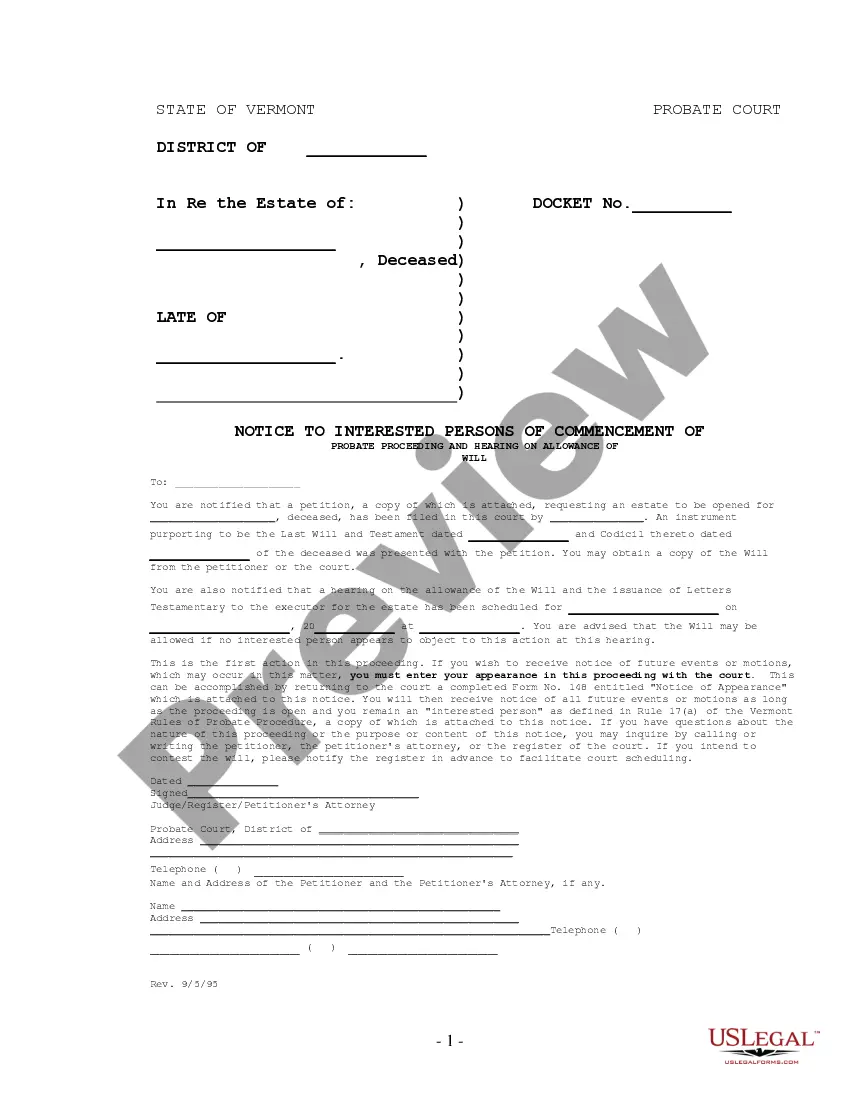

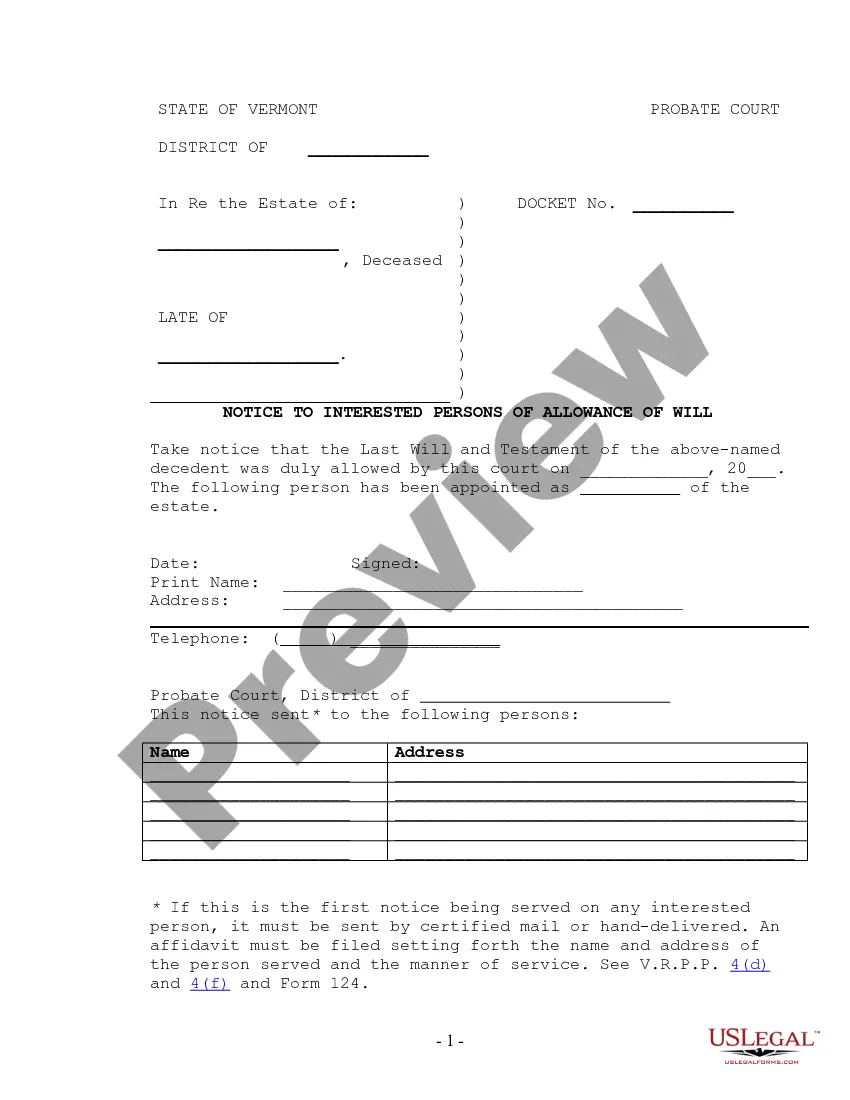

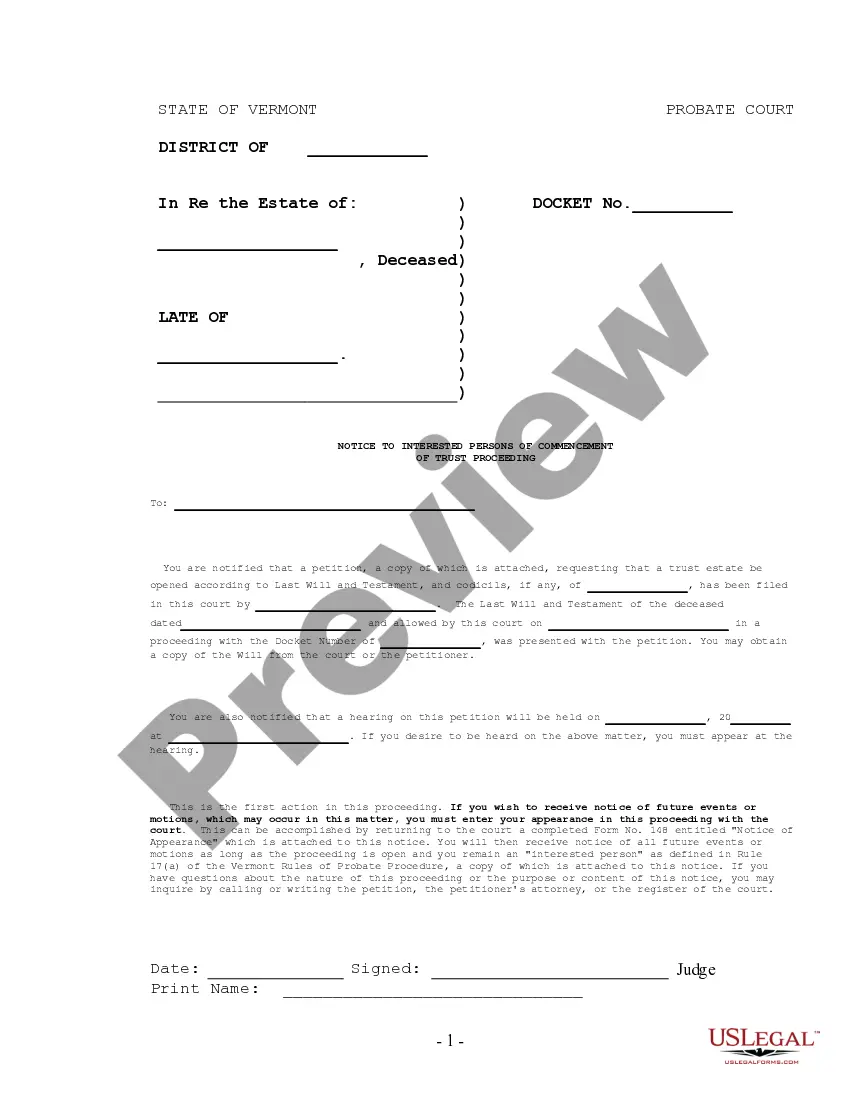

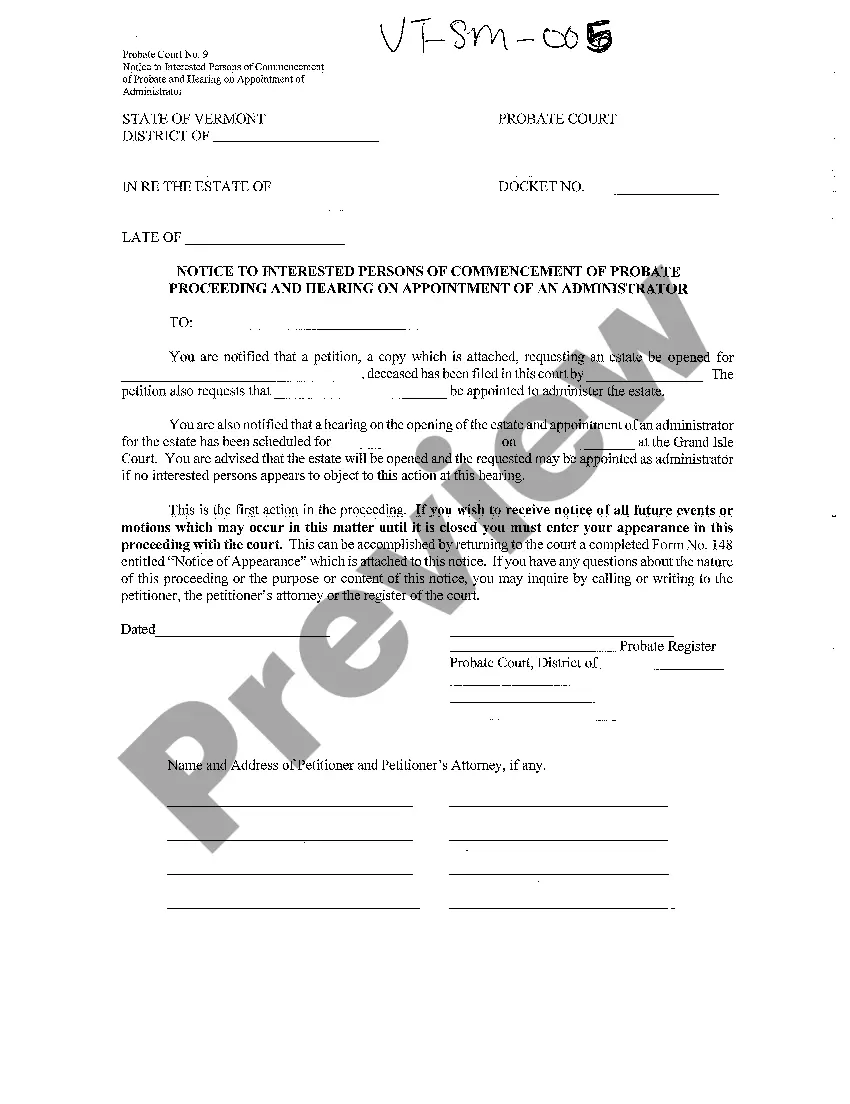

This form is used to provide notice to interested parties in an estate that a petition has been filed requesting that an estate be opened and an administrator appointed. This form gives the interested party notice that a hearing on these matters will be held and will likely be approved if no interested party appears at the hearing to object. This form also provides information to the interested party as to what they must do to continue receiving notices of court proceedings (submit Notice of Appearance form VT-148-P). This form is one of over 150 Official Probate forms for the state of Vermont.

Vermont Notice to Interested Persons of Commencement of Probate Proceeding and Hearing on Appointment of Administrator (Intestate)

Description

How to fill out Vermont Notice To Interested Persons Of Commencement Of Probate Proceeding And Hearing On Appointment Of Administrator (Intestate)?

Searching for a Vermont Notice to Interested Persons of Commencement of Probate Proceeding and Hearing on Appointment of Administrator (Intestate) on the internet can be stressful. All too often, you see documents that you simply think are