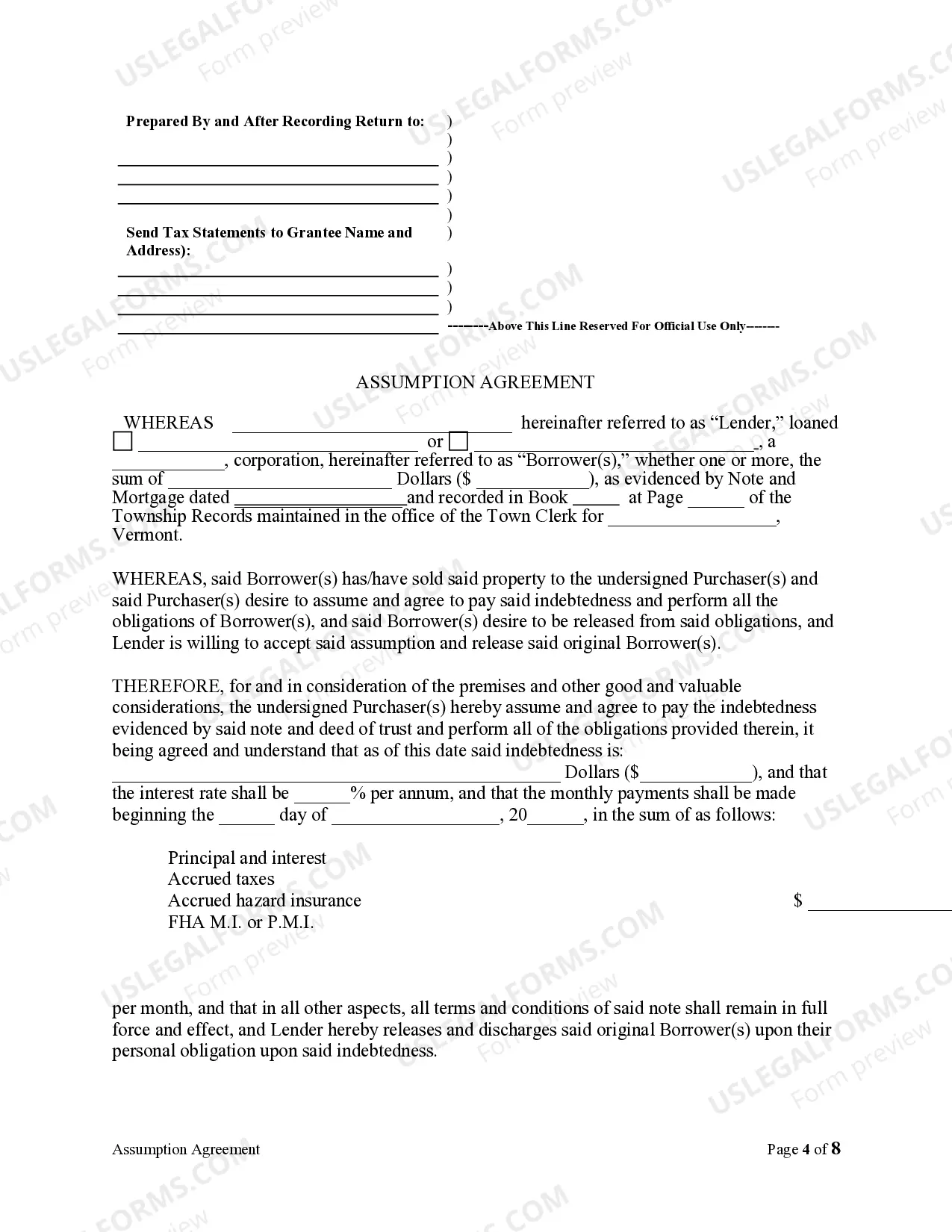

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Vermont Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Vermont Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Looking for a Vermont Assumption Agreement of Mortgage and Release of Original Mortgagors online can be stressful. All too often, you see documents which you think are fine to use, but discover later on they’re not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Get any form you are searching for quickly, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will instantly be added to the My Forms section. If you don’t have an account, you must register and pick a subscription plan first.

Follow the step-by-step instructions listed below to download Vermont Assumption Agreement of Mortgage and Release of Original Mortgagors from our website:

- Read the form description and hit Preview (if available) to check whether the form meets your expectations or not.

- If the form is not what you need, get others with the help of Search engine or the listed recommendations.

- If it’s appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms library. In addition to professionally drafted samples, users are also supported with step-by-step guidelines regarding how to get, download, and complete templates.

Form popularity

FAQ

Grantors and Grantees In mortgages and car leases, the grantor is the consumer and the grantee is the lender. In judgment and tax liens, the grantor is the debt holder and the grantee is either the government or the victorious plaintiff in a lawsuit.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

The Grantor is any person conveying or encumbering, whom any Lis Pendens, Judgments, Writ of Attachment, or Claims of Separate or Community Property shall be placed on record. The Grantor is the seller (on deeds), or borrower (on mortgages). The Grantor is usually the one who signed the document.

The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility. The lender usually requires a credit history from the buyer before approving the assumption and the payment of assumption fee(s).

Write the title. Begin the document with the official title, "Loan Agreement" and the current date. Then state who the loan agreement is between; list the borrowers' first with their middle and last names, followed by the lender. Indicate each party with the designation "Borrower" and "Lender" after each name.

People can just let the home go to foreclosure, and this will affect their scores for seven years. Or they can do a deed in lieu of foreclosure. With a deed in lieu, you voluntarily give your home to the lender in exchange for the cancellation of your loan. This, too, can create a negative mark on your credit history.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.