Virgin Islands Self-Employed Independent Contractor Esthetics Agreement

Description

How to fill out Self-Employed Independent Contractor Esthetics Agreement?

It is feasible to spend hours online trying to locate the authentic document format that satisfies the state and federal stipulations you need.

US Legal Forms offers a wide array of authentic forms that have been evaluated by specialists.

You can effortlessly download or print the Virgin Islands Self-Employed Independent Contractor Esthetics Agreement from our service.

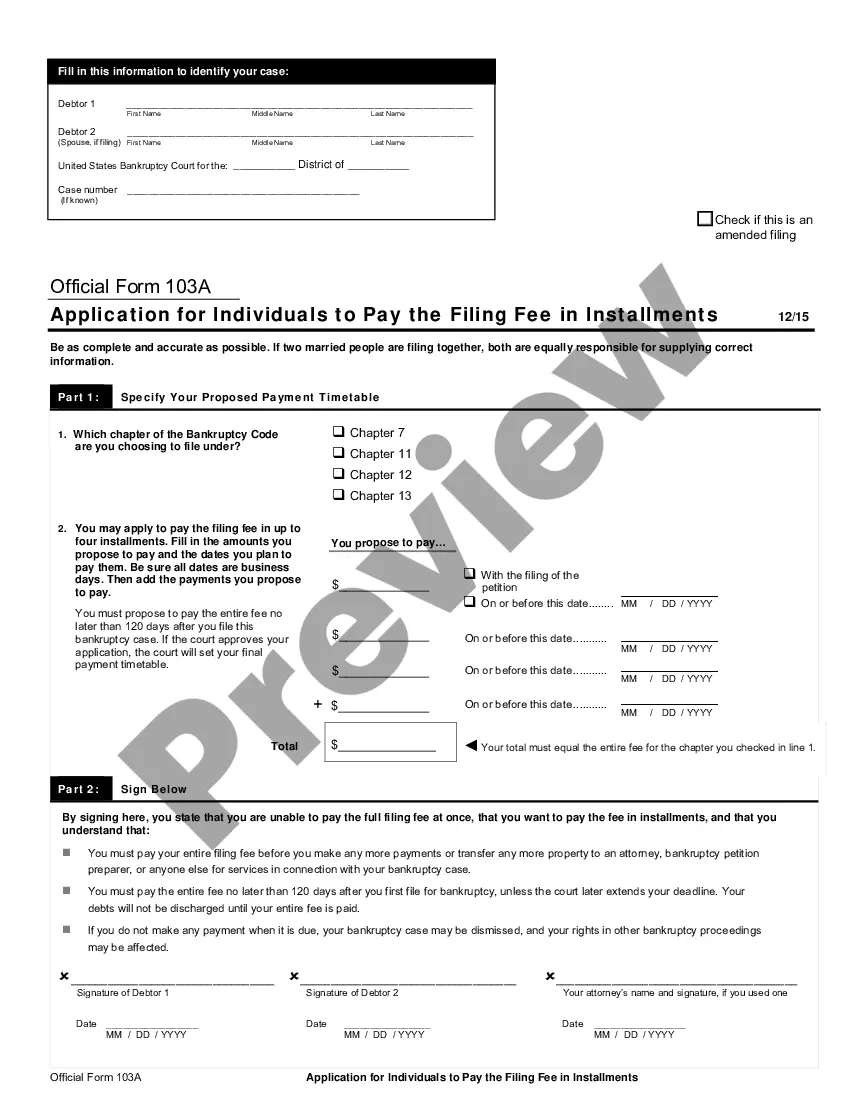

If available, use the Preview button to browse through the document format as well. If you wish to find another version of your form, utilize the Lookup field to locate the format that meets your needs and specifications. Once you have identified the format you require, click on Get now to proceed. Choose the payment plan you want, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the authentic form. Select the format of your document and download it to your device. Make modifications to your document if necessary. You can complete, alter, sign, and print the Virgin Islands Self-Employed Independent Contractor Esthetics Agreement. Obtain and print numerous document templates using the US Legal Forms website, which provides the largest selection of authentic forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Virgin Islands Self-Employed Independent Contractor Esthetics Agreement.

- Every authentic document format you acquire is yours for a long duration.

- To obtain another copy of a purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your chosen area/region.

- Check the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Yes, an independent contractor is generally classified as self-employed. This relationship allows professionals, like estheticians, to manage their own business ventures independently. Utilizing a Virgin Islands Self-Employed Independent Contractor Esthetics Agreement further clarifies their status and obligations, providing peace of mind.

The income of self-employed estheticians varies based on numerous factors, including clientele and services offered. Many report earning a comfortable living, especially as their reputation grows. Remember, having a solid Virgin Islands Self-Employed Independent Contractor Esthetics Agreement can help protect your earnings and ensure proper tax handling.

Estheticians have the option to work for themselves, embracing the self-employed lifestyle. This means they manage their own schedules and client relationships directly. By implementing a Virgin Islands Self-Employed Independent Contractor Esthetics Agreement, they can ensure they cover all necessary legal requirements.

