Vermont Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

How to fill out Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

It is feasible to dedicate hours online searching for the legal document format that meets the federal and state requirements you need.

US Legal Forms offers a vast collection of legal documents that have been reviewed by professionals.

You can effortlessly access or create the Vermont Agreement Between Physician and Self-Employed Independent Contractor along with Professional Corporation assistance.

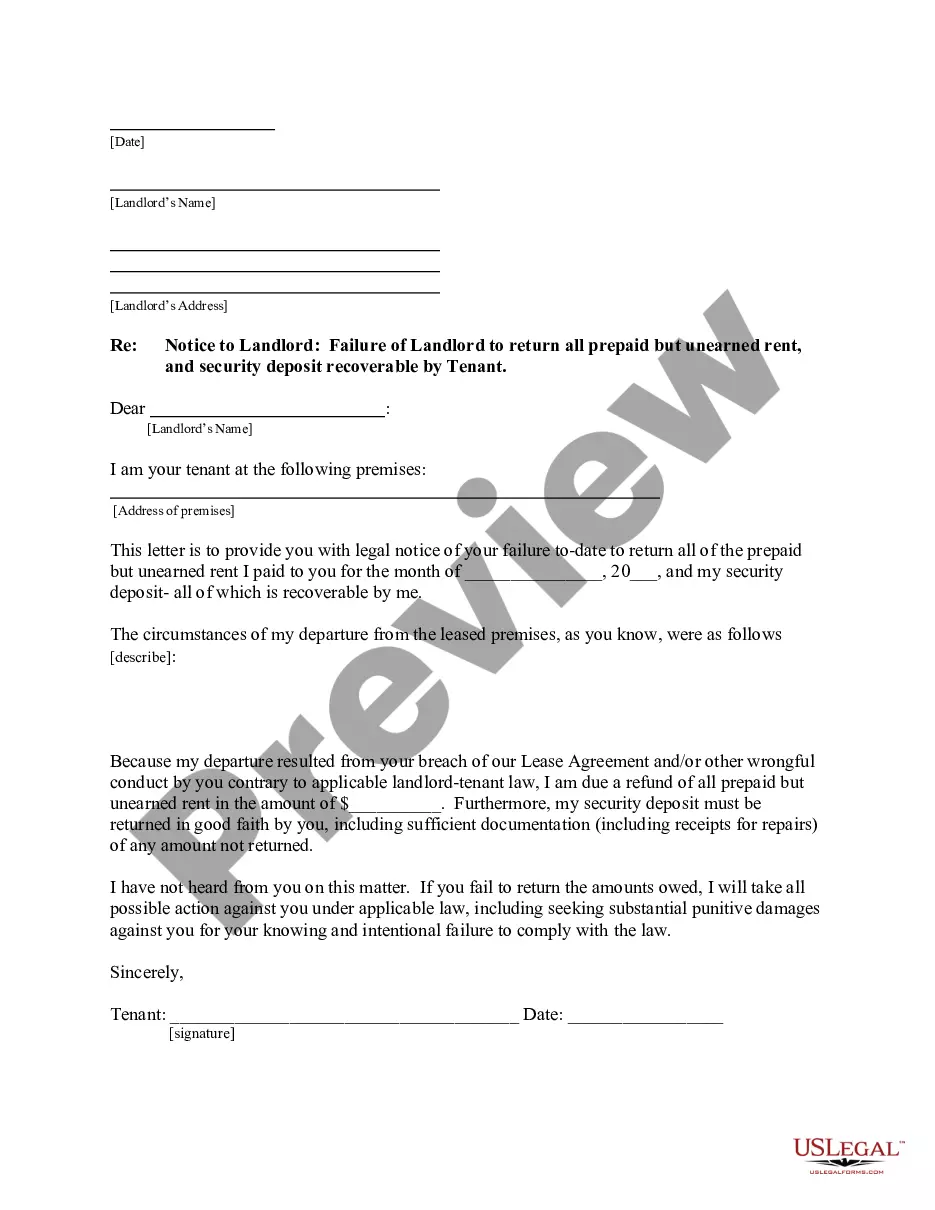

If available, use the Review button to view the document format simultaneously.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Vermont Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

- Every legal document format you receive is yours indefinitely.

- To obtain an additional copy of any purchased document, navigate to the My documents tab and click the relevant button.

- If you’re visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document format for your preferred area/region.

- Examine the document description to confirm you have chosen the correct template.

Form popularity

FAQ

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Other professions within health care are NOT exempt from AB 5 and therefore must meet the law's stated criteria in order to be appropriately classified as independent contractors, such as: nurse practitioners. physician assistants.

For some business-minded physician assistants (PAs), independent contracting offers a versatile and entrepreneurial way to practice medicine allowing for significant flexibility in hours, increased freedom of choice and income.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.