Massachusetts Option For the Sale and Purchase of Real Estate - Farm Land

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Farm Land?

If you wish to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available on the web.

Employ the site’s straightforward and user-friendly search to find the documents you require.

Various templates for commercial and personal purposes are organized by types and states, or keywords.

Every legal document template you acquire is yours indefinitely.

You have access to every document you saved in your account. Click the My documents section and choose a template to print or download again.

- Utilize US Legal Forms to obtain the Massachusetts Option For the Sale and Purchase of Real Estate - Agricultural Land in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Massachusetts Option For the Sale and Purchase of Real Estate - Agricultural Land.

- You can also access documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the template for the correct region/state.

- Step 2. Utilize the Preview feature to review the form’s content. Don’t forget to view the description.

- Step 3. If you are dissatisfied with the document, use the Search area at the top of the screen to find alternative templates in the legal document format.

- Step 4. Once you have located the document you need, click the Buy now button.

- Step 5. Process the payment; you can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

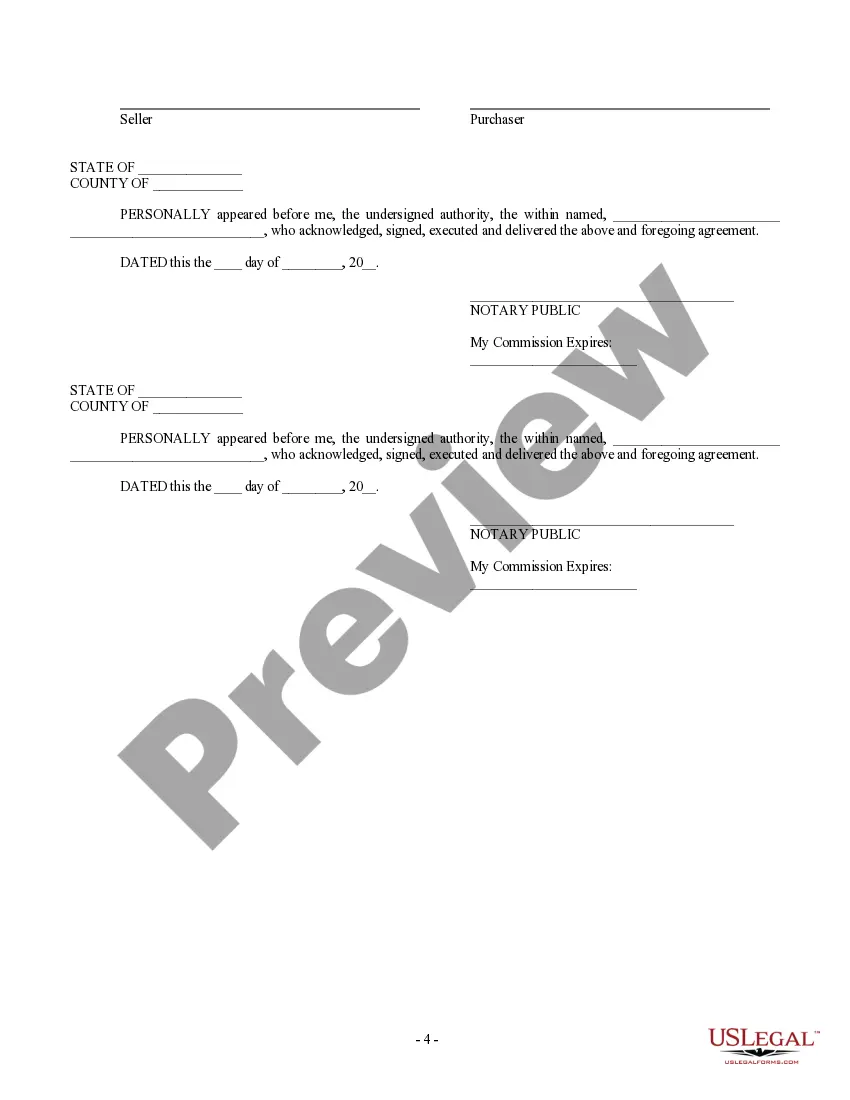

- Step 7. Complete, modify, print, or sign the Massachusetts Option For the Sale and Purchase of Real Estate - Agricultural Land.

