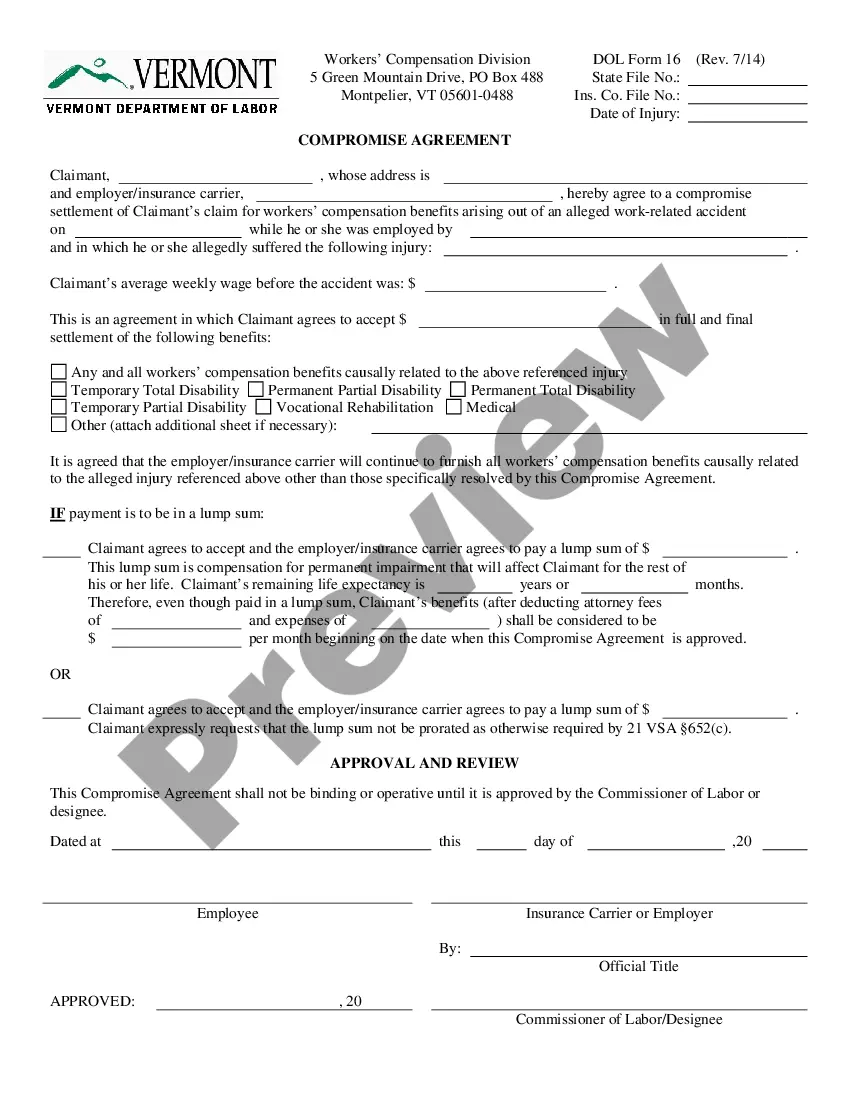

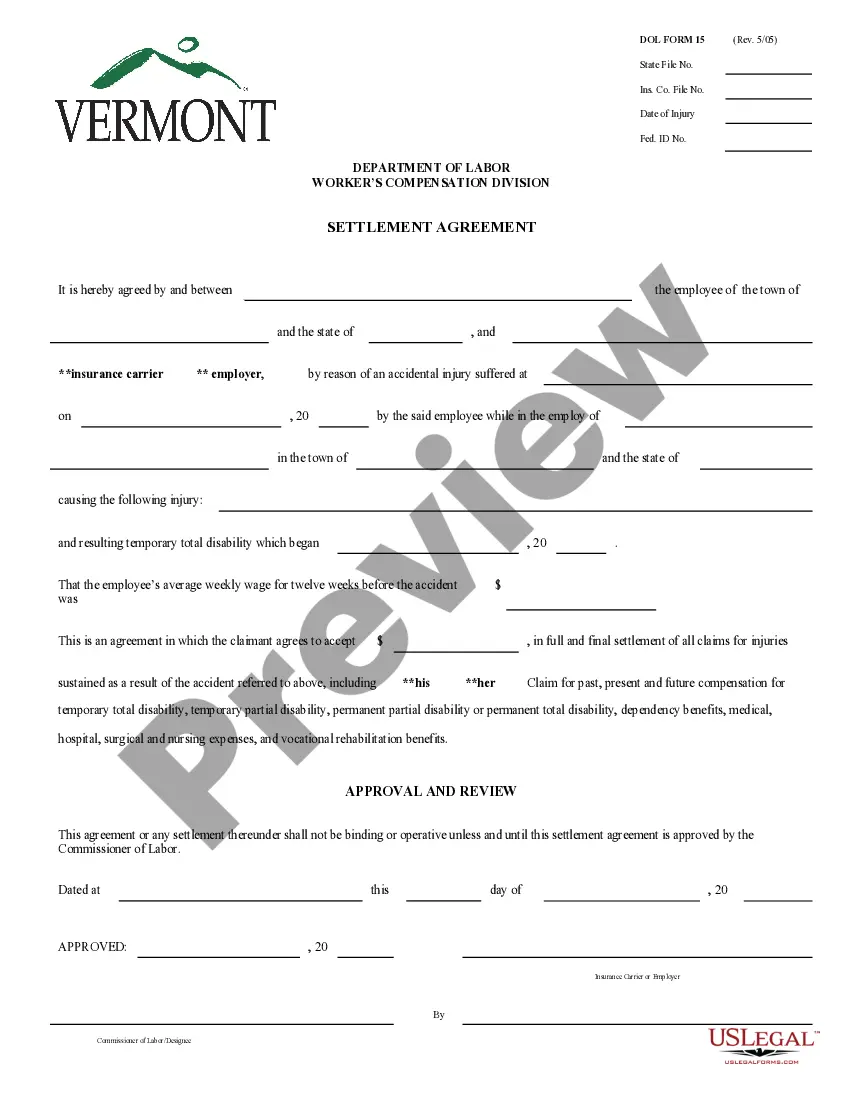

The Vermont Compromise Agreement is a form of dispute resolution that seeks to provide a mutually satisfactory solution to parties in conflict. It is a voluntary, non-binding agreement between two or more parties where the parties agree to compromise in order to resolve their dispute. The agreement is structured so that each party is willing to make a concession in order to reach an agreement. The Vermont Compromise Agreement can be divided into two main types: Facilitated and Facilitated. A Facilitated Vermont Compromise Agreement is one in which a neutral, third-party mediator is present to facilitate the negotiations and help the parties reach a satisfactory resolution. A Facilitated Vermont Compromise Agreement is one in which the parties resolve the dispute without the assistance of a neutral, third-party mediator. The Vermont Compromise Agreement is a useful tool for resolving disputes in a manner that is both timely and cost-effective. It is a non-adversarial process that encourages the parties to reach a solution that is in everyone’s best interests.

