Virgin Islands Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York

Description

How to fill out Participation Agreement Between Variable Insurance Products Fund, III, Lincoln Life And Annuity Company Of New York?

Are you presently within a position that you will need files for sometimes company or personal purposes nearly every working day? There are a variety of legal record web templates available online, but locating ones you can rely isn`t straightforward. US Legal Forms gives a large number of develop web templates, such as the Virgin Islands Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York, that are created in order to meet federal and state demands.

When you are currently knowledgeable about US Legal Forms website and have your account, simply log in. Afterward, you are able to obtain the Virgin Islands Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York format.

Unless you have an account and need to begin to use US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is to the right area/area.

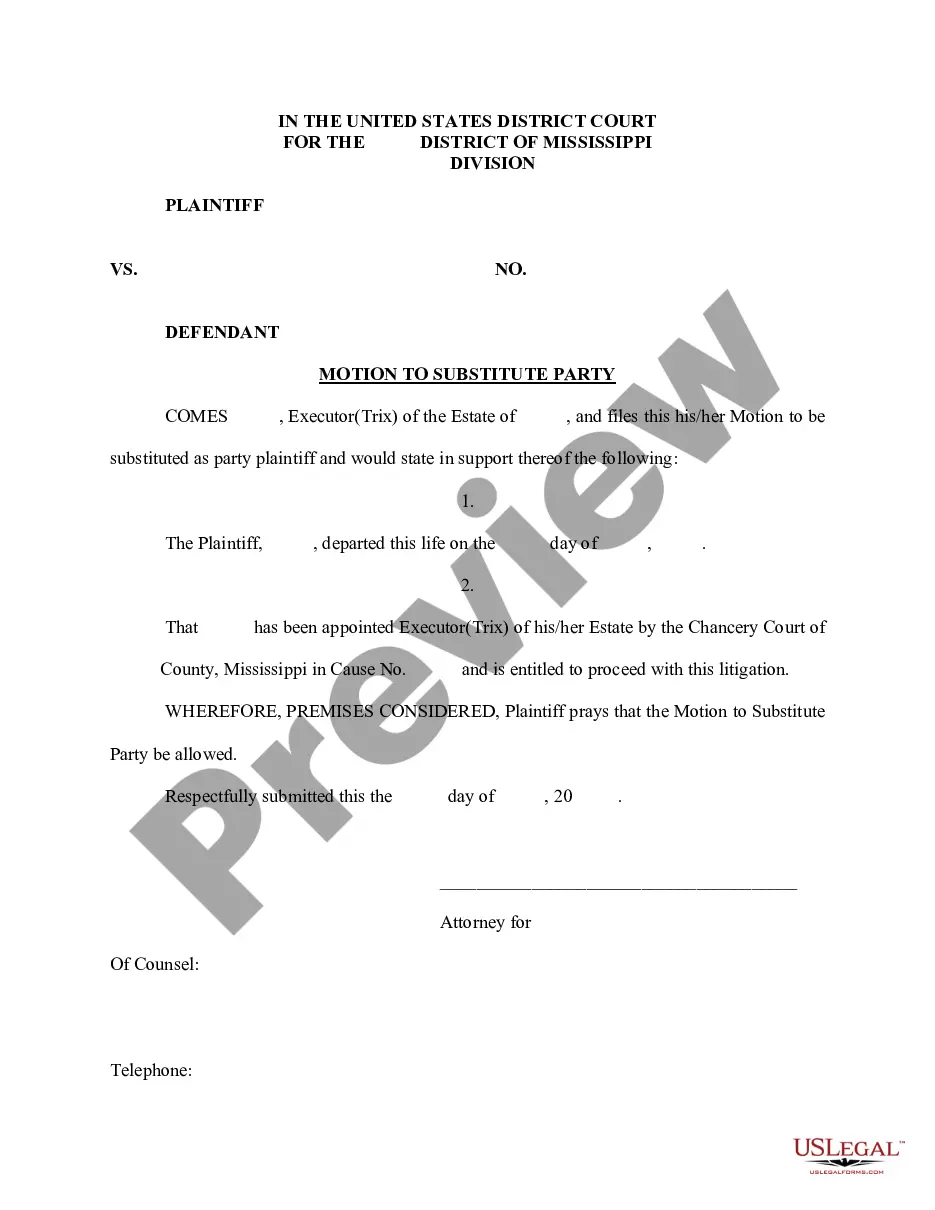

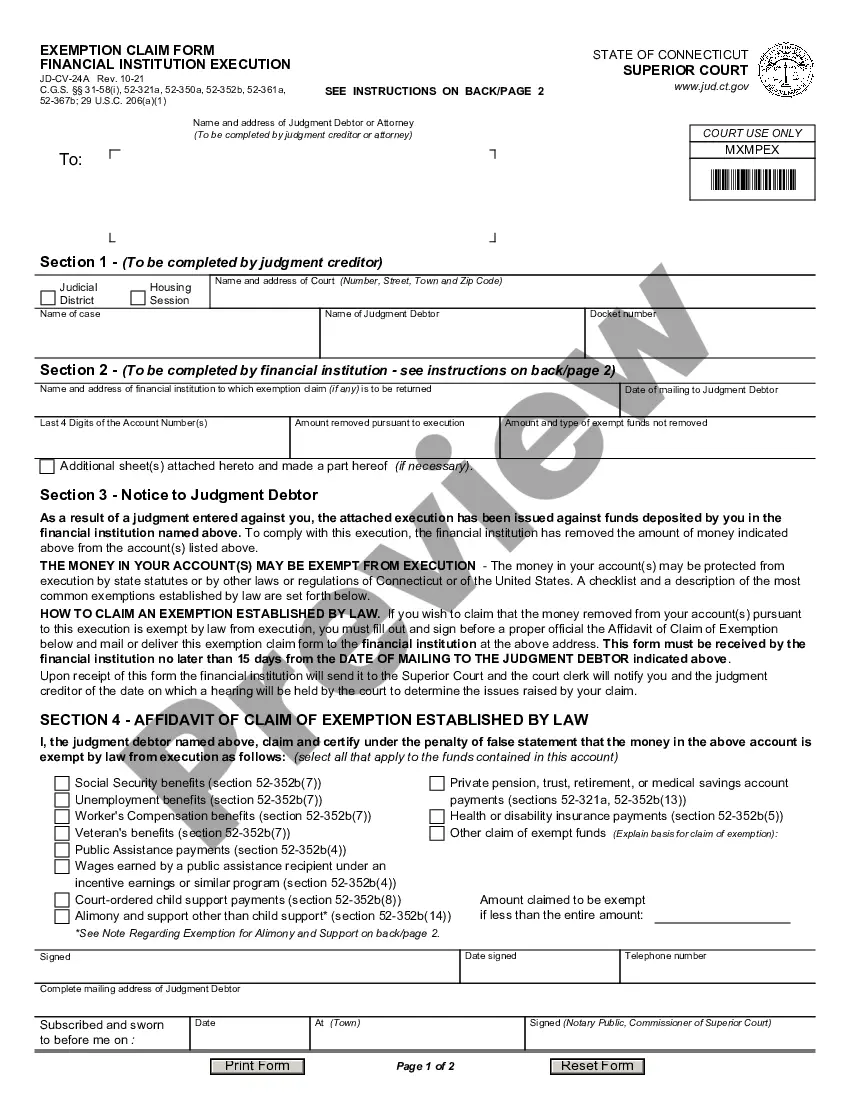

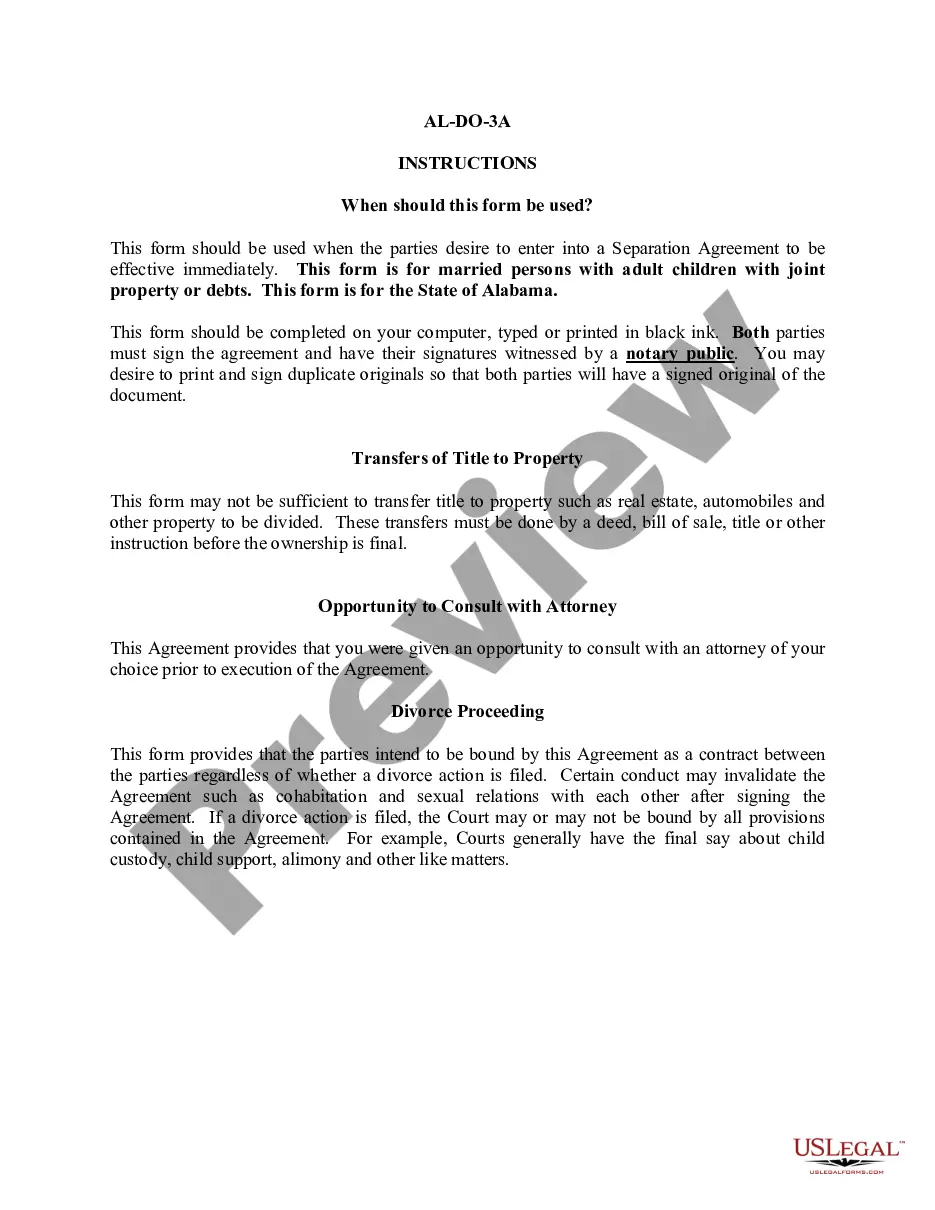

- Utilize the Review key to review the shape.

- Look at the explanation to ensure that you have chosen the right develop.

- In the event the develop isn`t what you`re looking for, take advantage of the Search field to obtain the develop that fits your needs and demands.

- Whenever you get the right develop, simply click Acquire now.

- Opt for the prices prepare you desire, fill out the required info to produce your money, and buy your order with your PayPal or credit card.

