Virgin Islands Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker

Description

How to fill out Sample Letter For Application Of Unsecured Creditors For An Order Authorizing Employment Of Investment Banker?

Are you currently within a position the place you will need files for either business or individual uses nearly every day time? There are tons of legal papers templates available online, but locating ones you can depend on is not easy. US Legal Forms delivers a large number of form templates, much like the Virgin Islands Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker, that are written to fulfill federal and state requirements.

When you are currently acquainted with US Legal Forms site and also have your account, just log in. Following that, you are able to down load the Virgin Islands Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker template.

If you do not offer an account and would like to start using US Legal Forms, follow these steps:

- Obtain the form you want and make sure it is for your appropriate city/county.

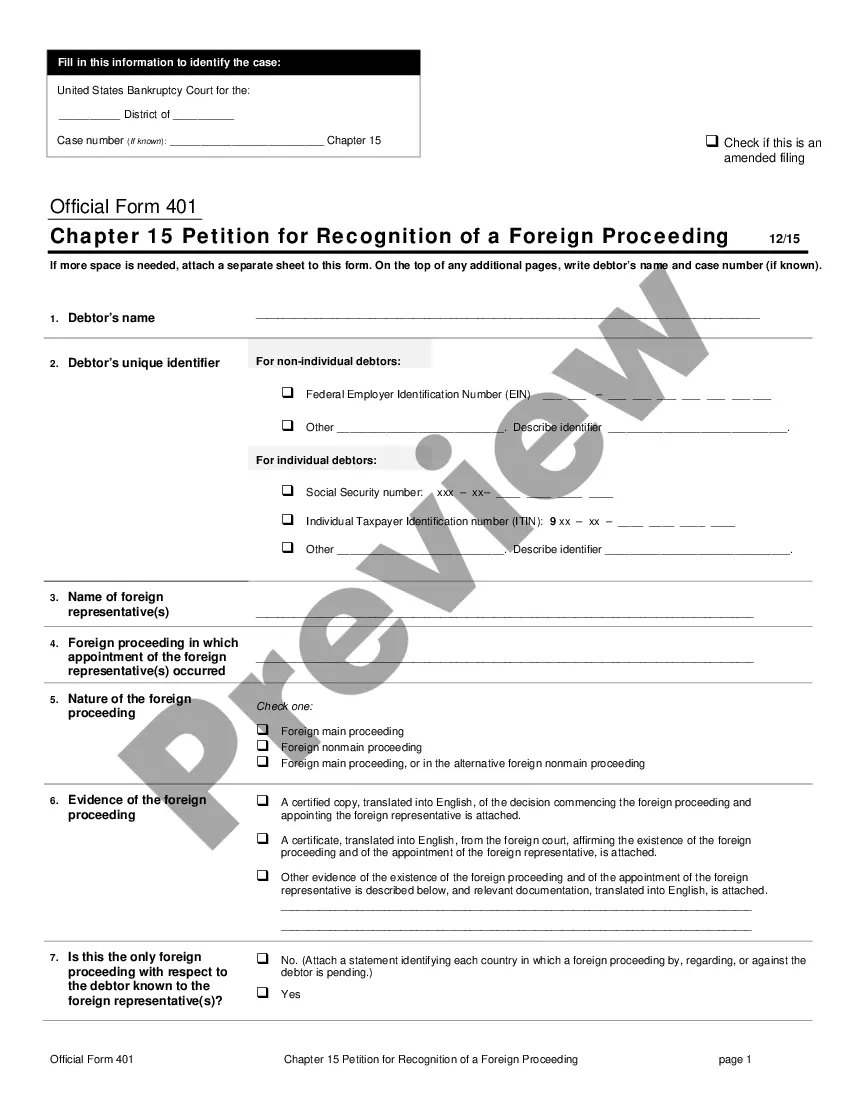

- Use the Review option to analyze the form.

- Read the description to actually have selected the right form.

- In case the form is not what you are trying to find, take advantage of the Research area to obtain the form that meets your requirements and requirements.

- Whenever you discover the appropriate form, just click Purchase now.

- Pick the rates prepare you desire, fill in the necessary information and facts to create your bank account, and pay for an order making use of your PayPal or charge card.

- Decide on a hassle-free paper formatting and down load your version.

Find all the papers templates you have bought in the My Forms menu. You can obtain a extra version of Virgin Islands Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker anytime, if necessary. Just go through the necessary form to down load or produce the papers template.

Use US Legal Forms, by far the most extensive selection of legal forms, in order to save time as well as avoid mistakes. The assistance delivers professionally made legal papers templates that can be used for a selection of uses. Produce your account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

What Is an Unsecured Creditor? An unsecured creditor is an individual or institution that lends money without obtaining specified assets as collateral. This poses a higher risk to the creditor because it will have nothing to fall back on should the borrower default on the loan.

Creditors in bankruptcy cases have debts paid either by waiting for a distribution from the estate (unsecured creditors), by reclaiming property from the bankruptcy estate (secured creditors), or by obtaining a judgment that the debt is not dischargeable.

Creditors' Rights for Unsecured Claims As an unsecured creditor, you can file a proof of claim, attend the first meeting of creditors, and file objections to the discharge. You can review the bankruptcy papers that were filed to determine whether there are any inaccuracies.

Further, the unsecured credit or debt so obtained or incurred is payable as an administrative expense in the case, which means that those creditors get paid ahead of all other unsecured creditors. Court approval is required prior to obtaining or incurring any other type of credit or debt during the case.

In the event of the bankruptcy of the debtor, the unsecured creditors usually obtain a pari passu distribution out of the assets of the insolvent company on a liquidation in ance with the size of their debt after the secured creditors have enforced their security and the preferential creditors have exhausted ...

Typically, interest rates on unsecured loans are higher than rates on secured loans because the lender has a higher risk level of the loan not being repaid. Unsecured loans may be difficult to obtain if you do not have much positive credit history or don't have a regular income.

Members of the Committee are fiduciaries who represent all unsecured creditors as a group. Section 1103 of the Bankruptcy Code provides that the Committee may consult with the debtor, investigate the debtor and its business operations and participate in the formulation of a plan of reorganization.