Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most notable collections of legal documents in the United States - offers a broad selection of legal template papers that you can download or print.

By using the website, you can discover countless forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor in mere seconds.

If you hold a subscription, Log In and acquire the Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Make modifications. Fill out, revise, print, and sign the downloaded Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor.

Every template you added to your account has no expiration date and belongs to you forever. Therefore, to download or print another copy, simply go to the My documents section and click on the form you require.

- To use US Legal Forms for the first time, follow these simple steps.

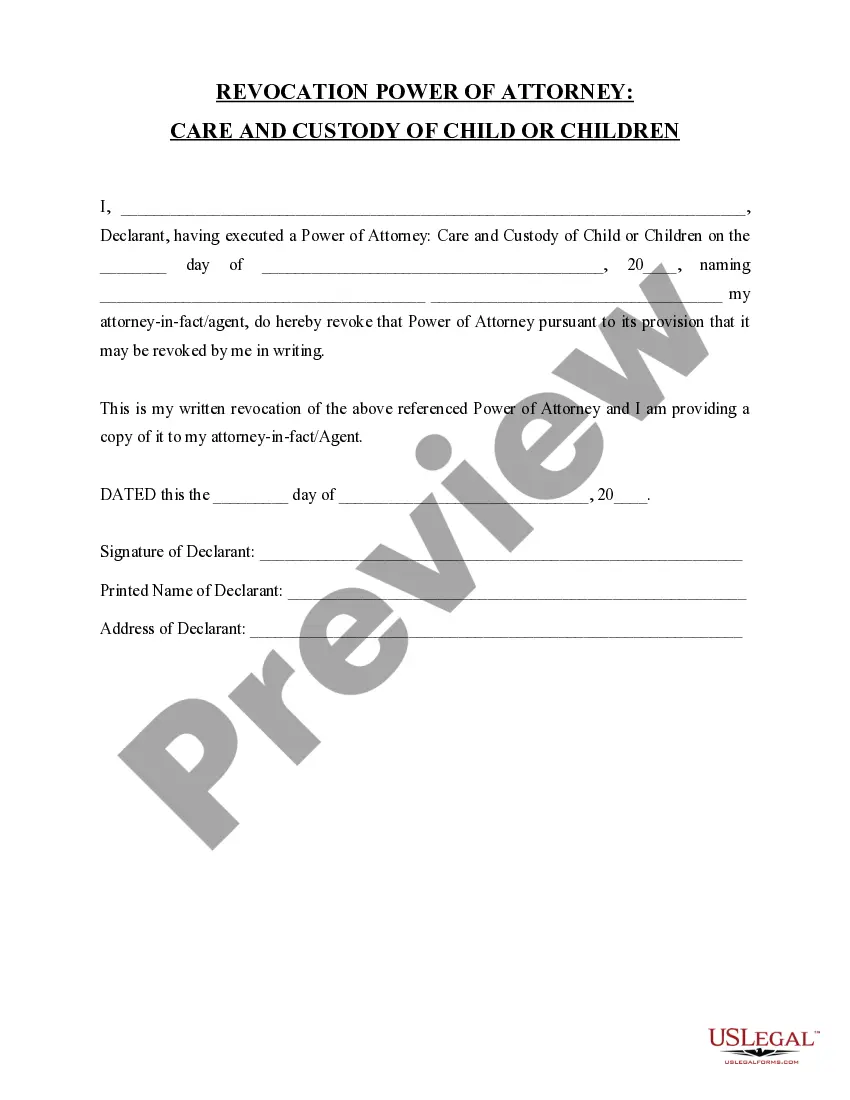

- Ensure you have selected the appropriate form for your region/locality. Click the Preview option to review the form’s content. Check the form description to confirm that you have chosen the correct one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, affirm your selection by clicking the Get now option. Then, choose the pricing plan that suits you and provide your information to register for an account.

- Process the payment. Use a credit card or PayPal account to complete the transaction.

- Select the file format and download the form to your device.

Form popularity

FAQ

Whether it is better to be on payroll or 1099 depends on your individual circumstances. Payroll offers benefits like health insurance and retirement plans, while 1099 contractors enjoy greater flexibility and control over their work. Often, independent contractors prefer the 1099 status for freedom and potential tax benefits. The Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor can provide clarity while navigating these options.

Legal requirements for independent contractors include filing taxes, maintaining business licenses, and following any applicable industry regulations. They must also adhere to the terms stipulated in their service agreements. Understanding these obligations can help you avoid legal issues. The Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor outlines these requirements clearly.

When employing an independent contractor, you typically need a service agreement, a W-9 form, and a 1099 form. The service agreement establishes the working terms, while the W-9 collects essential tax information. Finally, the 1099 form documents the contractor's earnings for tax purposes. The Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor provides a comprehensive solution for this paperwork.

A service agreement for an independent contractor outlines the terms of the working relationship between you and the contractor. This document specifies the scope of work, compensation, and deadlines. It is essential to create this agreement to ensure both parties are clear on expectations. The Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor serves as an effective template for these agreements.

Yes, an independent contractor is classified as self-employed. This status means they have the freedom to set their rates and control their work conditions. Understanding this relationship through the Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor provides clarity on your responsibilities and rights, ultimately empowering you in your business endeavors.

Reporting income as an independent contractor generally involves completing IRS Form 1040 and attaching Schedule C to report profits and losses. It is essential to keep track of all business-related expenses which can offset taxable income. Adhering to guidelines in the Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor ensures that your reporting complies with local laws and maximizes your deductions.

As an independent contractor, you can show proof of income through invoices, bank statements, and tax returns. Maintaining organized records of your earnings helps demonstrate your financial situation. Utilizing the Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor can provide a structured approach to managing your income documentation, increasing your credibility with clients and financial institutions.

Being self-employed means you operate your own business or provide services without being an employee. Key indicators include managing your own schedule, making a profit from your work, and being responsible for your own taxes. The Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor helps define these qualifications, ensuring you meet all necessary criteria.

Whether to say self-employed or independent contractor often depends on preference and context. Both terms effectively convey that you work independently, but 'independent contractor' specifically highlights a contractual relationship with a client. The Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor provides clarity on your status, making it easier to communicate your professional arrangement.

Proving that you are an independent contractor involves several key factors. You can gather documents such as contracts, invoices, and tax forms that reflect your work relationship with clients. The Virgin Islands Payroll Specialist Agreement - Self-Employed Independent Contractor outlines important elements that help establish your status, showing that you work independently and manage your own taxes.