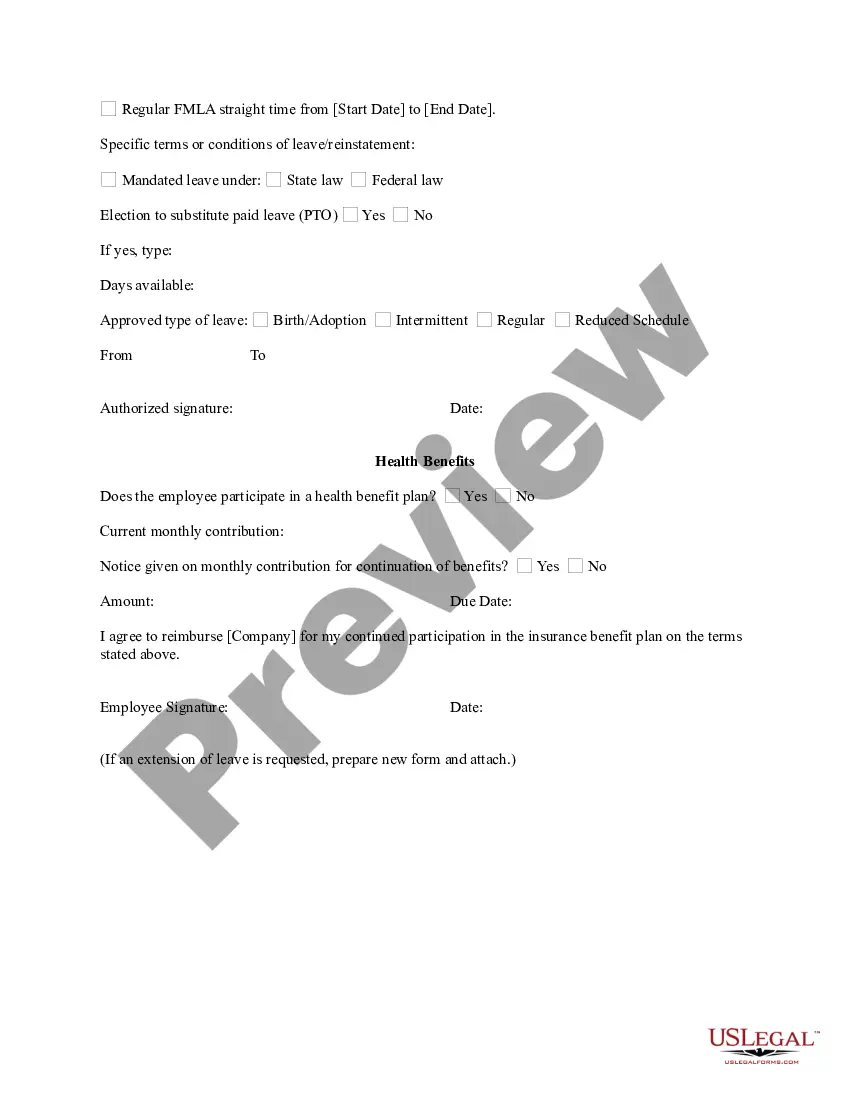

Virgin Islands File Form for Family and Medical Leave

Description

How to fill out File Form For Family And Medical Leave?

Locating the appropriate legal document format can be a challenge. Clearly, numerous templates are accessible online, but how do you acquire the legal form you need? Visit the US Legal Forms website. The service provides thousands of templates, such as the Virgin Islands File Form for Family and Medical Leave, which can be utilized for business and personal purposes. All forms are verified by professionals and comply with state and federal regulations.

If you are already registered, sign in to your account and click on the Download button to access the Virgin Islands File Form for Family and Medical Leave. Use your account to navigate through the legal forms you have previously purchased. Go to the My documents section of your account and obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions you can follow: Initially, ensure you have selected the correct form for your city/region. You can review the form using the Review button and read the form description to ensure it meets your needs. If the form does not meet your expectations, utilize the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Buy now button to acquire the form. Select the pricing option you want and provide the required information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Complete, edit, print, and sign the acquired Virgin Islands File Form for Family and Medical Leave.

US Legal Forms is the premier collection of legal forms where you can find a variety of document templates. Leverage the service to obtain professionally created documents that adhere to state requirements.

- Discovering the ideal legal document structure can pose a difficulty.

- Numerous templates are available on the web.

- Confirm the form aligns with your regional requirements.

- Use the search function to pinpoint the right document.

- Ensure the selected document aligns with your needs.

- Complete your purchase and download the legal format.

Form popularity

FAQ

IRS Form W-2VI is used to report wage and salary information for employees earning Virgin Island wages.

There is no electronic filing in the Virgin Islands at this time. Taxpayers must drop off in person or mail the returns to the Bureau for processing. For more information about filing requirements for bona fide residents, please call the Office of Chief Counsel at 715-1040, ext. 2249.

Subtitle C, Employment Taxes, of the Internal Revenue Code imposes employment taxes on wages and provides for income tax withholding. Form 941-SS is used to determine the amount of the taxes that you owe. Section 6011 requires you to provide the requested information if the tax is applicable to you.

How do I file Schedule H? File Schedule H with your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1041. If you're not filing a 2021 tax return, file Schedule H by itself.

Employers use Form 941, Employer's Quarterly Federal Tax Return, to report income taxes, Social Security tax or Medicare tax withheld from employees' paychecks and to pay their portion of Social Security or Medicare tax. In the end, the information on your quarterly 941s must match your submitted Form W-2s.

To take the credit, you must complete Form 8689 and attach it to your Form 1040 or 1040-SR. Add line 41 and line 46 of Form 8689 and include the amount in the total on Form 1040 or 1040-SR, Total payments line. On the dotted line next to it, enter Form 8689 and the amount paid.

More In Forms and Instructions Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

Who Must File Form 941-SS? Generally, you must file a return for the first quarter in which you pay wages subject to social security and Medicare taxes, and for each quarter thereafter until you file a final return.

Form 940for 2021: Employer's Annual Federal Unemployment (FUTA) Tax Return. Department of the Treasury Internal Revenue Service.

When Schedule H must be filed Your tax return must include Schedule H only if you pay any single employee at least $2,300 in the 2021 tax year, or cash wages to all household employees totaling $1,000 or more during any three-month calendar quarter during either the current or previous tax year.