Vermont Community Property Disclaimer

Description

How to fill out Community Property Disclaimer?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by category, state, or keywords. You can find the latest versions of forms such as the Vermont Community Property Disclaimer in just a matter of seconds.

If you already have a subscription, Log In and download the Vermont Community Property Disclaimer from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Make edits. Fill out, modify, print, and sign the downloaded Vermont Community Property Disclaimer.

Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are simple instructions to get you started.

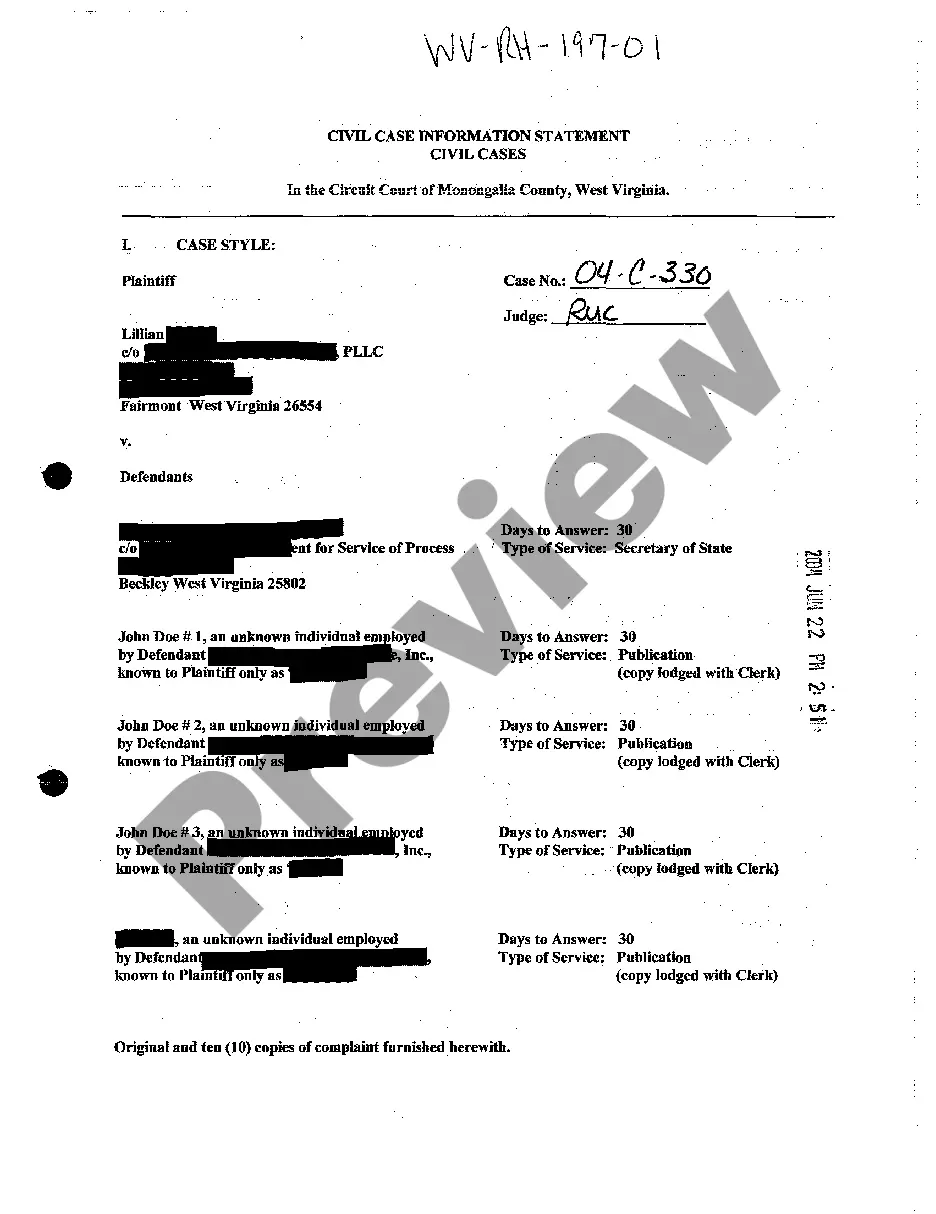

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s contents. Read the form description to confirm you have chosen the correct form.

