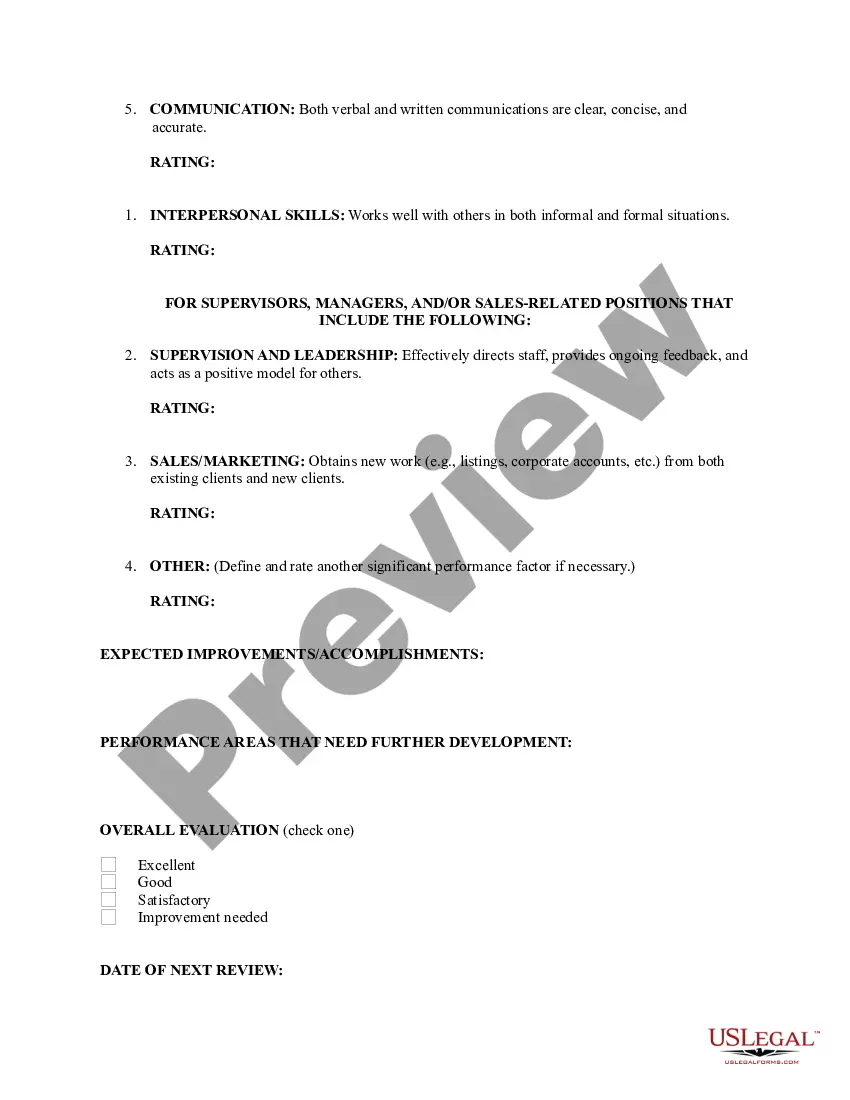

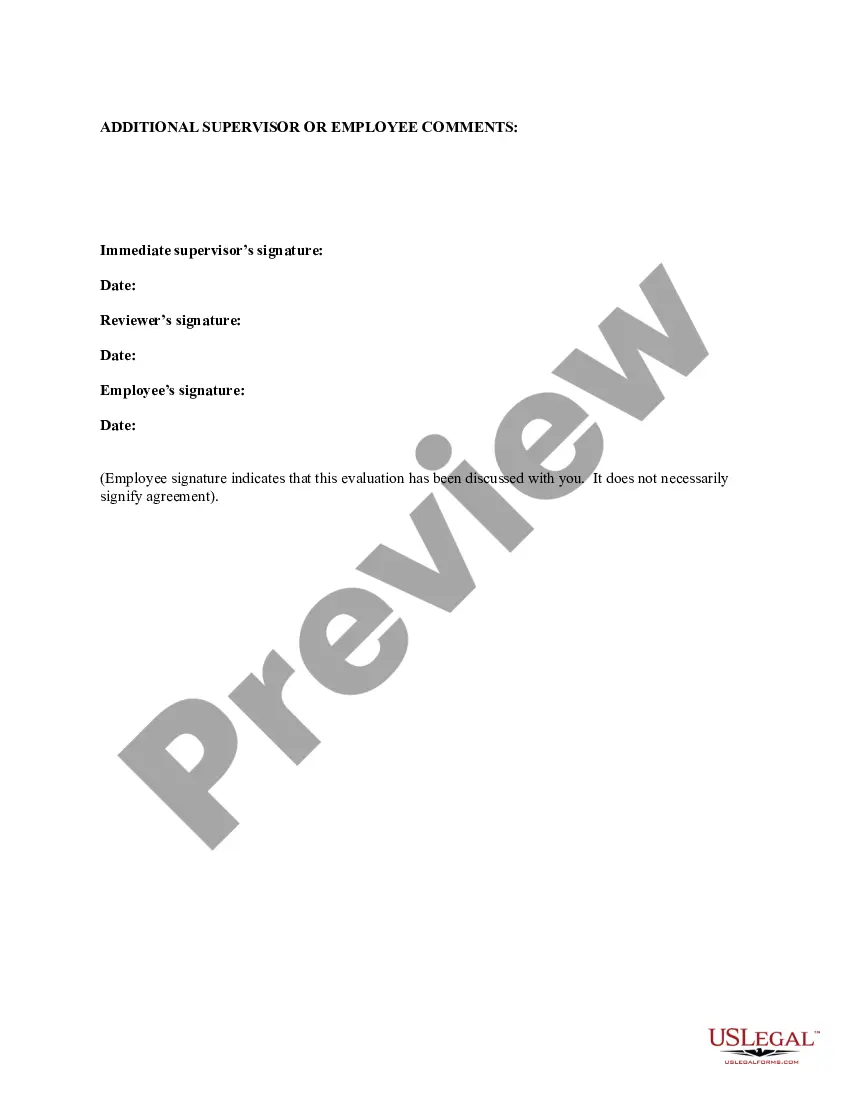

Virgin Islands Sample Performance Appraisal for Exempt Employees

Description

How to fill out Sample Performance Appraisal For Exempt Employees?

If you want to be thorough, fetch, or print recognized document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the website's straightforward and efficient search feature to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever. You have access to each form you have acquired within your account. Click the My documents section and select a form to print or download again.

Fill out, download, and print the Virgin Islands Sample Performance Appraisal for Exempt Employees with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to obtain the Virgin Islands Sample Performance Appraisal for Exempt Employees with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to acquire the Virgin Islands Sample Performance Appraisal for Exempt Employees.

- You can also access the forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to examine the form's content. Don't forget to review the description.

- Step 3. If you are dissatisfied with the template, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you require, select the Download now button. Choose the payment plan that suits you and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Virgin Islands Sample Performance Appraisal for Exempt Employees.

Form popularity

FAQ

Although several criteria separate salaried exempt workers from salaried nonexempt workers, the one key difference between salaried exempt status and salaried nonexempt status is overtime pay. Exempt employees don't receive overtime pay; nonexempt employees do.

Exempt: An individual who is exempt from the overtime provisions of the Fair Labor Standards Act (FLSA) because he or she is classified as an executive, professional, administrative or outside sales employee, and meets the specific criteria for the exemption. Certain computer professionals may also be exempt.

