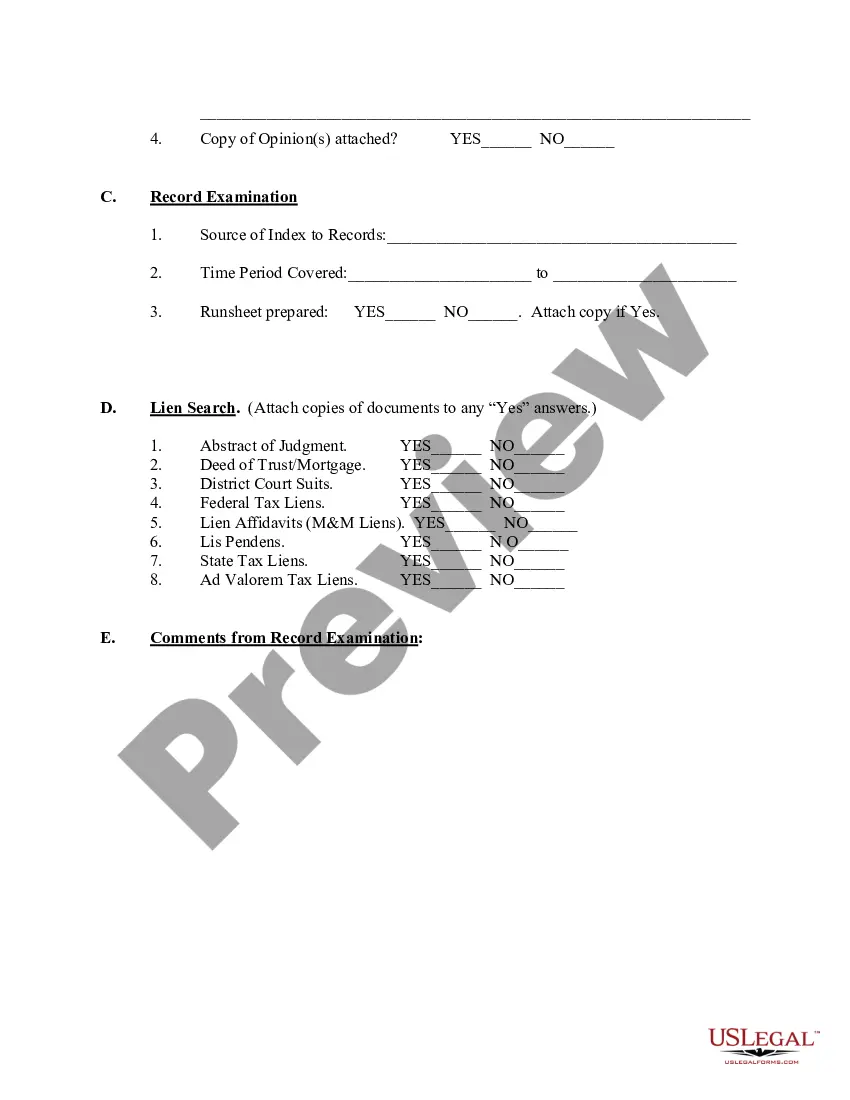

Virgin Islands Due Diligence Field Review and Checklist

Description

How to fill out Due Diligence Field Review And Checklist?

Are you presently within a situation the place you need papers for sometimes organization or person uses nearly every day time? There are plenty of authorized file templates accessible on the Internet, but discovering types you can depend on isn`t effortless. US Legal Forms offers a huge number of form templates, like the Virgin Islands Due Diligence Field Review and Checklist, which can be created to fulfill federal and state specifications.

Should you be already familiar with US Legal Forms website and have a free account, basically log in. Following that, you may download the Virgin Islands Due Diligence Field Review and Checklist format.

Should you not come with an bank account and want to begin using US Legal Forms, follow these steps:

- Discover the form you want and ensure it is for that right town/area.

- Utilize the Review button to examine the shape.

- Look at the description to ensure that you have selected the correct form.

- When the form isn`t what you`re looking for, make use of the Lookup area to get the form that meets your needs and specifications.

- When you find the right form, click Get now.

- Select the costs program you desire, fill out the desired info to produce your bank account, and pay for an order with your PayPal or bank card.

- Decide on a practical file formatting and download your version.

Discover every one of the file templates you might have purchased in the My Forms food selection. You can aquire a further version of Virgin Islands Due Diligence Field Review and Checklist whenever, if required. Just select the needed form to download or print the file format.

Use US Legal Forms, probably the most comprehensive selection of authorized varieties, to conserve some time and avoid errors. The assistance offers expertly produced authorized file templates that you can use for an array of uses. Produce a free account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

The 4 customer due diligence requirements are: Customer identification and verification. Ascertaining the nature and purpose of the business relationship. Ultimate Beneficial Owner (UBO) identification and verification. PEP identification and verification. Ongoing transaction monitoring.

Here are four steps to prepare you for the due diligence process: 1 Be honest. Get used to having honest conversations. ... 2 Record & store information from the start. ... 3 Ask questions. ... 4 Consider it as an opportunity to find the best match.

How To Prepare For Due Diligence - kagaar Introduction. ... Understanding Due Diligence. ... Defining Objectives and Scope. ... Assembling a Due Diligence Team. ... Organizing Documentation and Information. ... Financial Analysis and Documentation. ... Legal Review and Compliance. ... Operational Assessment.

In this article, we will guide you through the essential steps to prepare for due diligence effectively. Introduction. ... Understanding Due Diligence. ... Defining Objectives and Scope. ... Assembling a Due Diligence Team. ... Organizing Documentation and Information. ... Financial Analysis and Documentation. ... Legal Review and Compliance.

The due diligence guidelines for third parties involve gathering information about the third party's background, financial stability, legal and compliance history, business practices, and overall reputation.

Complete Due Diligence Documents Checklist Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

However, a standard due diligence report should include the following components: Executive summary. Company overview. Purpose and objective of the diligence. Financial due diligence. Legal due diligence. Operational due diligence. Market and commercial due diligence. Risk assessment.