Vermont Sample Letter for Special Discount Offer

Description

How to fill out Sample Letter For Special Discount Offer?

If you need to total, acquire, or print authorized document formats, utilize US Legal Forms, the largest assortment of legal forms, which are available online.

Take advantage of the site’s straightforward and convenient search tool to locate the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Vermont Sample Letter for Special Discount Offer in just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you have downloaded in your account. Click on the My documents section and choose a document to print or download again.

Stay competitive and download, and print the Vermont Sample Letter for Special Discount Offer with US Legal Forms. There are countless professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Vermont Sample Letter for Special Discount Offer.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the template for your correct city/state.

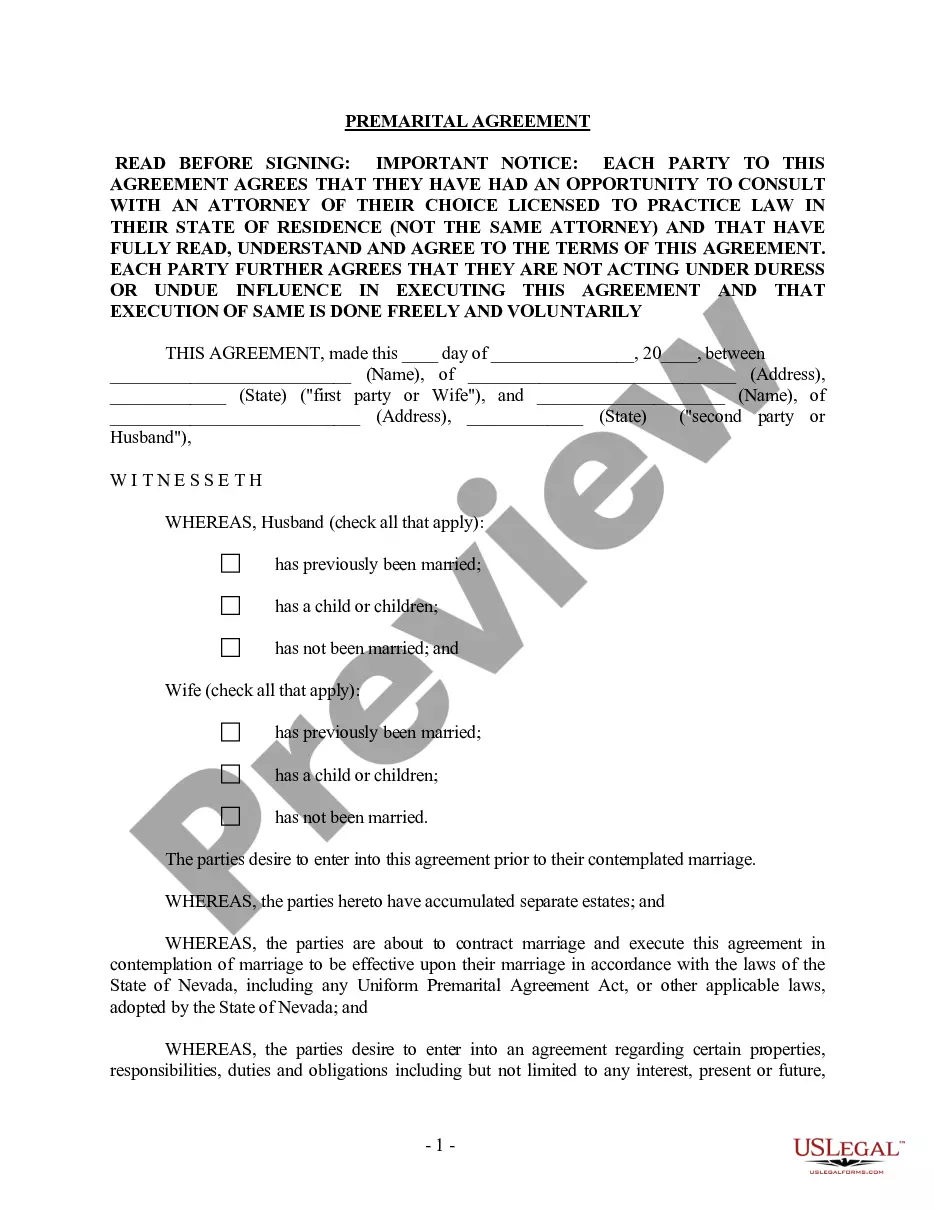

- Step 2. Use the Preview option to view the form’s contents. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form that fits your needs, click the Buy Now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it onto your device.

- Step 7. Complete, modify, and print or sign the Vermont Sample Letter for Special Discount Offer.

Form popularity

FAQ

Income tax in Vermont is structured progressively, meaning higher incomes are taxed at higher rates. Residents must file annual returns detailing their income and potential deductions. The Vermont Sample Letter for Special Discount Offer can help residents navigate available deductions and credits to minimize their overall tax burden.

The sales tax rate in the area with the ZIP code 68310 is reflective of local tax regulations and can vary by municipality. It’s important for residents and businesses to check local authorities for the most current rate. Using tools like the Vermont Sample Letter for Special Discount Offer can assist in communicating local tax obligations to customers.

The sales tax form in Vermont is the Form S-1, which businesses use to report and remit sales tax collected. Accurate completion of this form is crucial to comply with state laws. Additionally, businesses can utilize the Vermont Sample Letter for Special Discount Offer to communicate promotions that may affect their sales tax calculations.

Yes, Vermont has several state tax forms for various purposes, including income tax, sales tax, and property tax. Each form serves a specific function in the tax system. The Vermont Sample Letter for Special Discount Offer can be beneficial for those looking to clarify their tax obligations.

To register for sales tax in Vermont, businesses must complete a registration application through the Vermont Department of Taxes. The process includes providing essential business details and may be completed online. Once registered, businesses can also use the Vermont Sample Letter for Special Discount Offer to inform clients about promotional deals.

The tax form IN-111 in Vermont is the state income tax return. Residents must file this form to report their annual income and determine their tax liability. By using the Vermont Sample Letter for Special Discount Offer, individuals can effectively manage their tax filing process.

Yes, Vermont offers property tax relief programs for seniors, helping reduce their financial burdens. Seniors may qualify based on income and residence, making it essential to explore these options. A Vermont Sample Letter for Special Discount Offer can streamline the application process for seniors looking to secure these valuable discounts.

Avoiding Vermont estate tax typically involves careful estate planning and considering various exemptions and deductions. Engaging in strategies like gifting or setting up trusts can also be effective. You may find resources and tools, such as a Vermont Sample Letter for Special Discount Offer, valuable when discussing your estate tax concerns with professionals.

The town of Wilmington usually ranks among the places with the highest property taxes in Vermont. Various factors, including local budget needs and property valuations, impact tax rates. If you reside in a high-tax area, utilizing a Vermont Sample Letter for Special Discount Offer could be beneficial in seeking any relief options that may apply.

In Vermont, a resale certificate is generally not required for most sales, but specific industries, such as retail, may adhere to different regulations. Understanding the nuances of sales tax can be confusing, but being informed helps you comply with state laws. If your business is engaged in resale activities, consider using a Vermont Sample Letter for Special Discount Offer when seeking exemptions or clarifications.