Vermont Application for Renewal of Reservation of Corporate Name

Description

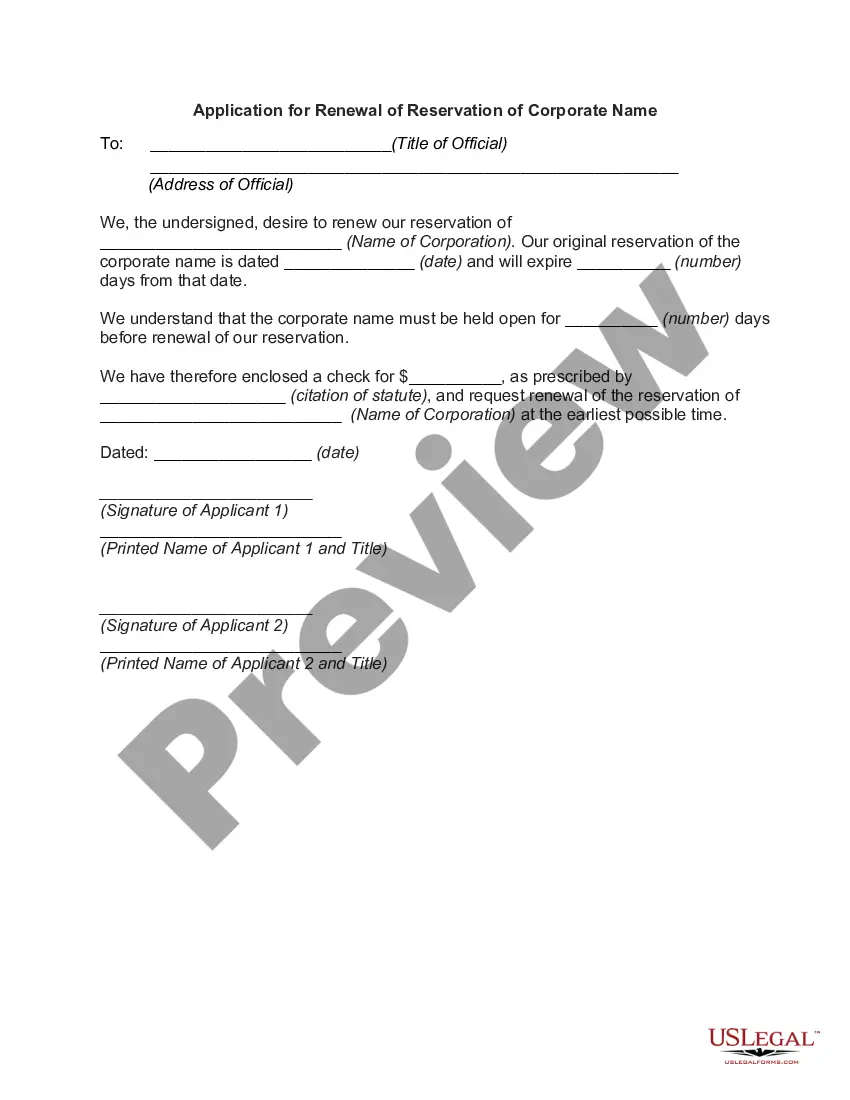

How to fill out Application For Renewal Of Reservation Of Corporate Name?

You may devote several hours on the Internet attempting to find the lawful document format which fits the federal and state demands you want. US Legal Forms gives a huge number of lawful types that are analyzed by pros. You can actually obtain or produce the Vermont Application for Renewal of Reservation of Corporate Name from the assistance.

If you already possess a US Legal Forms profile, you may log in and then click the Acquire button. Next, you may complete, change, produce, or indicator the Vermont Application for Renewal of Reservation of Corporate Name. Each lawful document format you acquire is yours forever. To obtain an additional duplicate of any acquired develop, check out the My Forms tab and then click the related button.

Should you use the US Legal Forms internet site the first time, stick to the straightforward guidelines listed below:

- Initially, make certain you have chosen the best document format for the county/city of your liking. Look at the develop outline to make sure you have picked out the correct develop. If offered, utilize the Preview button to search throughout the document format as well.

- If you wish to find an additional variation of the develop, utilize the Research industry to find the format that fits your needs and demands.

- Once you have located the format you need, just click Buy now to continue.

- Select the rates program you need, key in your references, and register for an account on US Legal Forms.

- Comprehensive the deal. You should use your credit card or PayPal profile to fund the lawful develop.

- Select the file format of the document and obtain it to your device.

- Make adjustments to your document if possible. You may complete, change and indicator and produce Vermont Application for Renewal of Reservation of Corporate Name.

Acquire and produce a huge number of document web templates while using US Legal Forms site, which provides the biggest selection of lawful types. Use professional and state-particular web templates to tackle your business or specific demands.

Form popularity

FAQ

It costs $125 to register your LLC with Vermont's Secretary of State. You can submit your Vermont Articles of Organization by mail or in person, but the fastest way is to file online with the Vermont Secretary of State's Business Service Center. Filing your articles is what officially forms your business in Vermont.

Amendment Filing Instructions Click VT Sec of State Online Services on the left menu. From the dropdown menu, click Business Amendments. Follow prompts and enter all required and updated information. Click Submit on the final page.

Vermont does not have a statewide basic business license. Businesses may need to register with the Vermont Secretary of State or the Department of Taxes for business taxes, sales tax, or payroll taxes.

In Vermont, state fees can vary depending on the type of entity you choose to form. ing to the Vermont Secretary of State website, expect to pay roughly $145 - $160 to start a business in Vermont.

If you plan to sell tangible personal property, rent rooms, sell meals and/or alcohol, or hire employees, you must register for a business tax account before doing business. Each tax type?Vermont Sales and Use Tax, Vermont Meals and Rooms Tax, and Vermont Withholding Tax?requires a separate account.

To register a foreign corporation in Vermont, you must file a Vermont Application for Certificate of Authority with the Vermont Secretary of State. You can submit this document by mail, fax, in person, or online. The Certificate of Authority for a foreign Vermont corporation costs $125 to file.

It costs $125 to register your LLC with Vermont's Secretary of State. You can submit your Vermont Articles of Organization by mail or in person, but the fastest way is to file online with the Vermont Secretary of State's Business Service Center. Filing your articles is what officially forms your business in Vermont.

Under Vermont law, all businesses except for corporations and limited liability companies doing business within the state will need to file a DBA. Filing for a DBA allows the company to open bank accounts, enter contracts, and otherwise operate with the new name.