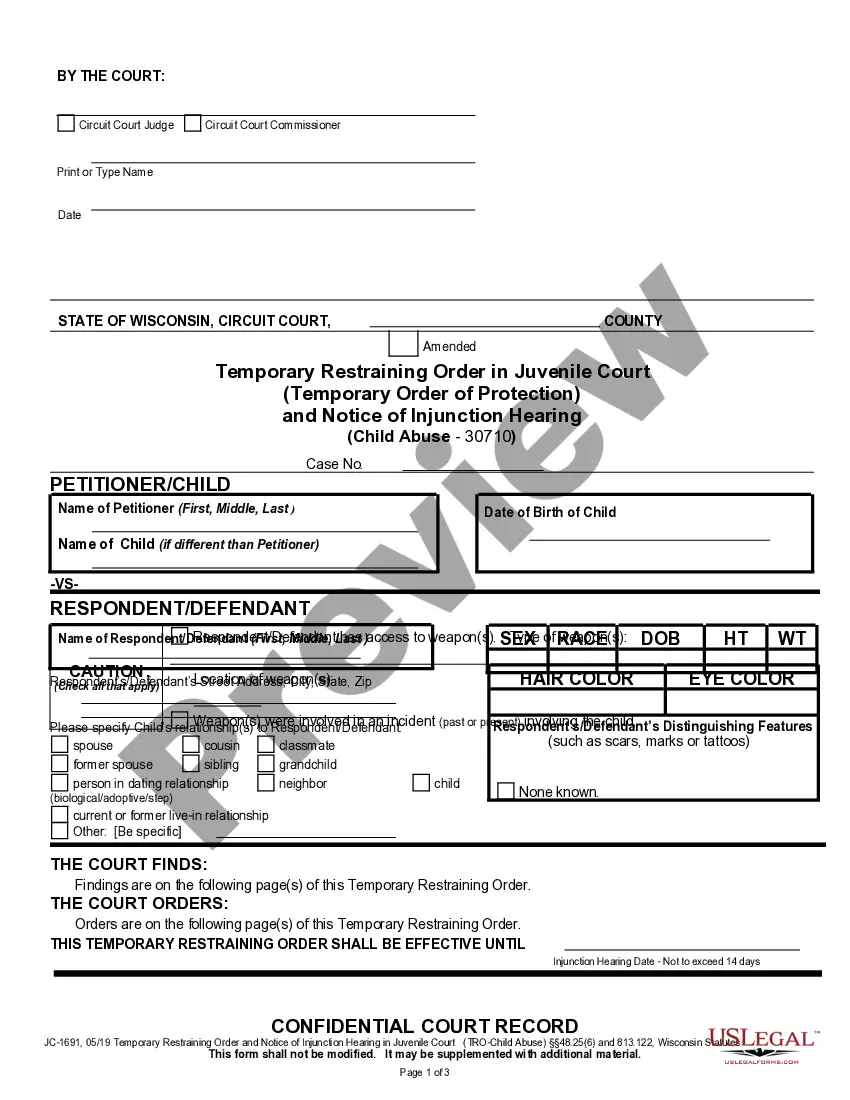

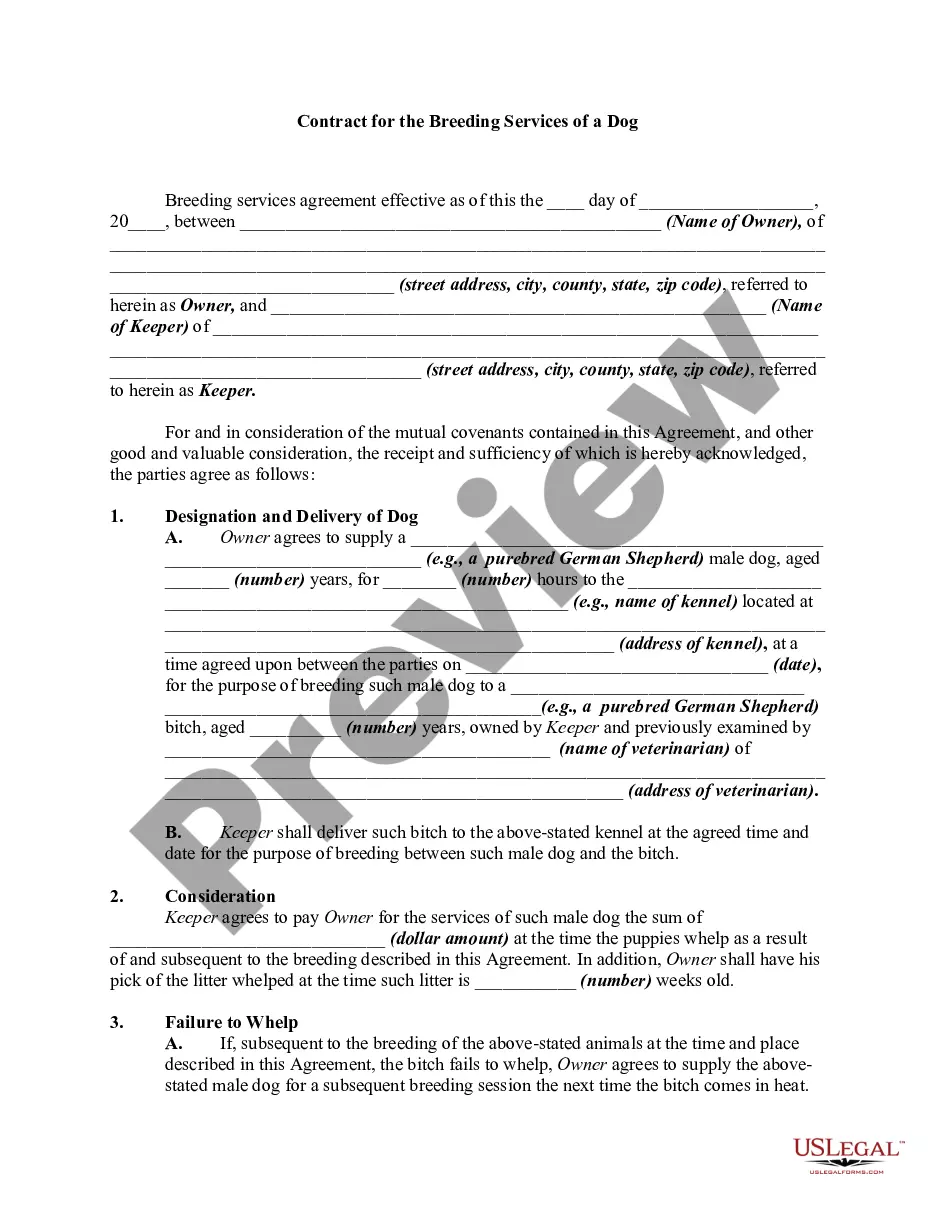

Virgin Islands Qualifying Event Notice Information for Employer to Plan Administrator

Description

How to fill out Qualifying Event Notice Information For Employer To Plan Administrator?

Selecting the ideal legal document template may present challenges.

Obviously, there are numerous templates available online, but how will you find the legal document you need.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Virgin Islands Qualifying Event Notice Information for Employer to Plan Administrator, suitable for both professional and personal use.

You can view the form using the Preview option and examine the form details to ensure it is suitable for you.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, sign in to your account and click on the Download button to obtain the Virgin Islands Qualifying Event Notice Information for Employer to Plan Administrator.

- Use your account to access the legal forms you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, confirm that you have selected the correct form for your specific area/location.

Form popularity

FAQ

Form W-2 is completed by an employer and contains important information that you need to complete your tax return. It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck.

Is a form that shows your wages or salary, the amount of tax your employer withheld, what you paid in Social Security taxes and other contributions you made.

Employers must file Form W-2, the IRS Wage and Tax Statement, for each employee who receives at least $600 in wages from your business, even if you did not withhold any income, Medicare or Social Security tax, though you would have had to withhold income tax if an employee did not claim an exemption from withholding on

Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes. Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes. The rate is 1.45% of the Medicare wage base.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

Form W-2 shows an employee's gross wages and withheld taxes. It can also include other information such as deferred compensation, dependent care benefits, contributions to a health savings account, and tip income. If you paid an employee during the year, you must complete a Form W-2.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.