Michigan Receipt and Release Personal Representative of Estate Regarding Legacy of a Will

Description

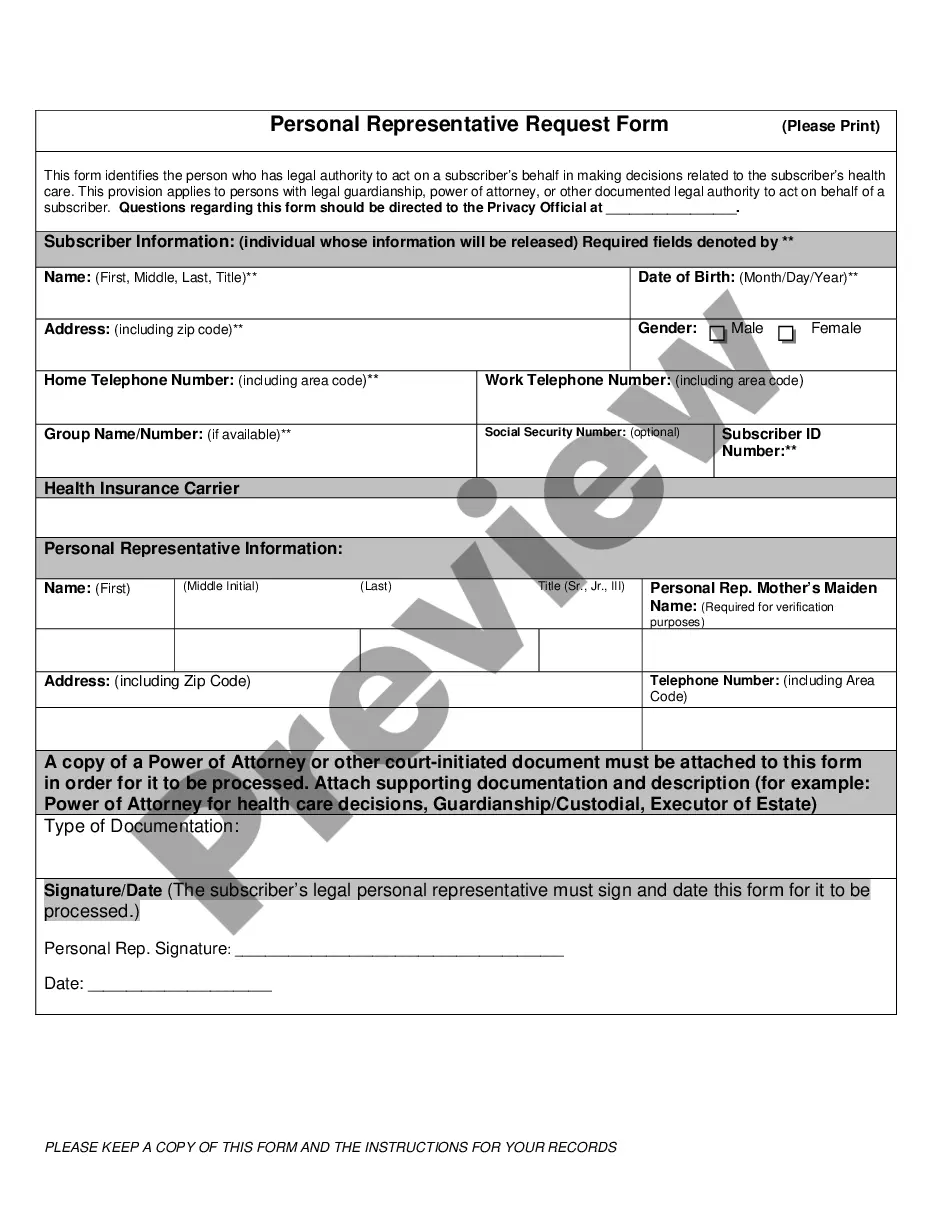

How to fill out Receipt And Release Personal Representative Of Estate Regarding Legacy Of A Will?

