Vermont Vendor Evaluation

Description

How to fill out Vendor Evaluation?

Are you in a scenario where you frequently require documents for either professional or personal reasons.

There are numerous official document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of document templates, such as the Vermont Vendor Evaluation, that are designed to comply with federal and state regulations.

Once you find the appropriate document, click Buy now.

Select the pricing plan you prefer, fill in the required information to make your payment, and complete the transaction using your PayPal account or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Vermont Vendor Evaluation template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the document you need and ensure it is for the correct city/region.

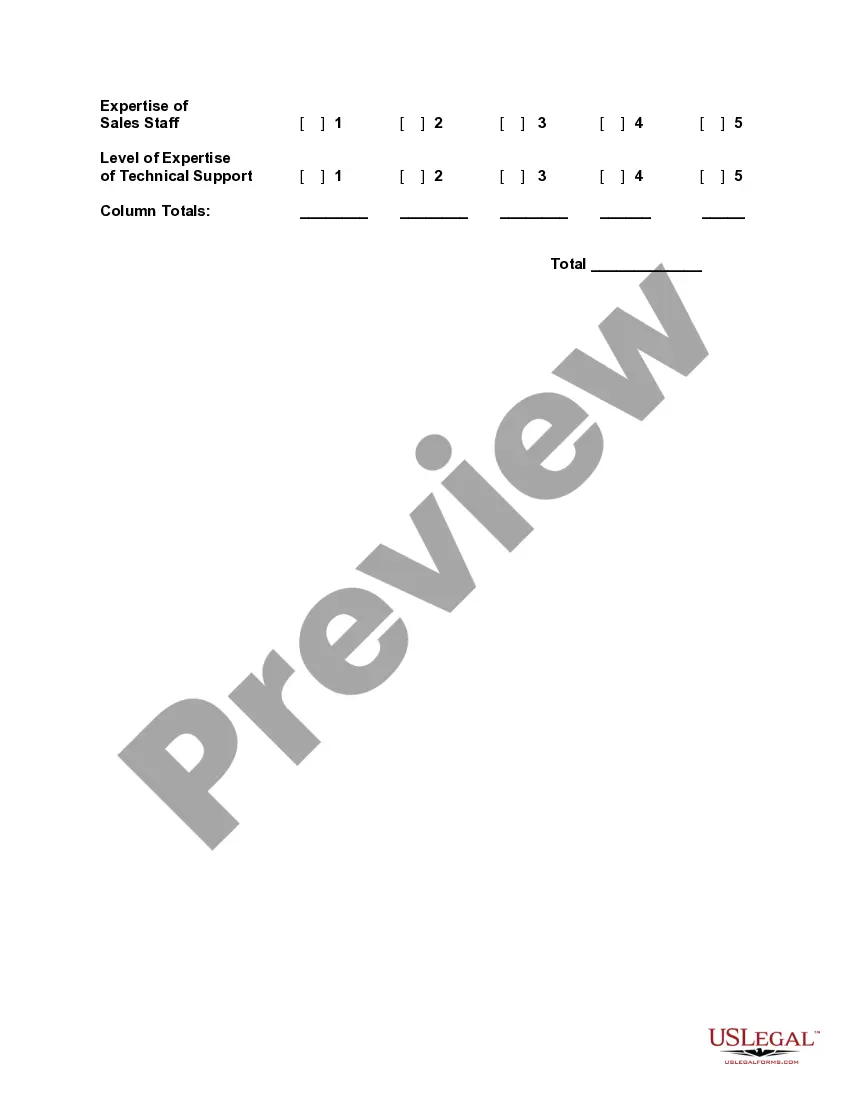

- Utilize the Preview button to examine the form.

- Review the information to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search bar to find a document that meets your needs.

Form popularity

FAQ

To register for sales tax in Vermont, you need to complete the online registration process through the Vermont Department of Taxes website. Providing necessary information about your business structure and expected sales will help you establish your sales tax account. A Vermont Vendor Evaluation can guide you through the intricacies of registration, ensuring you meet all requirements efficiently. Staying organized during this process will support your business operations moving forward.

The voluntary disclosure program in Vermont allows businesses to report unpaid sales tax without facing penalties. This program encourages compliance by providing a clear path for businesses to correct past oversights. Engaging in a Vermont Vendor Evaluation can help identify any areas of concern, ensuring your business remains compliant while benefiting from this program. This can be a proactive way to maintain good standing with the state.

The sales tax rate in Vermont is currently 6%. Additionally, certain municipalities may add a local option tax, increasing the overall rate. For businesses operating in Vermont, a thorough Vermont Vendor Evaluation is essential to ensure compliance with all tax requirements. Understanding these rates will help you make informed financial decisions.

The seven steps of supplier evaluation usually consist of defining needs, identifying potential suppliers, collecting data, evaluating suppliers, conducting site visits, negotiating terms, and making a final decision. Each of these steps works together to create a comprehensive evaluation process. This ensures you understand each supplier’s strengths and how they align with your Vermont Vendor Evaluation goals.

The process of vendor evaluation involves several steps to ensure that you choose the right vendor for your needs. Initially, you identify your requirements and criteria, then gather information on potential vendors. Following that, you assess each vendor’s capabilities, conduct interviews, and finalize your selection based on detailed insights from the evaluations.

Dairy products are the number one commodity in Vermont, with the state known for its high-quality milk, cheese, and other dairy items. This sector plays a significant role in Vermont’s economy and showcases the state's agricultural strengths. Engaging with local vendors in this industry can provide businesses unique opportunities to source top-notch products.

The vendor evaluation process is a systematic approach to selecting the best vendors for your business needs. In Vermont, this process typically includes defining evaluation criteria, gathering data on vendors, and comparing their offerings. It helps organizations systematically assess potential vendors and make informed decisions that align with their operational objectives.

The five phases of vendor selection in Vermont Vendor Evaluation include identifying needs, researching potential vendors, assessing qualifications, negotiating terms, and finally, selecting the vendor. Each phase is critical in ensuring you choose a vendor who meets your requirements and fits your business strategy. By following these phases, you enhance the chances of a successful partnership that contributes to your goals.

Yes, Vermont has introduced an incentive program that offers $10,000 for individuals who relocate to the state. This initiative aims to encourage new residents and support the local economy. It's a fantastic opportunity for anyone considering a move to Vermont, as it can help ease relocation costs and bolster your fresh start in the area.

The Vermont Vendor Evaluation process typically involves five key steps. First, you define your criteria for selection, ensuring they align with your organization’s needs. Second, you gather information on potential vendors through research and inquiries. Third, you assess and analyze each vendor based on your defined criteria. Fourth, you conduct interviews or presentations to gain deeper insights. Finally, you make a decision based on comprehensive evaluations and feedback.