Virgin Islands Engineering Agreement - Self-Employed Independent Contractor

Description

How to fill out Engineering Agreement - Self-Employed Independent Contractor?

Have you ever found yourself in a scenario where you require documents for various business or personal activities almost constantly.

There are numerous legal document templates accessible online, but finding versions you can rely on is not easy.

US Legal Forms offers a vast array of template forms, such as the Virgin Islands Engineering Agreement - Self-Employed Independent Contractor, which are designed to comply with both state and federal regulations.

Once you find the right form, simply click Get now.

Select the pricing plan you prefer, provide the necessary details to create your account, and complete the payment using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Virgin Islands Engineering Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to begin using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct region/state.

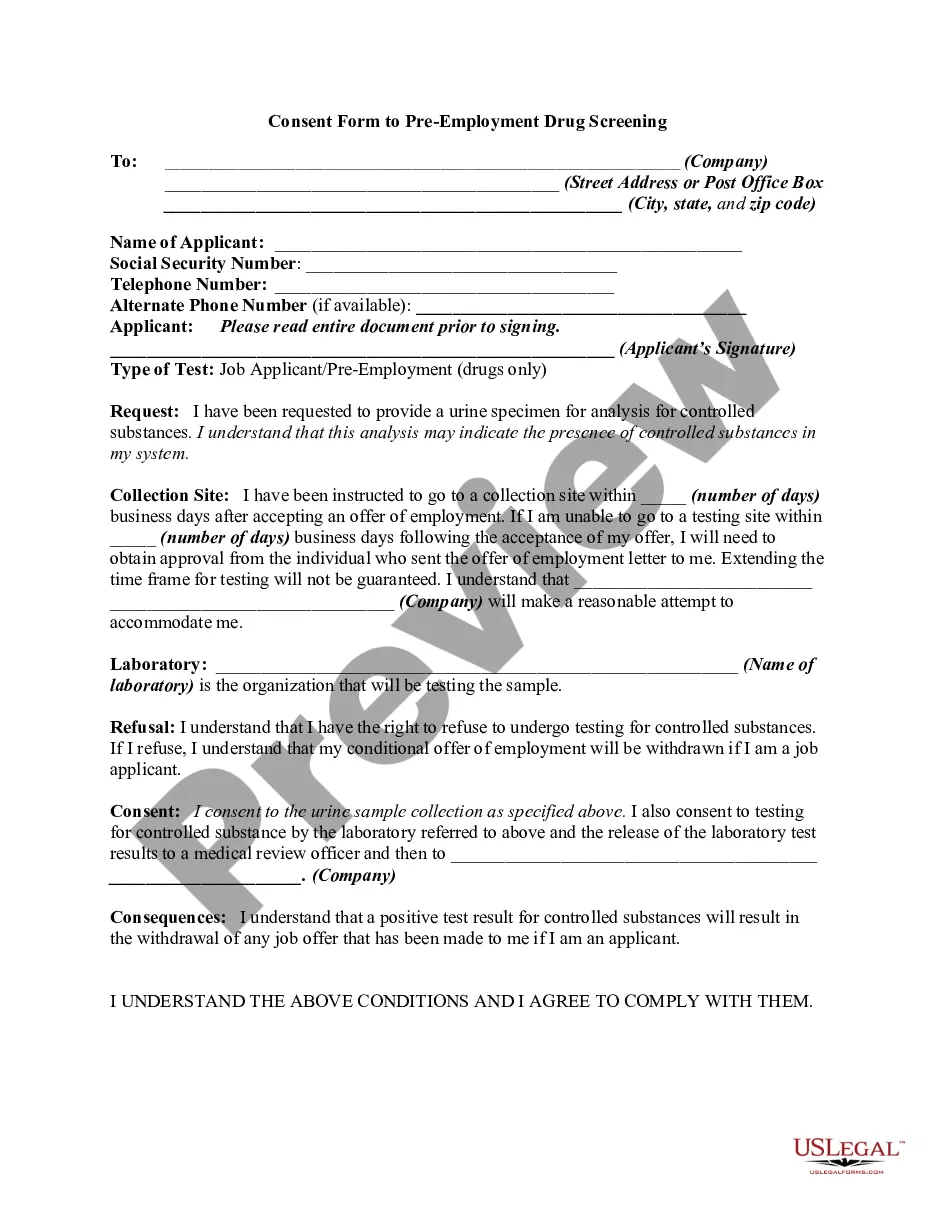

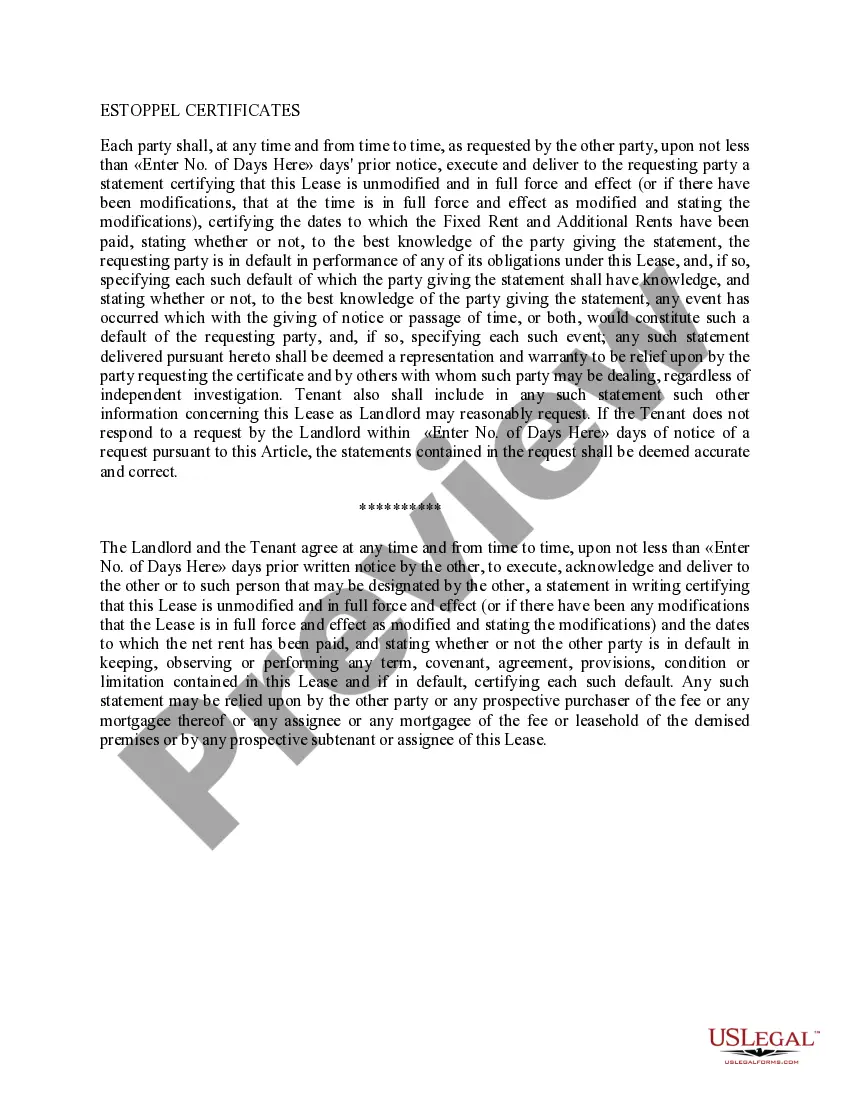

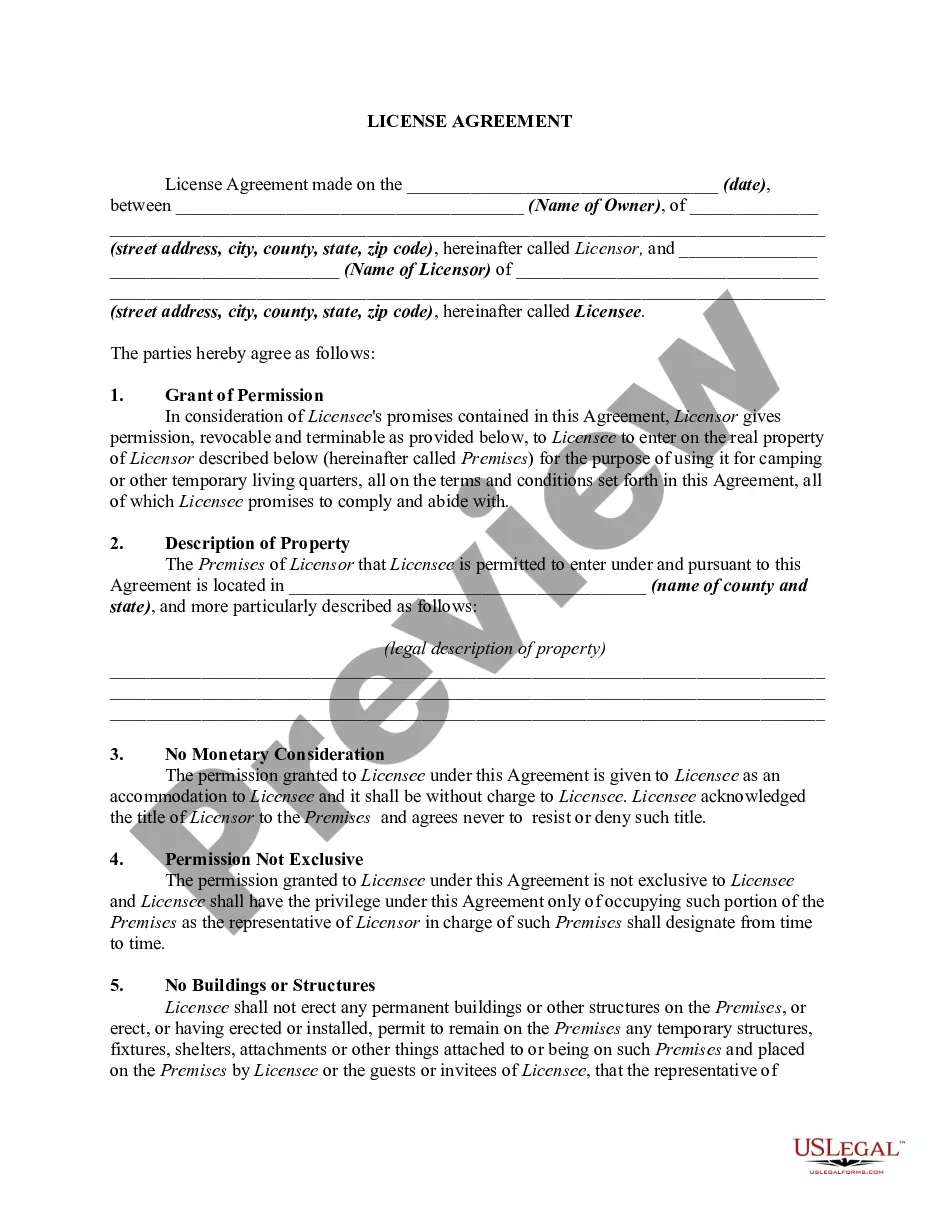

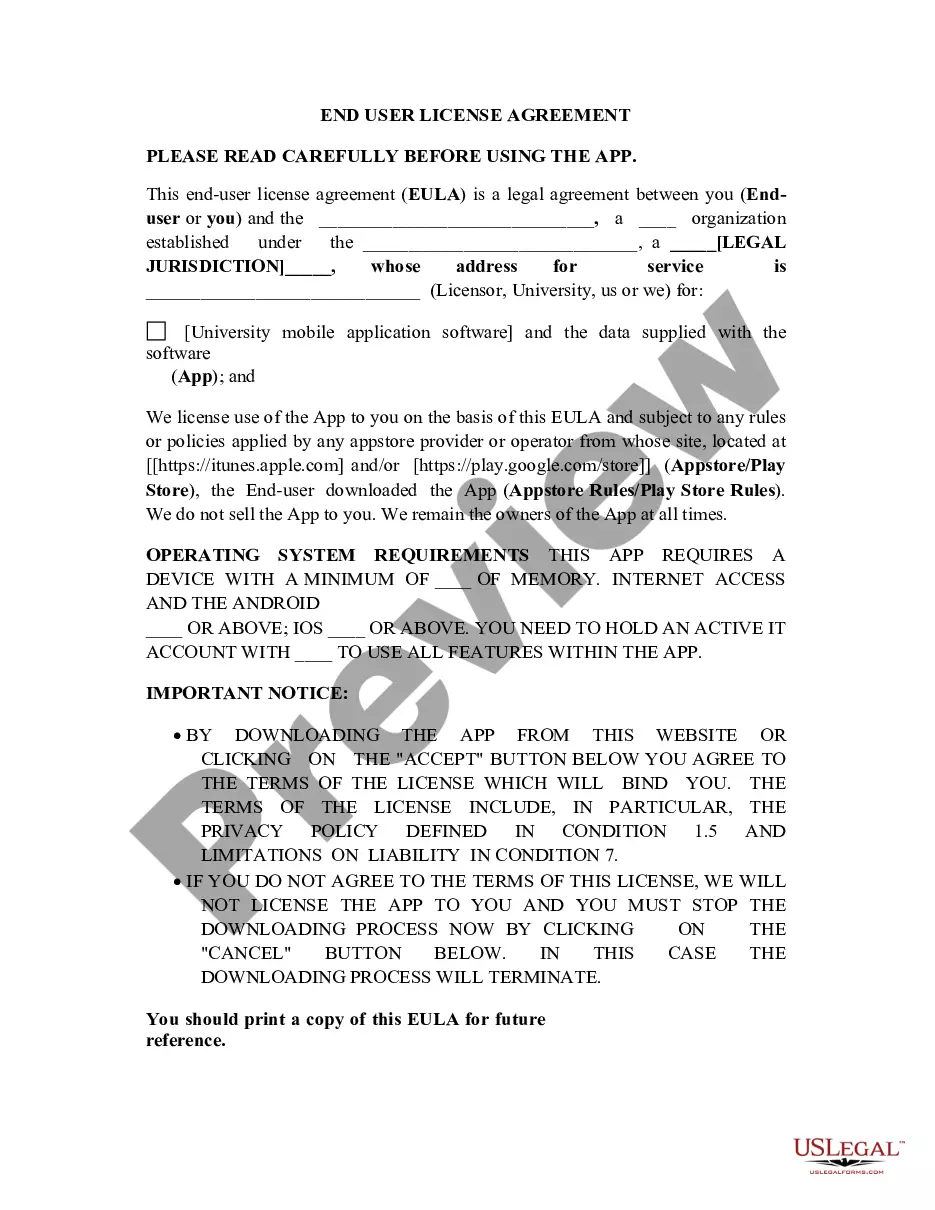

- Use the Review button to inspect the form.

- Check the summary to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

