Virgin Islands Partial Release of Oil and Gas Lease for Multiple Lessees

Description

How to fill out Partial Release Of Oil And Gas Lease For Multiple Lessees?

Discovering the right legitimate document web template can be quite a struggle. Needless to say, there are tons of templates available online, but how do you get the legitimate develop you want? Take advantage of the US Legal Forms site. The support delivers a large number of templates, for example the Virgin Islands Partial Release of Oil and Gas Lease for Multiple Lessees, which you can use for enterprise and private requires. All the varieties are checked by specialists and satisfy state and federal specifications.

If you are already signed up, log in to your profile and then click the Download option to obtain the Virgin Islands Partial Release of Oil and Gas Lease for Multiple Lessees. Make use of your profile to look with the legitimate varieties you possess bought earlier. Check out the My Forms tab of your own profile and acquire one more backup of your document you want.

If you are a fresh user of US Legal Forms, listed here are easy instructions for you to comply with:

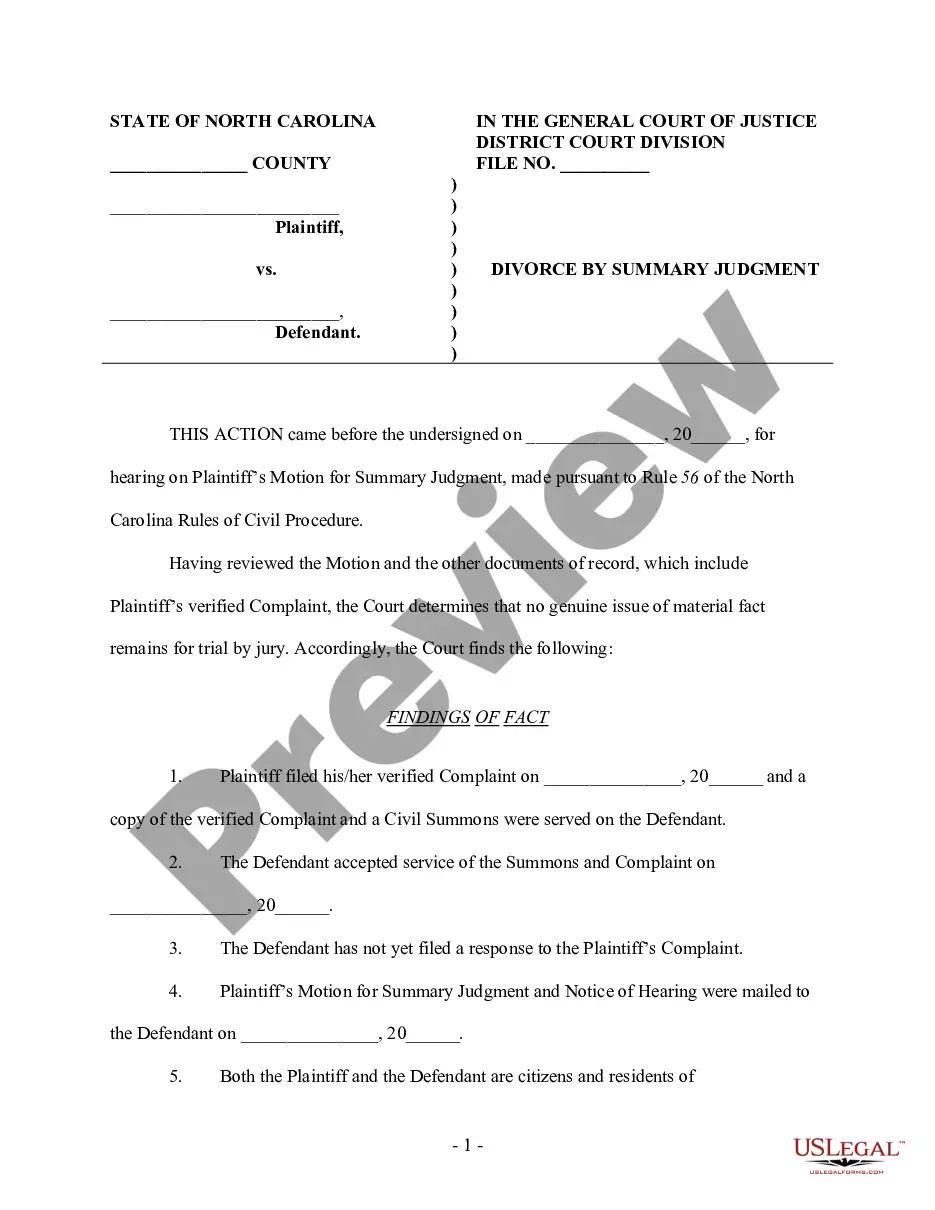

- Initial, ensure you have selected the appropriate develop for your personal metropolis/area. You may look over the shape while using Review option and look at the shape explanation to ensure this is the right one for you.

- When the develop fails to satisfy your expectations, utilize the Seach industry to obtain the correct develop.

- Once you are positive that the shape would work, click the Acquire now option to obtain the develop.

- Select the pricing plan you want and enter the necessary info. Make your profile and purchase an order making use of your PayPal profile or charge card.

- Select the document formatting and obtain the legitimate document web template to your product.

- Comprehensive, modify and print out and sign the acquired Virgin Islands Partial Release of Oil and Gas Lease for Multiple Lessees.

US Legal Forms is the most significant library of legitimate varieties that you can discover a variety of document templates. Take advantage of the company to obtain appropriately-created files that comply with condition specifications.

Form popularity

FAQ

Is there more than one type of oil and gas lease? Yes, there are three types: a surface use lease, a non-surface use lease, and a dual purpose lease.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Oil leases are agreements between an oil and gas company known as the lessee and mineral owners known as a lessor, in which the lessor grants the lessee the permission to explore, drill, and produce those minerals for a specified period known as a primary term or as long as the minerals continue to be productive.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

in clause (or shutin royalty clause) traditionally allows the lessee to maintain the lease by making shutin payments on a well capable of producing oil or gas in paying quantities where the oil or gas cannot be marketed, whether due to a lack of pipeline connection or otherwise.

- Lessor -The owner of the minerals that grants the lease. - Lessee -The oil and gas developer that takes the lease. - Primary Term-Length of time the Lessee has to establish production by drilling a well on the lands subject to the lease. Generally, primary terms run from one to ten years.

: a deed by which a landowner authorizes exploration for and production of oil and gas on his land usually in consideration of a royalty.