Vermont Property Information Check List - Residential

Description

How to fill out Property Information Check List - Residential?

Selecting the appropriate legal document template can be challenging. Clearly, there are numerous templates accessible online, but how can you obtain the legal form you require? Turn to the US Legal Forms website. This service offers an extensive selection of templates, including the Vermont Property Information Checklist - Residential, suitable for professional and personal use. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already a registered user, Log In to your account and click on the Acquire button to access the Vermont Property Information Checklist - Residential. Use your account to browse through the legal forms you have previously acquired. Navigate to the My documents section of your account to obtain another copy of the document you need.

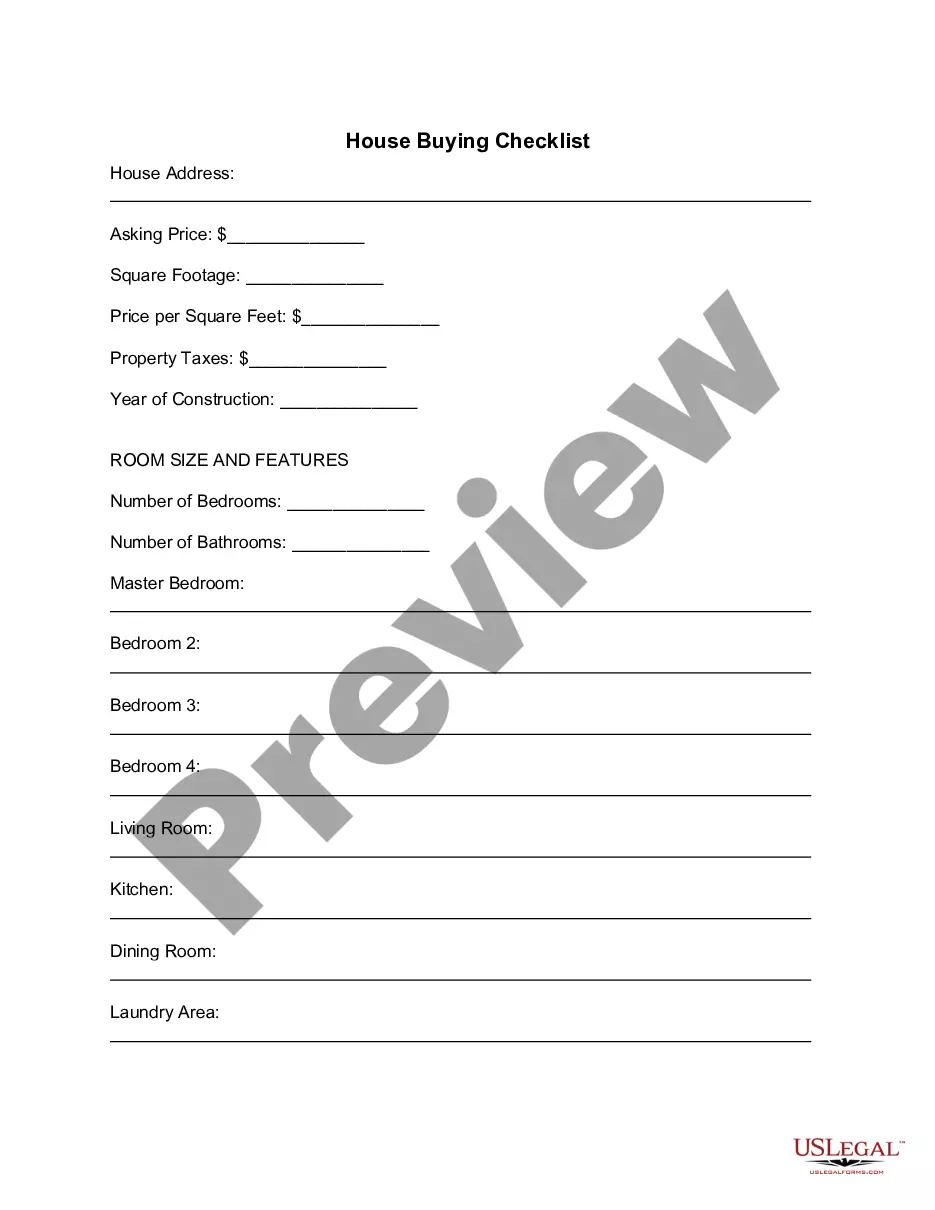

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure that you have selected the right form for your locality. You can preview the document using the Preview button and review the form description to ensure it meets your needs. If the form does not meet your specifications, utilize the Search field to locate the correct form.

- Once you are confident that the form is suitable, click on the Purchase now button to obtain the form.

- Choose the pricing plan you prefer and input the necessary information. Create your account and place an order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Vermont Property Information Checklist - Residential.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Leverage the service to obtain properly structured documents that comply with state regulations.

Form popularity

FAQ

Yes, the homestead exemption in Vermont factors in household income. While the actual exemption is based on property value, income determines your eligibility for property tax adjustments. By consulting the Vermont Property Information Check List - Residential, you can better understand how income levels affect your tax benefits and ensure compliance with state regulations.

Homestead limitation in Vermont refers to the cap on the amount of property value that can be exempt from property taxes under the Homestead Declaration. This limitation is designed to equitably distribute tax burdens among different property owners. To fully understand how this impacts you, consider reviewing the Vermont Property Information Check List - Residential, as it outlines critical details regarding your tax obligations.

Not qualifying for homestead credit in Vermont often results from failing to meet specific filing criteria or income thresholds. Additionally, incomplete or inaccurate submissions can also lead to disqualification. To ensure you don't miss out, refer to the Vermont Property Information Check List - Residential for guidance in preparing your documentation accurately.