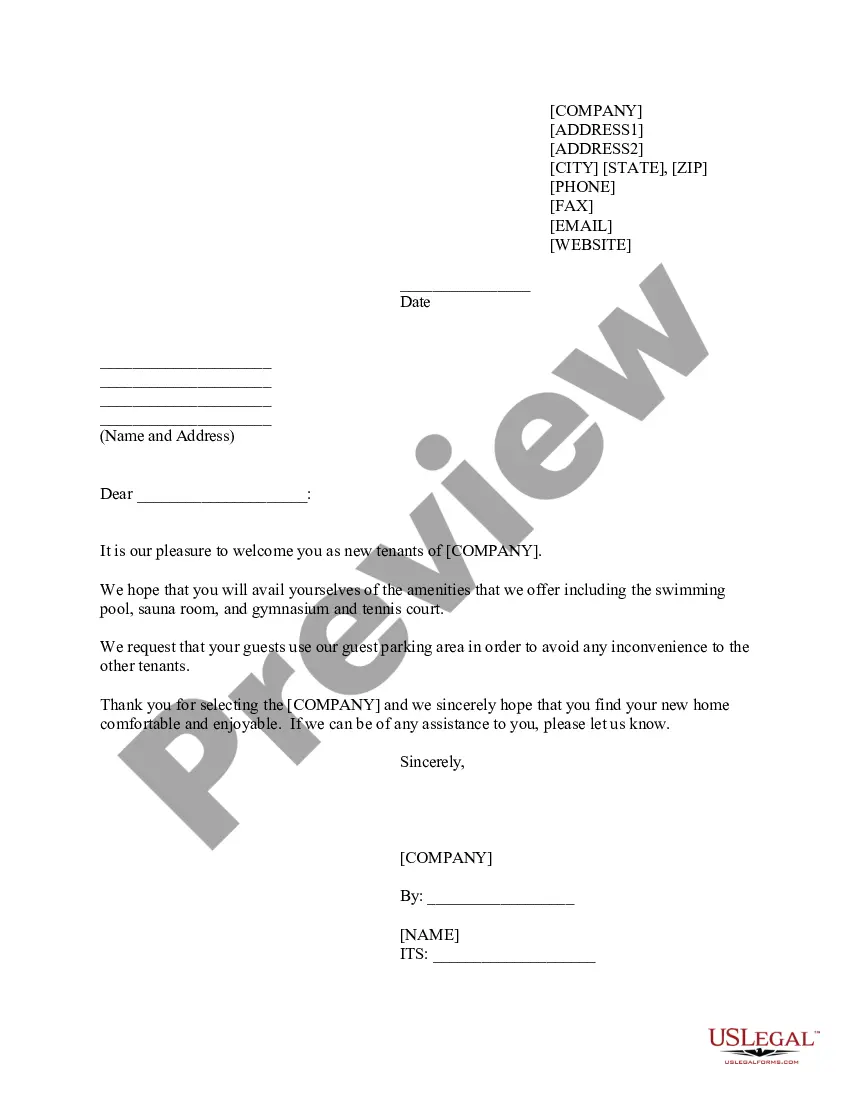

US Legal Forms - one of the greatest libraries of legitimate kinds in the States - delivers a wide range of legitimate file templates it is possible to obtain or produce. Using the site, you may get 1000s of kinds for company and personal reasons, sorted by groups, says, or search phrases.You will discover the latest versions of kinds such as the Michigan Receipt and Release Personal Representative of Estate Regarding Legacy of a Will in seconds.

If you have a subscription, log in and obtain Michigan Receipt and Release Personal Representative of Estate Regarding Legacy of a Will from the US Legal Forms collection. The Obtain option can look on each and every type you view. You gain access to all previously downloaded kinds in the My Forms tab of your profile.

If you would like use US Legal Forms the first time, here are easy instructions to help you started:

- Make sure you have selected the correct type for your city/region. Select the Preview option to check the form`s information. See the type explanation to actually have chosen the correct type.

- If the type doesn`t satisfy your requirements, take advantage of the Lookup area at the top of the screen to find the one that does.

- Should you be happy with the shape, affirm your choice by simply clicking the Get now option. Then, opt for the costs plan you favor and supply your accreditations to register for the profile.

- Approach the deal. Make use of credit card or PayPal profile to finish the deal.

- Pick the structure and obtain the shape on your system.

- Make adjustments. Complete, modify and produce and indicator the downloaded Michigan Receipt and Release Personal Representative of Estate Regarding Legacy of a Will.

Each web template you included with your money lacks an expiration date and is your own for a long time. So, in order to obtain or produce yet another version, just check out the My Forms area and click on on the type you will need.