Estheticians can work independently without being tied to a specific employer. This independence allows them to set their own hours and create their own services menu. Utilizing a Virgin Islands Self-Employed Independent Contractor Esthetics Agreement helps them navigate the complexities of running their own business.

Yes, an esthetician can definitely open their own business. By establishing a personal brand and creating a client base, they can offer services independently. Moreover, following a Virgin Islands Self-Employed Independent Contractor Esthetics Agreement is crucial for legal compliance and to secure their business interests.

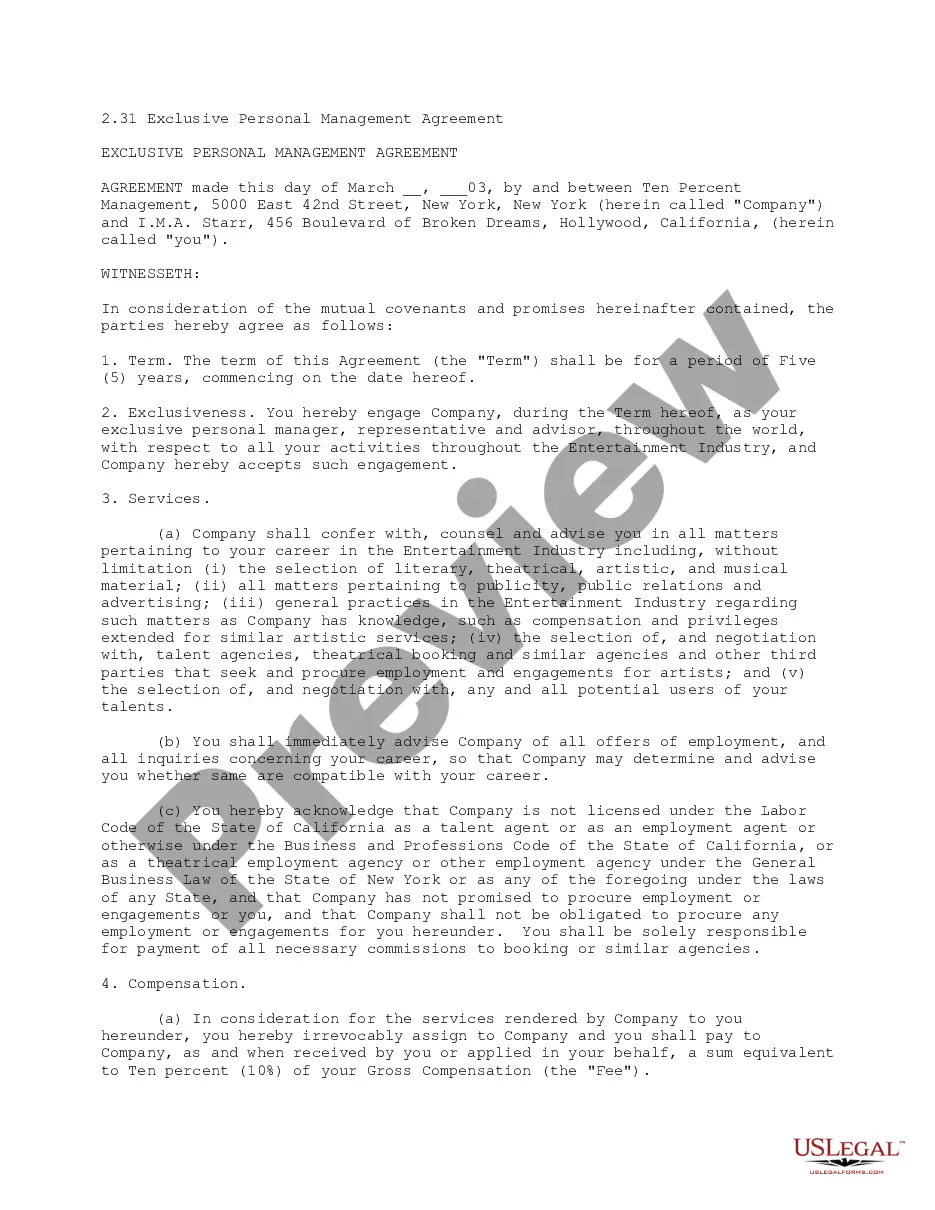

To write a contract as an independent contractor, start by clearly defining the services you will offer. Include terms of payment and deadlines to provide structure, especially in a Virgin Islands Self-Employed Independent Contractor Esthetics Agreement. Be sure to discuss any specifics such as liability insurance or provision of materials if necessary. For a smoother process, consider utilizing resources like uslegalforms to create a professional and legally sound agreement.

