Virgin Islands Sample Performance Review for Nonexempt Employees

Description

How to fill out Sample Performance Review For Nonexempt Employees?

Have you ever been in a location where you need paperwork for potential organization or certain purposes nearly every day.

There are numerous legal document templates accessible online, but finding versions you can rely on is not easy.

US Legal Forms offers thousands of form templates, such as the Virgin Islands Sample Performance Review for Nonexempt Employees, which can be customized to satisfy state and federal requirements.

Once you find the correct form, click Buy now.

Select the payment plan you want, fill out the necessary information to create your account, and finalize your purchase using PayPal or Visa or Mastercard. Choose a suitable file format and retrieve your copy. Access all the document templates you have ordered in the My documents list. You may download another copy of the Virgin Islands Sample Performance Review for Nonexempt Employees at any time if needed. Click the desired form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal templates, to save time and avoid errors. This service offers professionally crafted legal document templates that are applicable for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Virgin Islands Sample Performance Review for Nonexempt Employees template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

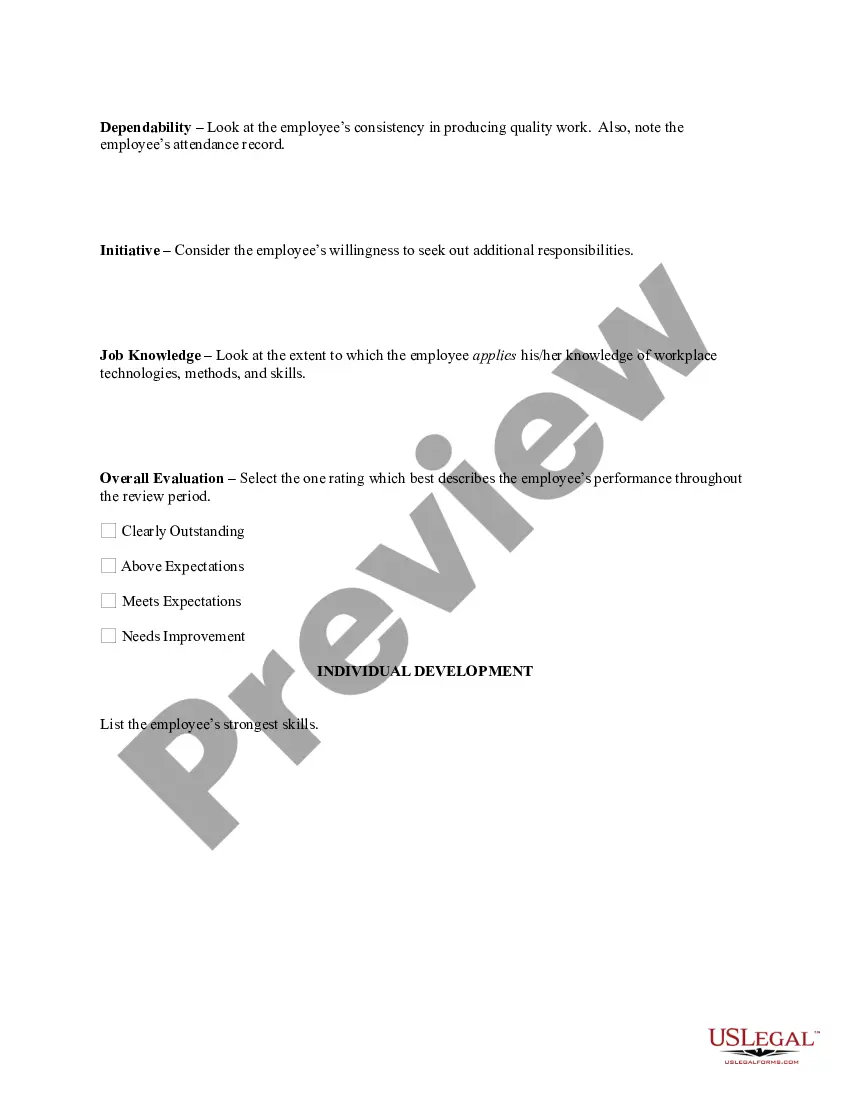

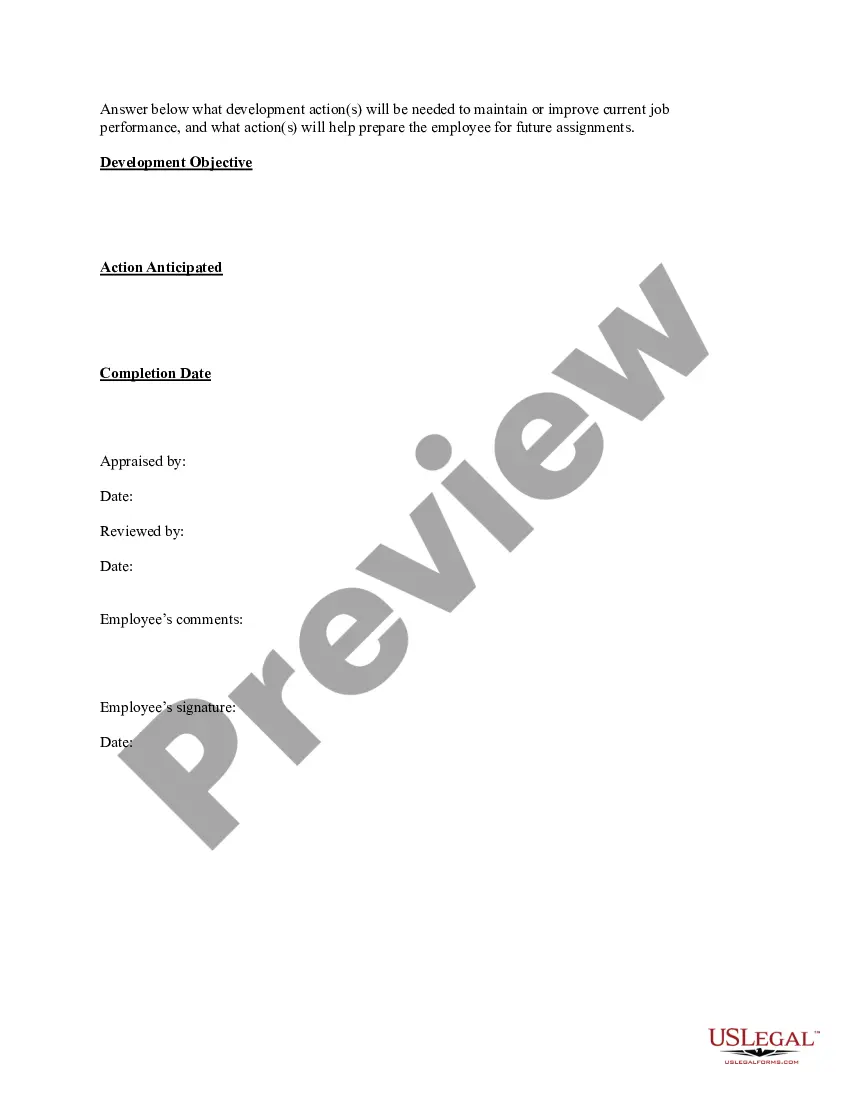

- Utilize the Preview button to review the form.

- Read the description to confirm you have chosen the appropriate form.

- If the form is not what you are looking for, use the Lookup field to find a template that meets your needs.

Form popularity

FAQ

Yes, it is perfectly acceptable to ask your employer about the schedule for performance reviews. This inquiry shows your interest in personal growth and your commitment to your role. Familiarizing yourself with the Virgin Islands Sample Performance Review for Nonexempt Employees may help you articulate this request more effectively. Open communication is key to building a good relationship with your employer.