- If the form does not meet your needs, use the Search area at the top of the screen to find the one that does.

- When you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your details to register for an account.

- Process the payment. Use a Visa or Mastercard or your PayPal account to complete the transaction.

- Choose the format and download the form onto your device.

Form popularity

FAQ

A qualified domestic relations order (QDRO) allows for the division of retirement assets such as pensions and 401(k) accounts in a divorce. It specifies the amount or percentage of the benefits that will go to the non-employee spouse. This legal order helps to protect both parties' interests and ensures compliance with federal laws concerning retirement plans. Familiarizing yourself with the Vermont Community Property Disclaimer can empower you to take control during this process and secure a fair division.

Once a judge signs a qualified domestic relations order (QDRO), it is sent to the retirement plan administrator for implementation. The administrator will then divide the retirement benefits as specified in the order. It’s crucial to ensure that the QDRO accurately reflects the agreement between both parties to avoid any future disputes. Knowing the implications of the Vermont Community Property Disclaimer can aid you in understanding your rights and responsibilities post-divorce.

In Vermont, there is no mandated separation period before filing for divorce. You can file as soon as you decide to end the marriage, although a brief separation may provide clarity during this challenging time. Having a clear understanding of the Vermont Community Property Disclaimer can help you address asset division effectively, regardless of your separation status. It’s prudent to consult with a legal professional to guide you through the process.

Vermont is not classified as a community property state; rather, it follows equitable distribution laws during a divorce. This means that assets are divided fairly, but not necessarily equally. The Vermont Community Property Disclaimer clarifies that courts consider various factors, such as the length of the marriage and each party's contributions. It's essential to understand how these laws impact asset division, ensuring a just outcome for both parties.

If your ex did not file a QDRO, it may affect your ability to access retirement benefits. In this case, seeking legal advice is advisable to understand your rights under Vermont law. You might need to file a QDRO yourself or request that your ex take action. Resources like US Legal Forms can provide templates and guidance to assist you in this process, especially in the context of the Vermont Community Property Disclaimer.

A qualified domestic relations order (QDRO) is a legal document used in Vermont to divide retirement assets during a divorce. This order recognizes a former spouse's right to receive a portion of retirement benefits. Typically, it outlines how the retirement plan administrator will allocate funds, ensuring compliance with both federal and state laws. Understanding the Vermont Community Property Disclaimer can help you navigate these complexities during your divorce proceedings.

There is no specific requirement for the number of years married to qualify for alimony in Vermont. While shorter marriages may receive less support, each case is unique and evaluated on various elements, including financial needs and prior contributions. Understanding the Vermont Community Property Disclaimer can illuminate how property considerations might impact your alimony request. Professional advice can further clarify your options.

Alimony in Vermont is determined through factors like the duration of the marriage, each spouse's income and needs, and contributions to the household. The court assesses financial stability and standard of living to decide on support amounts and duration. Engaging with the Vermont Community Property Disclaimer provides essential insights into how property division may play a role in alimony decisions. For personalized assistance, explore tools from US Legal Forms.

In Vermont, adultery does not directly determine divorce outcomes, as the state is a no-fault divorce state. However, it may impact alimony and asset distribution if the court finds it relevant to financial disparities. Understanding the implications of the Vermont Community Property Disclaimer can be crucial if you believe it plays a role in your case. Seeking guidance from legal platforms can clarify how these matters may influence your divorce.

While there is no defined minimum marriage duration for alimony in Vermont, cases with longer marriages often yield more favorable outcomes for support. Courts evaluate various factors, such as financial dependence and the standard of living during the marriage. Knowing the nuances of the Vermont Community Property Disclaimer can also provide insight into how such factors might affect your situation. Consider seeking professional input to fully understand your rights.