Creating an independent contractor agreement requires clarity about the work expectations and mutual benefits for both parties. Begin by outlining the services to be provided, the payment terms, and the duration of the contract. Utilizing a Virgin Islands Engineering Agreement - Self-Employed Independent Contractor template from US Legal Forms can simplify this process and ensure that you cover all necessary legal aspects. This allows both the contractor and client to focus on the project while having a solid agreement in place.

An independent contractor engineer is a professional who offers engineering services on a project basis rather than as a full-time employee. They work for multiple clients, providing specialized expertise in their field. By entering into a Virgin Islands Engineering Agreement - Self-Employed Independent Contractor, they establish clear terms regarding their services, payment, and project scope. This flexibility allows independent contractor engineers to manage their own schedules and work on diverse projects.

An independent contractor should complete several key forms to ensure compliance and clarity. Commonly required documents include the independent contractor agreement, tax forms like the W-9, and any specific project-related forms. Moreover, utilizing the Virgin Islands Engineering Agreement - Self-Employed Independent Contractor can streamline the process and ensure all critical information is included, protecting both parties.

Writing an independent contractor agreement starts with a straightforward outline. Begin by clearly defining the roles of each party and the scope of work. Address payment, timelines, and conditions for contract termination. For a solid foundation, you may want to refer to the Virgin Islands Engineering Agreement - Self-Employed Independent Contractor from US Legal Forms that provides a practical framework and legal safeguards.