Form popularity

FAQ

61B is the recreational land tax law. The purpose of Ch. 61B is to reduce the assessed value of land based on its use for open space or recreation. Assessed values under this law are reduced by 75%.

Outline any rules related to use of farmland for non-agricultural uses. Agricultural land in India is governed by state legislature as enshrined under article 246 of the Constitution. Land rights and their ownership are a state subject owing to its inclusion in the State List.

This By-law shall apply to all jurisdictional areas within the Town. The word "farm" shall include any parcel or contiguous parcels of land, or water bodies used for the primary purpose of commercial agriculture, or accessory thereto.

Bill Gates now owns the most farmland of anyone in the United States, according to a recent report from The Land Report. The outlet reported this week that Gates, 65, owns 268,984 acres of land combined across 19 states.

INTRODUCTION. The agricultural and horticultural land classification program under Massachusetts General Laws Chapter 61A is designed to encourage the preservation of the Commonwealth's valuable farmland and promote active agricultural and horticultural land use.

Massachusetts Department of Revenue The Massachusetts Department of Revenue's definition MGL Ch 61A Sec. 2 defines the real estate property tax exemption for agriculture.

Agricultural property is land or pasture that is used to grow crops or to rear animals intensively. This land could benefit from Agricultural Property Relief from Inheritance Tax granted by the Inheritance Tax Act 1984.

In 2020 the Karnataka government removed limitations on non-agriculturists for buying and selling agricultural plots, thereby repealing a decades-old rule.

