The articles of amendment shall be executed by the corporation by an officer of the corporation.

Virgin Islands Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation

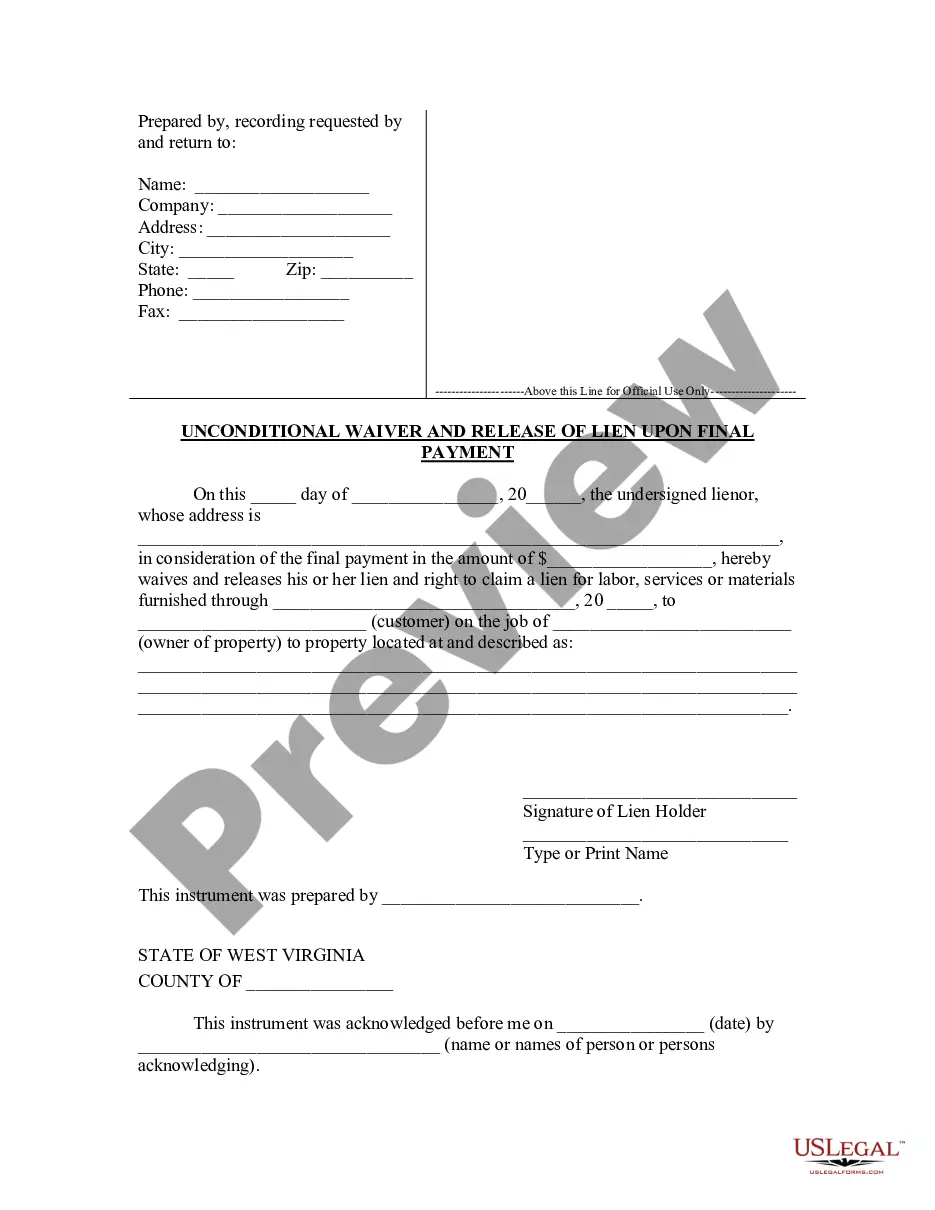

Description

How to fill out Articles Of Amendment To The Articles Of Incorporation Of Church Non-Profit Corporation?

If you wish to complete, obtain, or print legal document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Employ the site’s straightforward and user-friendly search feature to find the documents you require.

A variety of templates for business and personal purposes are categorized by sections and titles, or by keywords.

Step 4. After finding the form you need, select the Purchase now button. Choose your payment plan and provide your information to register for an account.

Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the payment.

- Utilize US Legal Forms to acquire the Virgin Islands Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation with just a few clicks.

- If you are already a US Legal Forms client, sign in to your account and then click the Acquire button to download the Virgin Islands Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate region/state.

- Step 2. Use the Preview option to review the form’s details. Do not forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A BVI company can be incorporated quickly, with a flexible organisational structure and minimal financial reporting requirements. BVI companies are ideal for startup companies as they can be operated from anywhere in the world and there are no restrictions on where a BVI company can carry out its business.

Depending on the state in which the business is incorporated, unanimous agreement from all the shareholders may be required to change the articles of incorporation. Most states have changed this older, common law rule, and now only require a majority of shareholders to agree to change the articles of incorporation.

No one person or group of people can own a nonprofit organization. Ownership is the major difference between a for-profit business and a nonprofit organization. For-profit businesses can be privately owned and can distribute earnings to employees or shareholders.

How to Start a Nonprofit in VirginiaName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

What is your mission? One of the most vital things to consider when you are starting a nonprofit is your mission. Writing a mission statement of one to two sentences can outline why it exists, what the organization does, who it serves and where it provides services all in one place.

When must you amend your entity's formation documents?Changes to the entity's name.Changes in the entity's purpose.Changes in the number of authorized shares of a corporation.Changes in the type/class/series of authorized shares of a corporation.More items...

One way of starting a nonprofit without money is by using a fiscal sponsorship. A fiscal sponsor is an already existing 501(c)(3) corporation that will take a new organization under its wing" while the new company starts up. The sponsored organization (you) does not need to be a formal corporation.

As can be gleaned from the foregoing, there are three (3) basic requirements for amending the Articles of Incorporation, namely:Majority vote of the board of directors.Written assent of the stockholders representing at least 2/3 of the outstanding capital stock.Approval by the Securities and Exchange Commission.

Changing articles of incorporation often means changing things like agent names, the businesses operating name, addresses, and stock information. The most common reason that businesses change the articles of incorporation is to change members' information.

Start a Nonprofit in Virgin IslandsStep One: Choose a Name.Step Two: File for Incorporation.Step Three: Prepare Your Bylaws.Step Four: Hold First Meeting.Step Five: Create a Records Book.Step Six: Apply for Federal Tax Exemption.Step Seven: State Tax Exemption.Step Eight: Register as a Charitable Organization.