Virgin Islands Lien and Tax Search Checklist

Description

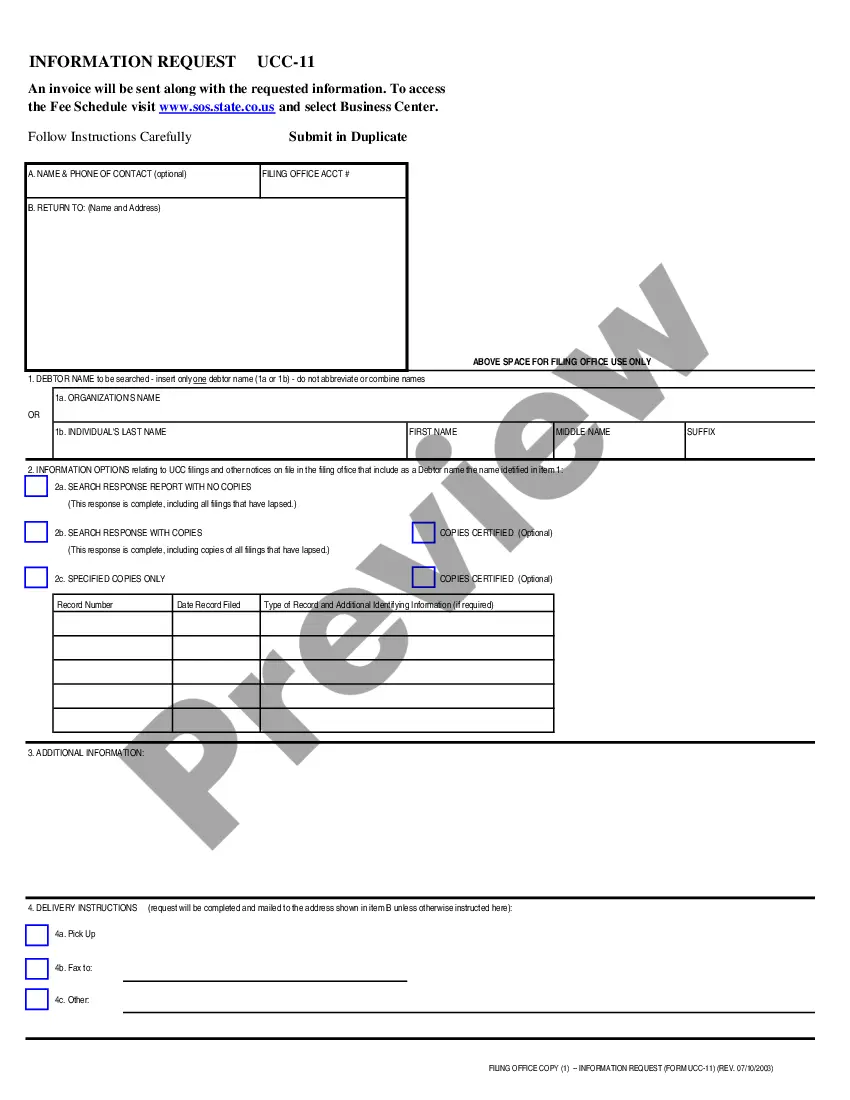

How to fill out Lien And Tax Search Checklist?

If you need to full, acquire, or produce authorized papers themes, use US Legal Forms, the most important assortment of authorized kinds, that can be found on the web. Use the site`s easy and convenient search to discover the paperwork you want. Different themes for company and person reasons are sorted by categories and claims, or keywords. Use US Legal Forms to discover the Virgin Islands Lien and Tax Search Checklist in a number of clicks.

If you are already a US Legal Forms client, log in to the profile and then click the Acquire button to obtain the Virgin Islands Lien and Tax Search Checklist. You can also gain access to kinds you earlier downloaded from the My Forms tab of your own profile.

Should you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for that appropriate metropolis/land.

- Step 2. Take advantage of the Review option to examine the form`s content material. Do not overlook to read the information.

- Step 3. If you are unsatisfied with the type, utilize the Search discipline near the top of the monitor to find other versions from the authorized type template.

- Step 4. Upon having discovered the shape you want, go through the Purchase now button. Choose the prices prepare you prefer and add your qualifications to sign up for the profile.

- Step 5. Procedure the purchase. You may use your charge card or PayPal profile to complete the purchase.

- Step 6. Find the structure from the authorized type and acquire it on your gadget.

- Step 7. Complete, revise and produce or indicator the Virgin Islands Lien and Tax Search Checklist.

Every authorized papers template you purchase is the one you have eternally. You have acces to each type you downloaded in your acccount. Click the My Forms portion and select a type to produce or acquire again.

Be competitive and acquire, and produce the Virgin Islands Lien and Tax Search Checklist with US Legal Forms. There are many specialist and express-distinct kinds you can use for the company or person requires.

Form popularity

FAQ

US Virgin Islands is not a tax haven or offshore jurisdiction, but USVI companies (or corporations) could be established as "USVI Exempt Companies" with partial or full exemption from local and US federal income taxes.

US Virgin Islands does not use a state withholding form because there is no personal income tax in US Virgin Islands.

VIRGIN ISLANDS INHERITANCE TAXES Code, all inheritances after 1984 are exempt from taxation.

The Virgin Islands Bureau of Internal Revenue and the IRS are not the same entity although the same tax rates and laws apply. If you are a US resident with income allocable to the Virgin Islands, file Form 8689 with your regular 1040 tax return.

EDC Tax Benefits 90% reduction in corporate income tax. 90% reduction in personal income tax. 100% exemption on excise tax. 100% exemption on property taxes. 100% exemption on gross receipts tax. 1% duty on imported goods.

Land tax is payable on every acre or part of an acre of land in the territory. House tax is payable on the assessed value of every house in the territory. The combined (Land and House) tax, referred to as Property Tax, is charged to every owner who erects, reconstructs, enlarges or repairs any existing building.

(a) For the purposes of this section a homestead shall constitute the abode including land and buildings, owned by, and actually occupied by, the property owner, or by members occupied by, a person, or by members of the property owner's family free of rental charges.

INDIVIDUAL INCOME TAX Individuals who are bona fide residents of the Virgin Islands file Form 1040 with the Virgin Islands and pay tax on their worldwide income to the Virgin Islands.