Get access to the Michigan Receipt and Release Personal Representative of Estate Regarding Legacy of a Will with US Legal Forms, by far the most considerable collection of legitimate file templates. Use 1000s of professional and status-certain templates that meet up with your business or personal demands and requirements.

Form popularity

FAQ

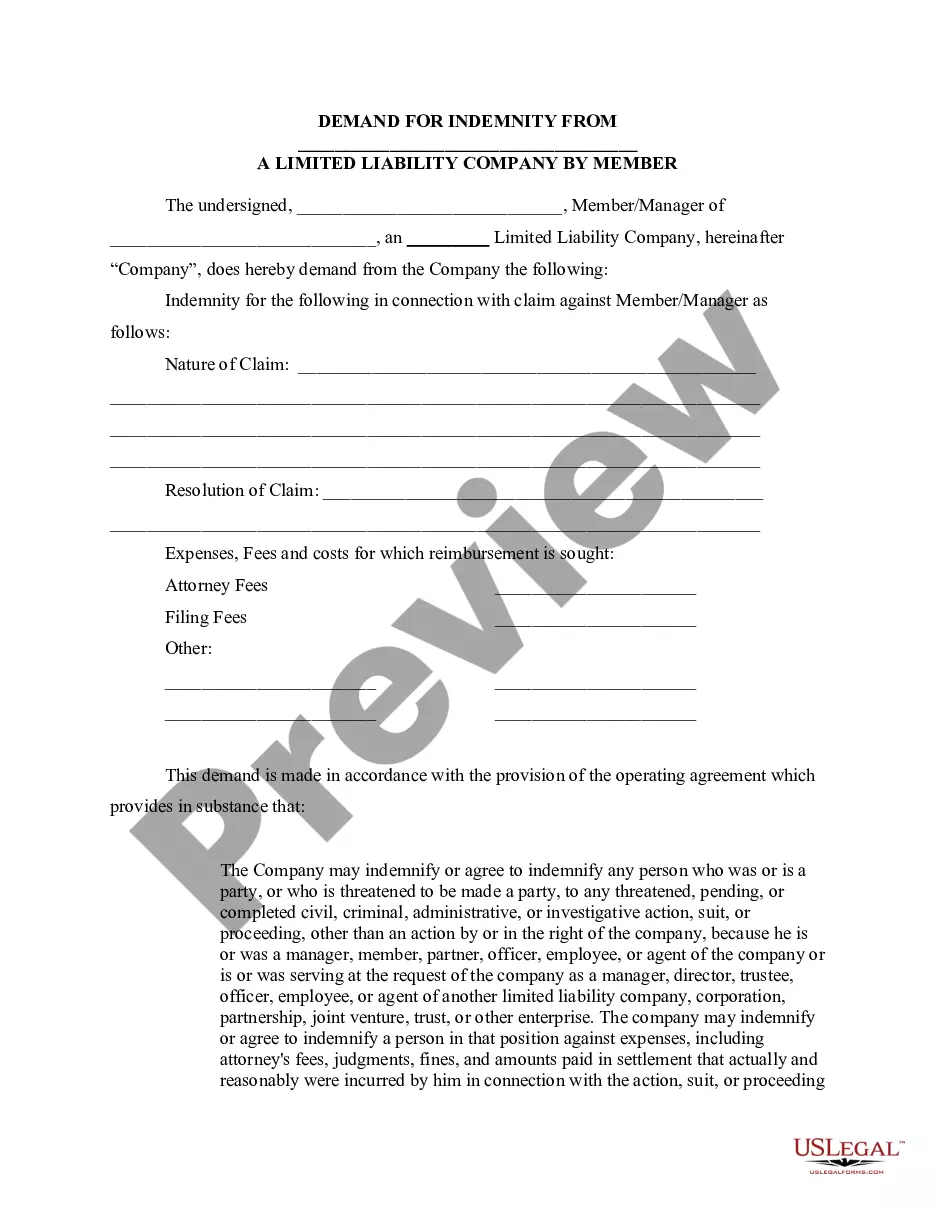

2 When certain conditions exist, however, the accounting may be waived, releasing the executor or administrator from his fiduciary duty. Since relief from the duty of accounting means a savings in time and expense in probating an estate, the busy attorney should be aware of those situations where waiver is applicable.

