Virgin Islands Contract for the International Sale of Goods with Purchase Money Security Interest

Description

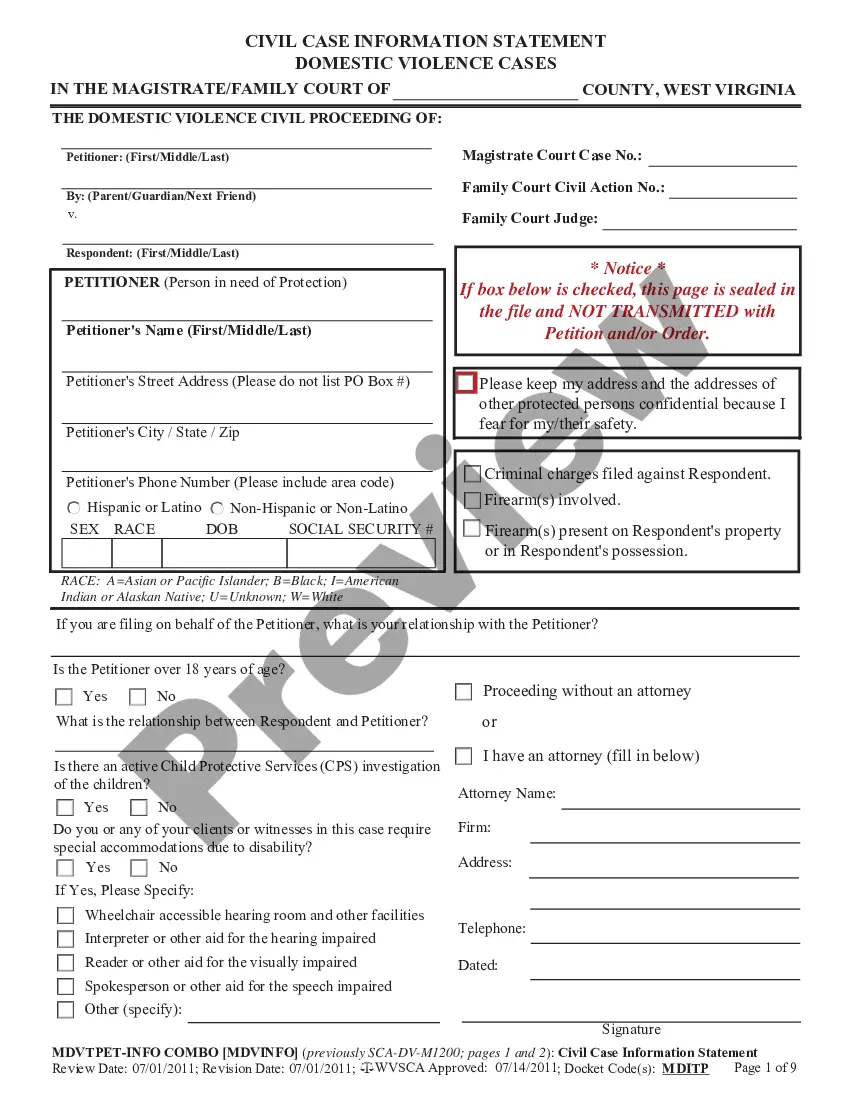

How to fill out Contract For The International Sale Of Goods With Purchase Money Security Interest?

Are you currently in a situation where you require documents for either business or personal purposes on a daily basis.

There are numerous legal document templates available online, but locating forms you can trust is not straightforward.

US Legal Forms offers thousands of form templates, including the Virgin Islands Contract for the International Sale of Goods with Purchase Money Security Interest, which are crafted to meet federal and state requirements.

Once you find the correct form, click Buy now.

Select the pricing plan you prefer, fill in the requested information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Contract for the International Sale of Goods with Purchase Money Security Interest template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for your correct city/region.

- Utilize the Review button to verify the form.

- Read the summary to confirm you have selected the right form.

- If the form isn't what you are looking for, use the Search field to locate the form that fits your needs and requirements.