At-Will Employment States:All states in the U.S., excluding Montana, are at-will. Most do have exceptions, but the states of Florida, Alabama, Louisiana, Georgia, Nebraska, Maine, New York, and Rhode Island do not allow any exceptions.

The current minimum is $7.25 an hour. Puerto Rico's minimum wage will automatically increase to $8.50 per hour on Jan. 1, 2022, and to $9.50 per hour on July 1, 2023, for all employees covered by the Fair Labor Standards Act.

The FLSA applies to employment within any state of the United States, the District of Columbia or any territory or possession of the United States. An employee working in a foreign country is not protected by the FLSA even though the employer has its main office in the United States.

The comparison reveals that Aruba offers the highest minimum wage, followed by the Bahamas, Curacao, and Sint Maarten.

Unlike virtually all U.S. jurisdictions, Virgin Islands law incorporates an exception to the common law employment-at-will doctrine for certain categories of nonunionized private sector employees.

As an American citizen, you can move to St. Thomas, in the Virgin Islands, without winning the jackpot. It's really no different than moving to another state, since you don't need a visa and can simply arrive and establish residency.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

Dominica's Minimum Wage is the lowest amount a worker can be legally paid for his work. Most countries have a nation-wide minimum wage that all workers must be paid. Dominica's minimum wage is EC$4.00 per hour ($1.50) for all public and private workers.

Minimum Wage Rate in the U.S. Virgin Islands is $10.50 per hour. Time and a half of the regular hourly rate must be paid for all hours worked over 8 hours each day and for over 40 hours in any work week including any hours worked on the 6th and 7th consecutive day of work.