Nebraska Qualified Investor Certification Application

Description

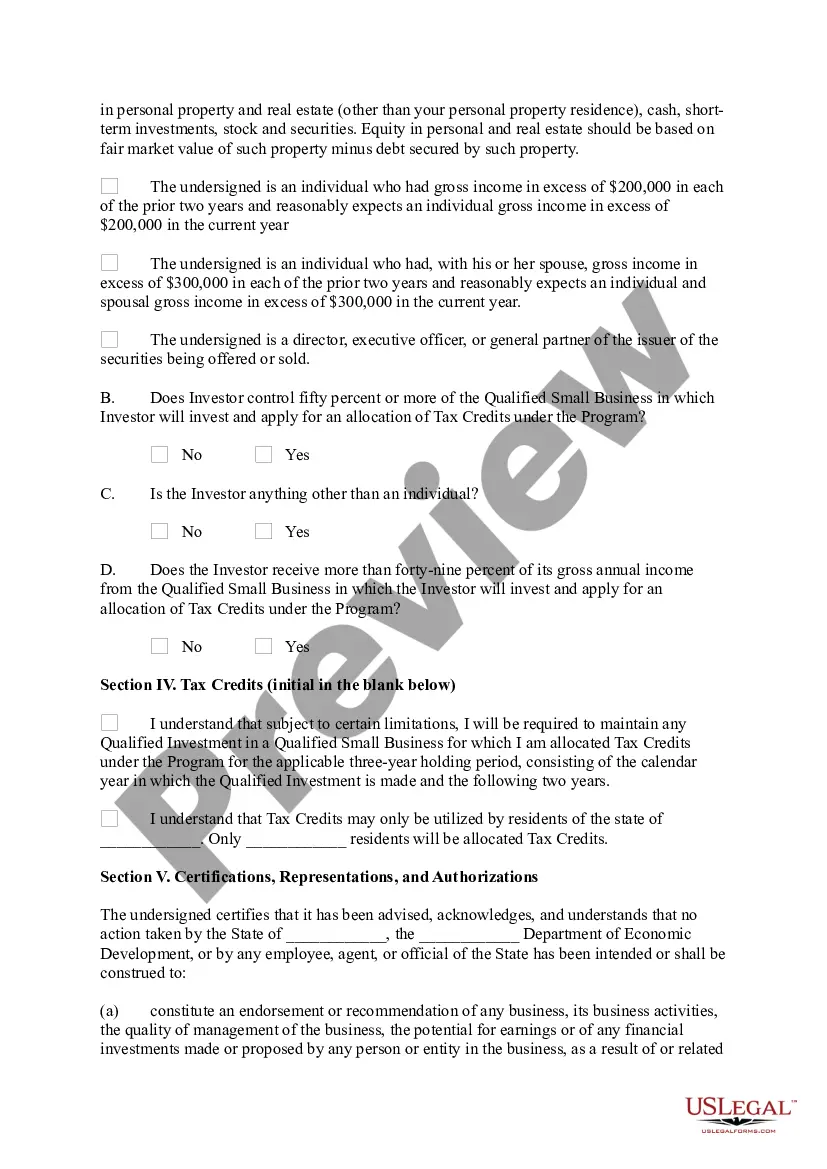

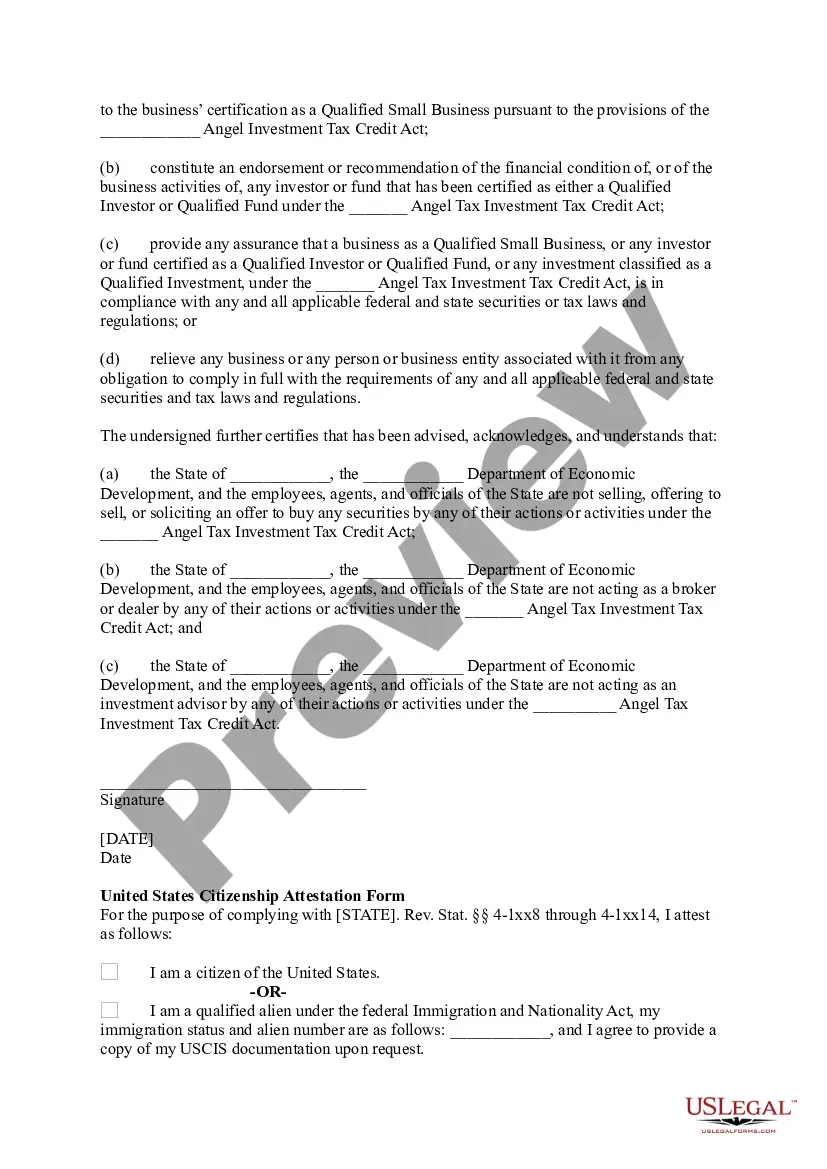

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Qualified Investor Certification Application?

If you want to complete, down load, or print authorized papers layouts, use US Legal Forms, the greatest selection of authorized types, which can be found on the Internet. Use the site`s easy and convenient lookup to get the documents you will need. Various layouts for enterprise and personal uses are sorted by types and says, or keywords. Use US Legal Forms to get the Nebraska Qualified Investor Certification Application in a number of clicks.

If you are currently a US Legal Forms client, log in to your accounts and click on the Download key to get the Nebraska Qualified Investor Certification Application. Also you can access types you in the past delivered electronically within the My Forms tab of your accounts.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have selected the form for the correct town/land.

- Step 2. Use the Review method to check out the form`s content material. Do not forget to read the information.

- Step 3. If you are not satisfied using the type, use the Lookup discipline at the top of the display to find other types of the authorized type format.

- Step 4. When you have located the form you will need, go through the Get now key. Select the prices strategy you prefer and include your qualifications to register for the accounts.

- Step 5. Process the deal. You should use your bank card or PayPal accounts to accomplish the deal.

- Step 6. Pick the structure of the authorized type and down load it on your device.

- Step 7. Complete, change and print or sign the Nebraska Qualified Investor Certification Application.

Each and every authorized papers format you get is your own property for a long time. You might have acces to each type you delivered electronically in your acccount. Select the My Forms section and choose a type to print or down load once again.

