Maryland Receipt and Release Personal Representative of Estate Regarding Legacy of a Will

Description

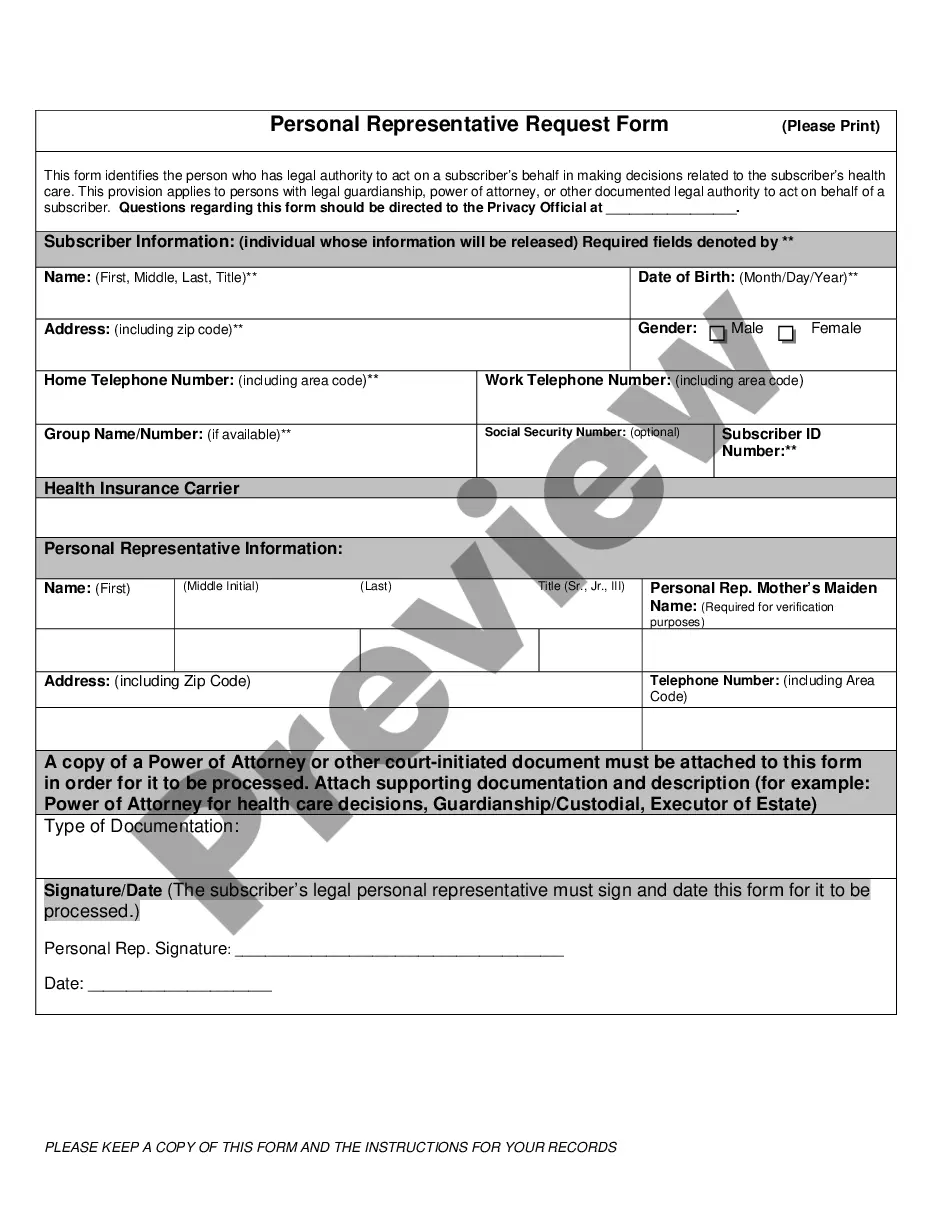

How to fill out Receipt And Release Personal Representative Of Estate Regarding Legacy Of A Will?

Are you inside a place where you will need files for sometimes enterprise or individual uses nearly every time? There are tons of legal papers themes available online, but discovering kinds you can depend on isn`t effortless. US Legal Forms offers 1000s of form themes, like the Maryland Receipt and Release Personal Representative of Estate Regarding Legacy of a Will, that happen to be composed in order to meet state and federal needs.

When you are already acquainted with US Legal Forms website and also have your account, merely log in. Following that, you are able to acquire the Maryland Receipt and Release Personal Representative of Estate Regarding Legacy of a Will template.

Should you not offer an profile and want to start using US Legal Forms, adopt these measures:

- Get the form you want and make sure it is for your right town/county.

- Make use of the Review switch to check the shape.

- Browse the information to actually have chosen the right form.

- In the event the form isn`t what you are trying to find, take advantage of the Look for discipline to get the form that meets your needs and needs.

- When you discover the right form, just click Buy now.

- Opt for the costs plan you desire, submit the necessary info to generate your account, and pay for an order making use of your PayPal or bank card.

- Pick a practical data file format and acquire your copy.

Locate each of the papers themes you possess bought in the My Forms food list. You can aquire a further copy of Maryland Receipt and Release Personal Representative of Estate Regarding Legacy of a Will any time, if possible. Just click the essential form to acquire or print the papers template.

