Vermont Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner

Description

How to fill out Agreement To Continue Business Between Surviving Partners And Legal Representative Of Deceased Partner?

You can spend time online trying to locate the correct legal document template that matches the state and federal requirements you need.

US Legal Forms offers numerous legal documents that have been validated by professionals.

It is easy to obtain or create the Vermont Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner from the service.

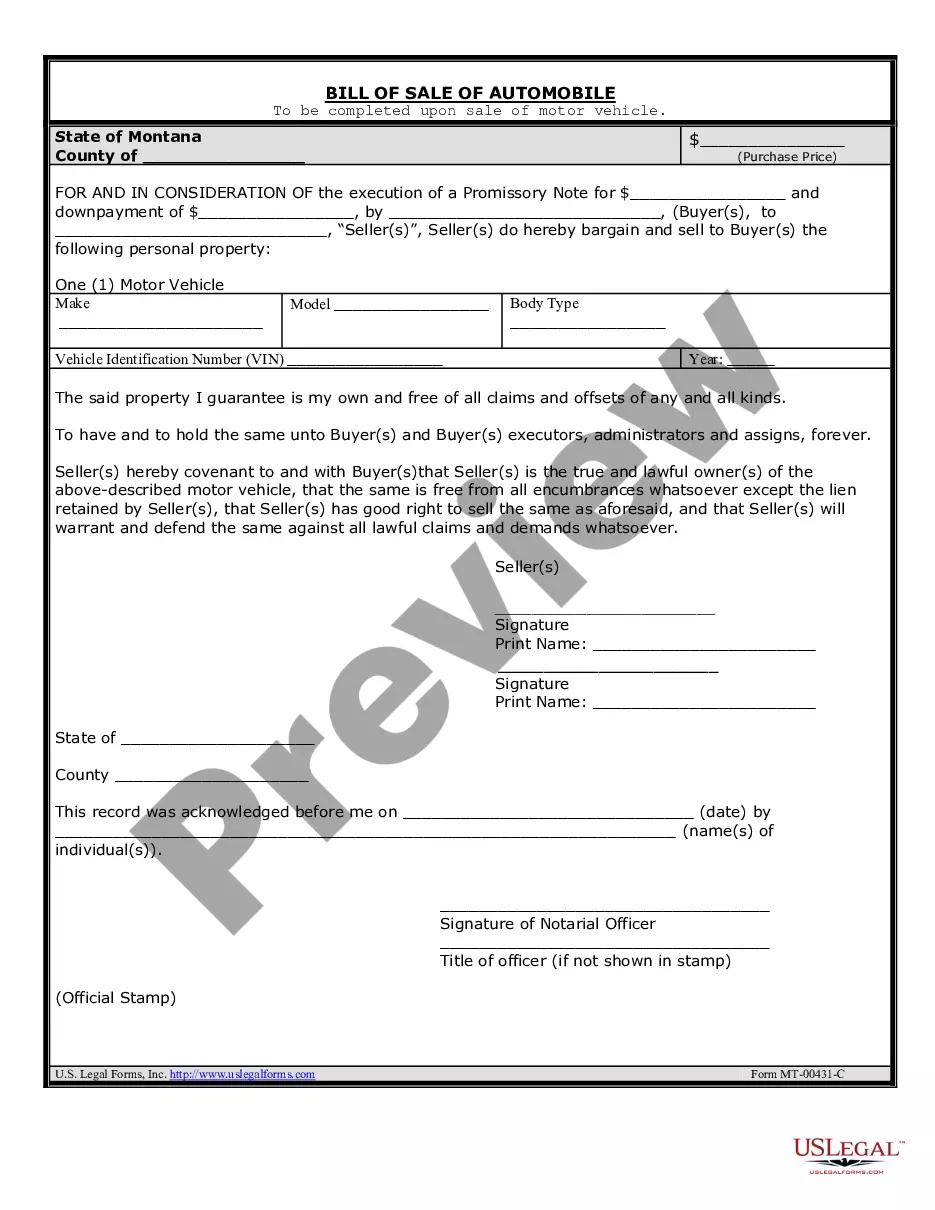

Check the form description to confirm you have chosen the right form. If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Vermont Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner.

- Every legal document template you purchase is yours for a long time.

- To obtain an additional copy of any purchased form, visit the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your region/city of your choice.

Form popularity

FAQ

When a partner in an unincorporated business dies, the surviving partners must take immediate steps to handle the deceased partner's stake. They should refer to the partnership agreement to determine the proper procedures to follow. Developing a Vermont Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner is an effective way to outline these procedures and clarify expectations among surviving partners during this challenging time.

Upon the death of a single member of an LLC, the business may dissolve unless there are provisions stating otherwise. The operating agreement may designate how the member's interests should be handled, typically allowing a legal representative to take over. Implementing the Vermont Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner can help ensure the business doesn’t stall and provides clarity on managing ownership transitions.

The deceased partner's estate will become entitled to their share of the business. A limited company will continue after the death of a shareholder. The shares in the business will pass to the estate of the deceased and will be distributed under the terms of their will.

The death of any Limited Partner shall neither dissolve nor terminate the Partnership. If a Limited Partner shall die or shall be adjudicated incompetent, his legal representative shall have the right to be a Substitute Limited Partner taking such Limited Partner's interest in the Partnership.

No Partnership Agreement often everyone loses out In the absence of an agreement the Partnership Act 1890 contains default provisions. For example, the death of a partner results in the dissolution of the partnership (i.e. it brings it to an end)!

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

On the death of a partner, the partnership ceases to exist. But the firm may not cease to exist as the other remaining partners may decide to continue the business.

Often the partnership agreement will provide for a few different options, including: the deceased's estate taking over their share of the partnership; a transfer of the other partner's share to you on a payment to the estate; an option for you to bring on a replacement if the deceased does not have an heir; or.

Partnerships automatically dissolve if any partner dies or becomes bankrupt, unless otherwise agreed. Thus partnerships should have a written partnership agreement, with provisions that permit the partnership to continue.

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.