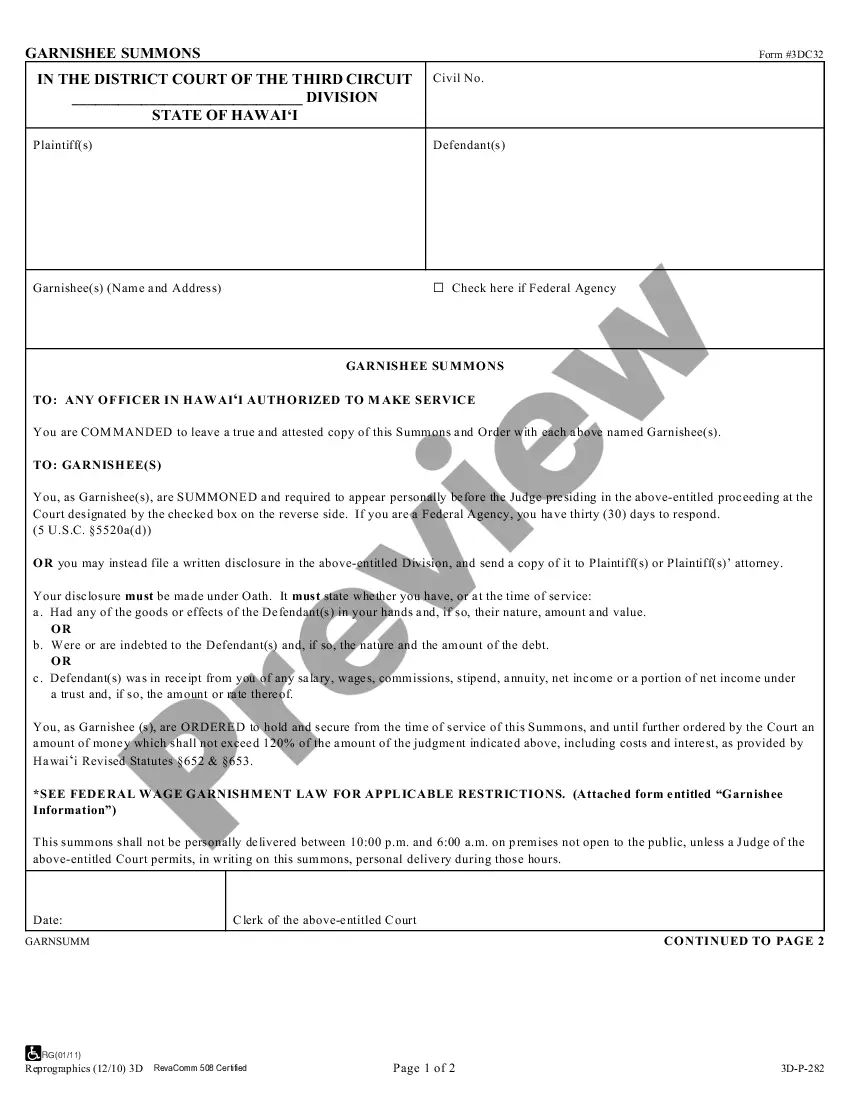

This form is a sample letter from a law firm to opposing counsel confirming the payment schedule of defendant.

Vermont Sample Letter for Payment Arrangements

Description

How to fill out Sample Letter For Payment Arrangements?

Selecting the appropriate valid document template can be a challenge. Clearly, there are numerous formats available online, but how can you find the valid form you require? Utilize the US Legal Forms platform. The service offers an extensive collection of templates, such as the Vermont Sample Letter for Payment Arrangements, which you can utilize for both business and personal purposes. All templates are reviewed by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click on the Download button to locate the Vermont Sample Letter for Payment Arrangements. Use your account to browse the legal templates you have previously ordered. Navigate to the My documents section of your account to obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are some simple instructions to follow: First, ensure you have selected the correct form for your city/county. You can view the document using the Preview button and review the form description to confirm it is suitable for your needs. If the document does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is correct, click the Buy now button to obtain the document. Choose the payment plan you desire and enter the necessary information. Create your account and purchase the order using your PayPal account or credit card. Select the file format and download the valid document template to your device. Complete, edit, print, and sign the received Vermont Sample Letter for Payment Arrangements.

Take advantage of this comprehensive service to streamline your document needs and ensure all legal paperwork is properly handled.

- US Legal Forms is the largest repository of legal templates where you can access various document formats.

- Utilize the service to download professionally crafted documents that adhere to state requirements.

- The platform provides a user-friendly interface for easy navigation.

- Each template is designed to cater to both personal and business needs.

- Legal professionals review all documents to ensure compliance.

- Access your purchased documents anytime through your account.

Form popularity

FAQ

For the 2022 tax year, the income tax in Vermont has a top rate of 8.75%, which places it as one of the highest rates in the U.S. Meanwhile, total state and local sales taxes range from 6% to 7%. A financial advisor can help you understand how taxes fit into your overall financial goals.

Pay Online with myVTax Enter your account number and the routing number of your bank or financial institution into the secure online form. Be sure to double check the numbers and match them exactly as errors will result in processing delays, and additional interest and penalties may accrue.

Three Ways to Pay Pay your taxes online at .eftps.gov, over the phone, or through your tax professional, payroll service, or financial institution.

For the 2022 tax year, the income tax in Vermont has a top rate of 8.75%, which places it as one of the highest rates in the U.S. Meanwhile, total state and local sales taxes range from 6% to 7%.

Pay Online You may pay your business and corporate income taxes, sales and use tax, meals and rooms tax, withholding, and miscellaneous taxes online by ACH debit or credit card. If you file your return electronically you can submit your payment by Automated Clearing House (ACH) Debit.

Send your return to VT Department of Taxes, PO Box 1881, Montpelier, VT 05601-1881. Making a payment? Send your return to VT Department of Taxes, PO Box 1779, Montpelier, VT 05601-1779. 10.

Overview of Vermont Taxes The average effective property tax rate in Vermont is 1.73%, which ranks as the fifth-highest rate in the U.S. The typical homeowner in Vermont can expect to spend $4,697 annually in property taxes. Not in Vermont?

Use myVTax, our secure online portal to file your return, make a payment electronically, or continue a previous filing. Log in to myVTax.