- Choose a handy file file format and obtain your backup.

Discover all the record web templates you have purchased in the My Forms menus. You can get a more backup of Virgin Islands Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York anytime, if necessary. Just select the necessary develop to obtain or printing the record format.

Use US Legal Forms, the most comprehensive collection of legal varieties, to save lots of efforts and stay away from errors. The service gives skillfully made legal record web templates which can be used for a variety of purposes. Make your account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

For example, a 65-year-old man who invests $50,000 in an immediate annuity could receive about $247 per month for life. A 70-year-old man who invests $50,000 could receive $286 per month, in part because his life expectancy is shorter. And second, that you might get even more if interest rates rise by then. 5 Things You Should Know About Annuities - AARP aarp.org ? retirement-savings ? info-2020 aarp.org ? retirement-savings ? info-2020

A variable annuity is a contract between you and an insurance company, under which the insurer agrees to make periodic pay- ments to you, beginning either immediately or at some future date. You purchase a variable annuity contract by making either a single purchase payment or a series of purchase payments.

While variable annuities have greater potential for earnings, since their interest rate rises and falls with their underlying investments, they can lose money. They are also riddled with fees, which can cut into profits. Fixed annuities typically earn at a lower, stable rate. Variable Annuity: Definition, How It Works, and vs. Fixed Annuity Investopedia ? ... ? Annuities Investopedia ? ... ? Annuities

Lincoln Level Advantage® is a long-term investment product that offers tax-deferred growth, access to a lifetime income stream and death benefit protection.

Variable Annuity Disadvantages There are two big disadvantages to variable annuities that you should take into account when comparing annuity plans?the possibility of market loss and high management fees and account charges. You may also have IRS penalties and tax implications to consider. Pros and Cons of a Variable Annuity: What You Should Know canvasannuity.com ? blog ? variable-annuities-pr... canvasannuity.com ? blog ? variable-annuities-pr...

Long-Term Care Customer Service: 888-503-8110. Variable Annuities (Prudential): 800-457-7617. Licensing and Commissions: 844-768-6777. LBL Home Office (for non-service related questions): 888-674-3667.

With the performance trigger strategy, your account is credited a set amount, called a trigger rate, if the index change is positive or flat at the end of the term. If the index return is negative, you can help protect it with a protection level or floor protection.

Third, variable annuities let you receive periodic income payments for a specified period or the rest of your life (or the life of your spouse). This process of turning your investment into a stream of periodic income payments is known as annuitization. Variable Annuities | Investor.gov Investor.gov ? insurance-products ? varia... Investor.gov ? insurance-products ? varia...