Vermont Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

How to fill out Provisions For Testamentary Charitable Remainder Unitrust For One Life?

US Legal Forms - one of the most extensive collections of legal documents in the USA - provides a variety of legal form templates available for download or creation.

By using the platform, you can access numerous forms for business and personal purposes, categorized by types, states, or keywords.

You can acquire the latest versions of forms like the Vermont Provisions for Testamentary Charitable Remainder Unitrust for One Life within moments.

Read the form description to confirm you have chosen the appropriate document.

If the document does not meet your needs, use the Search field at the top of the page to find a more suitable one.

- If you already possess a membership, Log In and retrieve the Vermont Provisions for Testamentary Charitable Remainder Unitrust for One Life from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously purchased forms in the My documents section of your account.

- If you are new to US Legal Forms, here are simple steps to help you get started.

- Ensure you have selected the correct form for your locality/state.

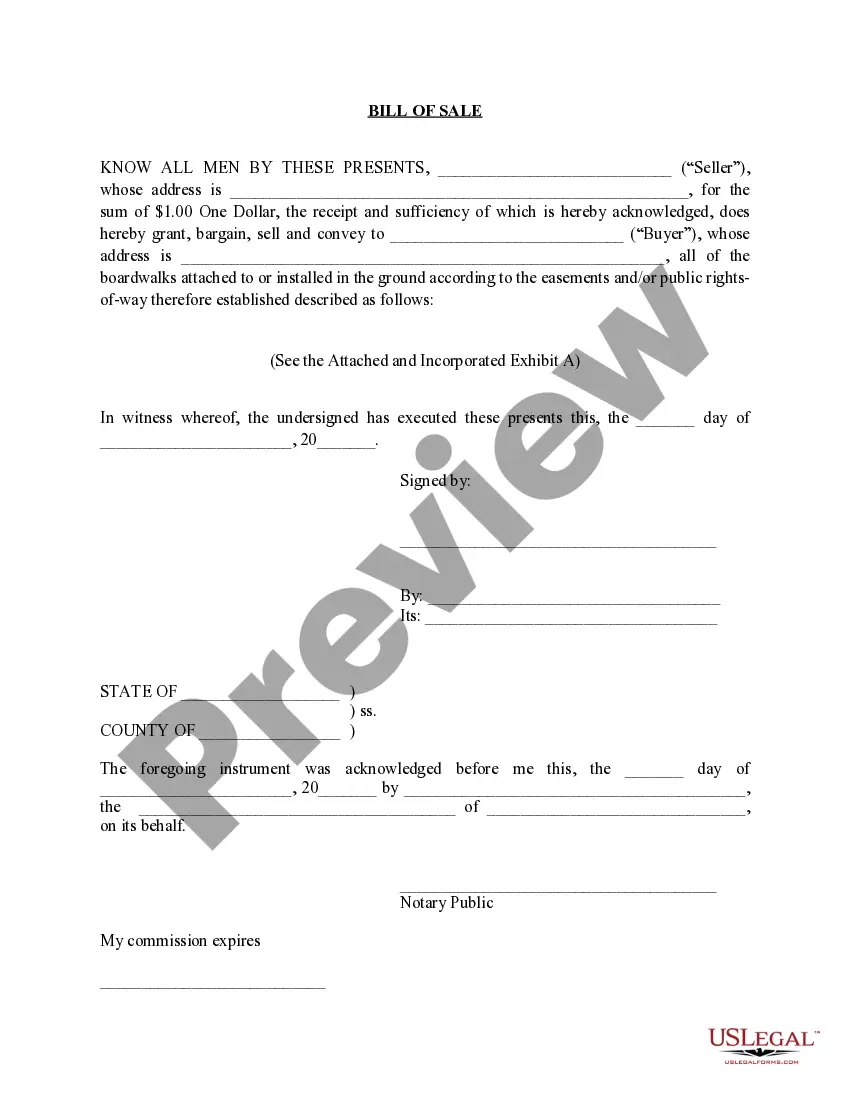

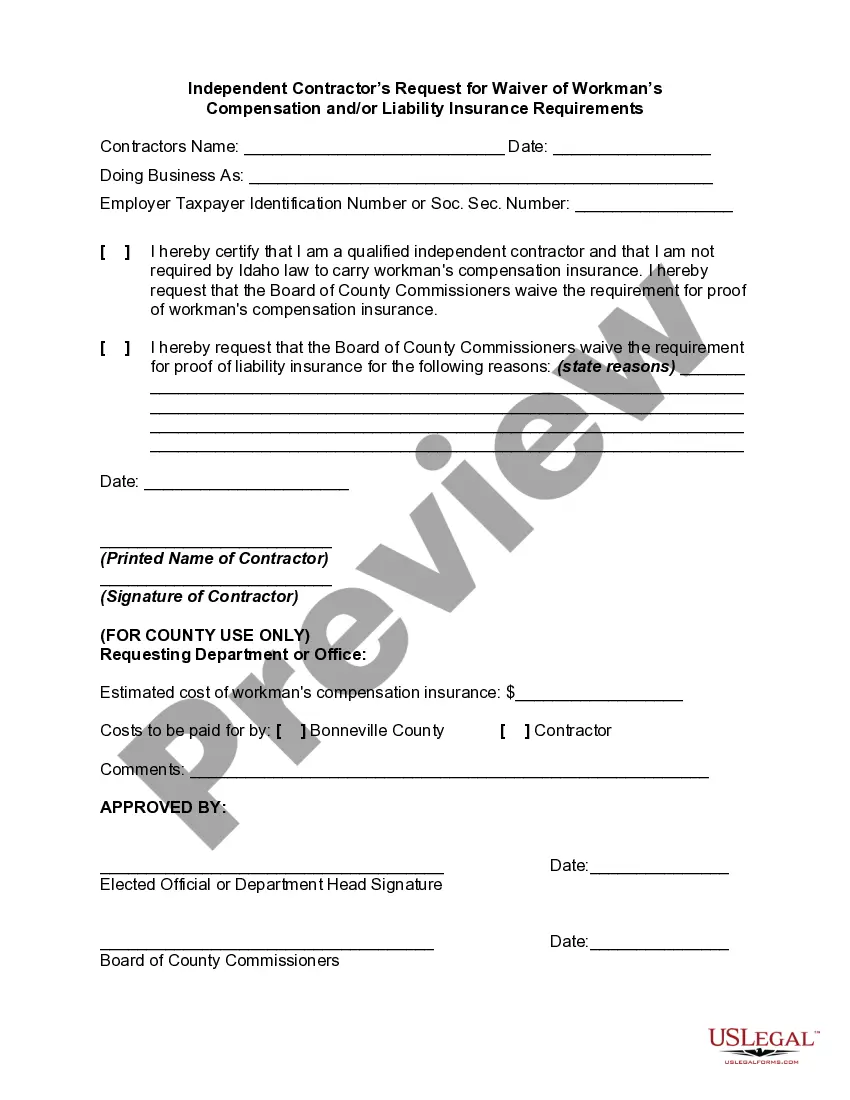

- Click the Preview button to review the document's content.

Form popularity

FAQ

If an individual establishes a charitable remainder trust for his or her life only, the trust assets will be included in his or her gross estate under IRC section 2036. The amount included, however, will wash out as an estate tax charitable deduction under IRC section 2055.

1. Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years.

Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed. Charitable remainder unitrusts (CRUTs) distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made.

How long can the CRT last? A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

In each case, when the income interest of a CRT terminates, usually due to the death of the income beneficiary or the passage of a stated term of years, the remainder interest passes to one or more qualifying charities.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years. 2. Charitable remainder annuity trust (CRAT) pays the beneficiary a fixed amount, or annuity, for the term of the trust.

By the Charitable Strategies Group A Charitable Remainder Trust (CRT) is a gift of cash or other property to an irrevocable trust. The donor receives an income stream from the trust for a term of years or for life and the named charity receives the remaining trust assets at the end of the trust term.

Generally, if a trust beneficiary is the owner of all interests in a trust (both the income and remainder interests), the trust terminates, and the beneficiary has access to the trust principal. If the merger doctrine doesn't apply under governing state law, a court order may be required to terminate the trust.

The term of a charitable remainder trust can be for up to 20 years or for the lifetime of one or more noncharitable beneficiaries.