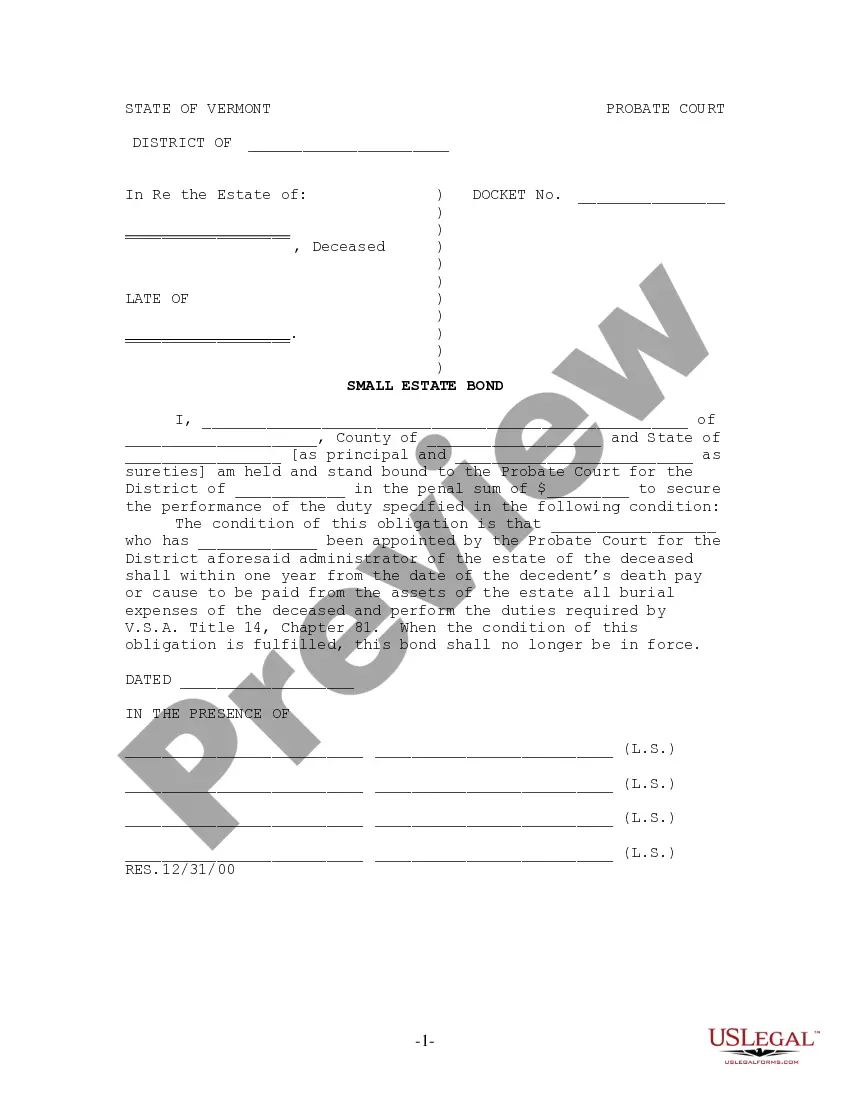

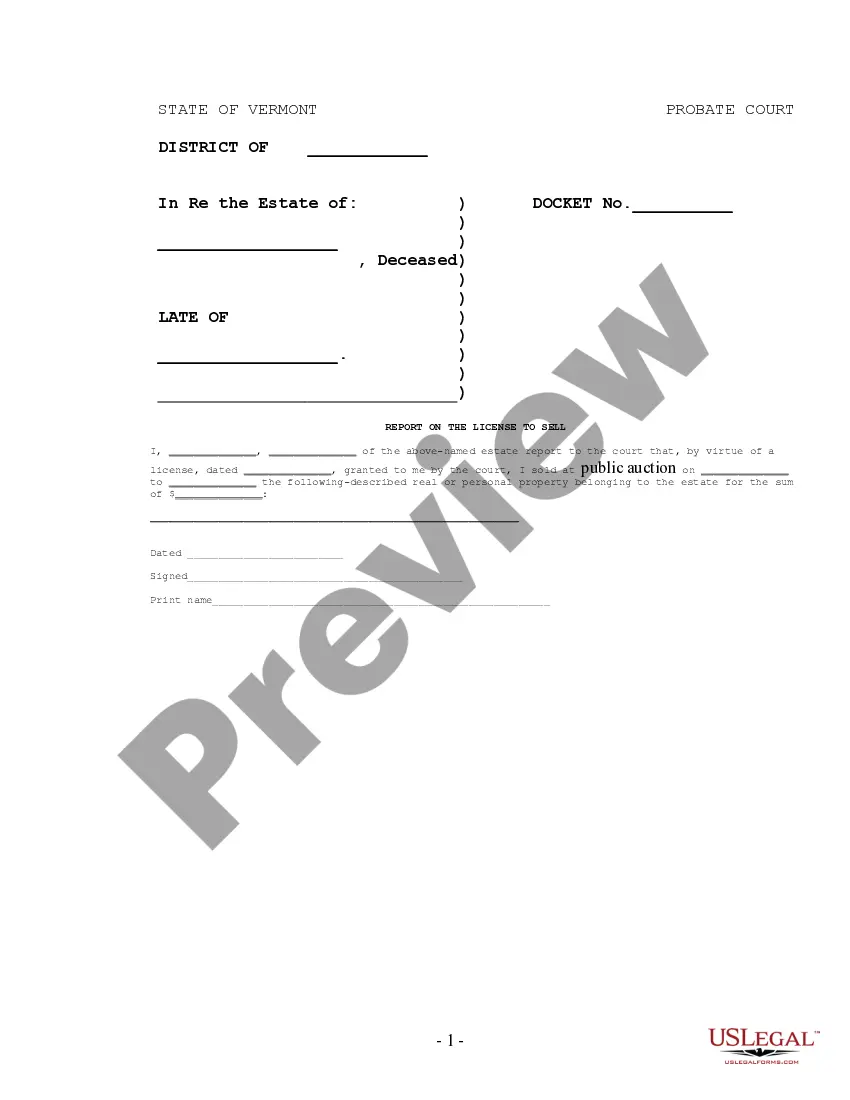

This form is used by an executor or administrator of a small estate to make a final report to the court, with an accompanying order from the court that the estate be closed. This is one of over 150 Official Probate forms for the state of Vermont.

Vermont Report of Executor or Administrator in Small Estate

Description

How to fill out Vermont Report Of Executor Or Administrator In Small Estate?

Searching for a Vermont Report of Executor or Administrator in Small Estate on the internet might be stressful. All too often, you see papers that you just believe are alright to use, but discover later on they’re not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional legal professionals according to state requirements. Have any document you’re searching for within minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll automatically be added to your My Forms section. If you do not have an account, you need to register and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Report of Executor or Administrator in Small Estate from the website:

- See the document description and hit Preview (if available) to check whether the form suits your expectations or not.

- If the document is not what you need, find others using the Search engine or the provided recommendations.

- If it is right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- After getting it, you can fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms library. Besides professionally drafted templates, customers can also be supported with step-by-step instructions concerning how to get, download, and fill out forms.

Form popularity

FAQ

The court only allows someone to get letters of administration in probate in cases of a full probate procedure. Many estates are settled through trust administration or through small estate procedures for California.Smaller estates often don't need letters of administration at all.

Duties and Responsibilities After debts, taxes, and expenses are paid, the remaining assets are distributed to the decedent's beneficiaries.It is the executor's or the administrator's responsibility to collect and distribute the assets and to pay any death taxes and expenses of the decedent.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.

An administrator will take title legally on the estate's assets, and has legal responsibility to file all tax returns and pay all related taxes.In certain cases, the administrator may have personal liability for any unpaid tax amounts due for the estate.

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.

There is no need for probate or letters of administration unless there are other assets that are not jointly owned. The property might have a mortgage. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.

Do you always need probate or letters of administrationYou usually need probate or letters of administration to deal with an estate if it includes property such as a flat or a house.you discover that the estate is insolvent, that is, there is not enough money in the estate to pay all the debts, taxes and expenses.

If the deceased owned a property in their sole name Probate will generally be needed before it can be sold or transferred.Although it is technically true that Executors can exchange contracts without the Grant of Probate, this is not best practice and is very rarely done.