Vermont Agreement to Compromise Debt by Returning Secured Property

Description

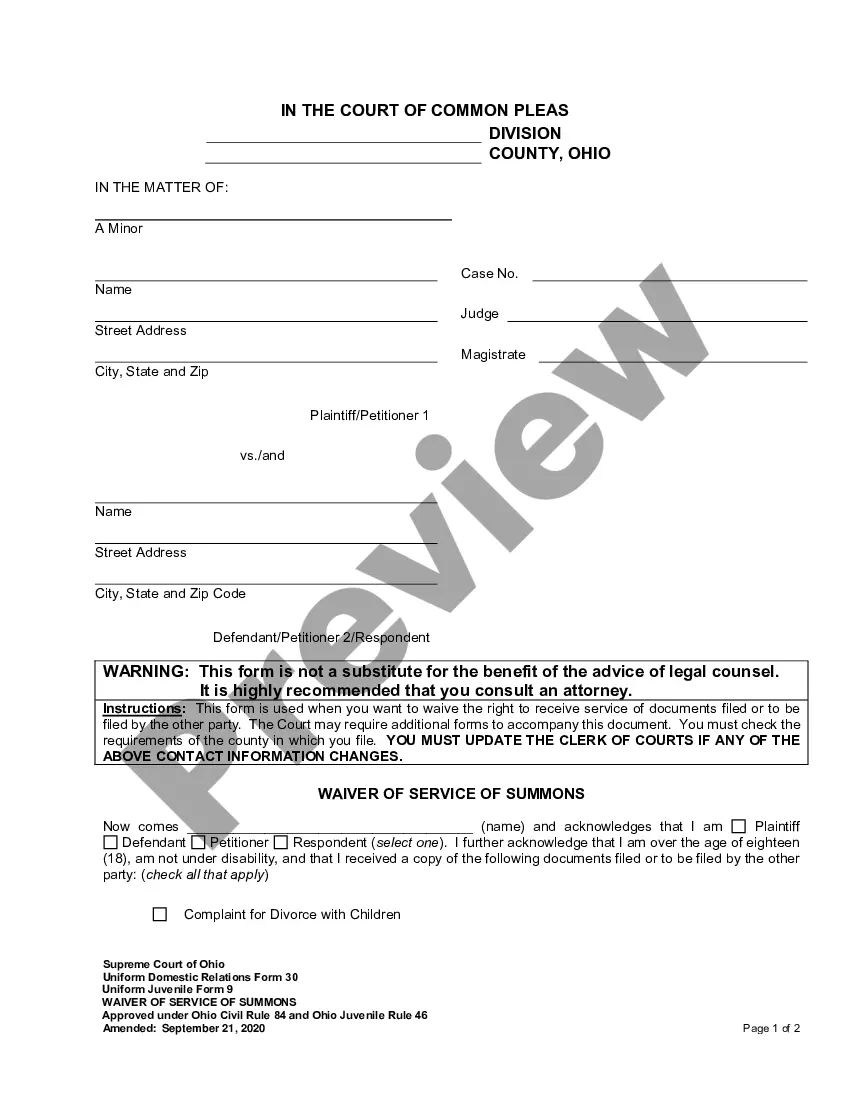

How to fill out Agreement To Compromise Debt By Returning Secured Property?

If you desire to completely, download, or create authentic document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you've found the form you need, click the Download now button. Select the billing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Vermont Agreement to Settle Debt by Returning Secured Property.

- Utilize US Legal Forms to find the Vermont Agreement to Settle Debt by Returning Secured Property with just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to obtain the Vermont Agreement to Settle Debt by Returning Secured Property.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the appropriate area/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Vermont has a mixed reputation when it comes to being a tax-friendly state. While it offers specific exemptions and has a skilled workforce, its property taxes can be relatively high. However, utilizing strategies like a Vermont Agreement to Compromise Debt by Returning Secured Property may allow you to manage your liabilities more effectively. Understanding the tax structure can help you make informed decisions about your financial future.

In Vermont, certain items such as groceries, prescription medications, and medical devices are exempt from sales tax. This exemption can significantly impact your budgeting when dealing with debt and focusing on essentials. When considering options like a Vermont Agreement to Compromise Debt by Returning Secured Property, it’s beneficial to understand these regulations. This understanding can help you allocate your funds more efficiently and work towards financial stability.

Currently, the state of Wyoming does not impose a state tax on personal income. This benefit can provide individuals with more financial flexibility, especially when considering options for managing debts. When using a Vermont Agreement to Compromise Debt by Returning Secured Property, it’s essential to understand how the absence of a state tax might influence your financial strategies. This allows you to navigate your obligations effectively and leverage available resources.

Vermont is not a no tax state. It imposes both state income tax and sales tax. Residents should consider how these taxes might impact their financial decisions, especially when dealing with debt. For those exploring options like the Vermont Agreement to Compromise Debt by Returning Secured Property, understanding tax implications can help in planning a debt relief strategy.

The interest rate for taxes owed in Vermont is 1.5% per month, which totals to an annual rate of 18%. This interest is applied to any unpaid taxes and can quickly increase the total amount owed. If you're struggling with unpaid taxes, exploring the Vermont Agreement to Compromise Debt by Returning Secured Property might be a smart choice to help you manage these debts effectively.

To compromise a debt means to reach an agreement between a debtor and a creditor, allowing the debtor to fulfill their obligations by settling the debt for less than the full amount owed. This process can involve the return of secured property as outlined in the Vermont Agreement to Compromise Debt by Returning Secured Property. It's a practical solution for those looking to alleviate financial pressure while still maintaining compliance with legal standards.

The interest rate on a tax lien in Vermont is set at 1.5% per month, equating to 18% annually. This rate accumulates for each month that the tax remains unpaid. If you find yourself facing a tax lien, exploring the Vermont Agreement to Compromise Debt by Returning Secured Property can be a beneficial step in addressing your obligations.

In Vermont, the legal interest rate typically stands at 12% per year, unless specified otherwise by a contract or law. This rate applies to most debts and can influence the financial strategies employed in the Vermont Agreement to Compromise Debt by Returning Secured Property. Understanding the legal interest rate is crucial for debtors looking to navigate their financial obligations effectively.

Vermont Form 111 is an official document related to property tax credits and adjustments in the state. This form assists residents in applying for tax relief based on income eligibility and property value. When considering a financial strategy, the Vermont Agreement to Compromise Debt by Returning Secured Property may also impact your overall tax situation. Utilizing uslegalforms simplifies the process of understanding and filing this form, ensuring you maximize your benefits.

Generally, property taxes remain a constant obligation for homeowners, and stopping payments can lead to significant penalties and liens against the property. However, if you are facing financial hardship, exploring options such as the Vermont Agreement to Compromise Debt by Returning Secured Property may provide potential solutions. Engaging with uslegalforms can guide you through available resources and options tailored to your situation. It's important to stay proactive and aware of your obligations.