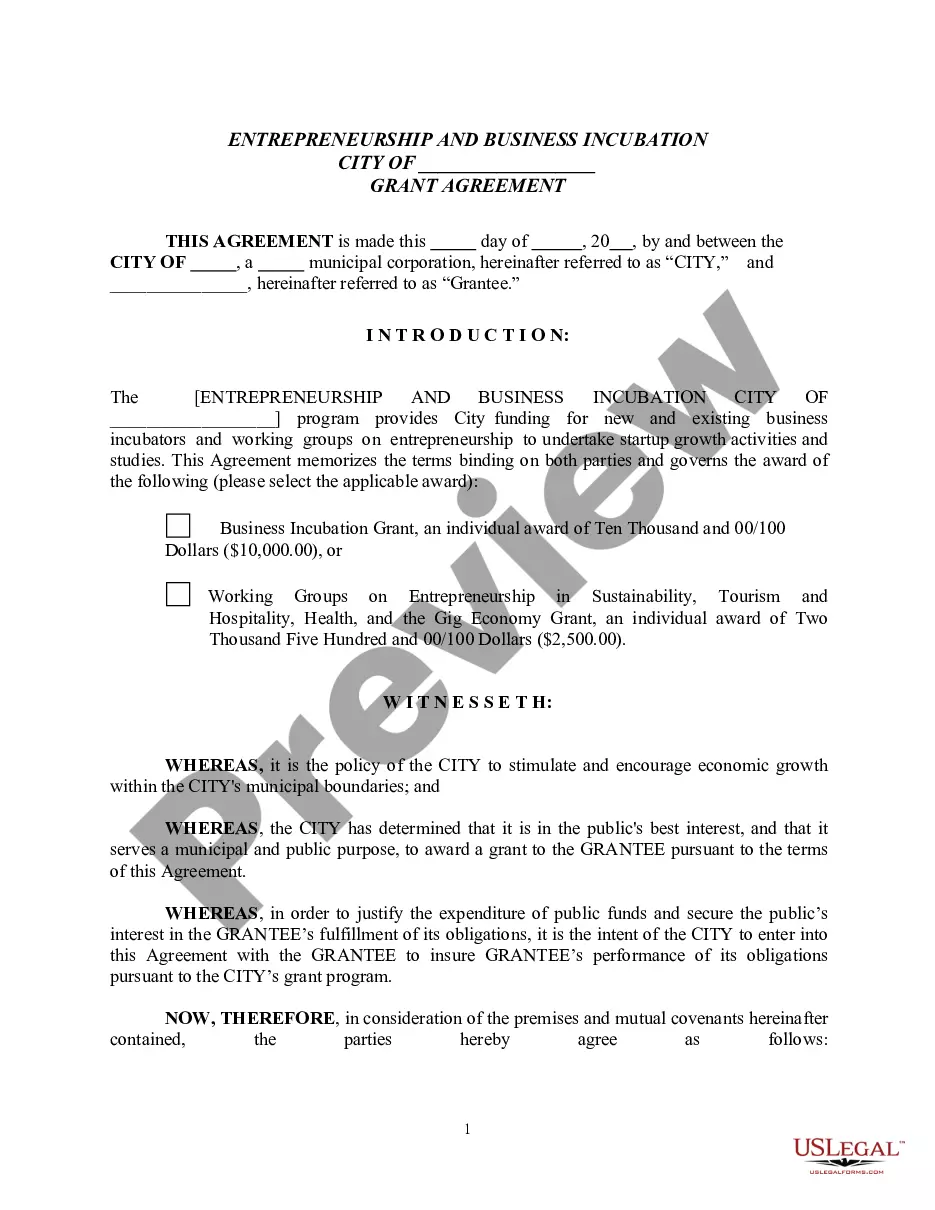

A basic independent contractor agreement includes vital elements such as the scope of work, payment details, and duration of the contract. For those interested in a Virgin Islands Self-Employed Independent Contractor Esthetics Agreement, this contract also outlines specific esthetic services to be provided. Additionally, it often contains confidentiality and termination clauses to protect both parties. A well-drafted agreement is crucial for a successful working relationship.

An independent contractor is typically someone who provides services to another entity or individual under a contract, yet retains control over how they execute those services. In the context of a Virgin Islands Self-Employed Independent Contractor Esthetics Agreement, this might include estheticians who work on a freelance basis. Key characteristics include having the freedom to set your own schedule and being responsible for your own taxes. Understanding these qualifications can help you align your work status correctly.

To write an independent contractor agreement, start by identifying the parties involved and the services to be provided. Incorporate essential details like payment terms, duration of the contract, and any specific clauses related to the Virgin Islands Self-Employed Independent Contractor Esthetics Agreement. Make sure to review the agreement for clarity and legality. Consulting legal resources or platforms like uslegalforms can also assist you in crafting a solid agreement.

Yes, you can write your own legally binding contract, including a Virgin Islands Self-Employed Independent Contractor Esthetics Agreement. It’s important to ensure that the contract meets all legal requirements in your jurisdiction. By clearly outlining the terms and conditions, you can protect both parties involved. Just remember that legal language must be precise to avoid any future misunderstandings.