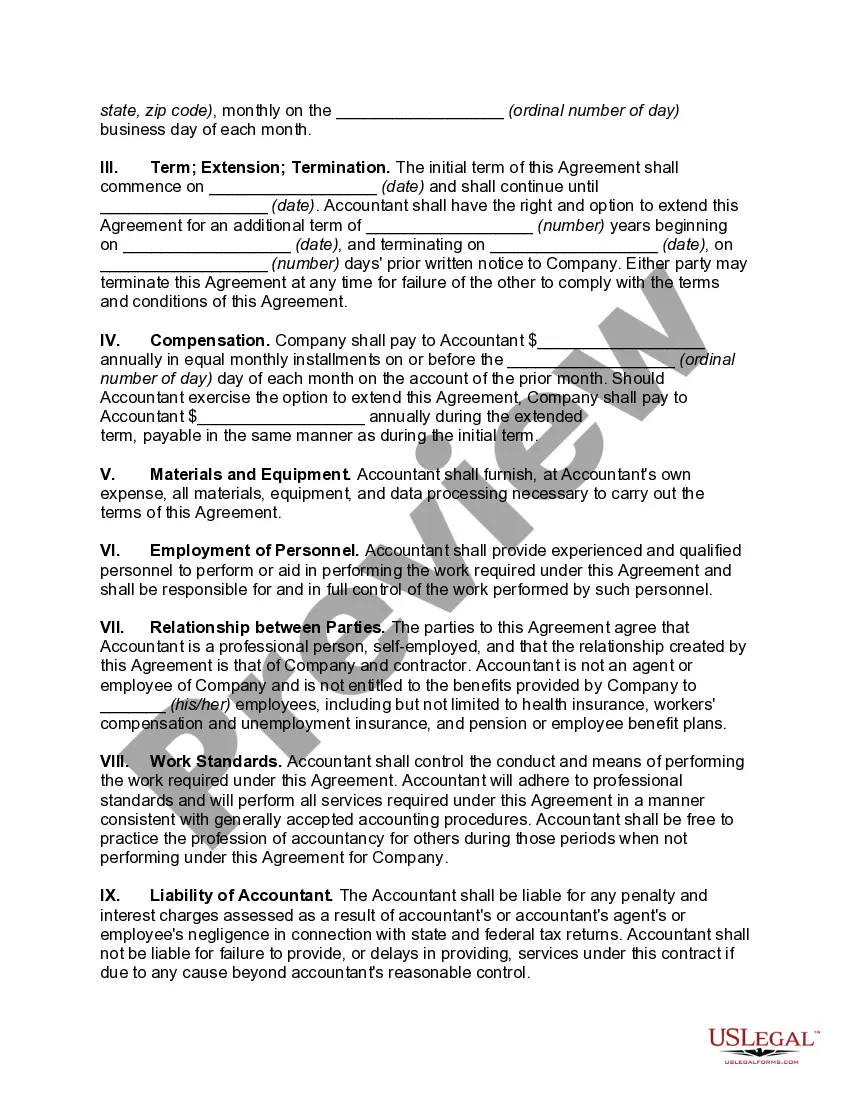

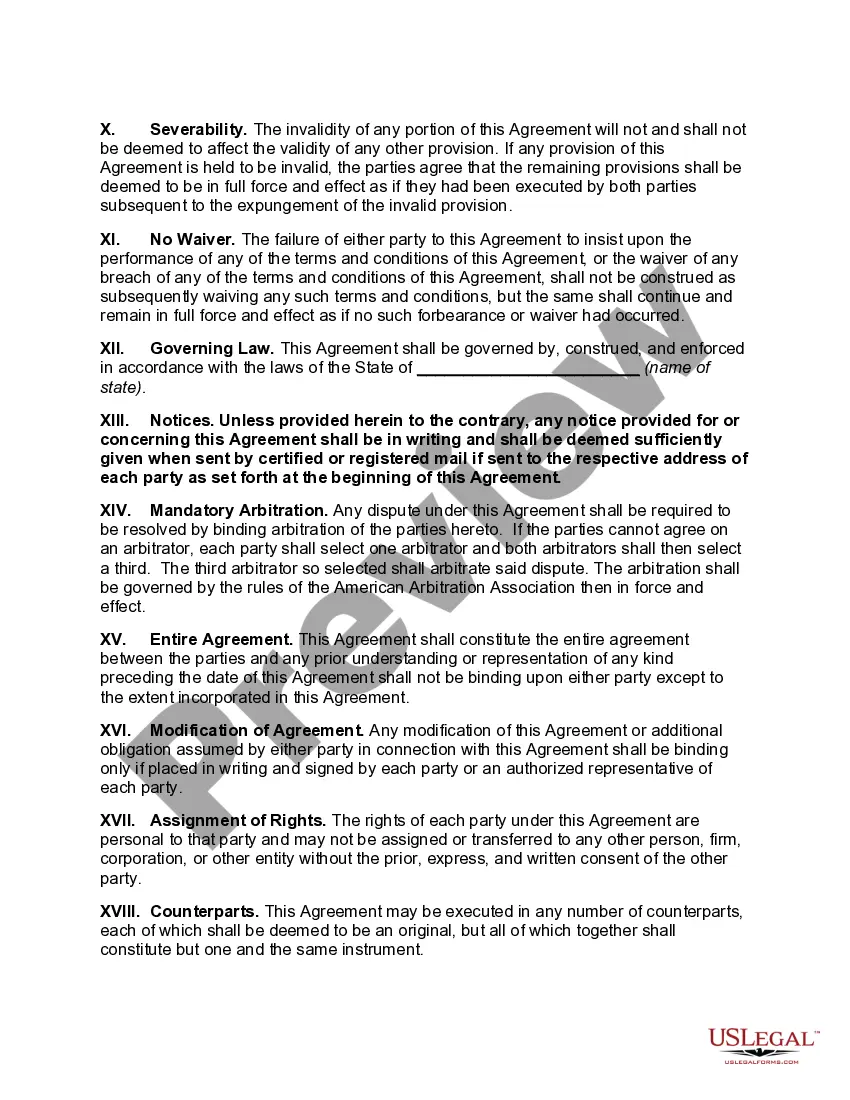

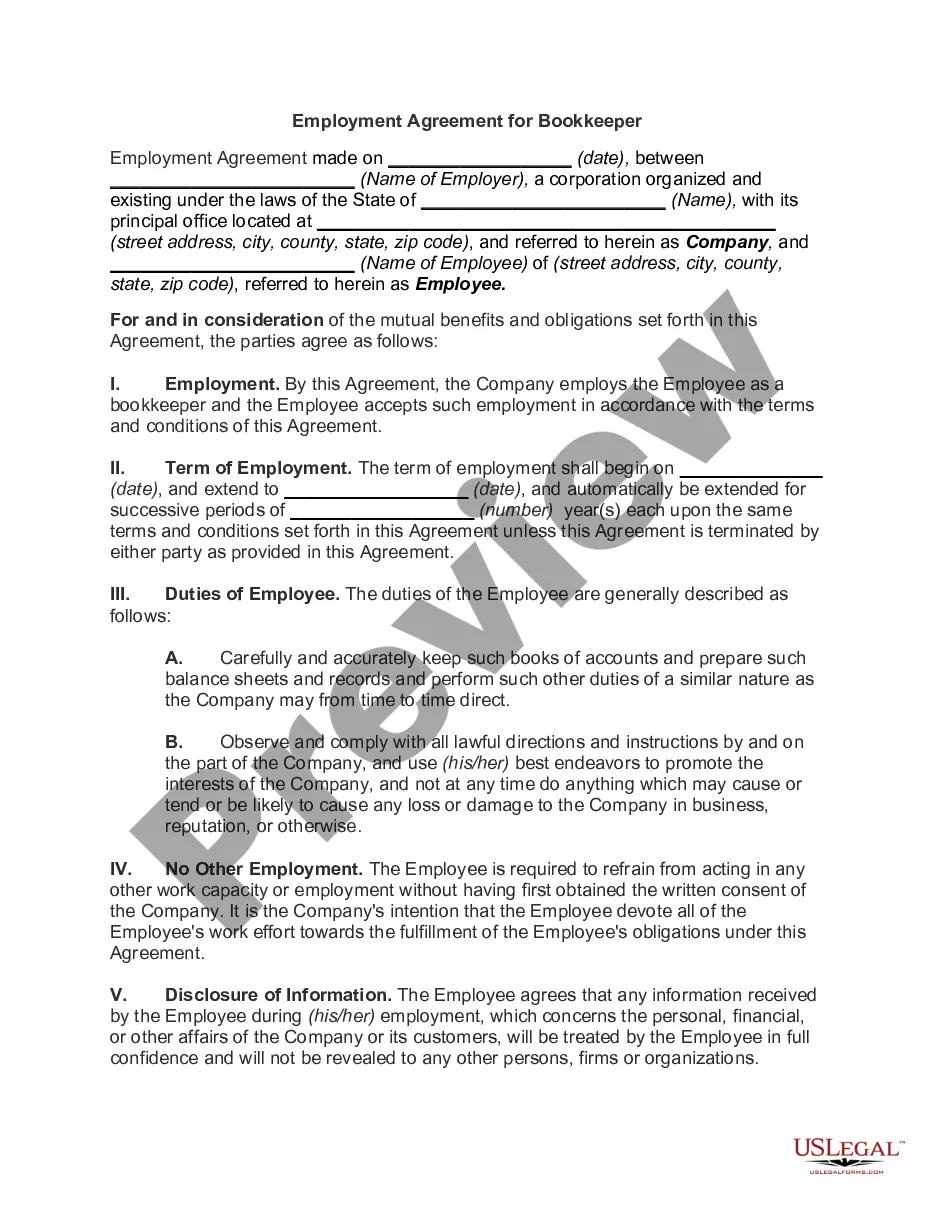

Virgin Islands Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Independent Contractor Agreement For Accountant And Bookkeeper?

If you need to compile, download, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's simple and convenient search function to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Choose the format of your legal document and download it to your device.

- Utilize US Legal Forms to acquire the Virgin Islands Independent Contractor Agreement for Accountant and Bookkeeper with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Virgin Islands Independent Contractor Agreement for Accountant and Bookkeeper.

- You may also access forms you previously saved from the My documents section of your account.

- If this is your first time using US Legal Forms, adhere to the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the document's content. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to find other types of your legal document template.

- Step 4. After locating the required form, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

An employee is on a company's payroll and receives wages and benefits in exchange for following the organization's guidelines and remaining loyal. A contractor is an independent worker who has autonomy and flexibility but does not receive benefits such as health insurance and paid time off.

How to approach paying foreign contractors. There is no requirement for U.S. companies to file an IRS 1099 Form to pay a foreign contractor. But as noted above, the company should require the contractor file IRS Form W-8BEN, which formally certifies the worker's foreign status.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The best way to send money to overseas independent contractors is still PayPal. The payment receiver fees are 2.9% + $0.30 in the US and 3.9% + exchange fee for payments made internationally. Some companies prefer PayPal because it allows payment through a corporate credit card.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

US company hiring a foreign independent contractor living abroad. The US company doesn't need to report the payments they made to the foreign independent contractor to the IRS if they are not US-sourced income. The company also doesn't need to withhold any tax.

1099 Worker Defined A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.