Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

You might spend hours online trying to locate the appropriate legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

It is easy to download or print the Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor from our service.

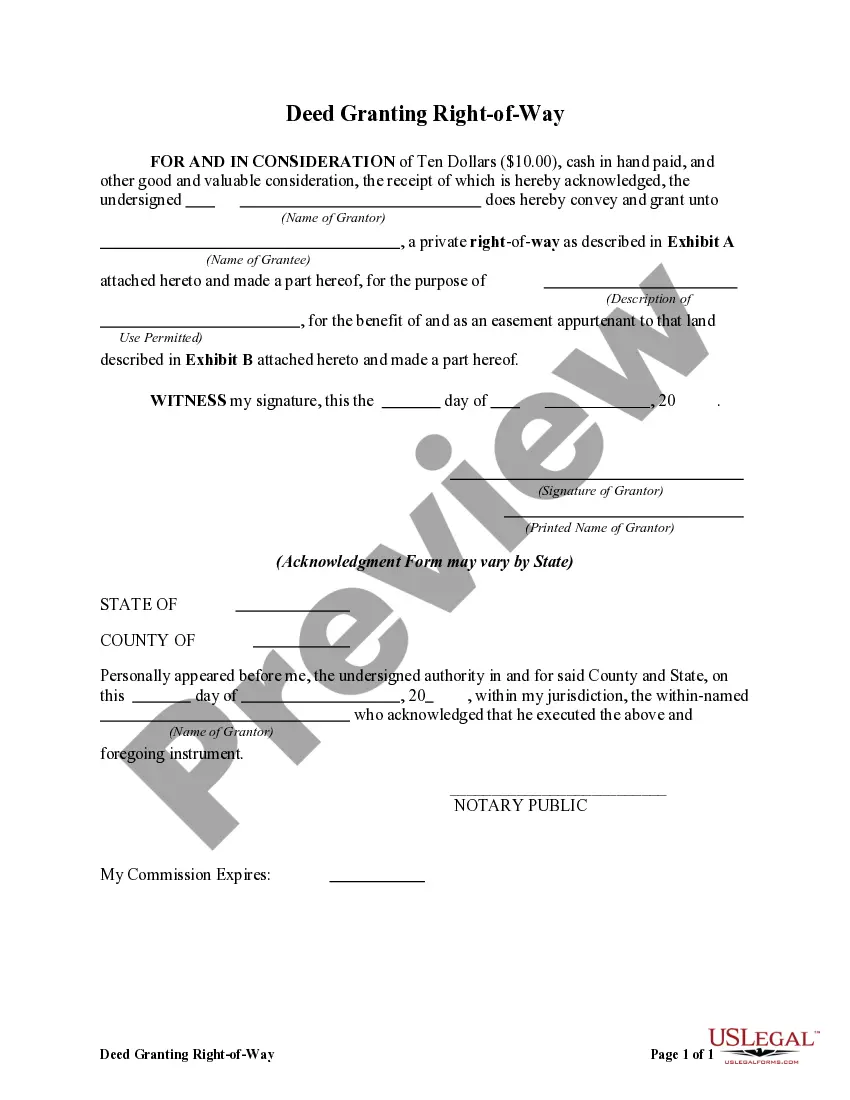

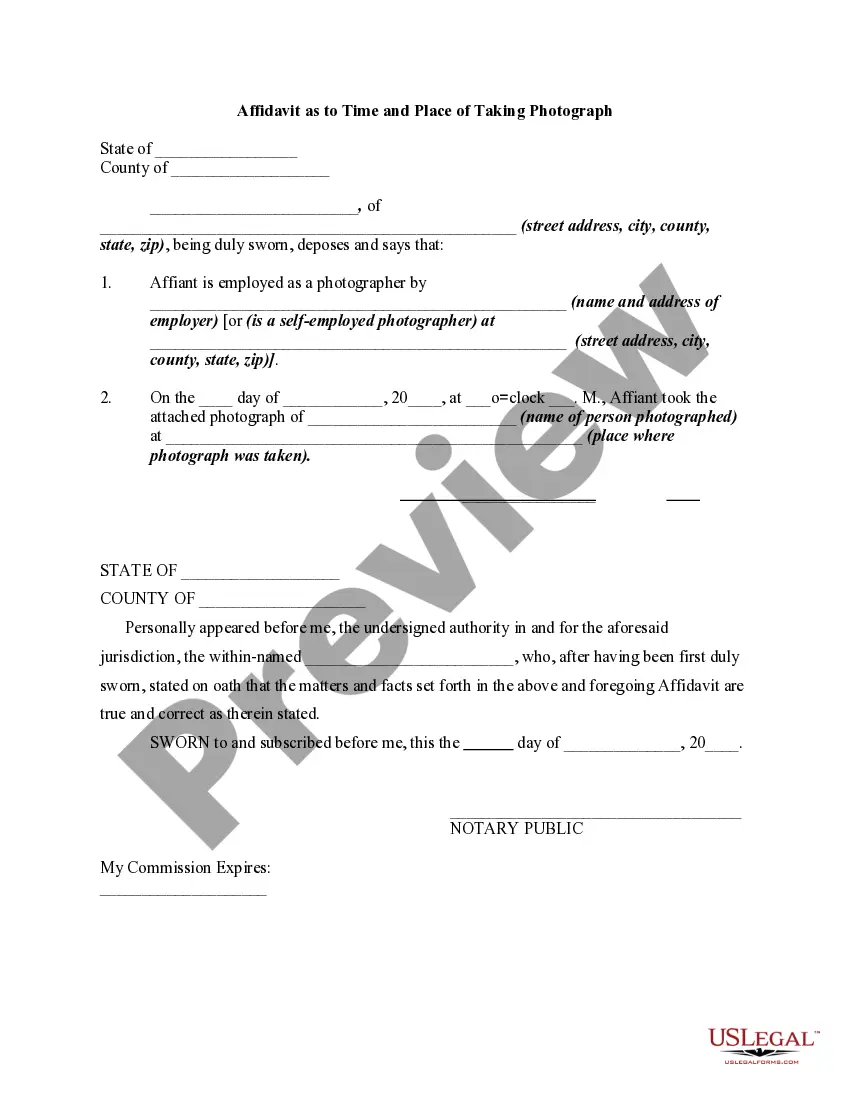

If available, use the Preview option to view the document template as well. If you want to find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can sign in and click the Get option.

- Then, you can complete, edit, print, or sign the Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase belongs to you forever.

- To obtain another copy of any purchased form, visit the My documents tab and click the respective option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city of choice.

- Read the form details to confirm that you have chosen the right form.

Form popularity

FAQ

The legal requirements for independent contractors vary by state but typically include compliance with tax regulations and providing necessary documentation. An independent contractor must receive a Form 1099 from the business if they earn over a specific threshold. The Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor helps clarify duties and ensures adherence to legal obligations. Consider using resources from USLegalForms to understand these requirements better and safeguard your business.

To create an independent contractor agreement, start by clearly defining the relationship between the parties. Include essential details such as the scope of work, payment terms, and duration of the agreement. The Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor offers a structured template to ensure compliance and protection for both parties. Utilizing a platform like USLegalForms can simplify this process, making it easier to tailor the agreement to your specific needs.

Independent contractors need to gather their income records, expenses, and any relevant tax forms, including 1099s. Proper documentation is crucial for accurate filing. By adhering to the practices outlined in the Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor, you can navigate the tax process smoothly.

