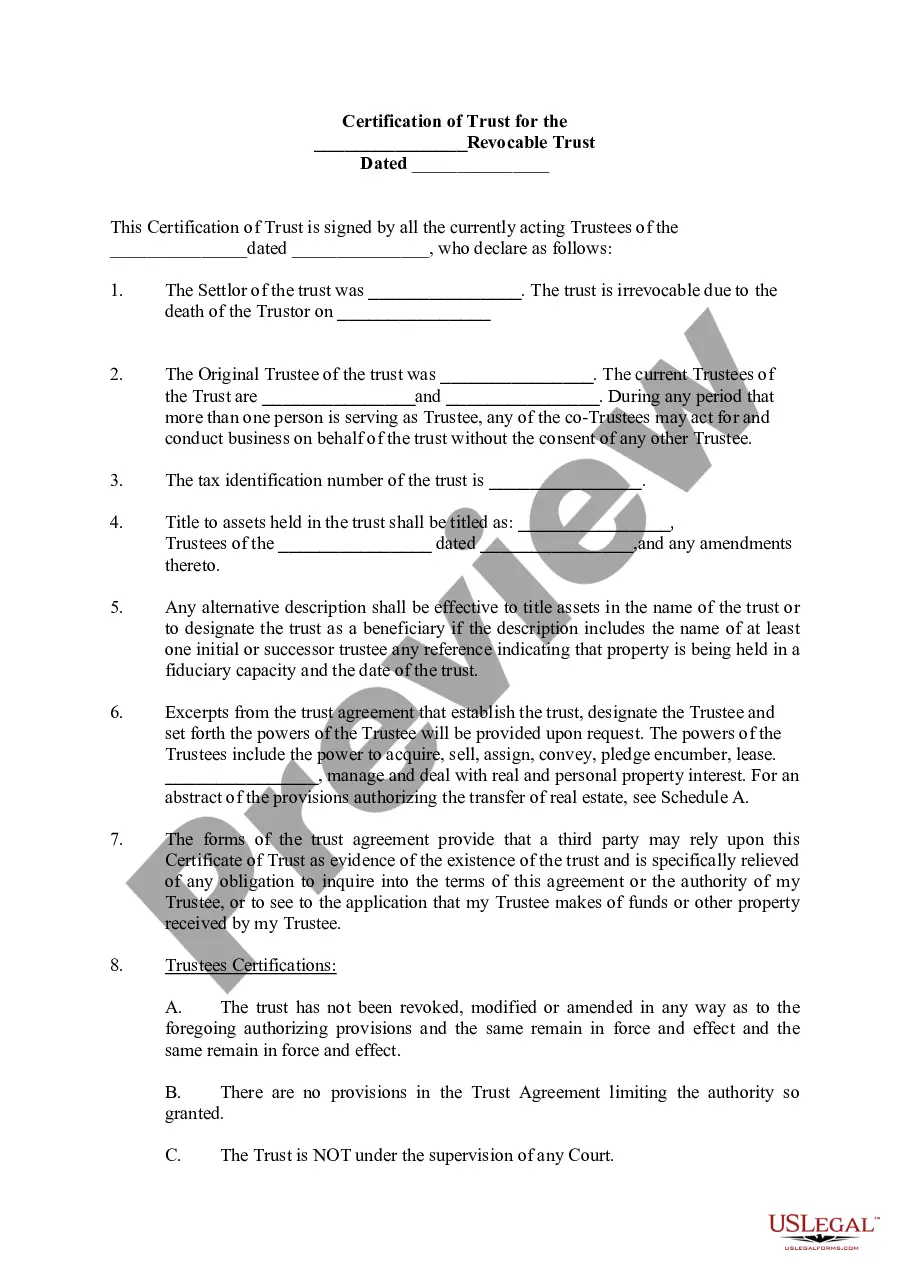

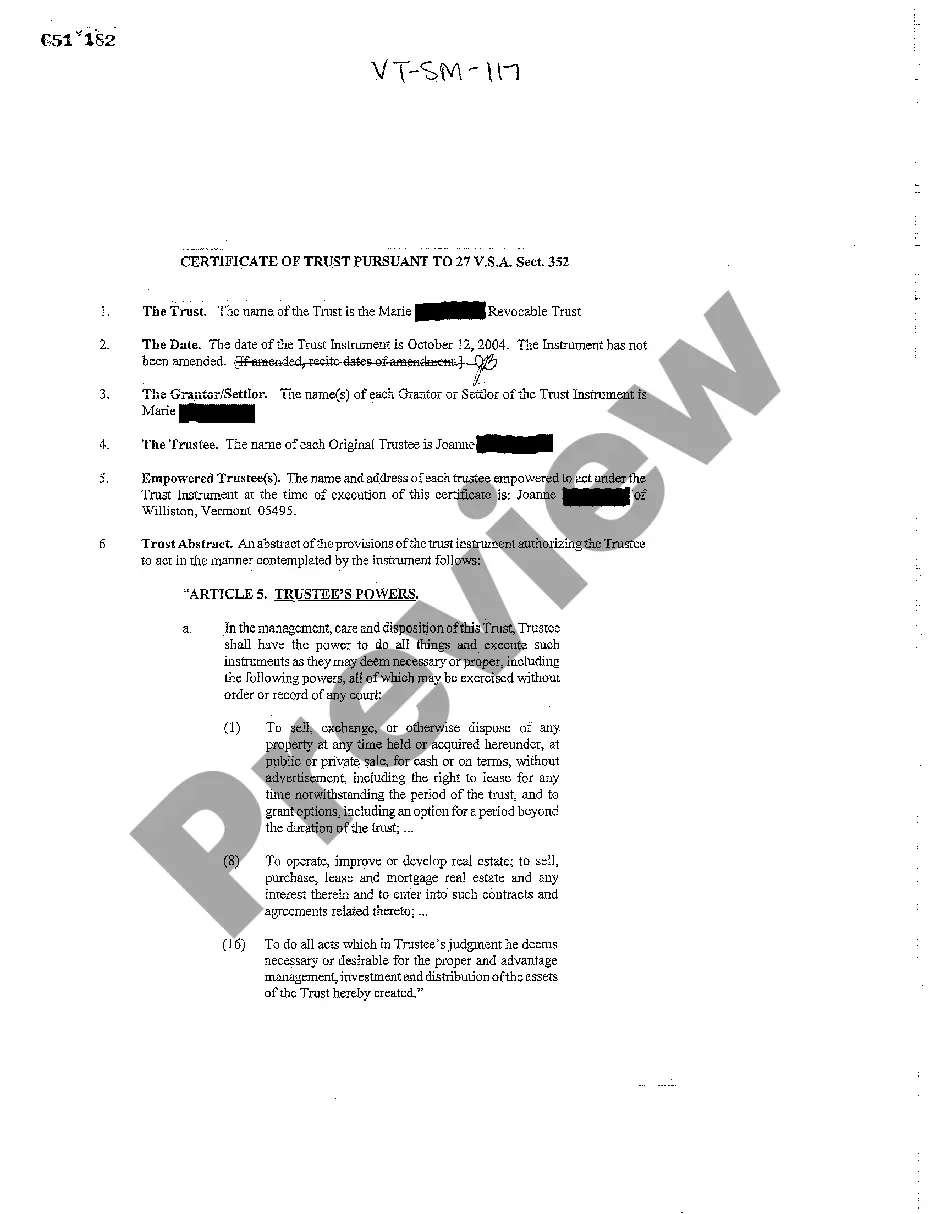

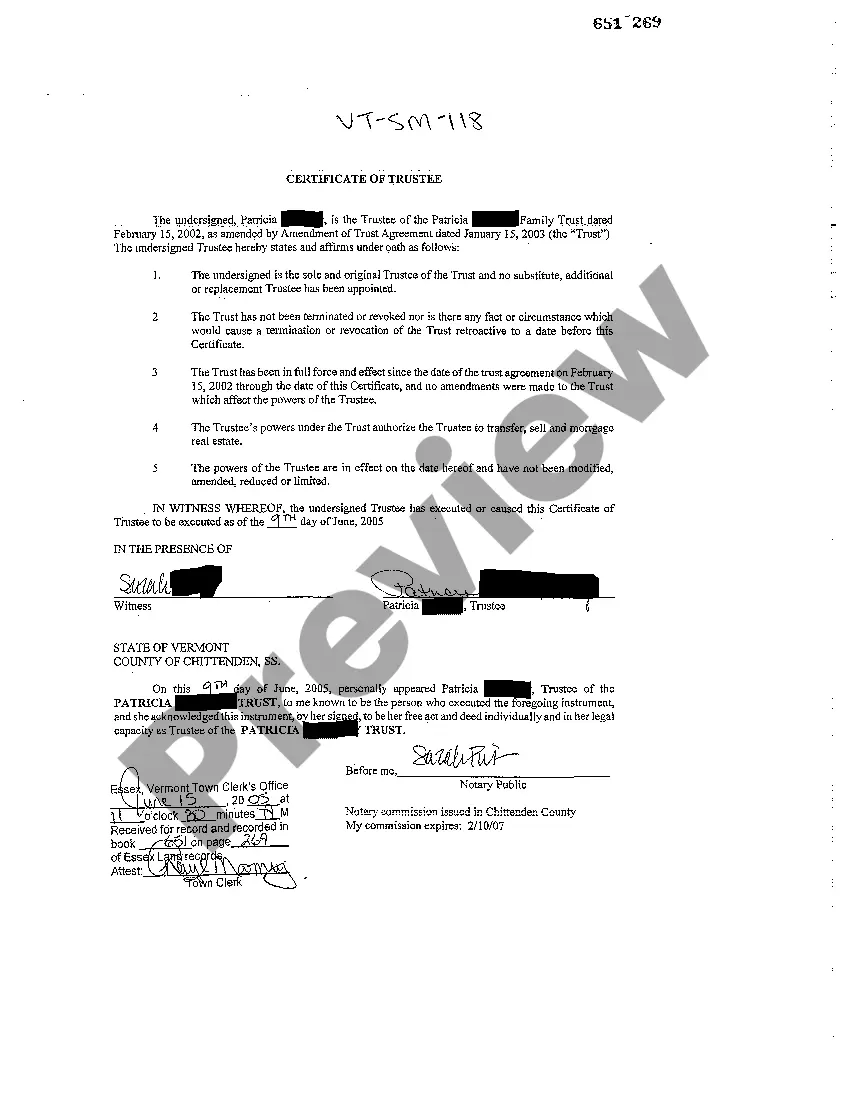

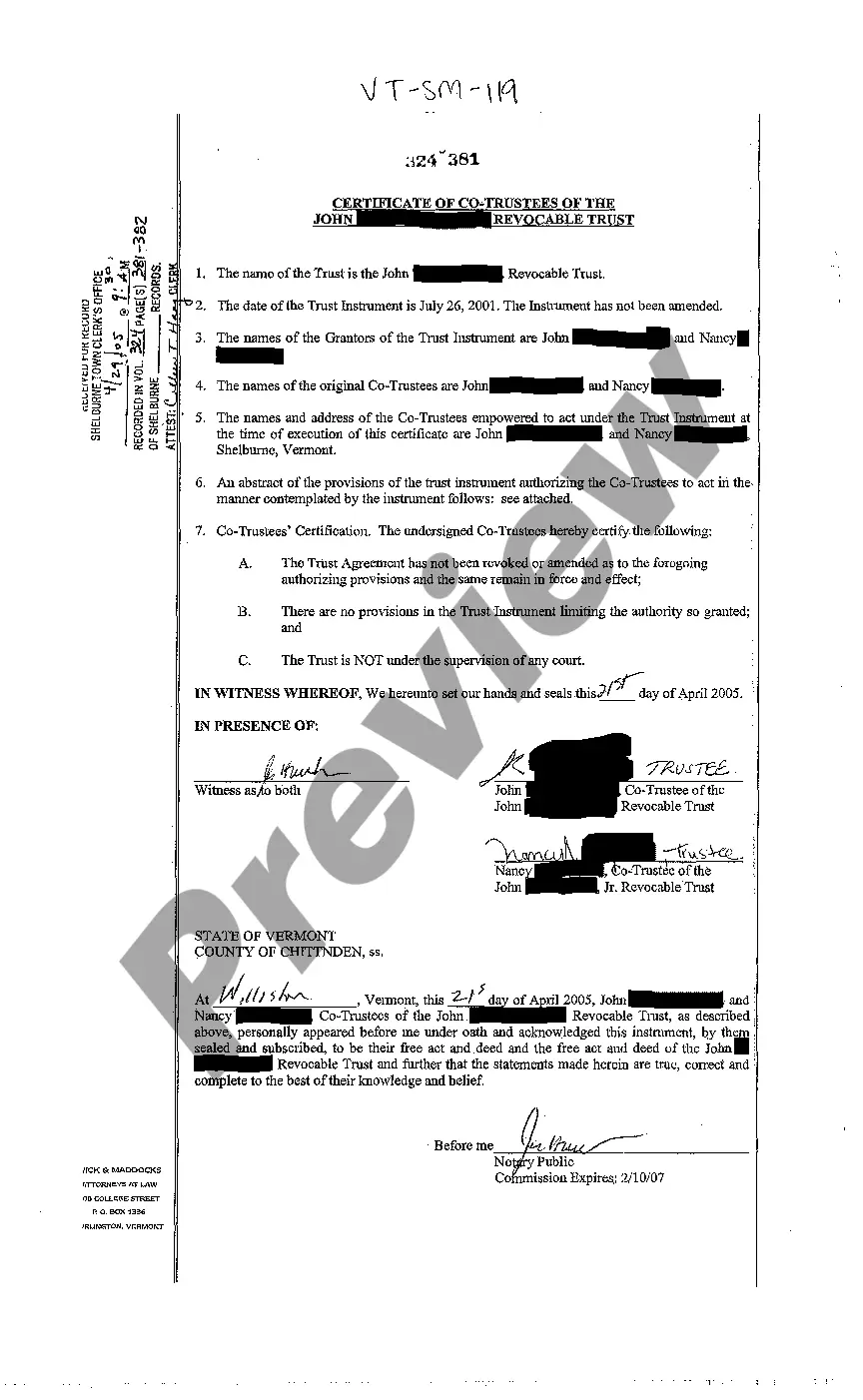

Vermont Certification of Trust for Revocable Trust

Description

How to fill out Vermont Certification Of Trust For Revocable Trust?

Searching for a Vermont Certification of Trust for Revocable Trust on the internet might be stressful. All too often, you see documents that you believe are ok to use, but discover afterwards they are not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Have any form you’re searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be added to your My Forms section. In case you do not have an account, you need to sign up and pick a subscription plan first.

Follow the step-by-step guidelines below to download Vermont Certification of Trust for Revocable Trust from our website:

- Read the document description and hit Preview (if available) to check whether the form meets your expectations or not.

- In case the form is not what you need, find others using the Search field or the listed recommendations.

- If it is appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the template in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms catalogue. Besides professionally drafted samples, customers may also be supported with step-by-step guidelines regarding how to get, download, and complete templates.

