Virgin Islands Stop Annuity Request

Description

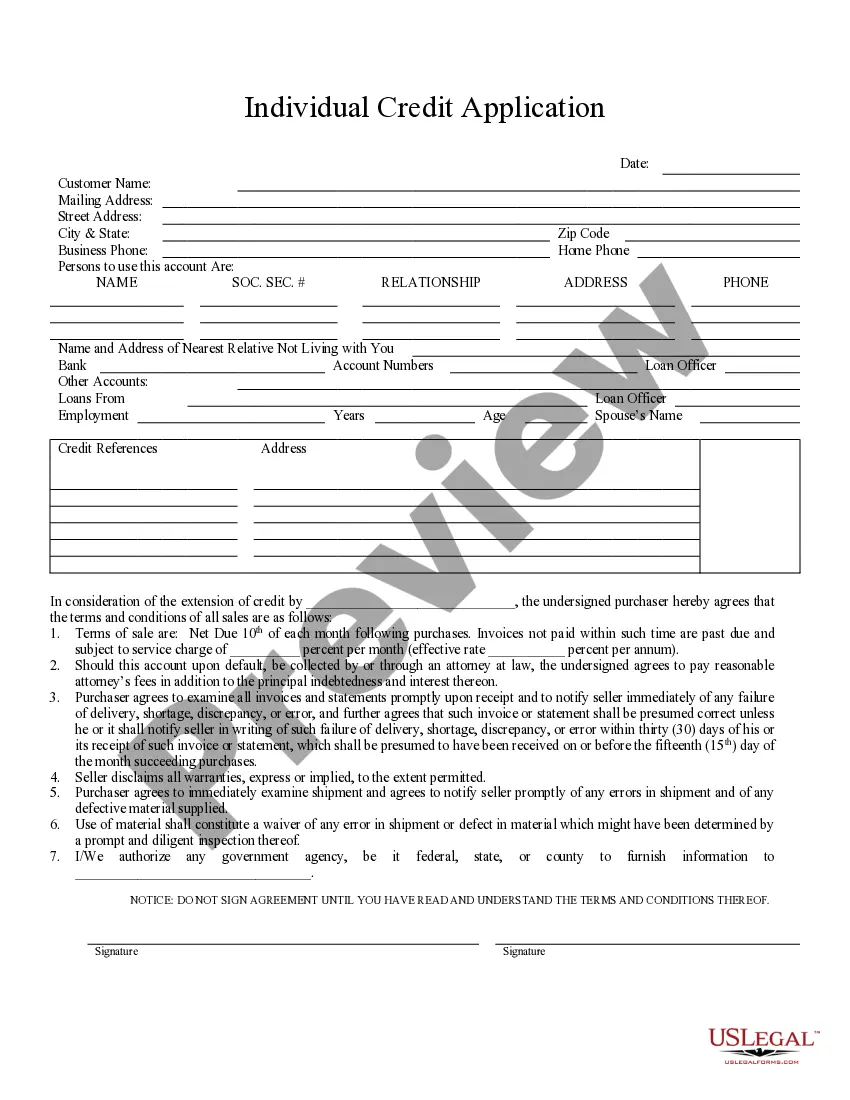

How to fill out Stop Annuity Request?

Locating the appropriate valid document template can be challenging.

Of course, there are numerous designs available online, but how do you identify the genuine version you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Virgin Islands Stop Annuity Request, suitable for both business and personal purposes.

If the form does not suit your needs, use the Search field to find the correct document. Once you are certain that the form is suitable, click the Buy now button to purchase the form. Choose your preferred pricing plan and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Virgin Islands Stop Annuity Request. US Legal Forms is the largest collection of legal templates where you can discover various document formats. Leverage the service to download professionally crafted documents that adhere to state regulations.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the Virgin Islands Stop Annuity Request.

- Use your account to browse through the official forms you may have purchased previously.

- Navigate to the My documents tab in your account to retrieve another version of the document you need.

- For new users of US Legal Forms, here are some straightforward instructions to follow.

- First, ensure you select the correct form for your city/county. You can review the form using the Preview button and examine the form description to make sure it is the right choice for you.

Form popularity

FAQ

Yes, you can collect social security in the U.S. Virgin Islands if you meet the eligibility requirements. Social Security benefits approved before your move are generally transferable. However, it’s wise to ensure that your records are updated and accurate to facilitate a smooth collection process. Your financial advisor can assist with ensuring proper compliance while you explore your Virgin Islands Stop Annuity Request.

Closing an annuity may incur penalties depending on the terms outlined in your contract. The Virgin Islands Stop Annuity Request could involve surrender charges or other fees if done within a specific period. It is crucial to review your annuity details and consult with your financial advisor to understand any potential costs involved in the closure.

Yes, it is possible to get out of an annuity, though it can be complex. Initiating a Virgin Islands Stop Annuity Request can help you navigate this process. Your options may include surrendering the annuity, considering a 1035 exchange, or selling it. Each choice comes with its own implications, so professional advice is often beneficial.

Annuity payments can often be stopped, but the process may vary depending on your specific contract. Initiating a Virgin Islands Stop Annuity Request may be necessary to halt payments effectively. Your provider will guide you through the steps and provide details on any implications related to stopping your payments. Always consult your contract for clarity.

Yes, you can cancel an annuity, but it's essential to understand the terms of your contract. Depending on your annuity type, the Virgin Islands Stop Annuity Request might involve specific conditions or penalties. Some contracts allow for cancellation within a particular timeframe without fees, while others do not. Be sure to review your documentation thoroughly.

To stop an annuity, you typically need to contact your insurance provider or financial institution that holds the annuity. Request to initiate the Virgin Islands Stop Annuity Request process. They will inform you of the necessary steps and paperwork required. Keeping detailed records of your communications can help ensure a smooth transition.

The US Virgin Islands does not tax most forms of retirement income. This includes distributions from pensions and annuities, which means you can enjoy your retirement without worrying about local taxes on these funds. However, it is always prudent to consult a local tax advisor for specific guidance. If you are considering a Virgin Islands Stop Annuity Request, understanding tax implications can help you make informed decisions.