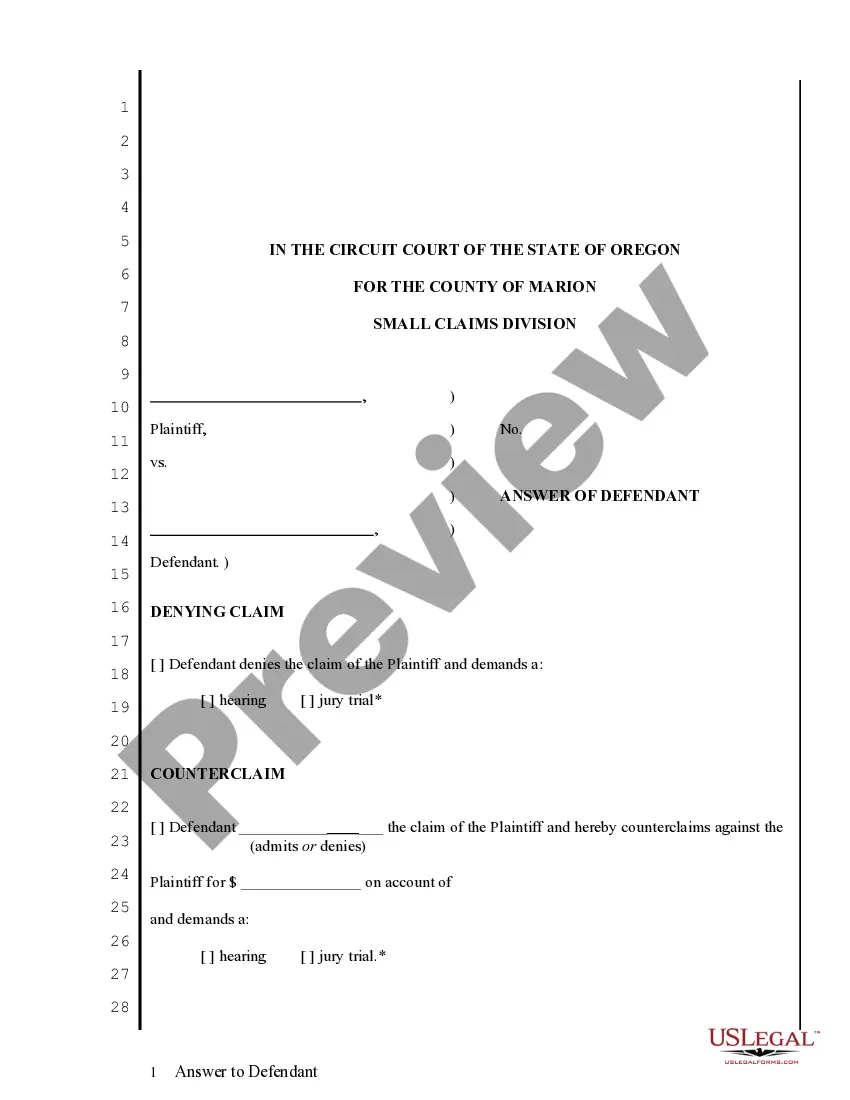

If you want to be the personal representative, complete the Application for Informal Probate and/ or Appointment of Personal Representative form. File the form, the decedent's will (if there is one), and a certified copy of the death certificate with the county probate court where the decedent lived.

Duties of an executor The executor may have to settle debts with the deceased's creditors. Only after creditors receive what the testator owed can the beneficiaries receive their due. Also, the executor may need to file the deceased personal income taxes.

Beneficiaries May Request an Accounting There are situations when a beneficiary will request that the executor or trustee provide an accounting. This may be a formal or informal accounting, depending on the request. Regardless, the fiduciary has a responsibility to provide an accounting when requested.

If the estate is not settled within a year of the first personal representative's appointment, file a Notice of Continued Administration with the court stating why the estate must remain open.

The personal representative is under a duty to settle and distribute the estate "as expeditiously and efficiently as is consistent with the best interests of the estate" and "except as otherwise specified or ordered in regard to a supervised personal representative, without adjudication, order or direction of the court ...

In general, beneficiaries do have the proper to request data about the estate, inclusive of financial institution statements. However, the unique regulations and limitations on gaining access to bank statements may also range relying on the jurisdiction and the particular circumstances of the estate.

As a beneficiary, you are entitled to review the trust's records including bank statements, the checking account ledger, receipts, invoices, etc. Before the trust administration is complete, it is recommended you request and review the trust's records which support the accounting.