Vermont General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability

Overview of this form

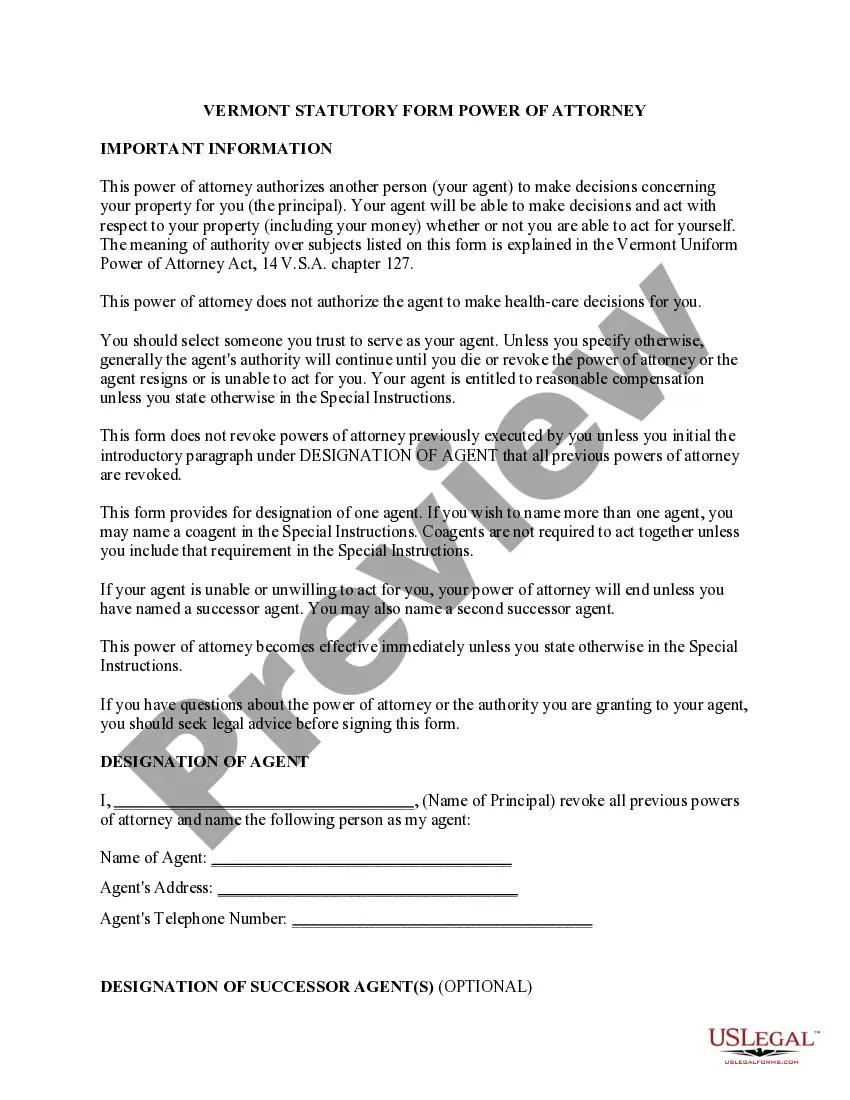

The General Durable Power of Attorney for Property and Finances Effective upon Disability form is a legal document that allows you to designate an agent to manage your financial and property matters in the event you become disabled or incompetent. This durable power of attorney only activates under such conditions, ensuring that your affairs can continue to be handled without interruption. Unlike forms that address health care decisions, this document specifically focuses on financial and property management tasks.

Main sections of this form

- Designation of an agent to act on your behalf when you are unable to do so.

- Explicit grants of authority for managing financial and property matters.

- Indemnification clause protecting the agent from liability when acting in good faith.

- Instructions for specifying powers that the agent may or may not exercise.

- Revocation details, allowing you to withdraw the power at any time before disability occurs.

- Considerations for appointing a successor agent if the primary agent can no longer serve.

Legal requirements by state

This form is designed to be effective across various jurisdictions, including Vermont laws. It adheres to the legal requirements necessary for validity in the state.

When to use this form

This form is appropriate in various scenarios such as:

- If you want to ensure your finances are managed effectively while you are incapacitated.

- When you have significant assets that require oversight during your disability.

- If you wish to avoid potential court intervention for financial management in case of illness or injury.

- When you want to designate a trusted individual to handle your affairs without requiring your approval during incapacitation.

Intended users of this form

This form is suitable for:

- Individuals seeking peace of mind regarding their financial affairs.

- People with complex financial portfolios that may need management during incapacitation.

- Those wishing to appoint a trusted friend or family member as their agent for property management.

- Anyone looking to ensure their financial interests are protected in the event of unexpected circumstances.

Completing this form step by step

- Identify the principal by entering your name and address.

- Designate your agent by providing their name and address.

- Clearly define the powers you wish to grant your agent regarding your property and finances.

- Sign the document in the presence of a witness and a notary public, if required.

- Notify your agent of their responsibilities and retain copies of the signed form for your records.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Failing to specify the powers granted to the agent clearly.

- Not updating the form when personal circumstances change, like a change of agent or additional property.

- Neglecting to inform the agent about their responsibilities and the nature of the authority youâve granted them.

- Not having the document properly witnessed or notarized when required.

Why complete this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows for adjustments if your preferences change.

- Access to legal templates drafted by licensed attorneys ensures reliability.

- Reduction of travel and waiting times associated with traditional legal services.

Legal use & context

- The durable power of attorney is legally binding and effective upon your incapacitation.

- Limitations may apply based on state laws, so it's crucial to understand your specific legal landscape.

- Ensure the agent you designate is trustworthy, as they will have significant control over your financial decisions.

Quick recap

- This form allows you to appoint an agent to manage your finances if you cannot do so.

- It is important to clearly outline the powers you grant to your agent.

- The document must be completed accurately to be legally valid.

- Consider the implications of granting broad powers to your agent.

Form popularity

FAQ

Non-Durable Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Medical Power of Attorney. Springing Power of Attorney. Create Your Power of Attorney Now.

Power of Attorney broadly refers to one's authority to act and make decisions on behalf of another person in all or specified financial or legal matters.Durable POA is a specific kind of power of attorney that remains in effect even after the represented party becomes mentally incapacitated.

In California and in many other states, there are POA forms specific to healthcare, and medical decisions are excluded from the general durable POAs. This means you can designate one person to be your agent for health decisions, and another for financial or legal decisions.

A financial power of attorney (POA) is a legal document that grants a trusted agent the authority to act on behalf of the principal-agent in financial matters.This kind of POA is also referred to as a general power of attorney.

1. About the Power of Attorney. A Durable Power of Attorney may be the most important of all legal documents.It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of.

A limited or special power of attorney may also be restricted to a specific time period.Financial Power of Attorney: Also called a durable power of attorney for finances, this gives the person of your choice the authority to manage your financial affairs should you become incapacitated.

In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances.(Ordinary, or "nondurable," powers of attorney automatically end if the person who makes them loses mental capacity.)