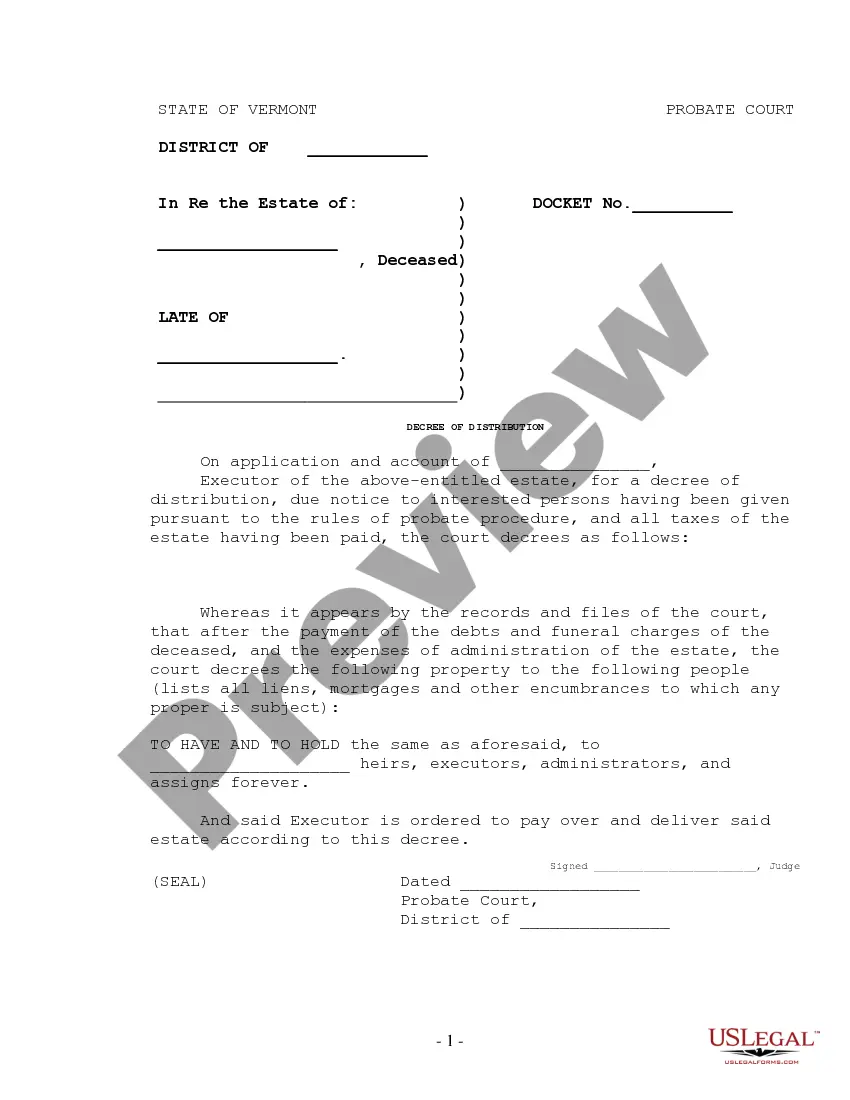

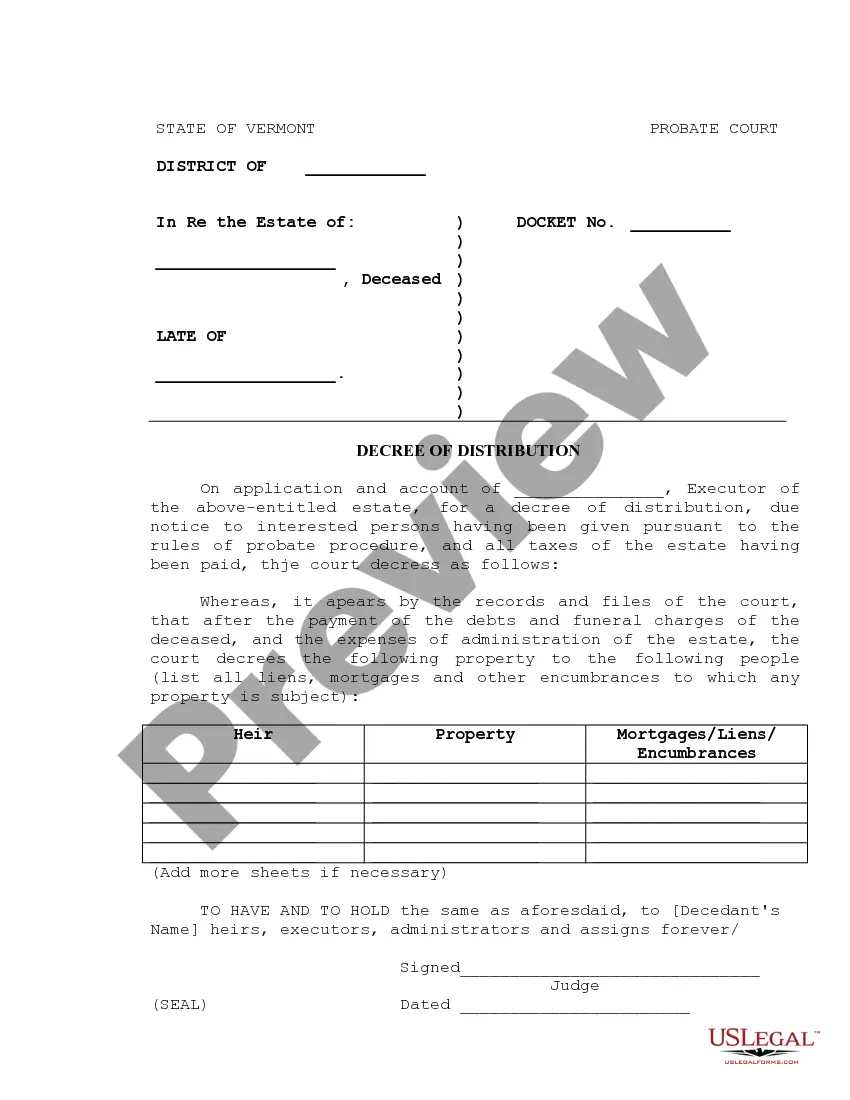

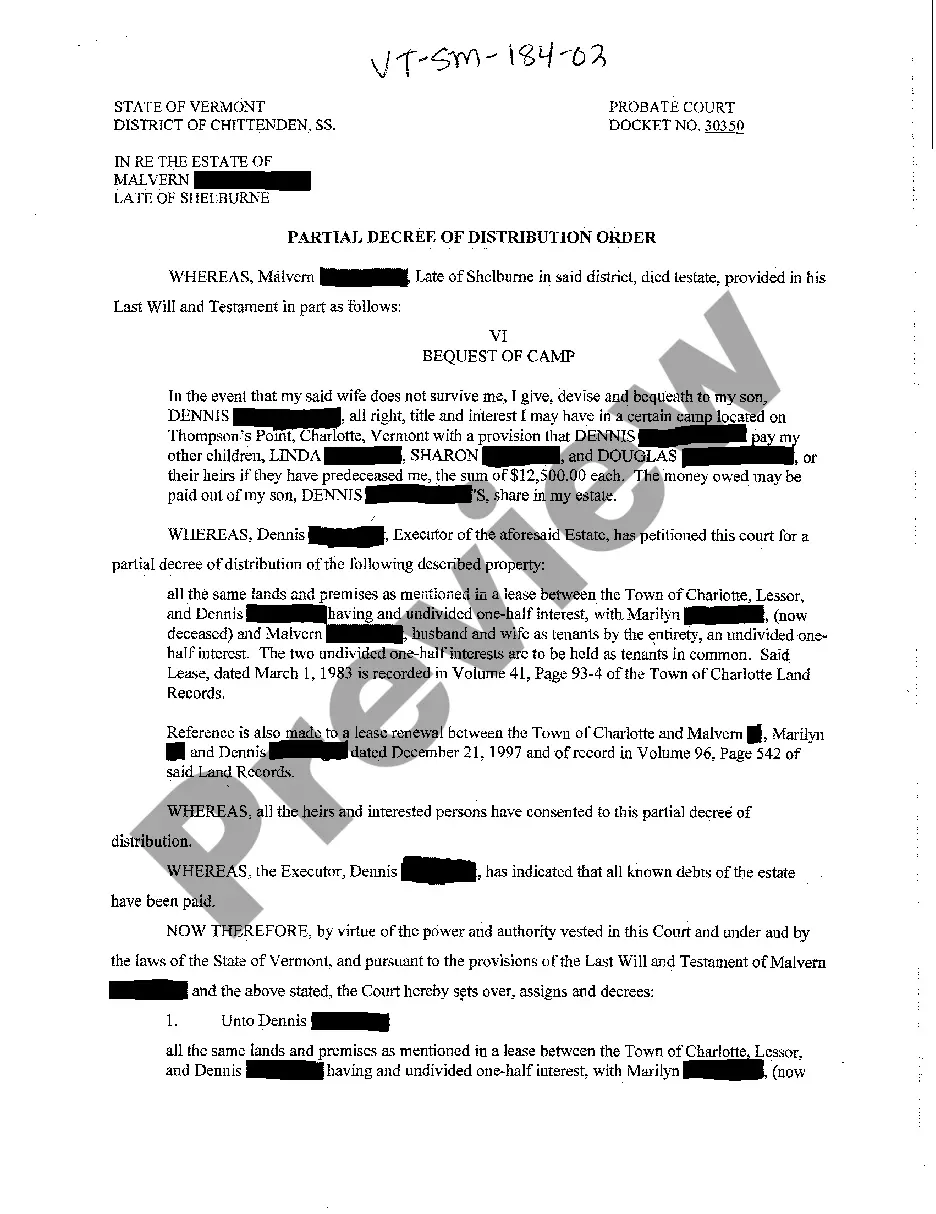

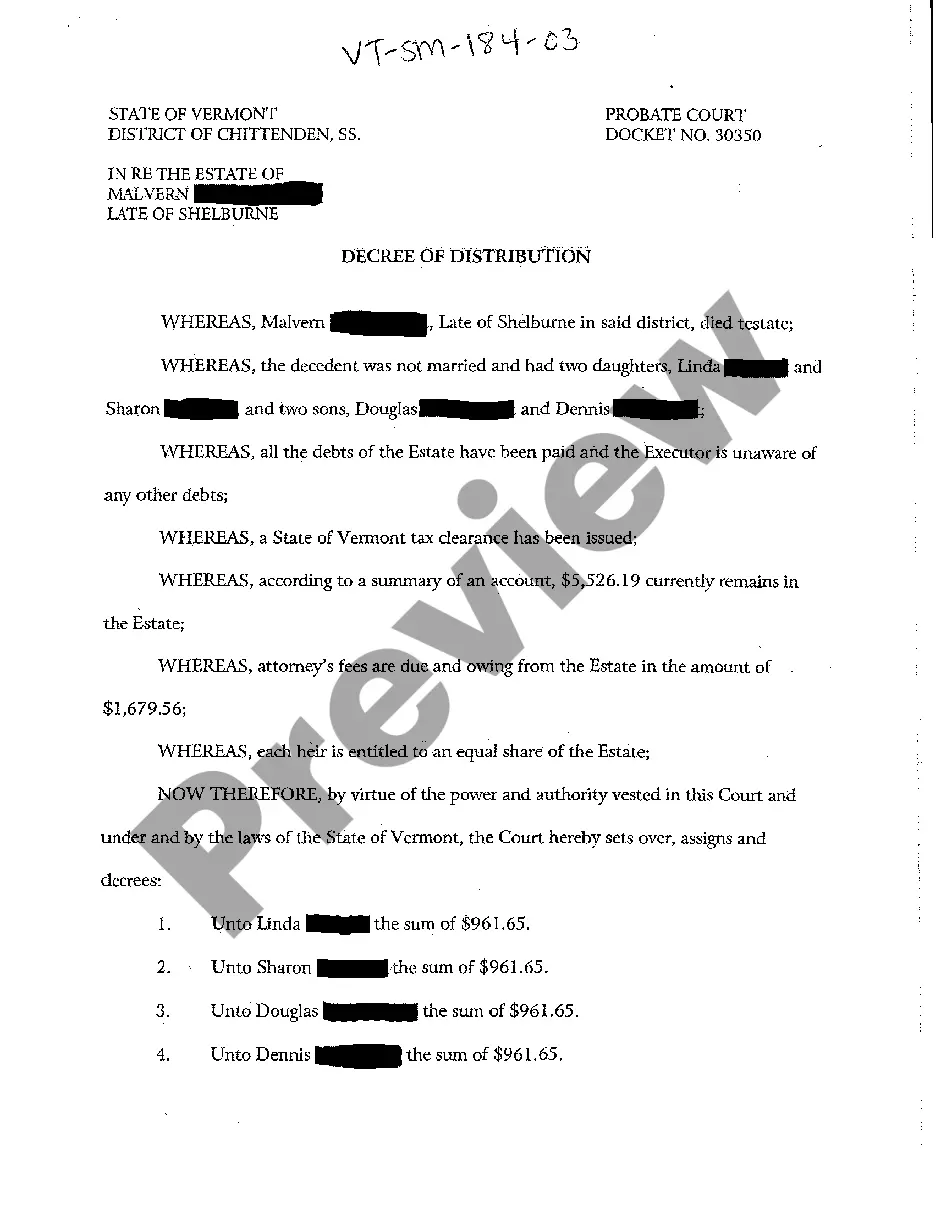

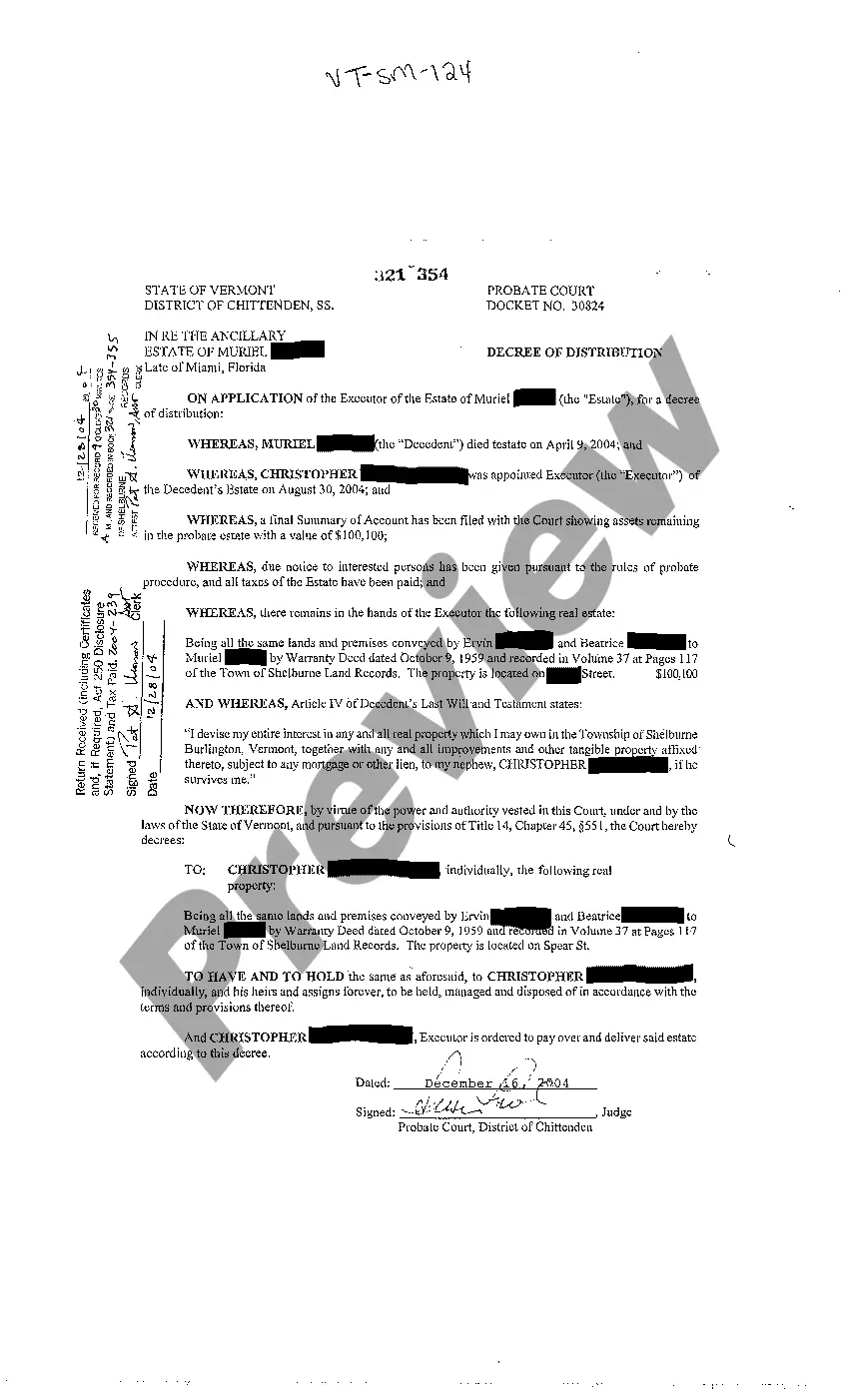

Vermont Decree of Distribution of Decedent's Property

Description

How to fill out Vermont Decree Of Distribution Of Decedent's Property?

Searching for a Vermont Decree of Distribution of Decedent's Property on the internet can be stressful. All too often, you see papers that you believe are alright to use, but discover afterwards they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional lawyers according to state requirements. Have any document you are looking for within minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll automatically be included to your My Forms section. In case you do not have an account, you need to register and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Decree of Distribution of Decedent's Property from the website:

- See the document description and click Preview (if available) to verify whether the form meets your expectations or not.

- If the form is not what you need, get others with the help of Search field or the provided recommendations.

- If it’s appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the template in a preferable format.

- Right after downloading it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms library. In addition to professionally drafted samples, customers may also be supported with step-by-step instructions concerning how to get, download, and complete forms.

Form popularity

FAQ

Decree means the formal expression of an adjudication which, so far as regards the Court expressing it, conclusively determines the rights of the parties with regard to all or any of the matters in controversy in the suit and may be either preliminary or final.

After someone dies, it can be a number of months before the assets are distributed to the beneficiaries. If a Grant of Probate is necessary, the Supreme Court needs to be informed of the current assets and liabilities of the deceased before probate can occur.

File the Will and Probate Petition. Secure Personal Property. Appraise and Insure Valuable Assets. Cancel Personal Accounts. Determine Cash Needs. Remove Estate Tax Lien. Determine Location of Assets and Secure "Date of Death Values" Submit Probate Inventory.

An order for final distribution in California probate is conclusive to the rights of heirs and devisees in a decedent's estate. The order also releases the personal representative from claims by heirs and devisees, unless, of course, there is fraud or misrepresentation present.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

What is Decree of Distribution? A final judgment issued by the probate court that is conclusive as to the rights of the legatees, devisees and heirs (all beneficiaries) and details their respective shares under the will or intestate estate.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

In the simplest of terms, under California intestate succession laws, the transfer of property after a death without a will in California generally will be divided among the spouse, children, parents, grandparents, siblings, cousins, aunts, uncles, nieces, and nephews of the deceased.

An estate bank account is opened up by the executor, who also obtains a tax ID number. The various accounts of the deceased person are then transferred to the account. The executor must pay creditors, file tax returns and pay any taxes due. Then, he must collect any money or benefits owed to the decedent.