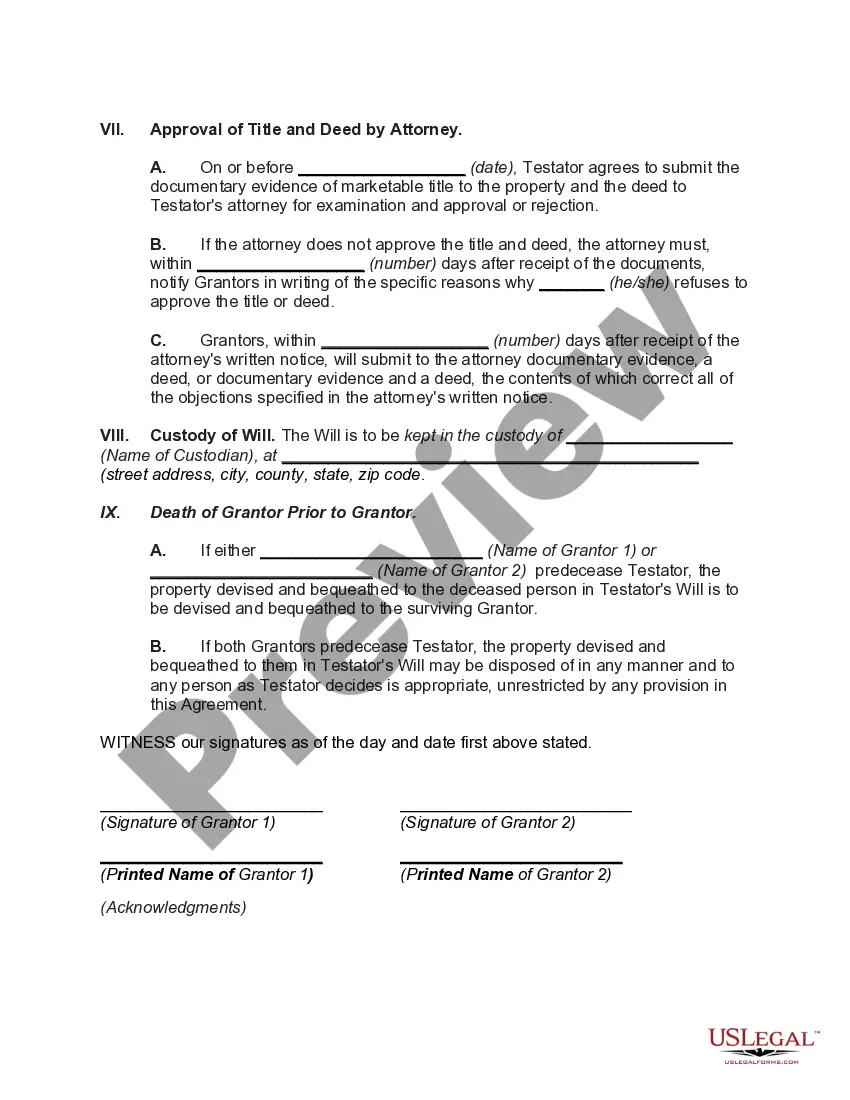

Virgin Islands Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator

Description

How to fill out Agreement To Devise Or Bequeath Property To Grantors Who Convey Property To Testator?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you can obtain numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can locate the most recent versions of forms such as the Virgin Islands Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator in just a few minutes.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to register for the account.

- If you have a membership, Log In and retrieve the Virgin Islands Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator from your US Legal Forms local archive.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for the area/county.

- Click the Review button to examine the content of the form.

Form popularity

FAQ

The validity of a will after the death of a testator can also be challenged. In general parlance, a will is valid whether it is registered or unregistered. There is no time bar for a will to come into effect. A will can be challenged up to 12 years from the death of the testator.

A distribution is any money paid to the benefit or care of the beneficiary. After all of the disbursements are made, the deceased's outstanding debts are settled, and all final taxes are paid, the executor can distribute the remaining assets to the beneficiaries.

Final Distribution and Closing the Estate: 1-3 Months If a credible debt claim is made against the estate, the court can hold the executor personally liable for failing to properly notify the creditor or distributing funds to beneficiaries before all debts were paid.

The California petition for final distribution gives the court a detailed history of the probate case. More specifically, it explains why the estate is ready to close and outlines the distributions to beneficiaries.

1. There will be no benefit from will to beneficiary or his legal heirs if beneficiary died before testator and no condition of legal heirs is there in will. The property shall be distributed as per intestate succession.

Make sure you enter all the essential personal details, including name, address, place and date, correctly; put in the full name and relationship of beneficiaries; mention the assets precisely; have it done in the presence of two witnesses; and sign it along with the witnesses and their details.

At common law, the estate of dower is held by a widow upon her husband's death and consists of a life estate of one-third to one-half of the land owned by her husband if he held a freehold interest in the land (e.g., a fee simple) and the land is inheritable by the issue of the marriage.

Will & Hindu Law A will or testament is a legal document by which a person, the testator, expresses their wishes as to how their property is to be distributed at death, and names one or more persons, the executor, to manage the estate until its final distribution. For the devolution of property not disposed of by will.

The California petition for final distribution gives the court a detailed history of the probate case. More specifically, it explains why the estate is ready to close and outlines the distributions to beneficiaries.

A court hearing will be set when you file the Petition for Final Distribution. If the Court grants your petition, you must prepare and file an Order for Final Distribution. Once you receive the Order for Distribution - Pleading Paper (No Court Form), distribute the remaining funds according to the order.