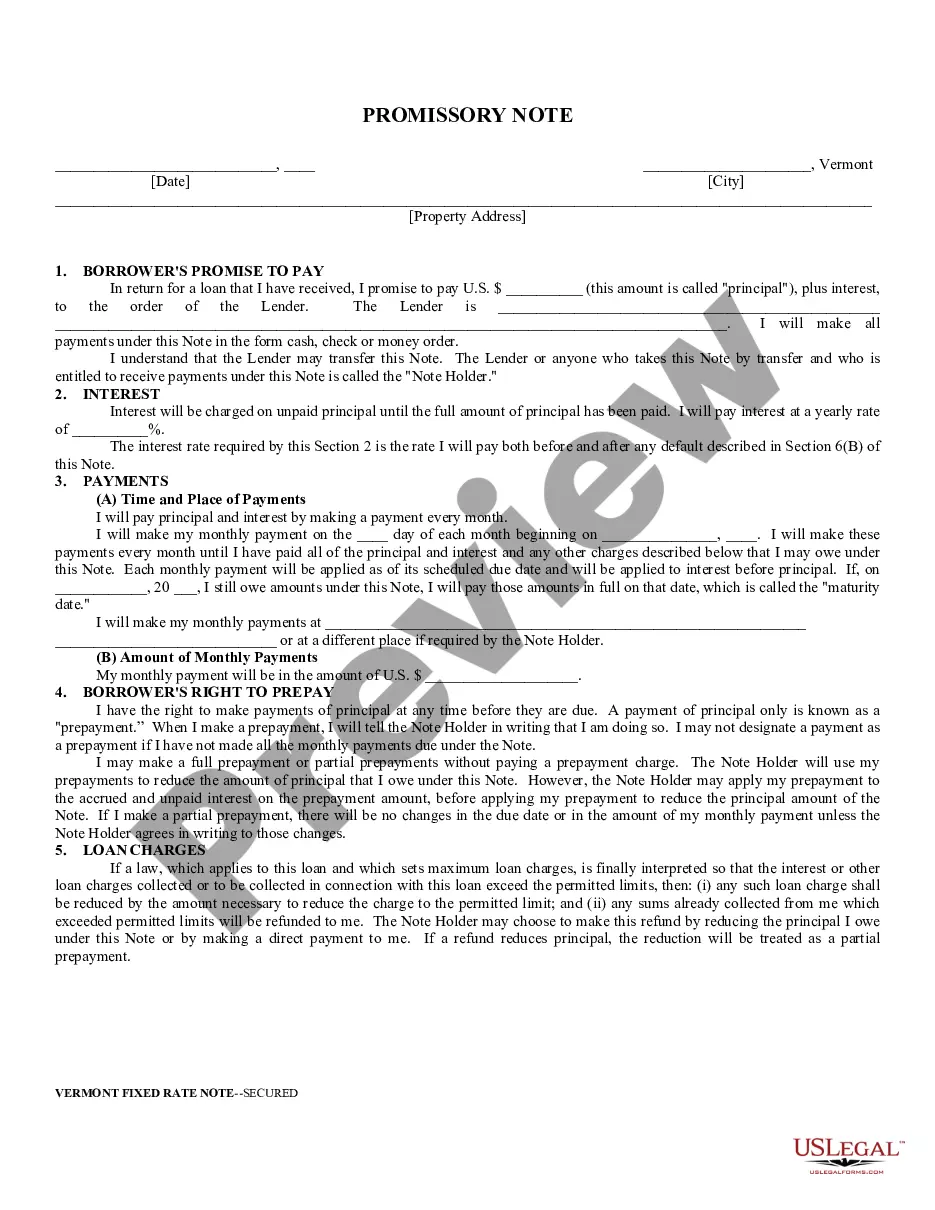

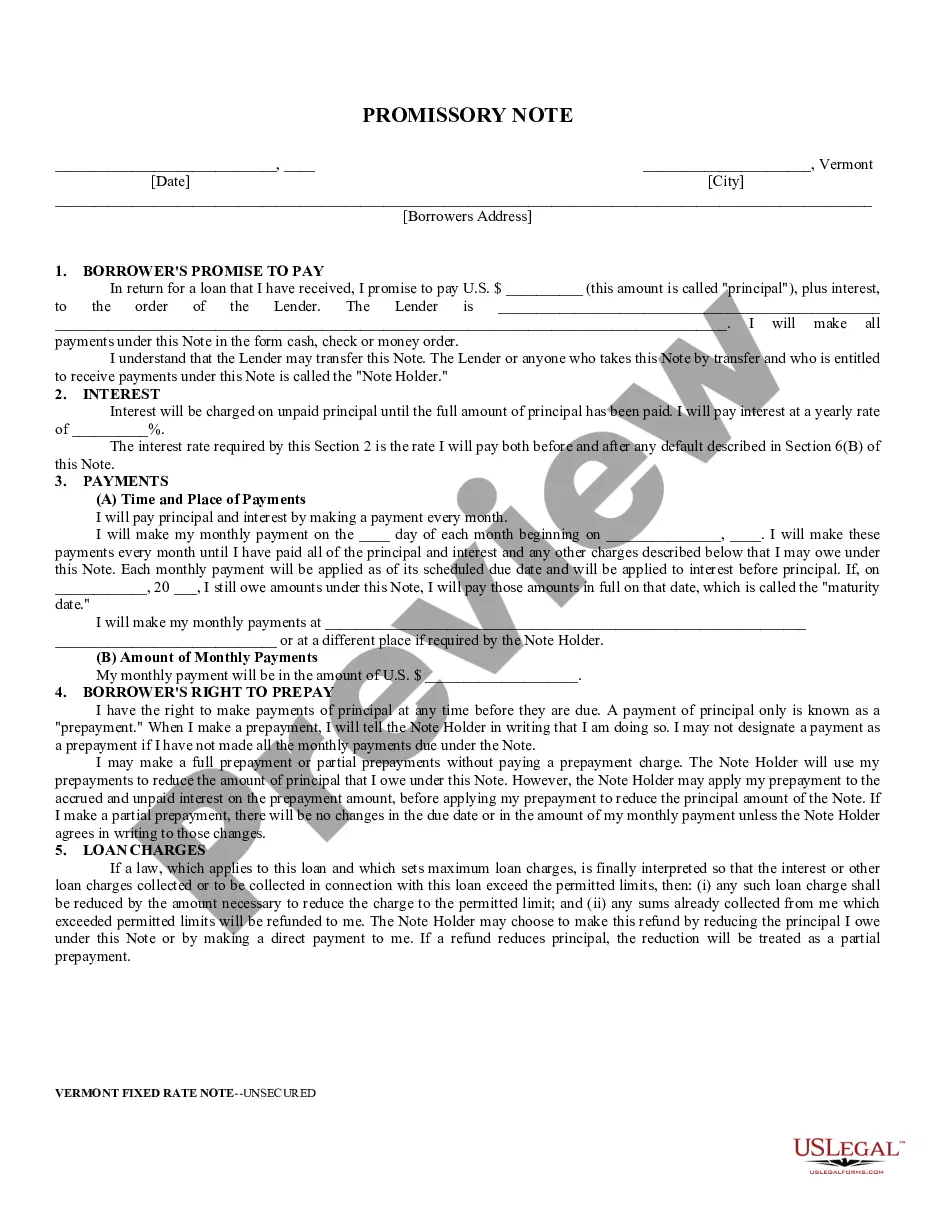

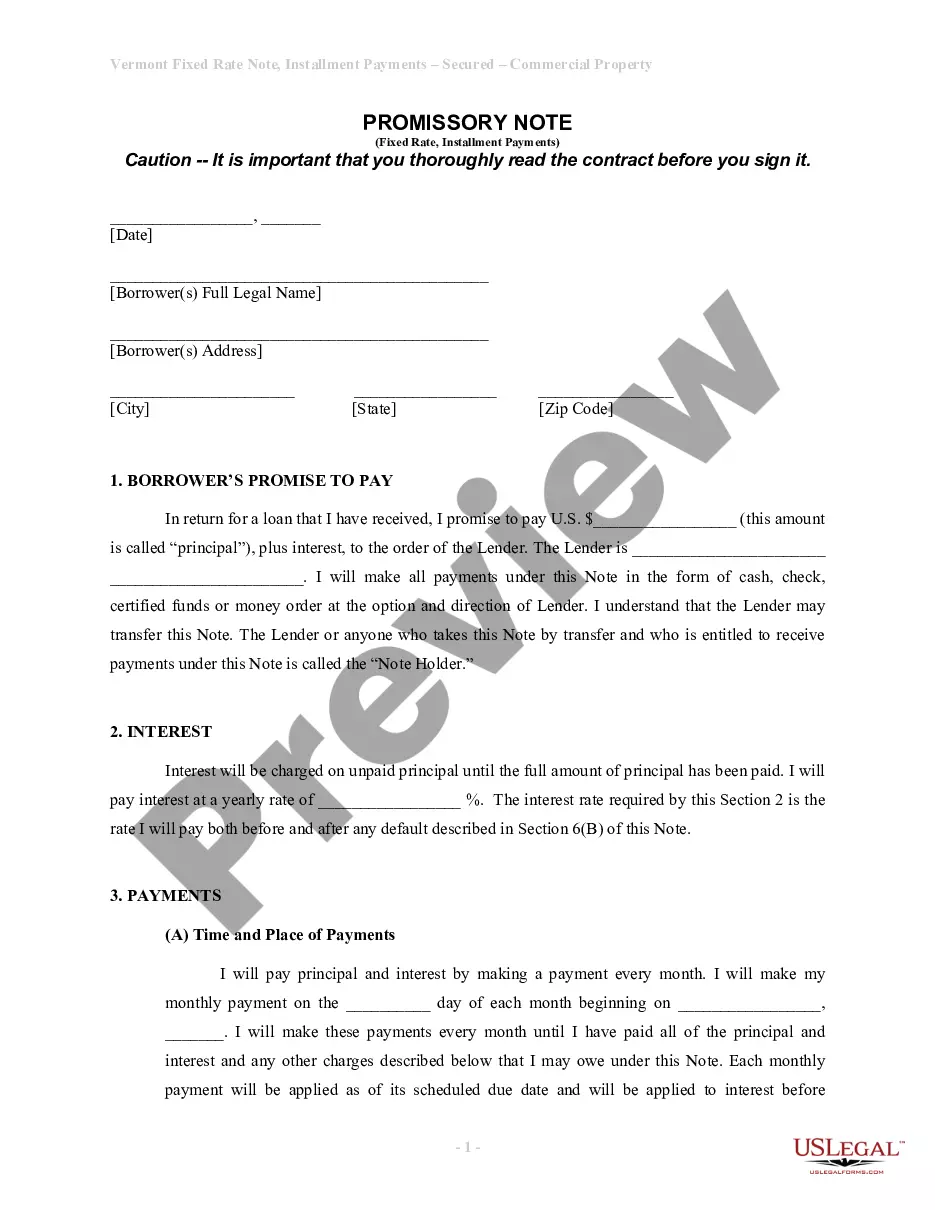

Vermont Secured Promissory Note

Understanding this form

The Vermont Secured Promissory Note is a legally binding document in which a borrower agrees to repay a specified loan amount along with interest to a lender. This form is unique as it includes security provisions, typically tied to property, making it different from unsecured promissory notes. It outlines the payment terms, interest rates, and conditions under which the lender can take action in case of default, ensuring both parties understand their obligations and rights.

Main sections of this form

- Borrower's promise to pay principal and interest to the lender.

- Details on the interest rate and payment schedule.

- Provisions for prepayment of the loan before the due date.