Seniors in Vermont may qualify for a property tax break through the state's property tax adjustment system. This program can significantly lower property taxes based on income and household size, providing relief for eligible seniors. Utilizing the Vermont Property Information Check List - Residential can assist you in determining eligibility and applying for this benefit effectively.

Household income for homestead declaration in Vermont includes all income earned by family members living in the home. This includes wages, benefits, and any additional income streams. You should tally everything accurately to ensure your application aligns with the Vermont Property Information Check List - Residential, which can help you understand the implications for property taxes and potential credits.

Filing your house in Vermont requires several important documents. You will need a completed Property Transfer Tax Return form, proof of ownership, and possibly an appraisal if your property has significantly changed. By using the Vermont Property Information Check List - Residential, you can ensure you have everything ready to file correctly and avoid delays.

The 183 day rule in Vermont determines how long an individual can stay in the state without becoming a resident for tax purposes. Essentially, if you maintain a physical presence in Vermont for 183 days or more, you may be required to file as a resident. It's crucial to understand this rule, especially when checking your Vermont Property Information Check List - Residential. Depending on your residency status, your property tax obligations and eligibility for credits may vary.

Vermont Form HS-122 is the application for the state's property tax credit program. This form is essential for homeowners and renters looking to receive property tax relief. Completing this form accurately is crucial to ensure eligibility, as outlined in the Vermont Property Information Check List - Residential. It's recommended to consult the Vermont Department of Taxes for assistance with this process.

For the year 2025, the estate tax exemption in Vermont is projected to increase to approximately $5 million. This exemption means that estates valued below this amount will not be subject to Vermont estate tax. It’s essential to stay informed about changes to this exemption, as strategic planning can help you effectively manage your estate. Utilize the Vermont Property Information Check List - Residential for the latest updates.

Avoiding Vermont estate tax can often be achieved through effective estate planning strategies. Using trusts, making lifetime gifts, or ensuring your will is structured correctly can significantly minimize tax implications. Consulting with a tax professional for personalized strategies can yield great results, and the Vermont Property Information Check List - Residential offers insights into these valuable tactics.