Under Section 2, Subdivision (b) of the AB-5 Text, the following is included in the ABC Test Exemption: (3) An individual who holds an active license from the State of California and is practicing one of the following recognized professions: lawyer, architect, engineer, private investigator, or accountant.

An exempt employee is not entitled to overtime pay according to the Fair Labor Standards Act (FLSA). To be exempt, you must earn a minimum of $684 per week in the form of a salary. Non-exempt employees must be paid overtime and are protected by FLSA regulations.

FLSA status is based on the intent of the job, and not individual monthly changes (e.g., furlough or leave of absence).

The learned professional exemption is restricted to professions where specialized academic training is a standard prerequisite for entrance into the profession. The best evidence of meeting this requirement is having the appropriate academic degree.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

Employees who do not meet the requirements to be classified as exempt from the Minimum Wage Act are considered nonexempt. Nonexempt employees may be paid on a salary, hourly or other basis. Employees who do not qualify for an exemption but are paid on a salary basis are considered salaried nonexempt.

In addition, to be classified as exempt after July 1, 2017, a teacher in a private elementary or secondary school must be paid the greater of the following: The lowest salary paid by any California school district to an employee with a teaching credential, or.

Employees who are exempt from the FLSA's minimum wage and overtime laws include: executive, administrative, and professional employees and some computer workers; outside salespeople such as those who do sales away from the employer's place of business, like a door-to-door salesperson.