Use US Legal Forms, the most comprehensive selection of legal varieties, to conserve efforts and avoid mistakes. The support offers appropriately produced legal papers themes that can be used for a variety of uses. Make your account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

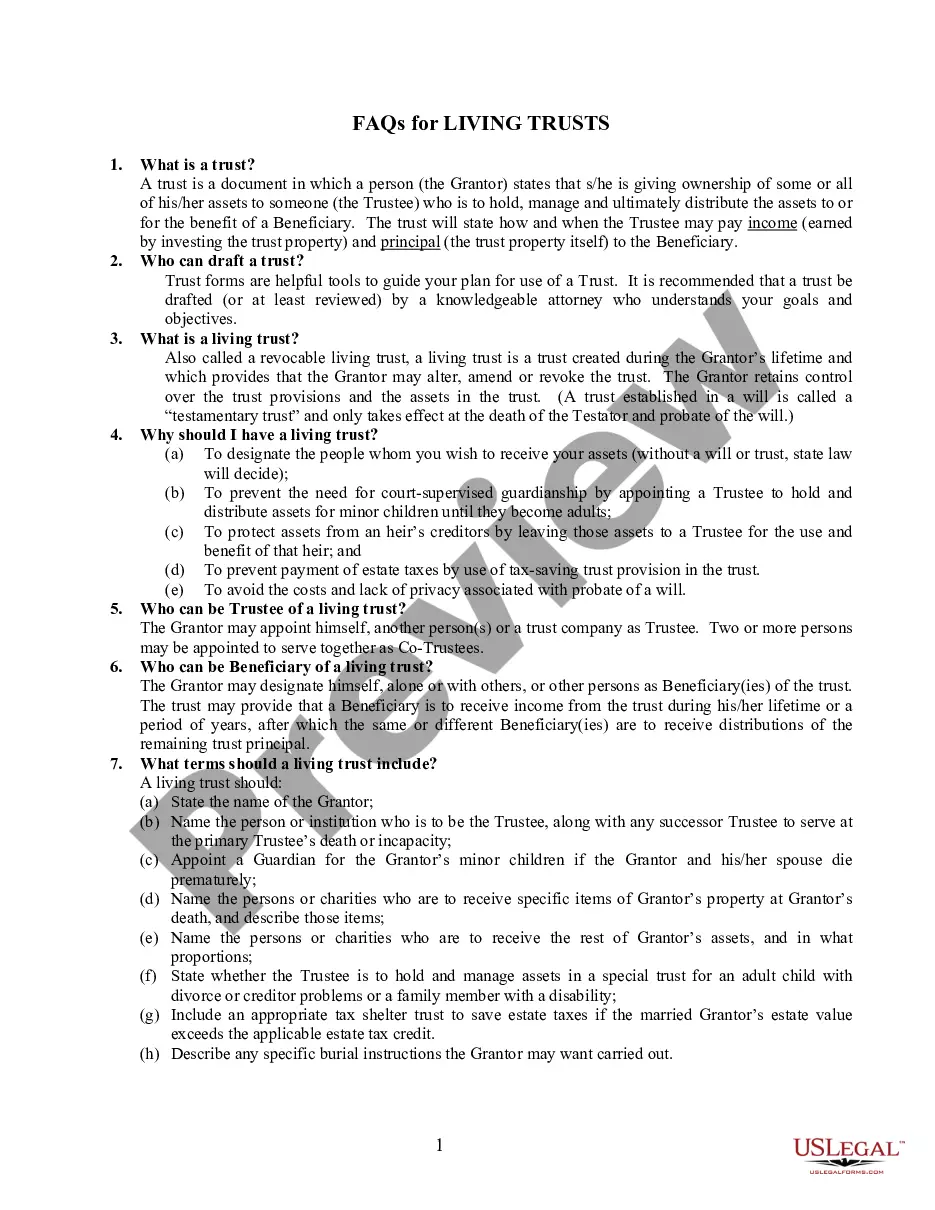

A successor personal representative has the same powers and duties to complete the administration and distribution of the estate as the original personal representative, including the powers granted in the will, but excluding any power expressly made personal to the executor named in the will. [An. Code 1957, art.

The personal representative is responsible for distribution of assets after approval from the Register of Wills and the Orphans' Court.

Maryland: Personal representative compensation may be up to 9 percent of the first $20,000 of the adjusted estate, plus 3.6 percent of the value of the estate over the first $20,000.

Ideally, you should be able to close the estate within 13 months of the decedent's death. However, depending on the size and complexity of the estate, it may take longer. In any case, it's important to keep meticulous records throughout the process to prove to the court that you've fulfilled all your fiduciary duties.

Ideally, you should be able to close the estate within 13 months of the decedent's death. However, depending on the size and complexity of the estate, it may take longer. In any case, it's important to keep meticulous records throughout the process to prove to the court that you've fulfilled all your fiduciary duties.

Very broadly speaking, those duties include marshaling all of the decedent's assets and valuing them based on the market value on the date of the death, reviewing, and maintaining any legally enforceable debts, making sure that all income and estate tax returns are filed and any associated taxes are paid, and then ...

Becoming an Executor A common misunderstanding is that nomination in the decedent's last will and testament alone enables the individual to act on behalf of the estate. A nominated personal representative must petition the orphan's court of the proper county to be appointed to serve as the personal representative.

If there is no will, the highest priority is the surviving spouse, then children. We can envision several scenarios where you might not want your spouse or children to be your Personal Representative.