Form popularity

FAQ

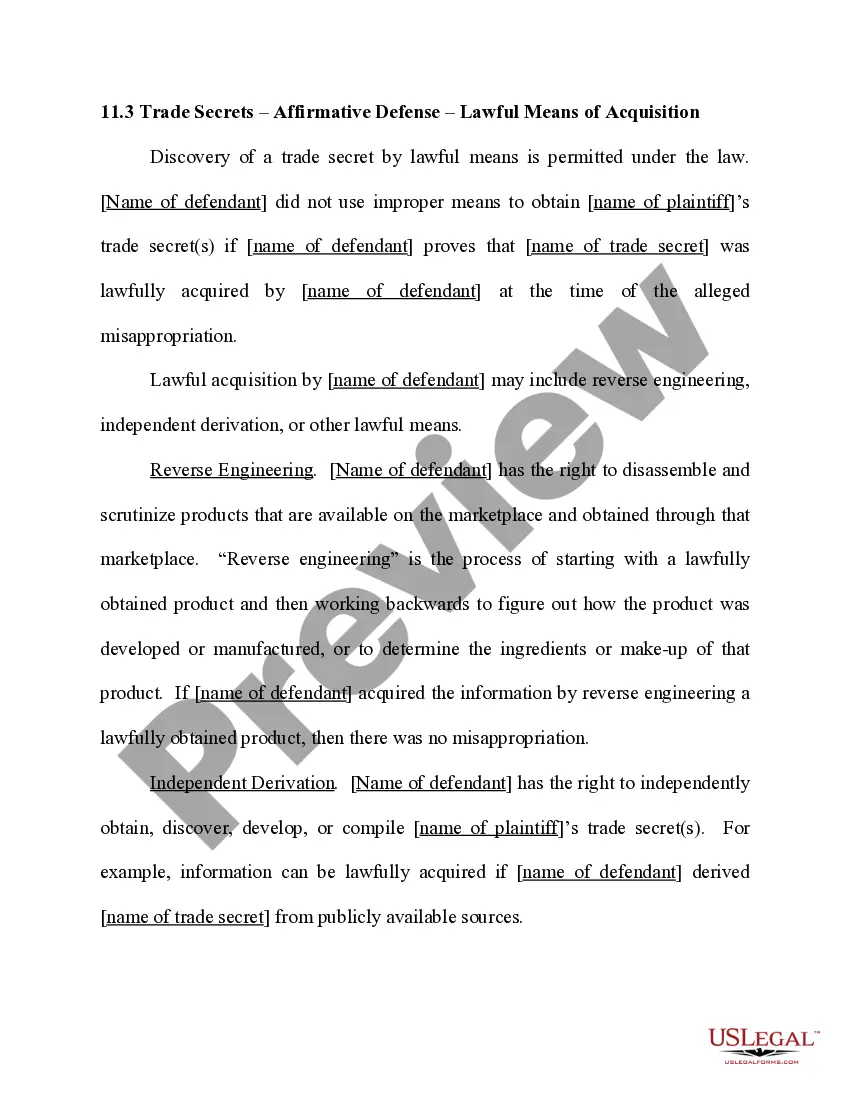

By Agreement with the Debtor Security obtained through agreement comes in three major types: (1) personal property security (the most common form of security); (2) suretyshipthe willingness of a third party to pay if the primarily obligated party does not; and (3) mortgage of real estate.

The three requirements of: giving value, debtor rights in the collateral, and an authenticated security agreement apply to the most common types of collateral, such as equipment, inventory and even payments due under a contract.

Certain types of collateral must be perfected through possession: Money. The only way that a secured party may perfect its security interest in money is by possession.

Other methods of perfection of a security interest in letter-of-credit rights (such as taking possession of a letter of credit) will no longer be available. Perfection can be only by perfection in the underlying obligation (and hence in the letter-of-credit rights as support obligations) or by "control. ''

The three requirements of: giving value, debtor rights in the collateral, and an authenticated security agreement apply to the most common types of collateral, such as equipment, inventory and even payments due under a contract.

Overview. "There are only four kinds of consensual security known to English law: (i) pledge; (ii) contractual lien; (iii) equitable charge and (iv) mortgage.

The term purchase money security interest (PMSI) refers to a legal claim that allows a lender to either repossess property financed with its loan or to demand repayment in cash if the borrower defaults. It gives the lender priority over claims made by other creditors.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

Under Revised Article 9 of the UCC, electronic chattel paper may be used as collateral in a secured transaction.