Form popularity

FAQ

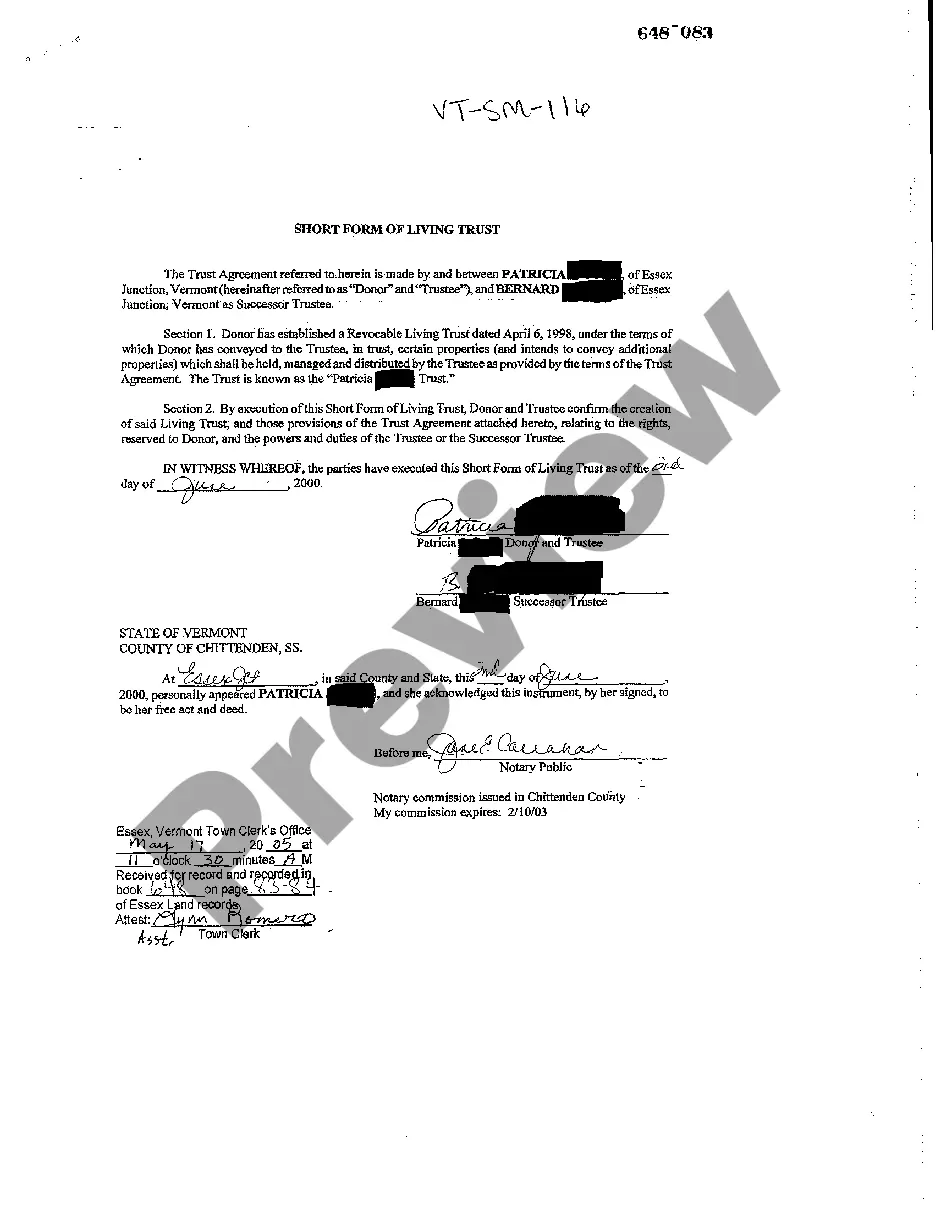

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...

If you have a trust in Michigan, state law provides that you can register the trust. Registering a Michigan trust is not required (except for certain charitable trusts, as discussed below). Even for non-charitable trusts, there are good reasons that a trust should be registered.