Filling out an independent contractor form involves providing essential details about both the contractor and the client. Start with basic information such as names, addresses, and contact information. Next, specify the nature of the work, payment terms, and important deadlines. Utilizing a well-structured form like the Virgin Islands Engineering Agreement - Self-Employed Independent Contractor can enhance clarity and enforceability.

To fill out an independent contractor agreement, begin by entering the date and the names of the parties involved. Clearly outline the services to be provided, compensation details, and the duration of the contract. Additionally, include any specific terms for work completion and confidentiality, ensuring both parties understand their obligations. Consider using the Virgin Islands Engineering Agreement - Self-Employed Independent Contractor template available on US Legal Forms for guidance.

Legal requirements for independent contractors vary by state but generally include maintaining control over your work and being responsible for your taxes. As an independent contractor, you should have a valid business license and register for any necessary permits. Additionally, using a contract like the Virgin Islands Engineering Agreement - Self-Employed Independent Contractor can help meet legal obligations while establishing your professional status. Understanding these requirements ensures compliance and reduces potential liabilities.

If you have no contract, your rights may be limited, but you do still have some protections under the law. In cases of disputes, the absence of a contract, such as the Virgin Islands Engineering Agreement - Self-Employed Independent Contractor, can make it challenging to assert your case. However, you may still be entitled to payment for the work completed, provided you can substantiate your claims. It’s advantageous to have a written agreement to safeguard your interests and rights.

The new independent contractor law in Virginia emphasizes the importance of written agreements. This regulation mandates that certain criteria must be met to classify workers correctly. Although this law primarily affects businesses, independent contractors should understand how it affects their agreements, including contracts like the Virgin Islands Engineering Agreement - Self-Employed Independent Contractor. Being informed ensures compliance and protects your status as an independent contractor.

Yes, you need a contract as an independent contractor. The Virgin Islands Engineering Agreement - Self-Employed Independent Contractor provides a clear framework for your work, detailing the scope, payment terms, and timelines. This contract is vital for establishing a professional relationship with your clients and protecting your rights. Thus, securing a contract will aid in avoiding potential conflicts and ensure both parties understand their commitments.