Virgin Islands Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares

Description

How to fill out Legend On Stock Certificate With Reference To Separate Document Restricting Transfer Of Shares?

Choosing the right legal file design could be a have a problem. Naturally, there are a variety of themes available online, but how will you find the legal type you want? Make use of the US Legal Forms internet site. The services provides thousands of themes, for example the Virgin Islands Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares, which you can use for business and private requires. All of the types are checked by experts and meet up with state and federal demands.

If you are previously signed up, log in to the accounts and click the Download key to find the Virgin Islands Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares. Make use of accounts to appear from the legal types you might have acquired formerly. Go to the My Forms tab of your respective accounts and acquire another duplicate from the file you want.

If you are a brand new user of US Legal Forms, here are simple recommendations that you can comply with:

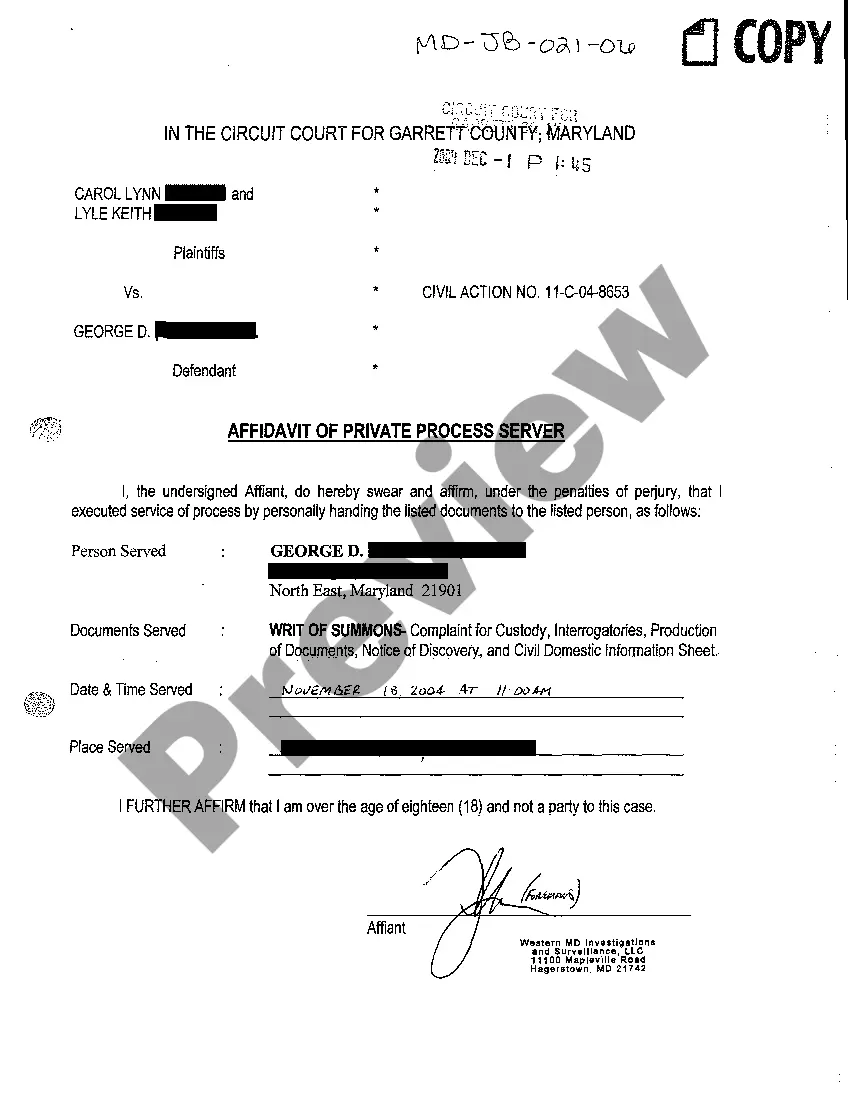

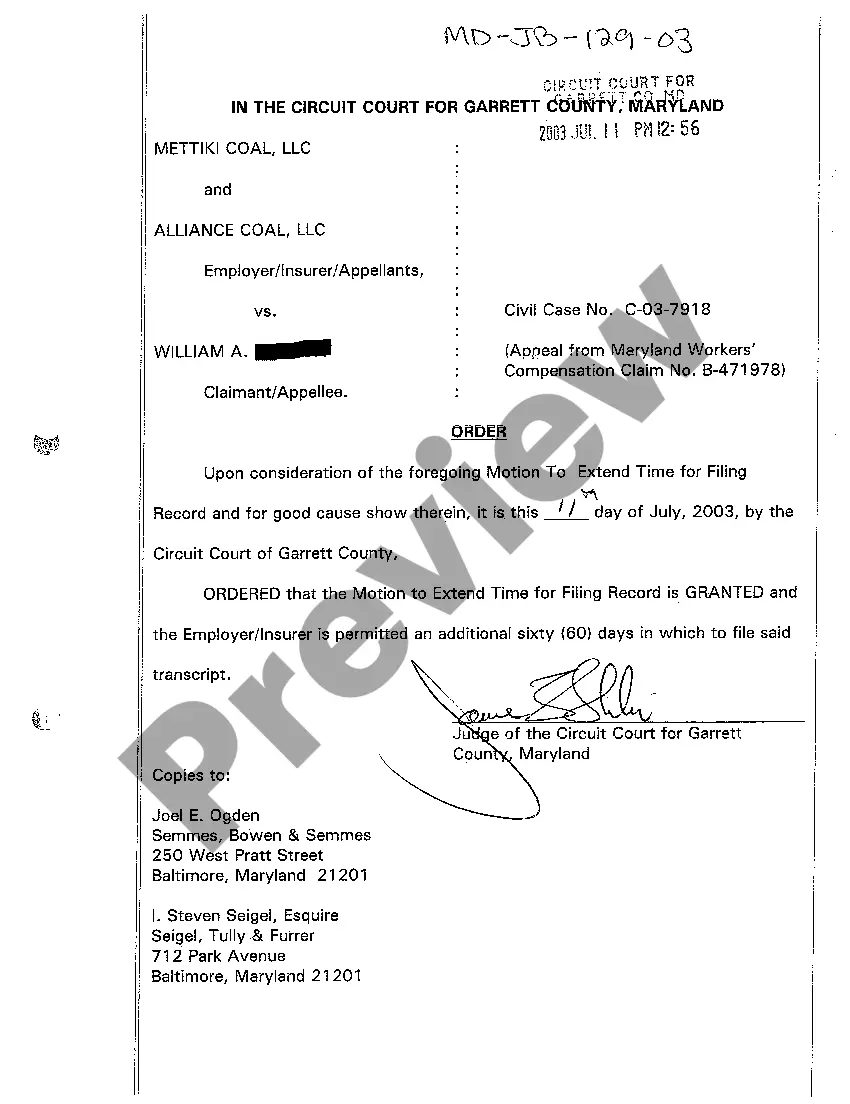

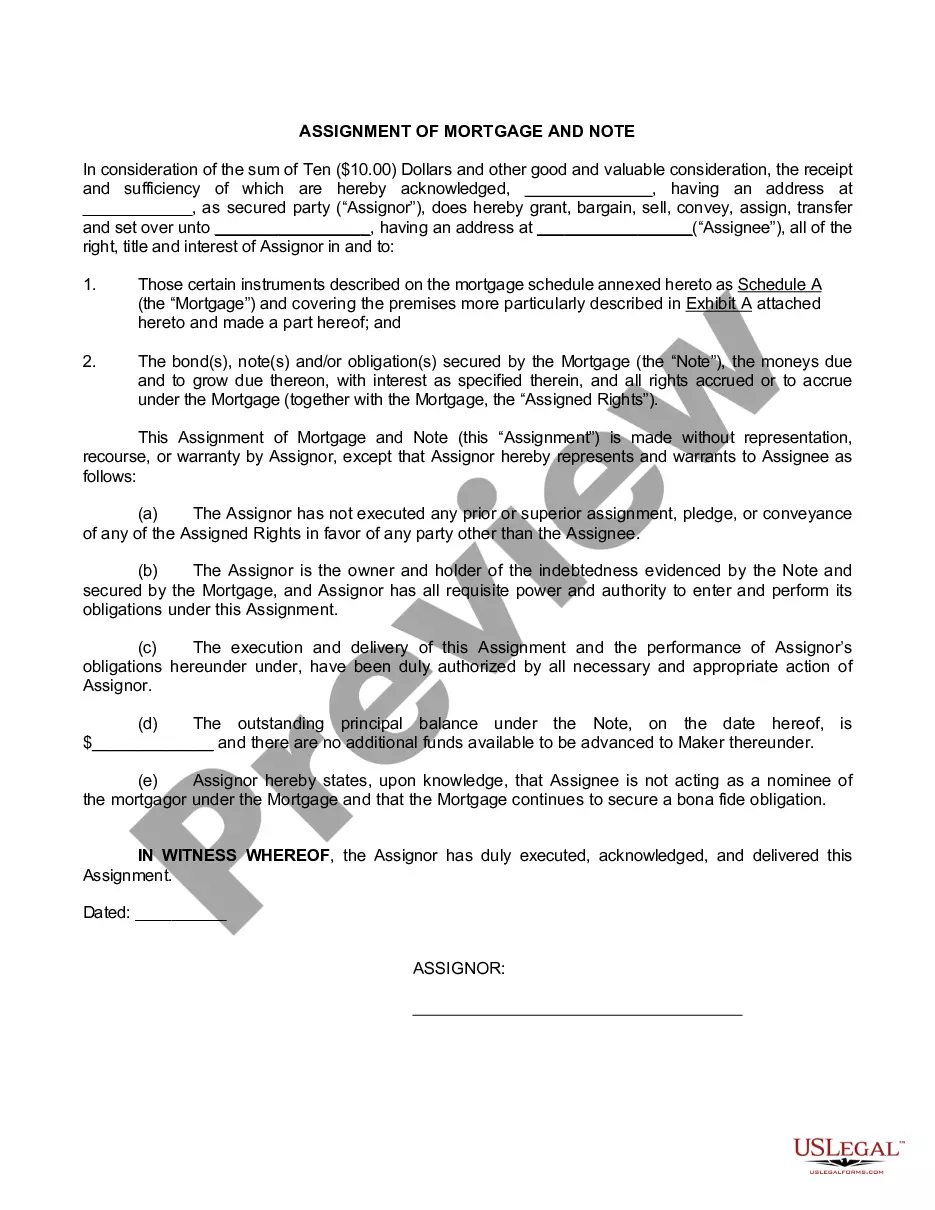

- Initial, make sure you have selected the appropriate type for the town/region. It is possible to look over the form making use of the Review key and look at the form explanation to ensure this is the best for you.

