Vermont Return Authorization Form

Description

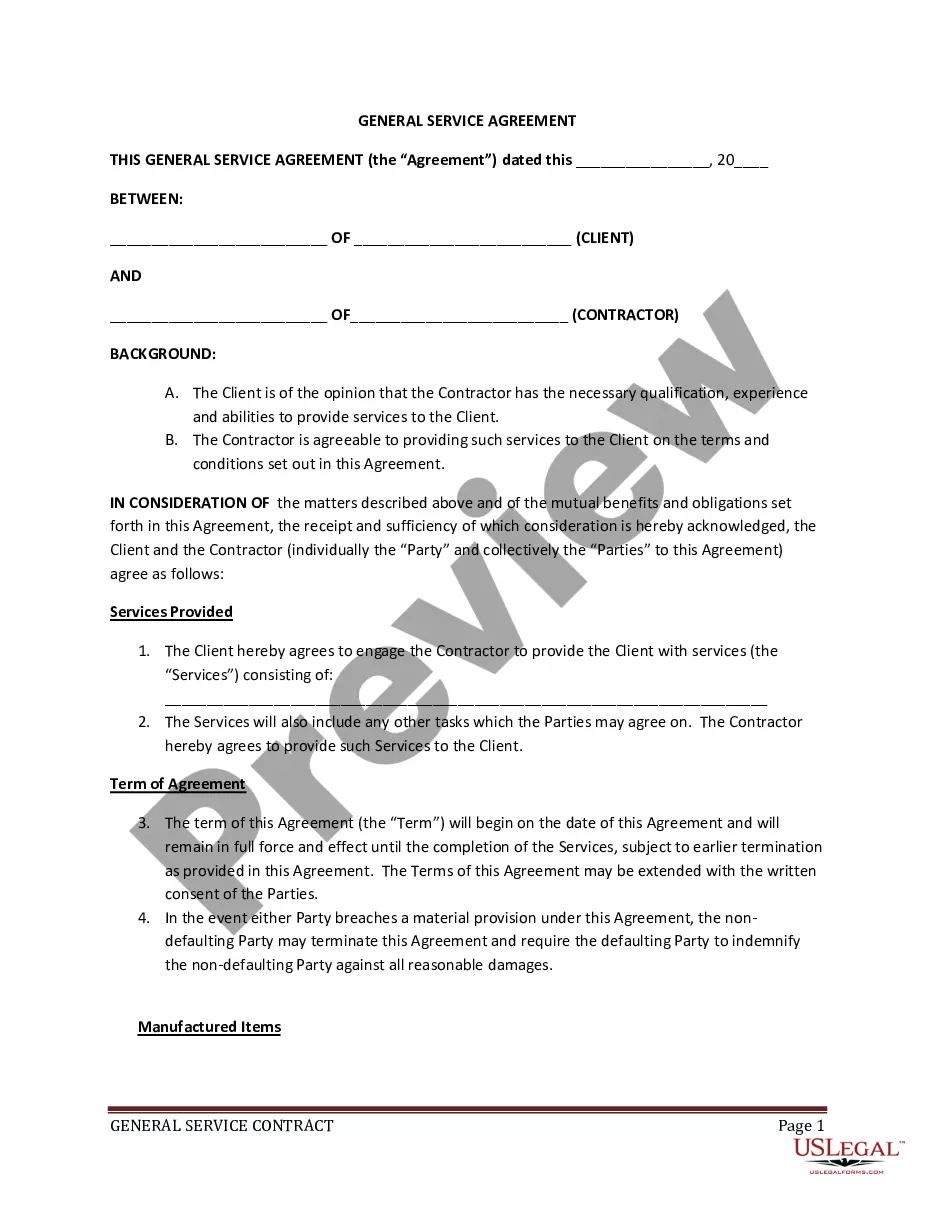

How to fill out Return Authorization Form?

If you need to finish, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal documents available online.

Take advantage of the site's user-friendly and straightforward search to find the documents you require.

Various templates for business and individual purposes are categorized by type and state, or by keywords.

Step 4. After identifying the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to obtain the Vermont Return Authorization Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to get the Vermont Return Authorization Form.

- You can also access forms you previously acquired in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's content. Do not forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to discover alternative versions of the legal form template.

Form popularity

FAQ

The VT form 113 is the Vermont Homestead Declaration and Property Tax Credit Claim form. It ensures that property owners can claim applicable tax credits and indicates their primary residence. If you are filing for tax credits, considering the Vermont Return Authorization Form may help clarify the necessary steps and requirements.

Yes, Vermont offers a property tax break for qualifying seniors, which can provide significant savings on property taxes. This benefit is designed to ease the financial burden on older residents while promoting homeownership stability. To fully understand how this works, you may want to reference the Vermont Return Authorization Form as part of your planning.

If you earn income while residing in Vermont, filing a state tax return is essential. This holds true whether you're a resident or a non-resident with Vermont-sourced income. Utilize the Vermont Return Authorization Form for simplified filing and to ensure you're meeting all state requirements appropriately.

The IN-111 form is used for filing individual income tax returns in Vermont. It helps taxpayers report their income, tax deductions, and credits specific to the state. When filing, it might be beneficial to have the Vermont Return Authorization Form on hand for clarity and compliance purposes.

Some retirees choose states with favorable tax structures, such as Florida or Texas, to reduce tax burdens. However, Vermont also offers benefits, including programs for seniors that may help manage tax obligations. If you are planning to navigate retirement taxes in Vermont, make sure to use the Vermont Return Authorization Form to streamline the process.

Individuals or entities managing an estate or trust in Virginia typically must file a fiduciary tax return. This requirement includes reporting income generated from the trust or estate during the tax year. If you are also managing assets in Vermont, consider using the Vermont Return Authorization Form to ensure proper compliance with state regulations.

Yes, the post office continues to offer IRS forms during peak tax season. However, the selection may vary based on location, so it's wise to check in advance. If you need the Vermont Return Authorization Form, visiting uslegalforms could save you time, as you can find all IRS forms online without any hassle.

To get your tax return forms online, visit the IRS website or trusted legal sites like uslegalforms. They offer an easy way to access all necessary forms, including the Vermont Return Authorization Form. Simply download the required forms, fill them out, and you are ready to submit your taxes efficiently.

Federal tax forms are available at various locations such as post offices, libraries, and IRS offices. Finding them in your area may require a quick search or phone call to confirm availability. For the Vermont Return Authorization Form and other federal forms, uslegalforms is an excellent resource to acquire the documents you need quickly.

You can pick up IRS tax forms at several locations, including post offices and public libraries. Most IRS offices also provide these forms directly. If you're in need of the Vermont Return Authorization Form, consider visiting uslegalforms, where you can download it conveniently from home.