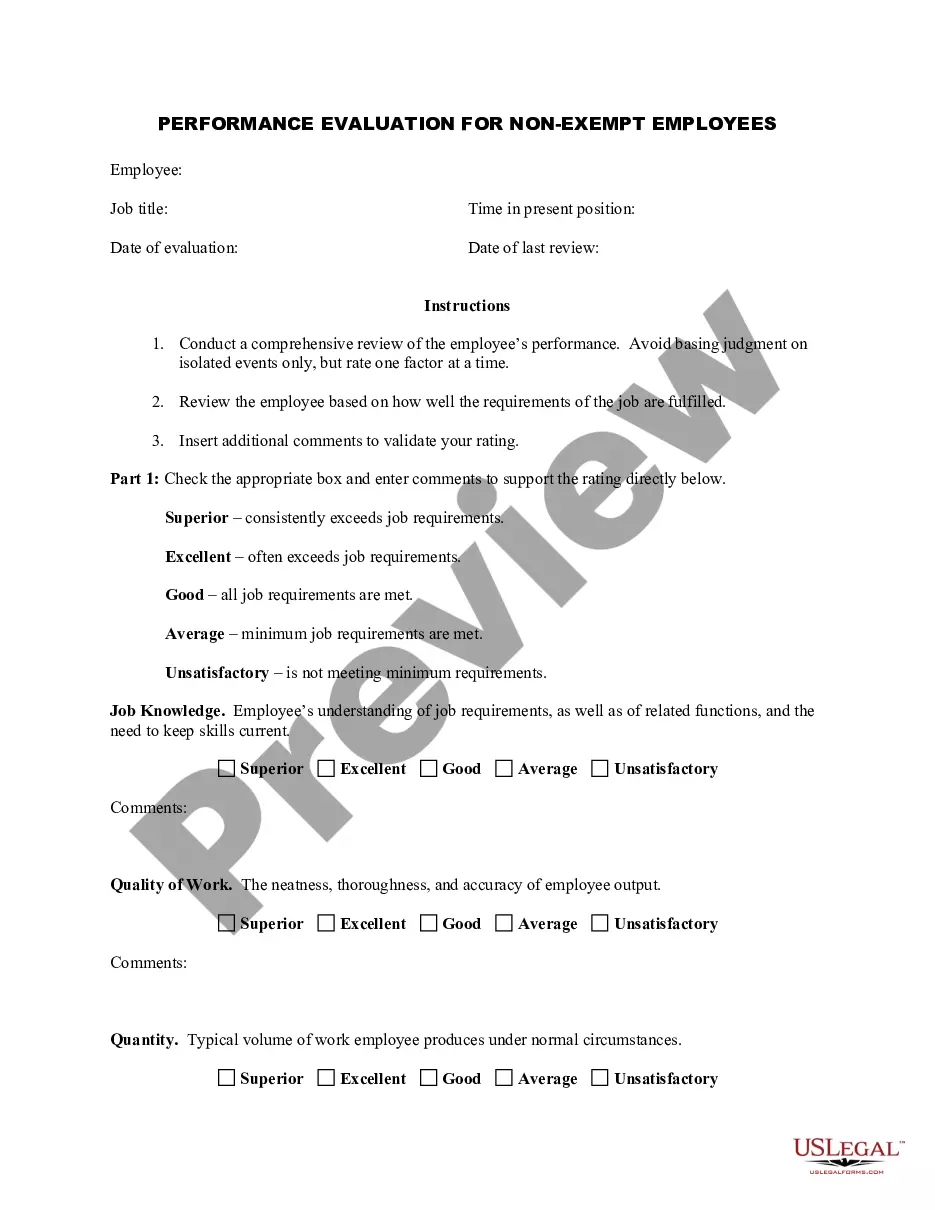

How to fill out Information For Alternative Method Of Counting Creditable Coverage?

If you need to fill out, obtain, or print authentic document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Leverage the site's user-friendly search tool to locate the documents you require. Various templates for business and personal purposes are categorized by types and states, or by search terms.

Employ US Legal Forms to access the Vermont Information for Alternative Method of Counting Creditable Coverage with just a few clicks.

Every legal document template you purchase belongs to you permanently. You have access to every form you downloaded in your account. Browse the My documents section to select a document to print or download again.

Be proactive and download and print the Vermont Information for Alternative Method of Counting Creditable Coverage using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Vermont Information for Alternative Method of Counting Creditable Coverage.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm that you have selected the document for the correct city/state.

- Step 2. Use the Preview option to review the document's content. Don't forget to read the overview.

- Step 3. If you are dissatisfied with the document, utilize the Search field at the top of the screen to find other versions in the legal form format.

- Step 4. Once you have identified the document you need, click the Get now button. Choose your preferred pricing plan and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Vermont Information for Alternative Method of Counting Creditable Coverage.

Form popularity

FAQ

You should receive a notice from your employer or plan around September of each year, informing you if your drug coverage is creditable. If you have not received this notice, contact your human resources department, drug plan, or benefits manager.

Group health plan sponsors are required to disclose to CMS whether their prescription drug coverage is creditable or non-creditable. This disclosure is required regardless of whether the health plan's coverage is primary or secondary to Medicare.

The Notice of Creditable Coverage works as proof of your coverage when you first become eligible for Medicare. Those who have creditable coverage through an employer or union receive a Notice of Creditable Coverage in the mail each year. This notice informs you that your current coverage is creditable.

Non-creditable coverage: A health plan's prescription drug coverage is non-creditable when the amount the plan expects to pay, on average, for prescription drugs for individuals covered by the plan in the coming year is less than that which standard Medicare prescription drug coverage would be expected to pay.

A certificate of Creditable Coverage (COCC) is a document provided by your previous insurance carrier that proves that your insurance has ended. This includes the name of the member to whom it applies as well as the coverage effective date and cancelation date.

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

Eliminating the Part D LEP For most people, you have to pay the LEP as long as you are enrolled in the Medicare prescription drug benefit. There are some exceptions: If you receive Extra Help, your penalty will be permanently erased. If you are under 65 and have Medicare, your LEP will end when you turn 65.

Employers must provide creditable or non-creditable coverage notice to all Medicare eligible individuals who are covered under, or who apply for, the entity's prescription drug plan (Part D eligibles), whether active employees or retirees, at least once a year.

Notices of creditable/non-creditable coverage may be included in annual enrollment materials, sent in separate mailings or delivered electronically.

You'll still get a notice from your drug plan letting you know what your copayments for 2021 will be. What should I do if I don't qualify automatically? You should apply for Extra Help if: Your yearly income is $19,140 or less for an individual or $25,860 or less for a married couple living together.