Vermont Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Contract For Part-Time Assistance From Independent Contractor?

Are you in a location where you require documentation for both organizational or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers a vast array of template documents, such as the Vermont Contract for Part-Time Assistance from Independent Contractor, which can be customized to fulfill federal and state requirements.

Once you obtain the correct document, click Buy now.

Choose the pricing plan you desire, complete the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have your account, simply Log In.

- After that, you can download the Vermont Contract for Part-Time Assistance from Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

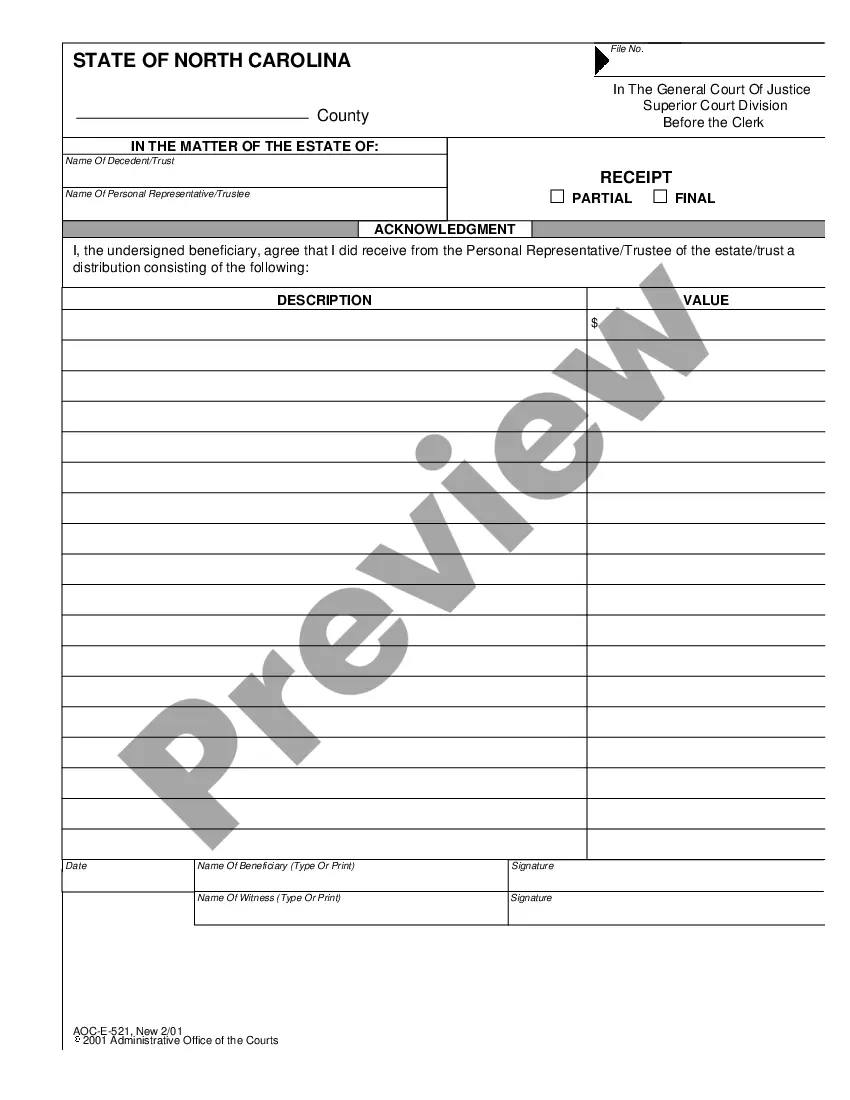

- Utilize the Preview feature to review the document.

- Read the description to confirm you have selected the accurate document.

- If the document isn't what you're looking for, use the Search box to find the document that suits your needs.

Form popularity

FAQ

To set up a Vermont Contract for Part-Time Assistance from Independent Contractor, start by clearly defining the scope of work. Ensure you specify the responsibilities, payment terms, and deadlines. Next, include any legal provisions to protect both parties. You can simplify this process by using USLegalForms, which offers templates specifically for Vermont contracts to help you create a comprehensive agreement.

The 2-year contractor rule often refers to the time frame within which contractors may be reclassified as employees if they continuously work under the same contract. In the context of a Vermont Contract for Part-Time Assistance from Independent Contractor, the rule emphasizes the need for clearly defined agreements to avoid any legal complications. Understanding this rule can help protect your business and ensure you maintain proper classification of your workforce.

You can provide bonuses to independent contractors as an incentive for their work. Including such provisions in your Vermont Contract for Part-Time Assistance from Independent Contractor can motivate contractors to meet or exceed expectations. Make sure to clearly communicate the conditions under which bonuses may be awarded to avoid any confusion later on.

Yes, companies can offer benefits such as bonuses or limited health perks to their 1099 employees, but these are not mandatory. When drafting the Vermont Contract for Part-Time Assistance from Independent Contractor, it's advisable to specify any offered benefits. Understanding this can help enhance contractor satisfaction while ensuring you maintain compliance with labor regulations.

Yes, businesses can offer benefits to one contractor while deciding not to provide them to another. However, it is important to outline this in each Vermont Contract for Part-Time Assistance from Independent Contractor to ensure clarity. Different terms may apply based on individual contracts, but consistency and fairness in how you offer benefits can foster better relations with all contractors.

Yes, you can offer benefits to independent contractors, but it is not a legal requirement. When drafting a Vermont Contract for Part-Time Assistance from Independent Contractor, consider specifying any benefits you wish to offer. This can help in attracting and retaining skilled talent, but ensure that these benefits align with the independent status of the contractor to avoid misclassification.

Typically, independent contractors do not receive benefits like full-time employees. This is mainly because they operate under a Vermont Contract for Part-Time Assistance from Independent Contractor, which does not generally include provisions for benefits. However, some companies may choose to offer limited benefits on a case-by-case basis, depending on their contractual agreement. It's essential to clearly define any expected benefits in the contract to avoid misunderstandings.

Yes, independent contractors should always have a contract. A written agreement helps clarify roles, responsibilities, and payment terms, fostering a professional relationship. By using a Vermont Contract for Part-Time Assistance from Independent Contractor, you protect your rights and establish clear guidelines for your work. This proactive approach minimizes potential conflicts and enhances your overall working experience.

If you do not have a contract, you may face uncertainty regarding your expected duties and compensation. This lack of clarity can result in disputes between you and your client. To prevent these issues, consider using a Vermont Contract for Part-Time Assistance from Independent Contractor. This contract outlines the terms of your agreement, ensuring both parties have a clear understanding of their obligations.

An independent contractor typically receives a 1099 form when they earn $600 or more from a client within a calendar year. It is crucial to track your earnings accurately to ensure you receive the appropriate tax documentation. Utilizing a Vermont Contract for Part-Time Assistance from Independent Contractor can also help keep your income records organized and clear. This documentation can simplify your tax reporting process.