Both terms convey a similar meaning, but 'independent contractor' is more specific and denotes a particular type of self-employment relationship. Using the term in contexts like the Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor may offer clearer communication, especially within legal or tax settings.

Independent contractors do indeed file as self-employed individuals. This process involves reporting income and expenses accurately through IRS Form 1040 with Schedule C. By following the guidelines set by the Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor, you can confidently file your taxes without any confusion.

To prove you're an independent contractor, maintain documentation of your contracts, invoices, and payment records. This evidence aligns with the terms outlined in the Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor. Additionally, keeping a good record of your business activities will strengthen your status.

Receiving a 1099 form indicates that you are considered self-employed. It shows you earned income from a source that does not withhold taxes. Therefore, if you work under the Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor, your 1099 confirms your status as an independent contractor.

To declare independent contractor income, you must accurately report all earnings on your tax return. Use IRS Form 1040 and include Schedule C to detail your profits and expenses. Following the guidelines of the Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor helps maintain proper records and compliance with local regulations.

Yes, an independent contractor is classified as self-employed. This means they operate their own business and provide services to clients without being tied to a single employer. The Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor outlines the terms and conditions for such arrangements, ensuring clarity for both parties.

An independent contractor should complete several forms, including W-9 forms and any contract agreements pertinent to their work. These documents establish your identity, tax status, and the terms of your engagement. When executing the Virgin Islands Electrologist Agreement - Self-Employed Independent Contractor, ensure you understand all necessary forms to maintain compliance and establish a solid foundation for your business dealings.