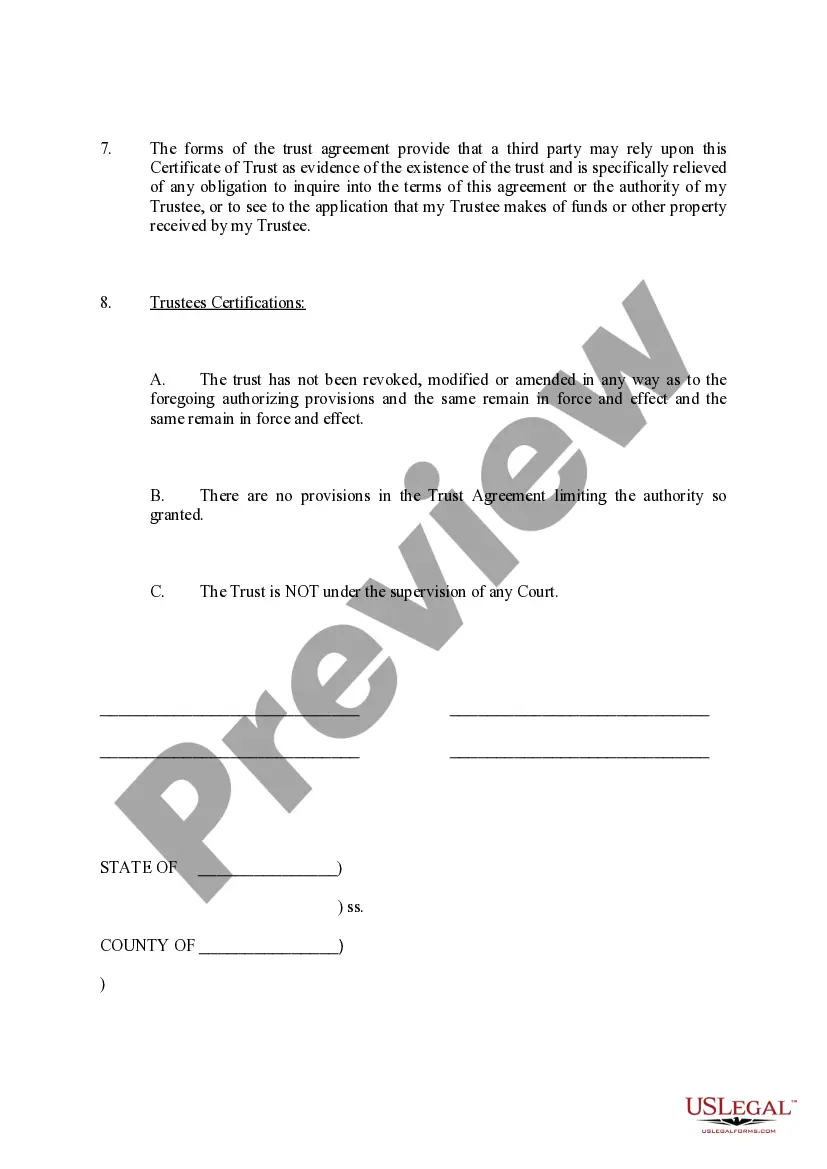

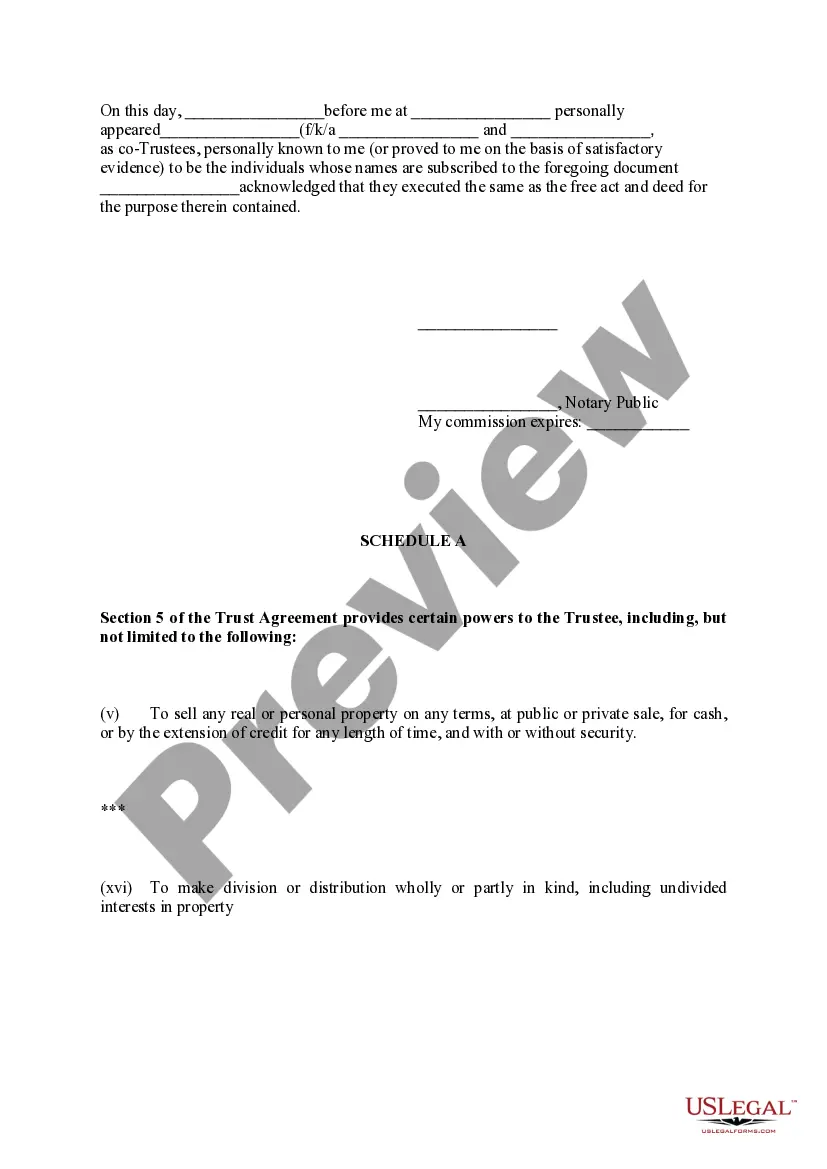

A certificate of trust is used by an acting trustee or trustees of a trust to prove to financial institutions or other third parties that he/she/they has/have the authority to act on behalf of the trust.The certificate also specifies how the trust will vest title to real property.

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

A Memorandum of Trust is a synopsis of a trust that is used when transferring real property into a trust.A Certification of Trust is used in place of the actual trust to open up an account on behalf of a trust at a financial institution.

Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.Understanding the 3 primary types of trusts - The Des Moines Register\nwww.desmoinesregister.com > money > business > columnists > 2015/08/31

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.

A: An affidavit of trust and a certificate of trust are essentially the same thing. At least they serve the same functions. Simply put, an affidavit of trust is an abbreviated version of the trust agreement that provides general information about the terms of the trust.

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.