alright to use, but discover afterwards they’re not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Get any form you are searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll automatically be included to the My Forms section. In case you do not have an account, you should sign-up and select a subscription plan first.

Follow the step-by-step recommendations listed below to download Vermont Notice to Interested Persons of Commencement of Probate Proceeding and Hearing on Appointment of Administrator (Intestate) from our website:

- Read the document description and press Preview (if available) to verify if the template meets your expectations or not.

- In case the form is not what you need, find others using the Search field or the listed recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- After downloading it, you are able to fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms catalogue. In addition to professionally drafted samples, customers are also supported with step-by-step guidelines regarding how to get, download, and fill out templates.

Form popularity

FAQ

Probate if there is a Will They can also choose who should benefit from their Estate after their death these are their Beneficiaries. Therefore if there is a Will, it's the Executors who must apply to the Probate Registry for a Grant of Probate. On average this takes between three and six months to be issued.

Retirement accountsIRAs or 401(k)s, for examplefor which a beneficiary was named. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) Property held in a living trust. Funds in a payable-on-death (POD) bank account.

Dying Without a Will in VermontIf you die without a valid will, you'll lose control over what happens to your assets after your death.If there isn't a will, the probate court must appoint someone to serve as the executor or personal representative. Usually the surviving spouse or adult child is chosen for this role.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

As an aside, Vermont Statute Title 32 § 1143 states that executors may be paid $4 per day spent in court, but this is geared towards the court paying appointed agents, and that amount was set in 1866.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

In Vermont, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Common expenses of an estate include executors fees, attorneys fees, accounting fees, court fees, appraisal costs, and surety bonds. Most estates are settled though probate in about 6 to 18 months, assuming there is no litigation involved.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.