Vermont Compromise Agreement

Description

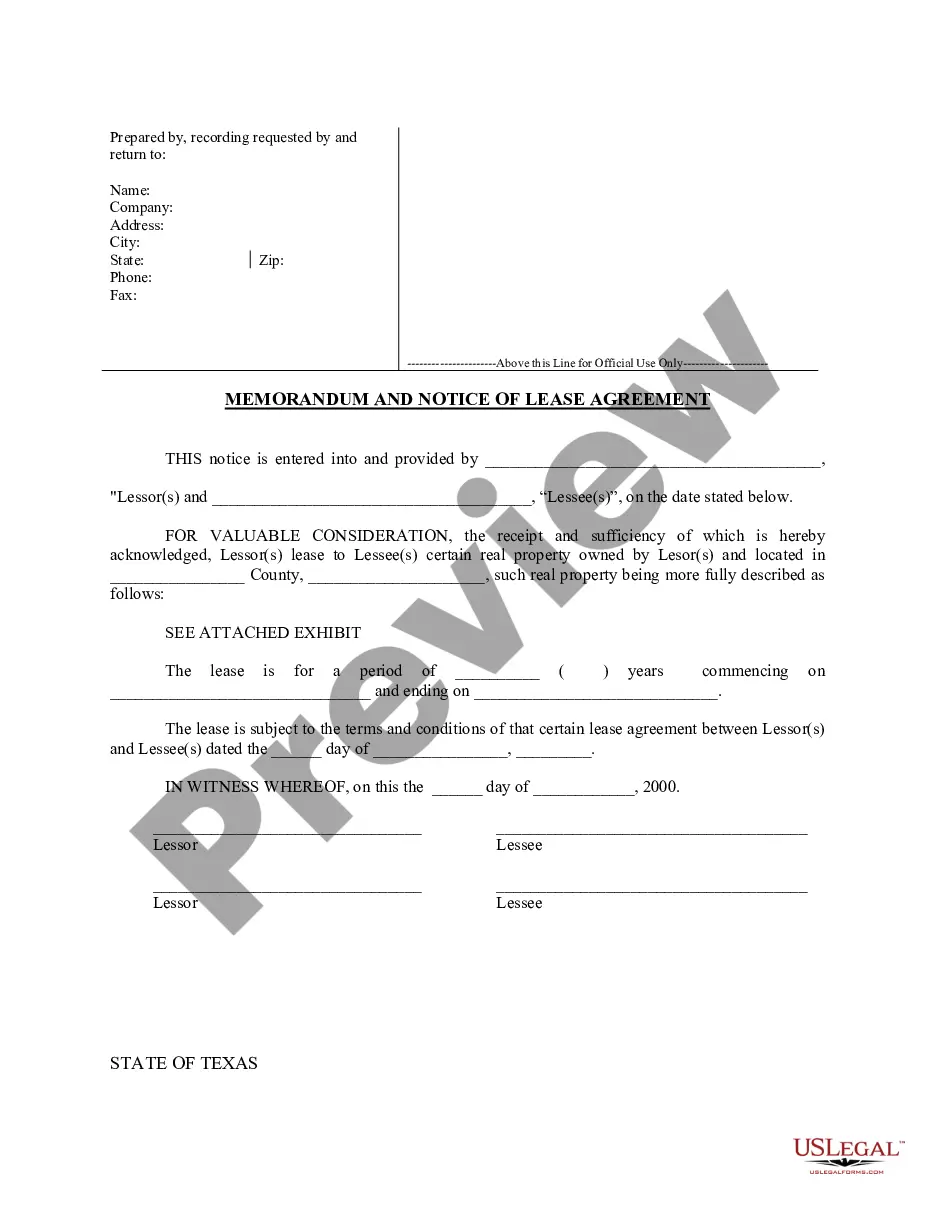

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Vermont Compromise Agreement?

Handling official paperwork requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Vermont Compromise Agreement template from our service, you can be sure it meets federal and state regulations.

Working with our service is easy and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to get your Vermont Compromise Agreement within minutes:

- Remember to attentively look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Vermont Compromise Agreement in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Vermont Compromise Agreement you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

But statistically, the odds of getting an IRS offer in compromise are pretty low. In fact, the IRS accepted only 15,154 offers out of 49,285 in 2021.

An offer in compromise (OIC) is an agreement between a taxpayer and the Internal Revenue Service that settles a taxpayer's tax liabilities for less than the full amount owed. Taxpayers who can fully pay the liabilities through an installment agreement or other means, generally won't qualify for an OIC in most cases.

There are 2 basic Offer in Compromise formulas: On a 5-month repayment plan: (Available Monthly Income x 12) + Value of Personal Assets. On a 24-month repayment plan: (Available Monthly Income x 24) + Value of Personal Assets.

How much will the IRS settle for? The IRS will typically only settle for what it deems you can feasibly pay. To determine this, it will take into account your assets (home, car, etc.), your income, your monthly expenses (rent, utilities, child care, etc.), your savings, and more.

The cons include: With this method, you are able to reduce what you owe. However, you also surrender your right to tax credits that you may have access to each year. This could mean your tax return could be lowered each year going forward. OIC does create a public record.

For the IRS to accept an offer, you must file all tax returns due and be current with estimated tax payments or withholding. If you own a business and have employees, you must file all returns and be current on all your federal tax deposits.