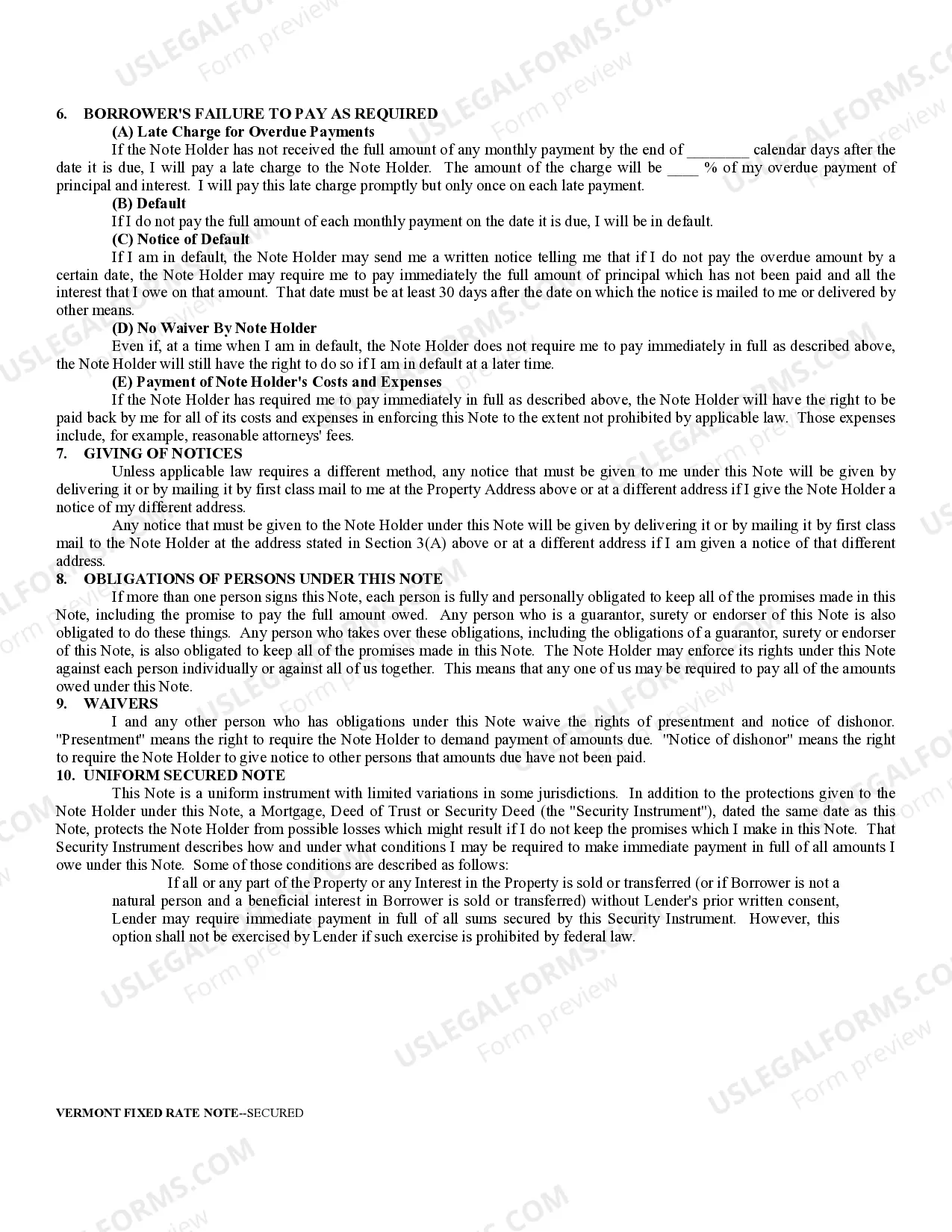

- Consequences of late payments, including potential late charges.

- Rights and obligations in case of default.

- Address for making payments and giving notices.

When to use this document

This form is necessary when an individual or entity borrows money and intends to secure the loan with collateral, typically real estate. It is often used in situations such as purchasing property, refinancing an existing loan, or borrowing funds for personal or business use where security against assets is required for the lender's protection.

Who can use this document

- Individuals borrowing money for personal use.

- Small businesses needing financing secured by assets.

- Lenders offering secured loans who require formal documentation.

- Anyone seeking to document a loan agreement with clear terms and conditions.

Instructions for completing this form

- Identify the borrower and lender, including their full names and addresses.

- Specify the loan amount (principal) and the fixed interest rate.

- Indicate the payment schedule, including the start date and amount of monthly payments.

- Detail any prepayment options and terms associated with them.

- Include information on consequences of late payments and any applicable charges.

- Make sure all parties sign and date the form appropriately.

Does this document require notarization?

This form does not typically require notarization unless specified by local law. However, it is recommended to have it notarized to enhance the document's validity and enforceability in the case of disputes.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to specify the exact loan amount or interest rate.

- Not clarifying the payment schedule or prepayment conditions.

- Omitting signatures from all relevant parties.

- Neglecting to keep a copy of the signed note for personal records.

Benefits of completing this form online

- Instant access to a professionally drafted legal document.

- Ability to edit and customize the form to fit specific loan terms.

- Online completion saves time and reduces paperwork.

- Reliability and assurance from using a legally vetted template.

Legal use & context

This secured promissory note is a legally binding agreement that ensures the lender has recourse through the collateral if the borrower defaults on repayment. It must be completed properly to be enforceable in a court of law.

Summary of main points

- The Vermont Secured Promissory Note is essential for securing a loan with collateral.

- It specifies terms of repayment, interest, and obligations in case of default.

- Proper completion and signatures are vital for the form's legal validity.

Looking for another form?

Form popularity

FAQ

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Small businesses frequently borrow money, or extend credit, in the course of their operations. A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.