Contend and down load, and print the Nebraska Qualified Investor Certification Application with US Legal Forms. There are thousands of expert and state-certain types you may use for your enterprise or personal requires.

Form popularity

FAQ

To apply for a Nebraska Identification Number, you can either register online, or complete the Nebraska Tax Application, Form 20. If you indicate that you will be collecting sales tax, you will be issued a Sales Tax Permit. The permit must be displayed at each retail location.

The Nebraska Advantage Act allows a taxpayer involved in a qualified business to earn and use tax benefits based on investment and employment growth.

Any taxpayer who has filed an application for a Nebraska Advantage Act project must file Form 312N, with supporting schedules, for each year beginning with the filing of the application through the expiration of all incentives under the Act. Nebraska Advantage Act Incentive Computation, Form 312N nebraska.gov ? incentives ? nebraska-adv... nebraska.gov ? incentives ? nebraska-adv...

Any business firm making expenditures in Nebraska for research and experimental (R&D) activities as defined in Internal Revenue Code (IRC) § 174 may claim a regular research tax credit equal to 15% of the federal credit allowed under IRC § 41. 3800N Research Tax Credit Worksheet nebraska.gov ? files ? doc ? tax-forms nebraska.gov ? files ? doc ? tax-forms

ImagiNE is a performance-based incentives program that rewards you for hiring, investing, relocating and expanding in Nebraska. Credits earned are based on the number of Full Time Equivalent Employees (FTE's) that are added and the amount of investment made at qualified locations in the state. Download the Brochure - imagiNE Nebraska nebraska.gov ? uploads ? 2022/05 ? Ima... nebraska.gov ? uploads ? 2022/05 ? Ima...