- In case the type is not going to meet up with your needs, take advantage of the Seach area to obtain the right type.

- Once you are positive that the form is suitable, click the Purchase now key to find the type.

- Opt for the rates prepare you want and enter in the needed details. Design your accounts and pay money for the order with your PayPal accounts or charge card.

- Select the submit format and acquire the legal file design to the device.

- Comprehensive, change and printing and indication the acquired Virgin Islands Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares.

US Legal Forms will be the greatest collection of legal types where you can discover different file themes. Make use of the service to acquire skillfully-created paperwork that comply with condition demands.

Form popularity

FAQ

If a security is determined to be a restricted security as defined by SEC Rule 144, it can only be resold under specific circumstances, including the passage of time, the filing of Form 144, and compliance with the quantity limitations imposed by the rule.

If you hold stocks in physical certificate form and want to sell them, you will have to send the certificate to your broker or the company's transfer agent to execute the sale. You probably will need to get your signature guaranteed. Once the brokerage firm has the stock certificates, the sell order can be executed.

Restricted Stock Units cannot be sold or transferred while they are subject to forfeiture. This means that the employee cannot sell or transfer the units until they are vested.

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.

In order to have the legend on a stock certificate removed, investors should contact the company's shareholder relations department to find out the details of the removal process. Following that, the company will send a confirmation authorizing its transfer agent to remove the legend.

Restricted stock refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates, such as executives and directors. Restricted stock is non-transferable and must be traded in compliance with special Securities and Exchange Commission (SEC) regulations.

The purpose of the restrictive legend or notation is to protect the issuing company from loosing its private placement exemption for the initial sale of the securities and to notify the investor that the restricted securities cannot be resold into the public securities market without satisfying certain requirements.

Only a transfer agent can complete the task of removing a restrictive stock legend. The transfer agent will require an opinion letter from the issuer's counsel or from his or her own lawyer plus 144 papers completed by a broker?stating that the restricted legend can be removed.