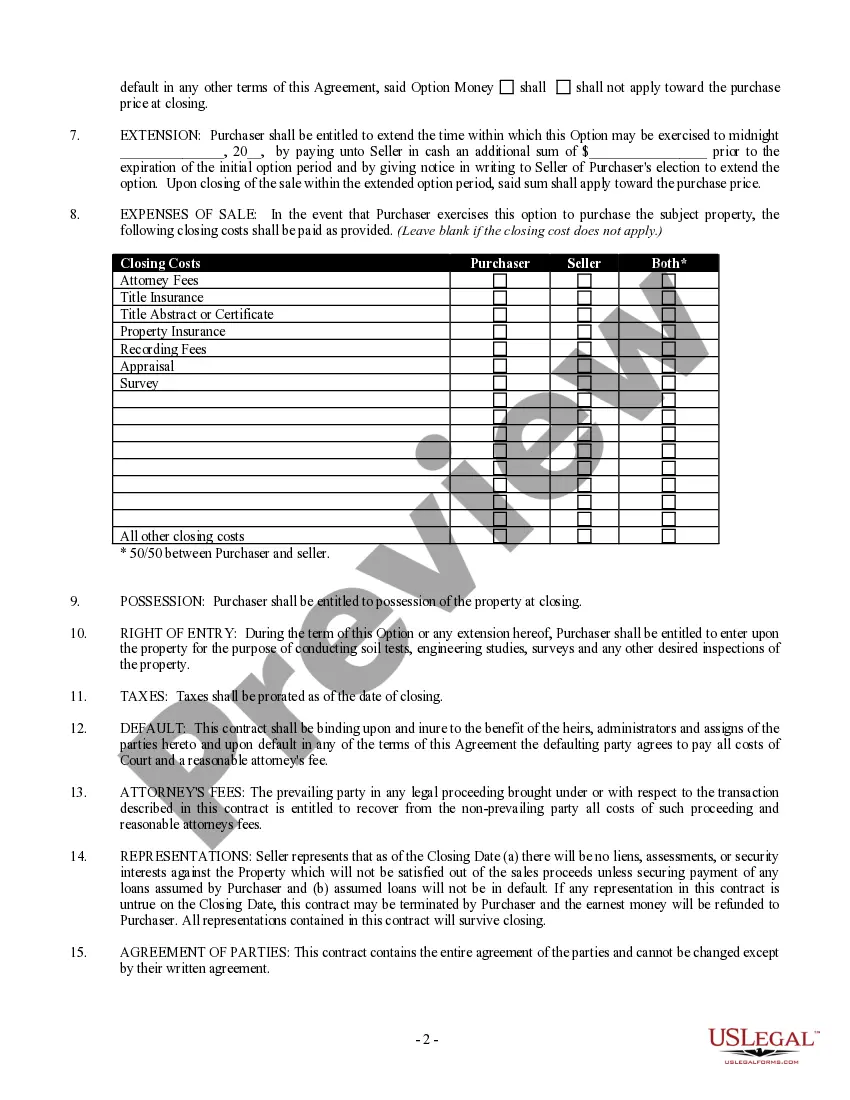

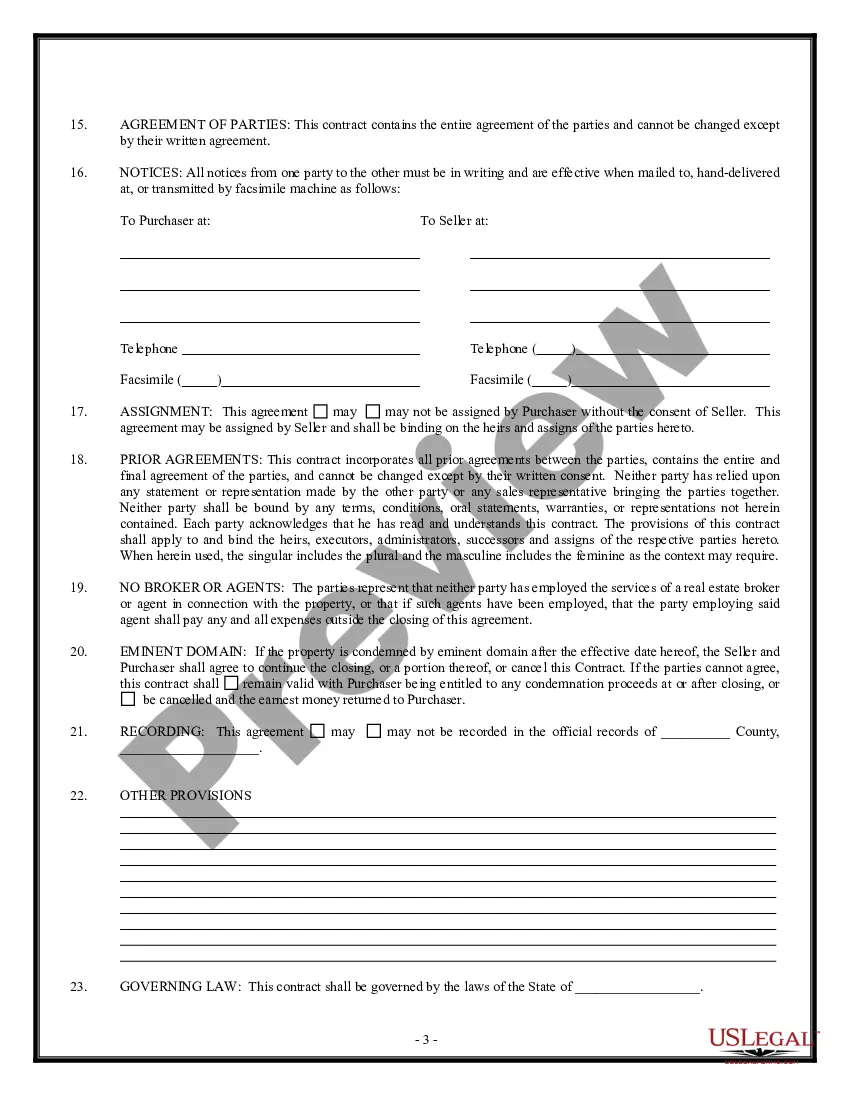

Farm land is a real estate niche that deals with the purchase and sale of Arable land. This niche requires the real estate agent to have very particular knowledge about the land and farming industry.

7 Tips Before Selling a Farm Get the Price RIGHT! In order to make a quick sale on your property, price your farm no more than 5 to 10% over market price. Make the Place Presentable Tidy Up. Consider Dividing the Property. Get a Survey. Decide: Auction or Listing? Use Technology. Call a Professional.